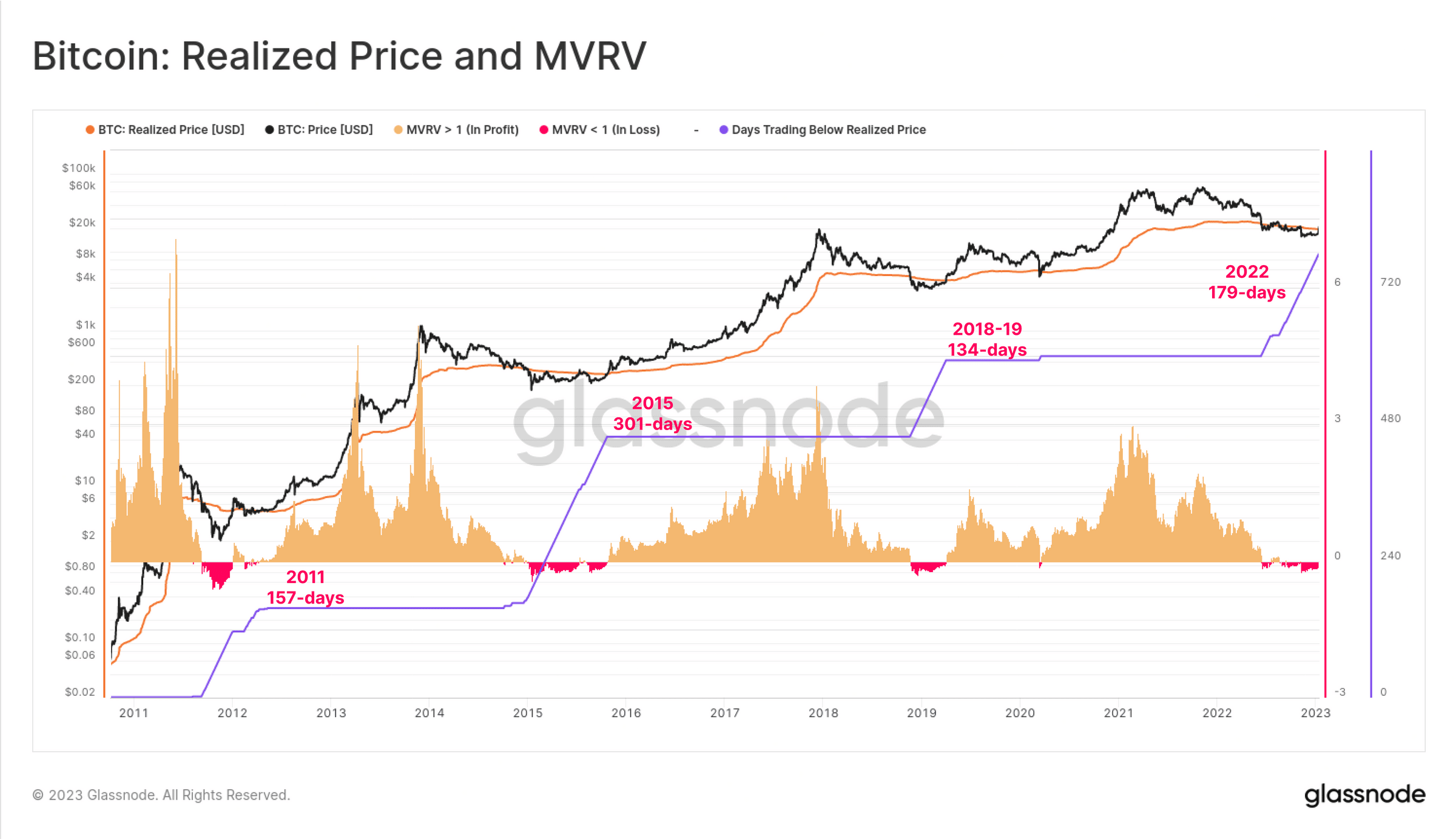

- The current rally in BTC’s value led to many BTC holders netting unrealized positive factors.

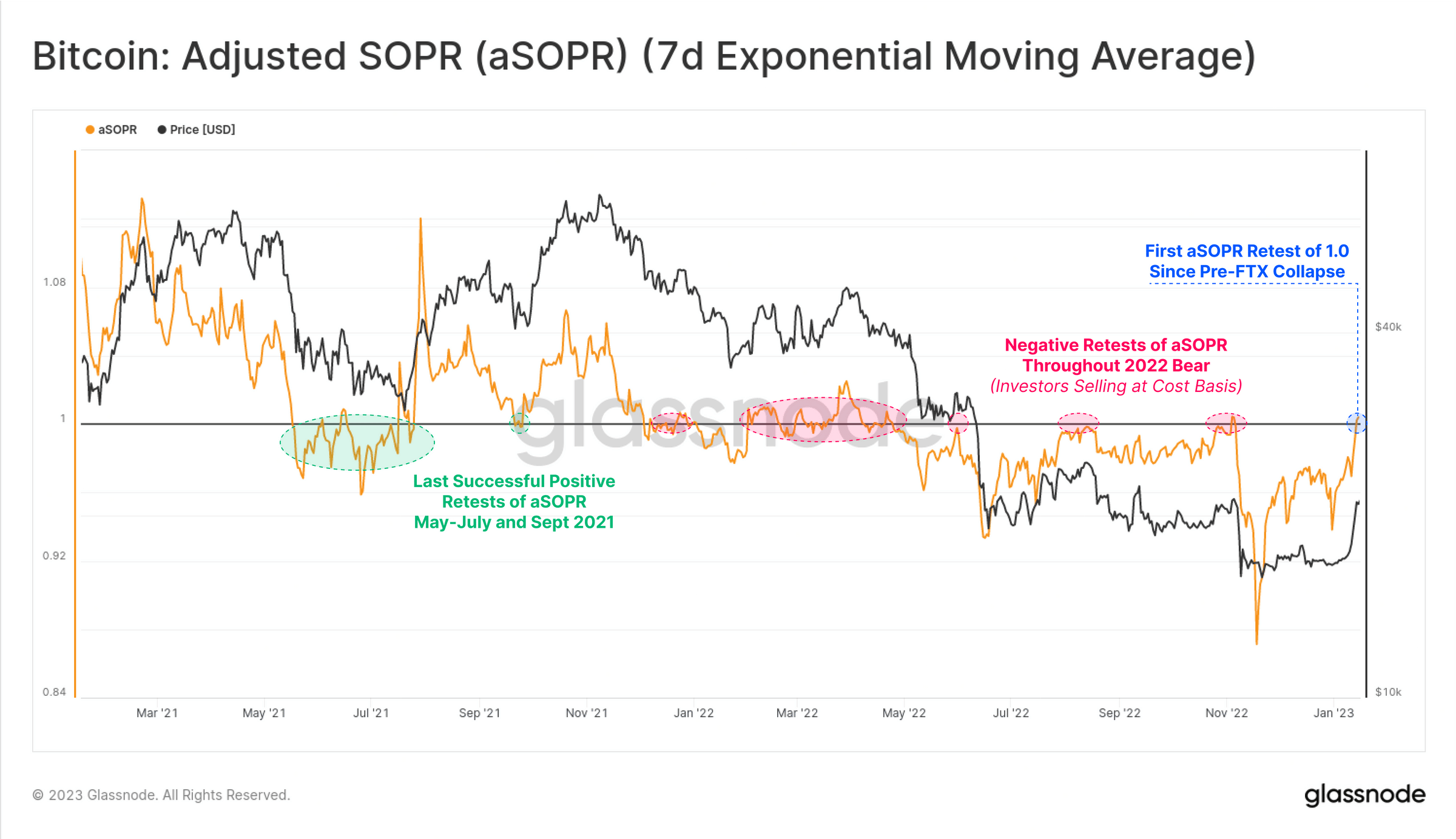

- The aSOPR’s try and retest the worth of 1.0 signaled a bullish pattern within the present market.

Bitcoin [BTC] began the yr with a powerful rally of 23.3%, which has resulted in a variety of buyers and miners seeing their web holdings and operations return to profitability.

Main on-chain information supplier Glassnode, in a brand new report titled “Is Bitcoin Back?”, assessed a couple of on-chain metrics to find out the which means behind final week’s current value surge and underlying components behind the identical.

Learn Bitcoin’s [BTC] Value Prediction 2023-24

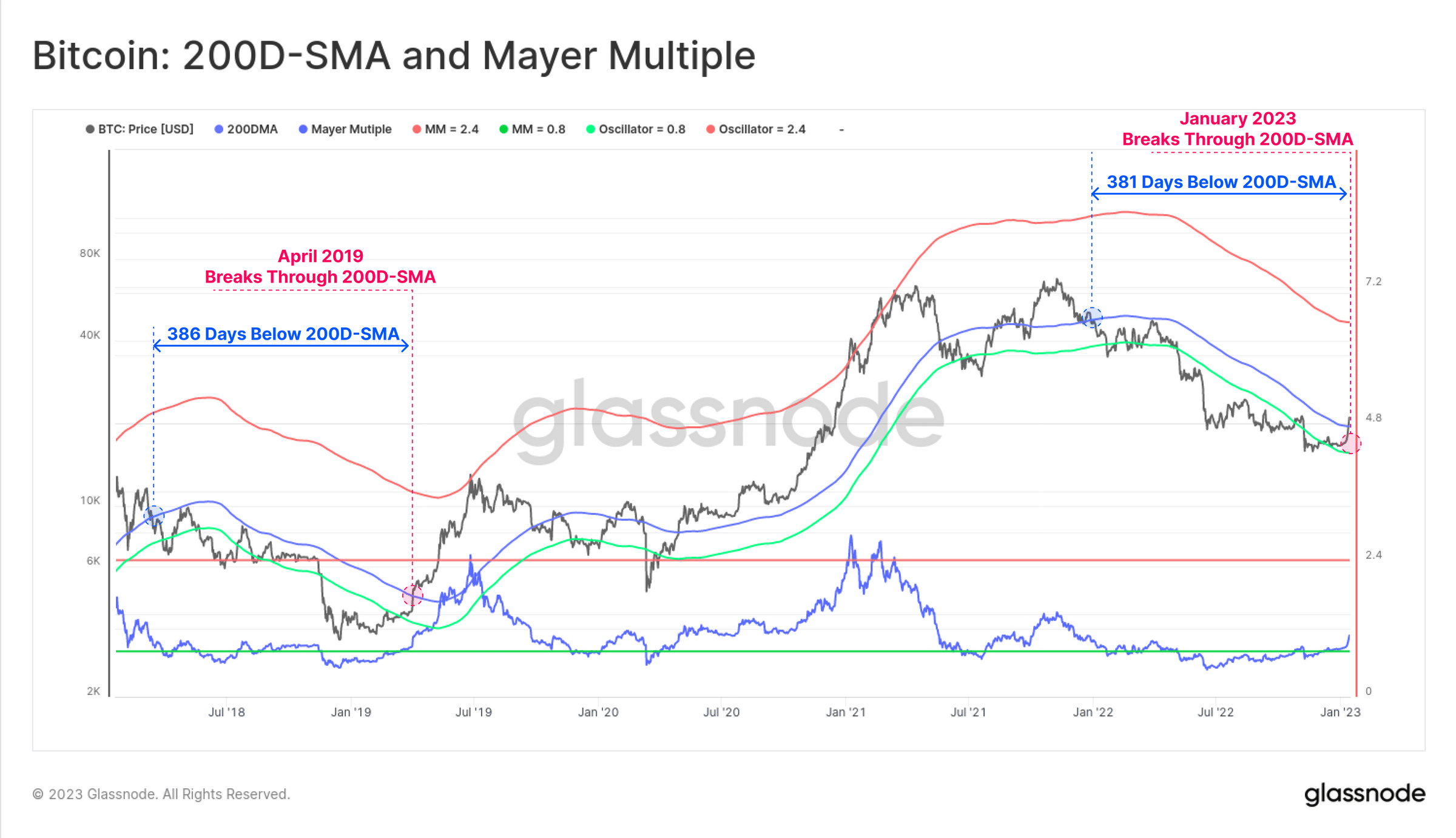

Glassnode thought of BTC’s 200-day Easy Shifting Common (200D-SMA) to verify whether or not the sentiment available in the market within the final week was bullish or bearish.

What do the metrics reveal?

The 200-day SMA metric is commonly utilized as a benchmark for figuring out macroeconomic tendencies throughout all kinds of crypto property. By evaluating BTC’s value to its 200- day SMA, buyers and merchants alike can decide whether or not the market is in a bullish or bearish pattern.

With the worth uptick within the final week, Glassnode discovered that BTC’s value surpassed the psychological stage of $19,500. It added additional that BTC markets show a constant sample of cycles, with the present cycle buying and selling beneath the 200D-SMA for 381 days, solely barely lower than the 386 days of the bear market in 2018-2019.

Ought to BTC’s value break above the 200D SMA, one may anticipate the worth to rally because it did in 2019 and 2021.

Supply: Glassnode

Glassnode additional famous that the current value rally brought on BTC’s worth to exceed its Realized Worth, indicating that the typical BTC holder skilled a web unrealized revenue within the final week. For context, the present bear market has lasted for 179 days beneath the Realized Value, making it the second longest bear market out of the final 4 cycles.

Supply: Glassnode

Bitcoin’s aSOPR suggests…

A take a look at the king coin’s Adjusted Spent Output Revenue Ratio (aSOPR) revealed that the metric would have retested a worth of 1.0 from beneath. BTC’s aSOPR is a metric deployed in direction of measuring the profitability of BTC transactions by evaluating the income generated by a transaction to the price of creating it.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

In response to Glassnode:

“An aSOPR break above, and ideally a profitable retest of 1.0, has typically signaled a significant regime shift, as income are realized, and ample demand flows in to soak up them.”

When the 30-day transferring common of the aSOPR exceeds 1.0, transactions grow to be extra worthwhile on a bigger scale, which normally alerts a powerful total market.

Supply: Glassnode

![Bitcoin [BTC]: What you should expect following 2023’s 23% rally](https://ambcrypto.com/wp-content/uploads/2023/01/1665608907310-6dff1a09-02c7-4cec-86f1-d28354fda536-1000x600.jpg)