- Bitcoin dumped into a possible bounce area

- The coin remained undervalued however on-chain knowledge confirmed no affirmation to start shopping for

Bitcoin [BTC], like many different cryptocurrencies, adopted by means of with a downtrend within the simply ended 16 to 18 December weekend. Evidently, the downturn led BTC into an traditionally favorable place.

Based on on-chain knowledge supply, Santiment, this lower pushed the king coin right into a zone that screamed rebound in worth.

📉 #Crypto market caps have flushed downward over the weekend and into Monday. #Bitcoin & #Ethereum are holding up considerably, however #altcoins have been hit significantly exhausting. Our mannequin, although, signifies, that a number of tasks at the moment are at historic ache factors the place bounces happen. pic.twitter.com/oPZnSFdFkH

— Santiment (@santimentfeed) December 19, 2022

Learn Bitcoin’s [BTC] Value Prediction 2023-2024

Uncertainty in alternative

Bitcoin, trading under $17,000, had been topic to accumulation interval discussions recently. However a staggering incapability to show these projections into actuality additionally plagued BTC. Nevertheless, has this presumption with respect to previous cycles had any impact on the BTC pattern?

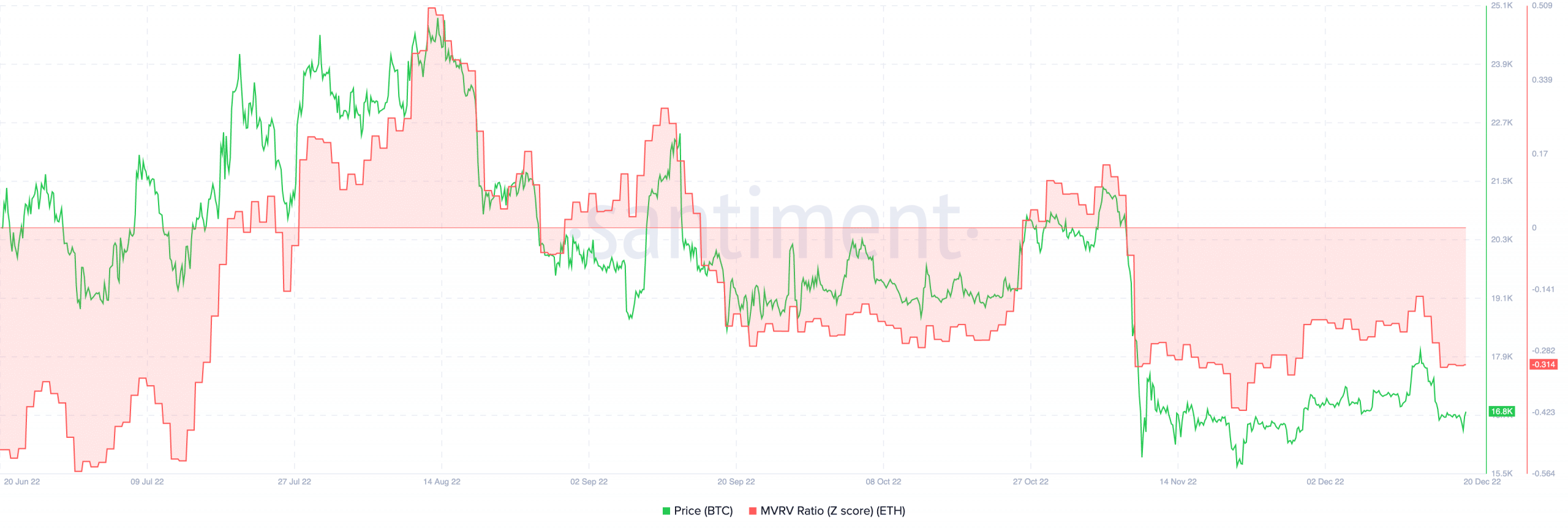

From the on-chain standpoint, Bitcoin was thought-about below the fair value stance. This assertion got here because of the place mirrored by the Market Worth to Realized Worth (MVRV) z-score. Based mostly on Santiment knowledge, the MVRV z-score was -0.314. The metric, not being above 6.9 and seeming residing below 0.1 implied that BTC was vastly undervalued. In the meantime, this doesn’t give credit score to an instantaneous resurgence.

Supply; Santiment

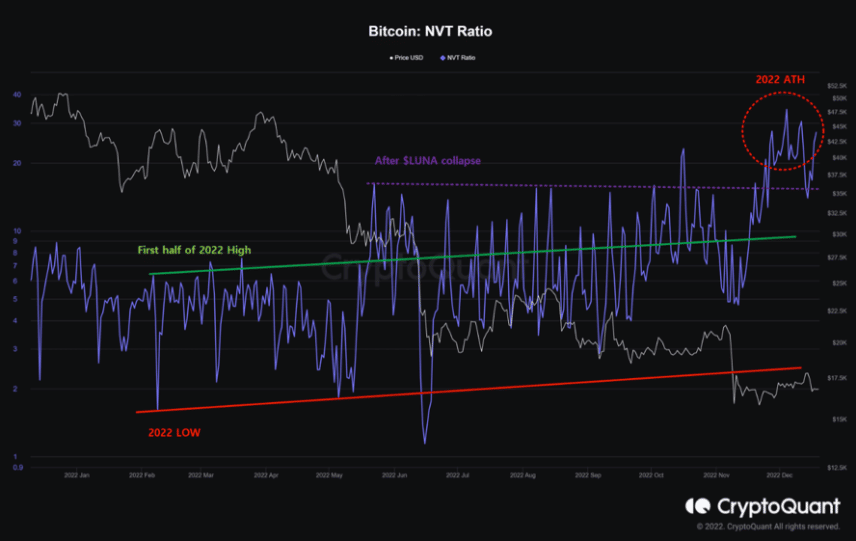

Nonetheless, Bitcoin was not comprehensively optimistic all spherical. CryptoQuant analyst and blockchain expertise specialist, Wenry recognized causes traders ought to train warning.

In his publication in the marketplace knowledge platform, the analyst famous that the Unspent Transaction Output (UTXO) prompt an prolonged bear market.

At press time, the Bitcoin UTXO in loss was on an increasing trend. Thus, indicating that the final market revival had minimal influence on investor holdings. On the a part of the Community Worth to Transaction (NVT) ratio, Wenry identified that it was comparatively excessive.

Because the ratio was excessive, it indicated a bearish market sentiment as the worth was larger than that across the Terra [LUNA] catastrophe.

Supply: CryptoQuant

Mid-month hesitation?

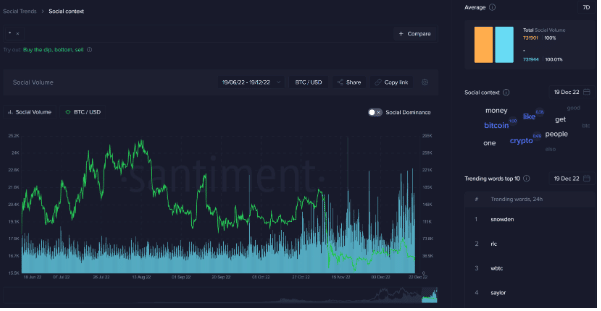

Moreover, Santiment launched its mid-month market replace. Based on the report, merchants’ reluctance to purchase BTC was nonetheless very a lot at its peak. This was because of the coin remaining within the adverse territory.

As such, it requires concern in regards to the up-to-date notion in direction of it. Contemplating that Bitcoin discussions had been excessive initially of December, growing social quantity and present hesitation in attaching BTC to conversations might transfer it in a downswing place.

Nevertheless, a latest motion had improved curiosity whereas one other aimed to push down BTC. In addressing this half, the report learn,

“The Fed got here out with extra hawkishness and raised rates of interest as soon as once more, which pushed equities and crypto down as soon as once more. However on a shiny facet, all of this volatility appeared to have introduced some curiosity again into crypto dialogue boards after such a lifeless interval within the center a part of 2022.”

Supply: Santiment

In essence, the Bitcoin situation nonetheless prevails in skepticism about confirming the underside or activating a rebound. Thus, exercising endurance and observing the market is perhaps the choice on this uncertainty.