- The depend of mini BTC addresses has shot up within the final month.

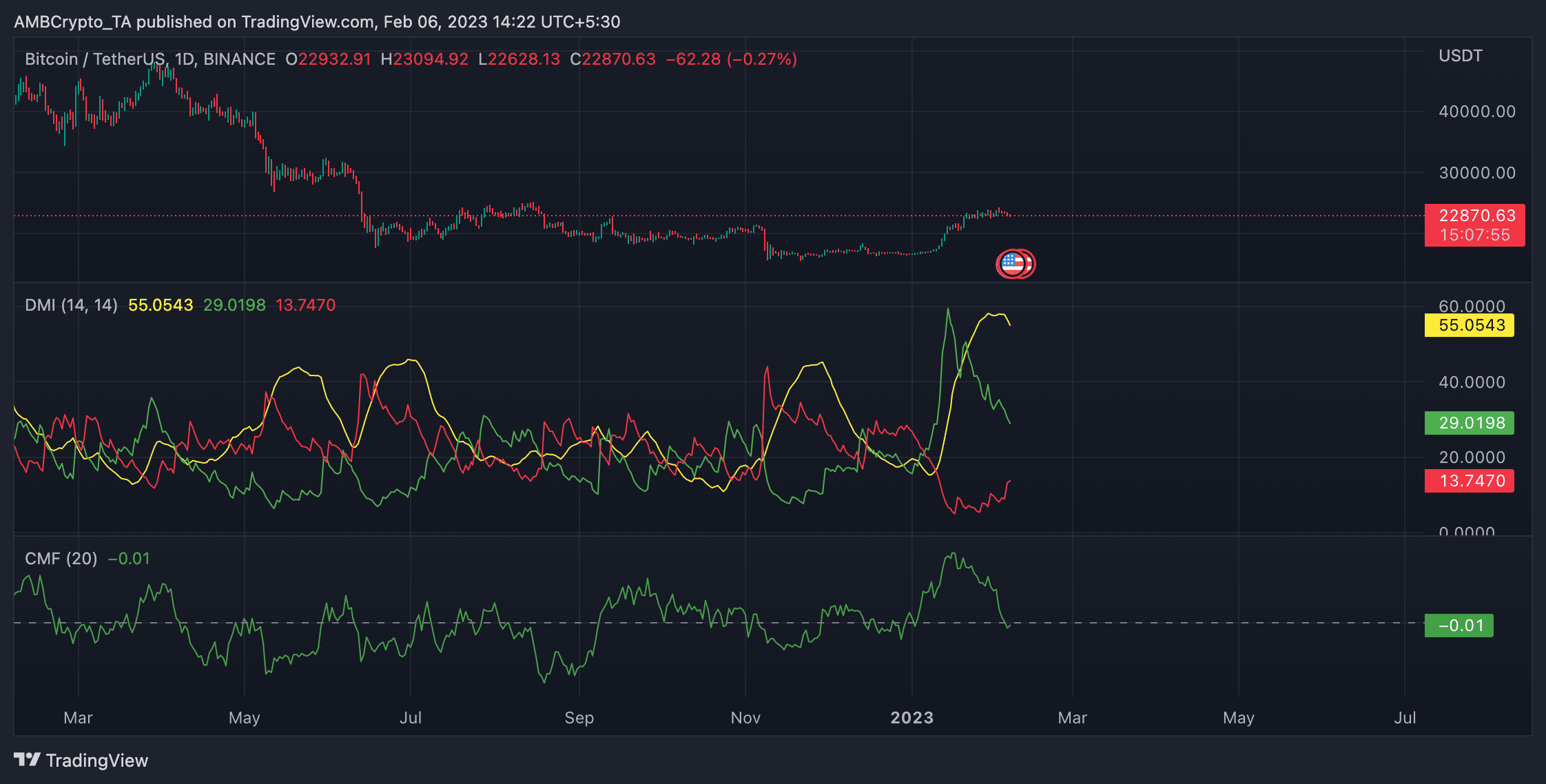

- Worth chart studying confirmed that purchasing strain has weakened over time.

Since Bitcoin’s [BTC] value regained the $20,000 mark, the depend of BTC addresses that maintain 0.1 BTC elevated, knowledge from Santiment revealed.

In accordance with the on-chain knowledge supplier, since reclaiming the $20,000 value mark, roughly 620,000 small BTC addresses containing 0.1 BTC or much less have re-emerged on the community.

Whereas the market lingered below extreme bearish situations in 2022, these addresses noticed gradual development. Nevertheless, with the surprising bull run because the yr began, dealer optimism has returned amongst this cohort of buyers, Santiment famous.

🧐 There have been ~620k small #Bitcoin addresses which have popped again up on the community since #FOMO returned on January thirteenth when value regained $20k. These 0.1 $BTC or much less addresses grew slowly in 2022, however 2023 is exhibiting a return of dealer optimism. https://t.co/CUAS0nV23x pic.twitter.com/wo8NBDNXs3

— Santiment (@santimentfeed) February 6, 2023

The spike within the depend of BTC buyers that maintain 0.1 BTC or much less because the yr started may be attributable to the Worry of Lacking Out (FOMO). Most of the mini BTC addresses might need returned to the market to make the most of the latest value rally to log positive aspects.

Will they get desired outcomes?

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

Will you be rewarded on your FOMO?

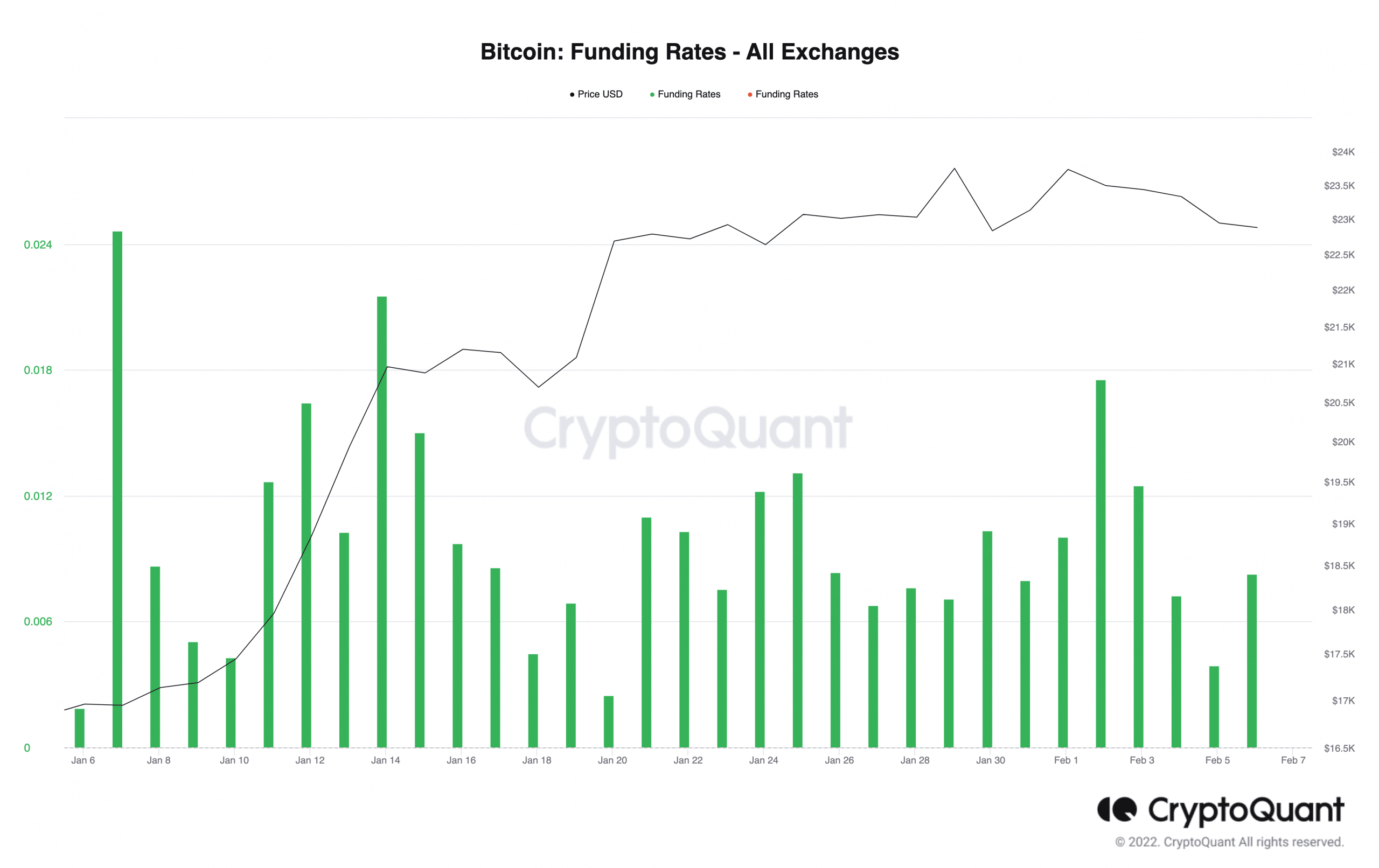

A have a look at BTC’s funding charges revealed that it has been constructive within the final month. Nonetheless constructive at press time, it was pegged at 0.008.

When an asset’s funding charges are constructive, it signifies that there’s extra demand for lengthy positions than for brief positions, and merchants who maintain quick positions are paying a price to merchants who maintain lengthy positions.

As well as, when the funding price is constructive, it means that market contributors anticipate the asset’s value to extend.

Supply: CryptoQuant

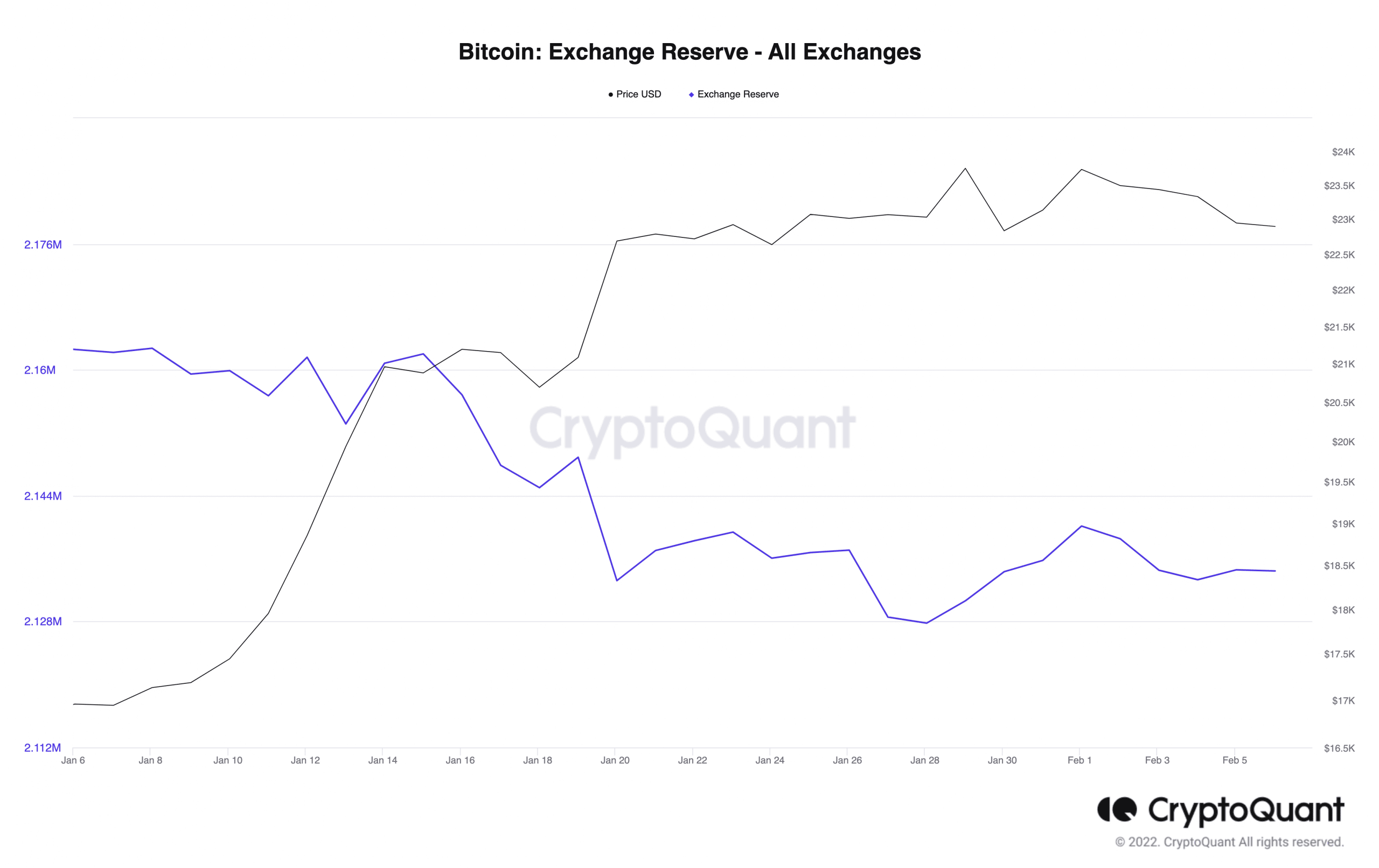

The value of BTC skyrocketed in January, and because the month ended, there was a rise in BTC’s alternate reserve, indicating that many holders transferred their belongings to exchanges to money of their income.

Nevertheless, this was solely short-term because the alternate reserve of the king coin resumed its downward pattern. Per knowledge from CryptoQuant, BTC’s alternate reserve was 2.13 million BTC at press time.

A decline in an asset’s alternate reserve implies that fewer cash are in distribution. With a corresponding improve within the coin’s provide outdoors of exchanges, its value would possibly proceed to develop.

Supply: CryptoQuant

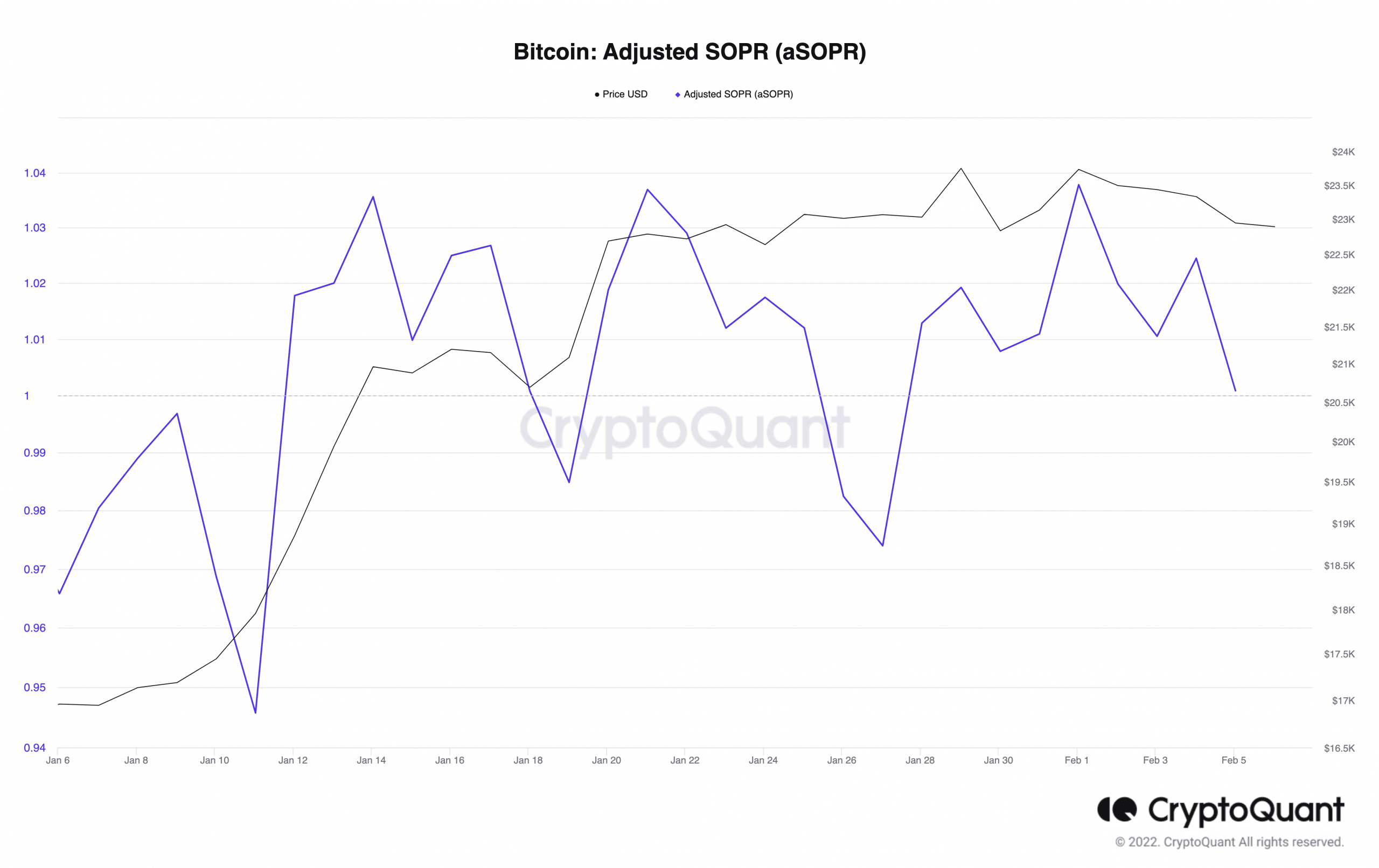

Additional, an evaluation of BTC’s Adjusted Spent Output Revenue Ratio (aSOPR) revealed that at its present value, many buyers offered at a revenue. At press time, the aSOPR was 1.008. A worth above one for a coin’s aSOPR means extra buyers are promoting at a revenue.

Supply: CryptoQuant

Whereas BTC could also be nicely positioned on the chain, a have a look at its efficiency on the day by day chart revealed that purchasing strain has weakened. At press time, the Chaikin Cash Circulate (CMF) was destructive at -0.01.

Moreso, the constructive directional index (yellow) of its Directional Motion Index (DMI) was positioned in a downtrend and inching nearer to the destructive directional index (crimson). This confirmed that consumers had been beginning to lose management of the market.

Supply: BTC/USDT on TradingView