- BTC’s Realized Capitalization confirmed that the main coin is now overbought.

- On-chain evaluation hints at a worth downside within the coming days.

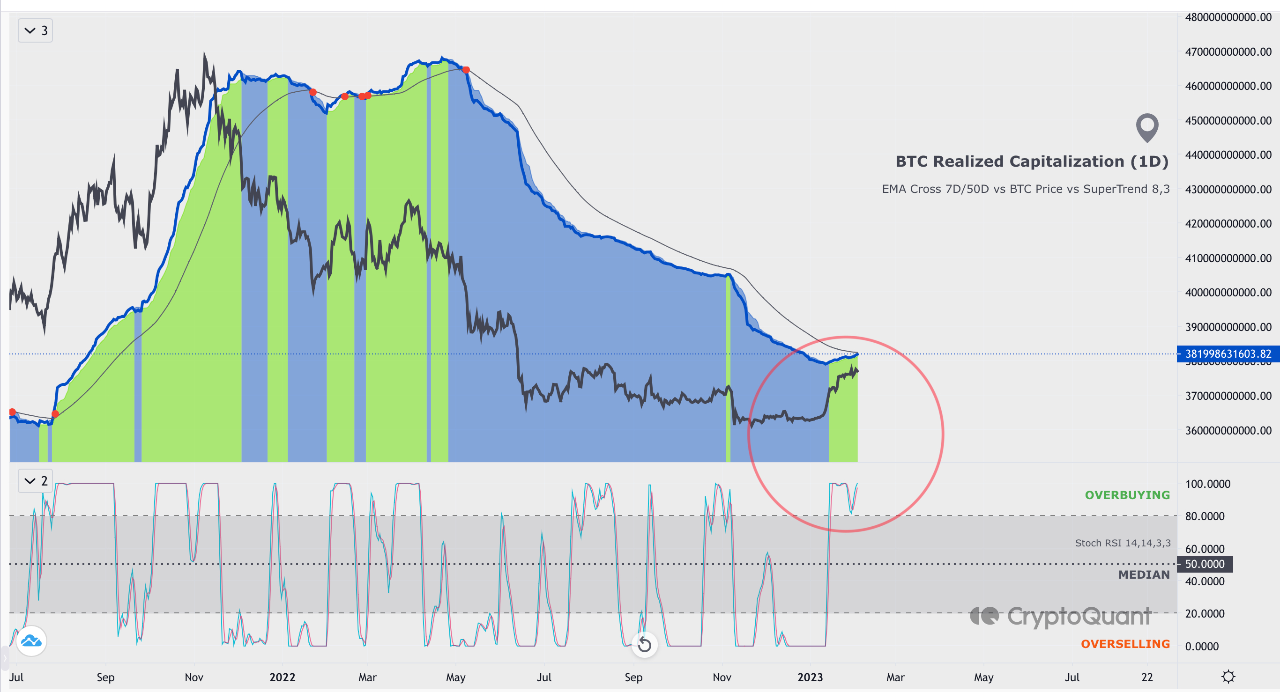

In accordance with CryptoQuant analyst Axel Adler Jr, as a result of bullish nature of the overall cryptocurrency market because the 12 months started, the Realized Capitalization metric for a lot of belongings grew considerably previously 20 days.

The metric, which takes under consideration the price of manufacturing for every coin, gives a extra correct image of the market’s general well being and is taken into account to be a greater indicator of the true market sentiment in the direction of a cryptocurrency.

Learn Bitcoin’s [BTC] Value Prediction 2023-24

Nevertheless, an evaluation of Bitcoin’s [BTC] Realized Capitalization metric over a single-day common revealed that the coin’s Stochastic RSI (Relative Power Index) oscillator lay on the overbought area.

Usually, an asset’s Stoch RSI oscillator presents overbought circumstances when the asset has been buying and selling at a comparatively excessive worth for a chronic time frame, main buyers to consider that the asset is overvalued and due for a correction. In accordance with Adler,

“This suggests {that a} doable adjustment or decline available in the market might happen within the close to future.”

Supply: CryptoQuant

The whales have swooped in

Whereas BTC’s worth oscillated inside a decent vary within the final week, the on-chain evaluation confirmed an uptick in transactions and accumulation amongst massive buyers.

In accordance with on-chain knowledge supplier Santiment, the counts of BTC whale transactions above $100,000 and $1 million have jumped considerably throughout that interval.

Supply: Santiment

Likewise, in the course of the intraday buying and selling session on 3 February, a large BTC transaction came about, marking the biggest of such transfers within the final 4 weeks.

A brand new whale tackle emerged, going from zero to holding 13,369 BTC, valued at roughly $313.1 million, in a single switch.

🐳 8 hours in the past, the biggest #Bitcoin transaction in 4 weeks came about. This model new whale tackle went from nothing to out of the blue holding ~13,369 $BTC (price ~$313.1M) after a single switch. Observe this pockets right here as costs fluctuate going ahead. 👀 https://t.co/Vk7GTw4diT pic.twitter.com/G2IwLP0tpp

— Santiment (@santimentfeed) February 4, 2023

When the value of an asset begins to see a downside and the whales start to build up, it normally implies that these massive holders consider that the asset is undervalued and have began to purchase extra of it. It’s typically taken as a bearish sign which might additional drive down the worth of such an asset.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

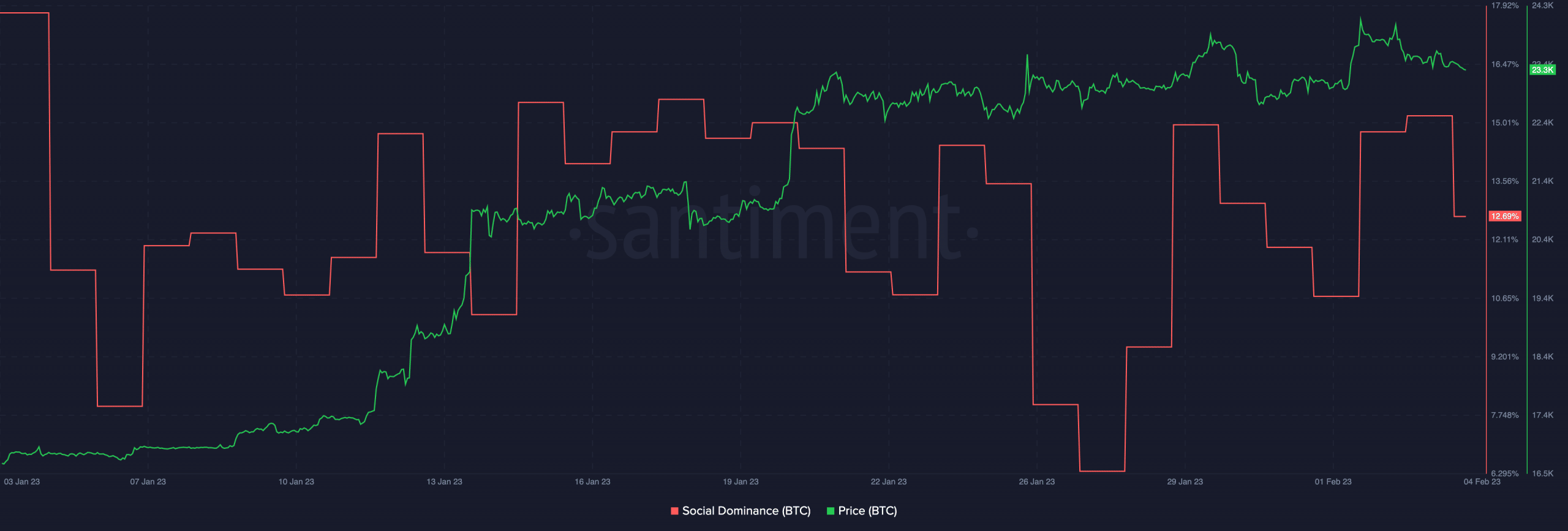

Additional, BTC’s social dominance spiked considerably previously few days. With its worth oscillating in a decent vary, gearing as much as breakout in both route, a surge in social dominance might imply the presence of euphoric sentiments available in the market.

Such highs in social exercise with out a corresponding worth rally typically precede a worth downside.

Supply: Santiment

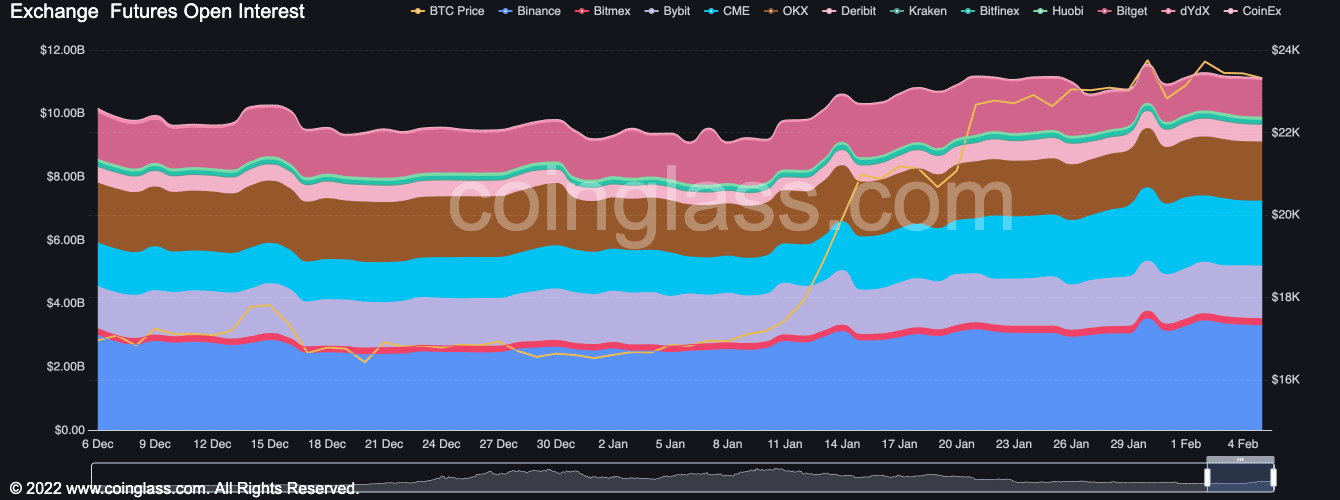

Lastly, in response to Coinglass, BTC’s Open Curiosity has been reducing because the starting of February. At $11.11 billion at press time, it has decreased by 2% since then.

Supply: Coinglass

![Bitcoin [BTC]: The rest of the month may not be fruitful, here is why](https://ambcrypto.com/wp-content/uploads/2023/02/1674566725228-a731357b-ba69-464b-b0aa-4898d973c8b5-3072-1000x600.jpg)