- New evaluation prompt that BTC’s value may decline within the coming days.

- On-chain metrics and some market indicators regarded bearish.

For the previous couple of days, the crypto market has been on a bullish streak, inflicting the costs of most cryptos to rise. Bitcoin [BTC], the market chief, additionally benefited from the scenario.

In keeping with CoinMarketCap, BTC’s value was up by greater than 3% and 13% over the past 24 hours and the final seven days, respectively. On the time of writing, BTC was buying and selling at $24,482.41 with a market capitalization of greater than $472.4 billion. Nevertheless, the desk would possibly flip quickly.

Learn Bitcoin’s [BTC] Value Prediction 2023-24

Hassle within the close to time period

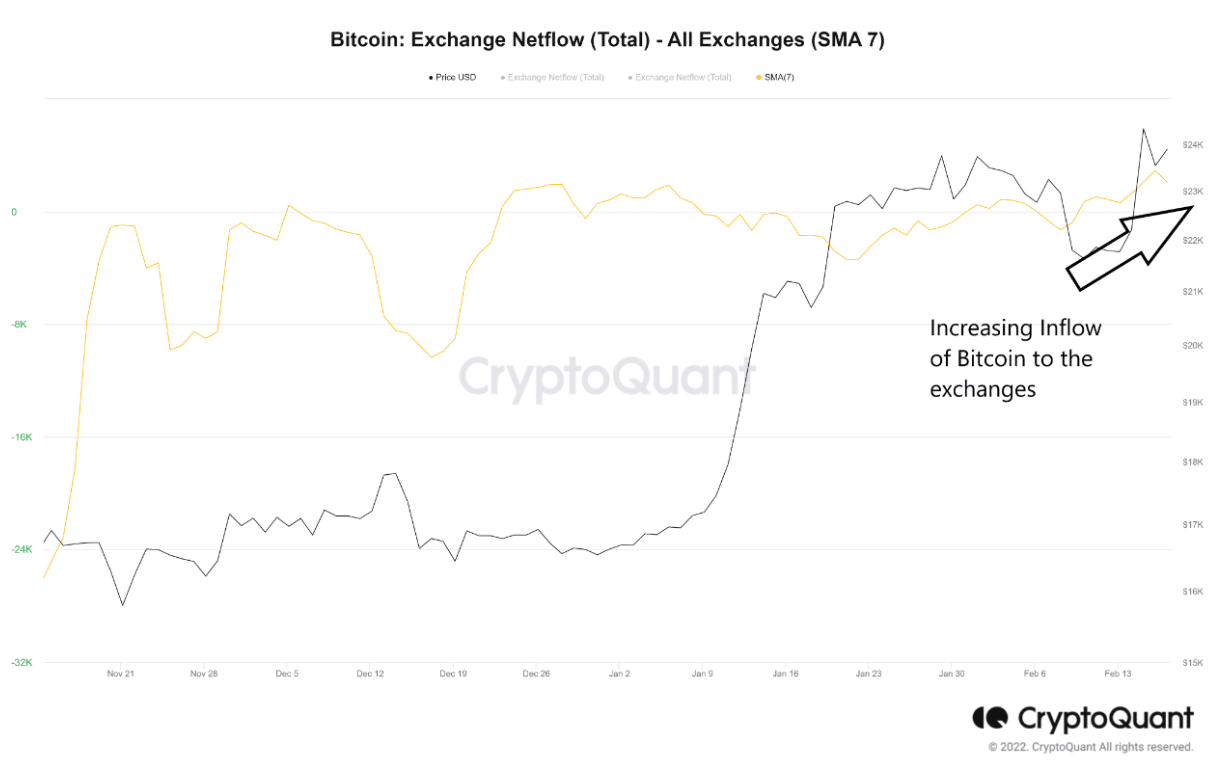

CryptoOnchain, an creator and analyst at CryptoQuant, posted an analysis on 17 February, which prompt BTC’s good days would possibly quickly finish. As per the evaluation, there was a rise within the influx of Bitcoins to exchanges and the outflow of stablecoins from exchanges – a bearish sign.

Supply: CryptoQuant

Just a few different metrics additionally regarded bearish for BTC. As an example, Glassnode Alerts revealed that Bitcoin’s steadiness on exchanges reached a one-month excessive of two,267,202.721 BTC.

📈 #Bitcoin $BTC Stability on Exchanges simply reached a 1-month excessive of two,267,202.721 BTC

Earlier 1-month excessive of two,266,916.823 BTC was noticed on 19 January 2023

View metric:https://t.co/9vOOAmwh32 pic.twitter.com/h8ytX0U6f6

— glassnode alerts (@glassnodealerts) February 18, 2023

As per CryptoQuant’s data, BTC’s alternate reserve was additionally on the rise, suggesting larger promoting strain. On high of that, the aSORP was additionally within the purple, so extra buyers have been promoting at a revenue, indicating a attainable market high.

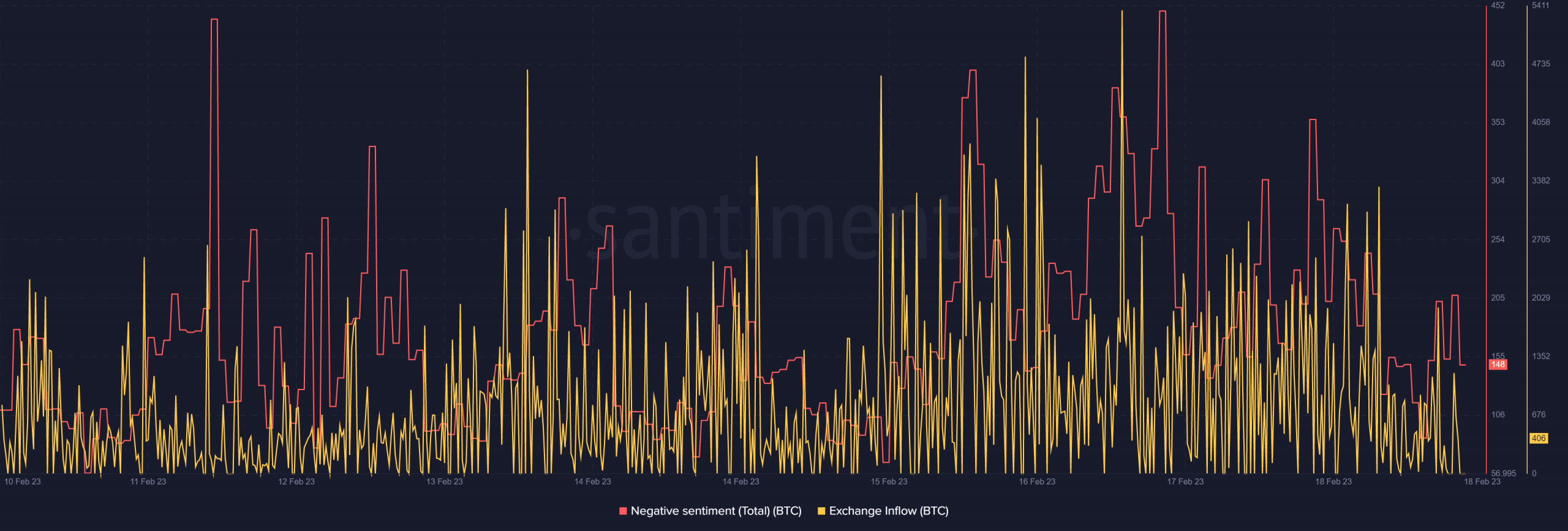

Demand from the derivatives market additionally appeared to dwindle, as BTC’s taker purchase promote ratio prompt that promoting sentiment was dominant within the futures market. In keeping with Santiment’s chart, BTC’s alternate influx spiked in the previous couple of days. Furthermore, detrimental sentiments round BTC additionally went up, reflecting much less belief amongst buyers.

Supply: Santiment

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

Bitcoin: What the metrics must say

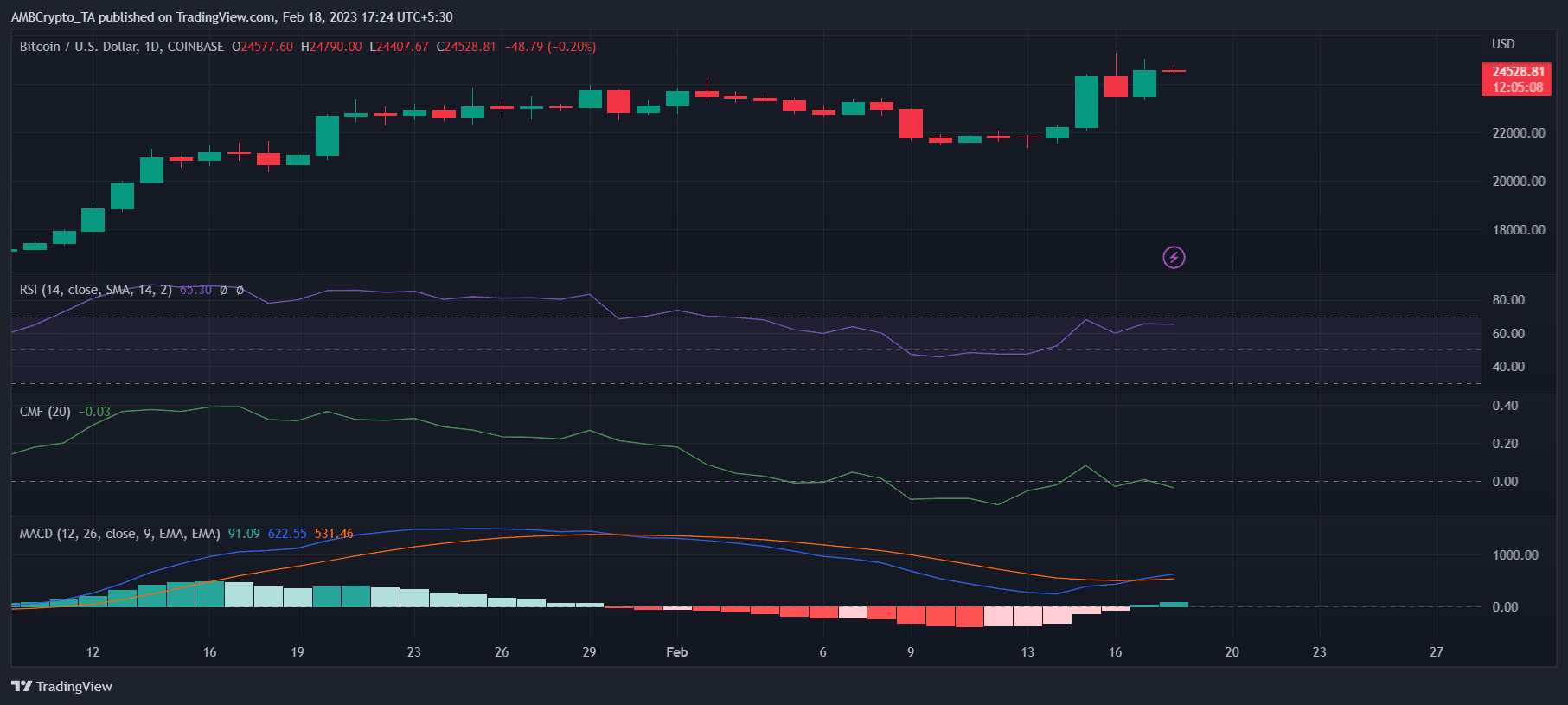

Persevering with with the bearish development, BTC’s Relative Energy Index (RSI) was hovering close to the overbought zone, which could improve promoting strain. Furthermore, the king coin’s Chaikin Cash Stream (CMF) registered a downtick and was headed additional under the impartial mark.

Regardless, the MACD displayed a bullish crossover, giving hope for a continued uptrend within the quick time period.

Supply: TradingView

![Bitcoin [BTC]: Trend reversal on the horizon? Analysts say…](https://ambcrypto.com/wp-content/uploads/2023/02/BTC-1-1000x600.jpg)