- Bitcoin’s worth was gravely impacted by the failure of FTX.

- On-chain metrics steered a shift in HODLer’s habits.

The sudden collapse of Sam Bankman-Fried’s crypto empire left the final cryptocurrency coping with important losses. The results of the occasions between 6 -14 November 2022 might be in comparison with the collapse of Mt Gox in 2012.

Learn Bitcoin’s [BTC] Value Prediction 2022-2023

For the primary time in two years, main coin Bitcoin’s [BTC] worth fell under the $17,500 worth mark. Per knowledge from CoinGecko, the cascading impression of the FTX collapse induced the worldwide cryptocurrency market cap to fall under $900 billion for the primary time since January 2021.

Whereas BTC HODLers have remained resilient despite the market downturn, FTX’s collapse examined their religion. This was as a result of many long-term holders sought security for his or her investments within the final week.

On-chain analytics firm Glassnode, in a brand new report, thought of just a few metrics to evaluate whether or not “there was a discernible lack of conviction” amongst BTC holders because the FTX debacle unraveled.

Allow us to take a better take a look at a few of these metrics.

To name it in or not?

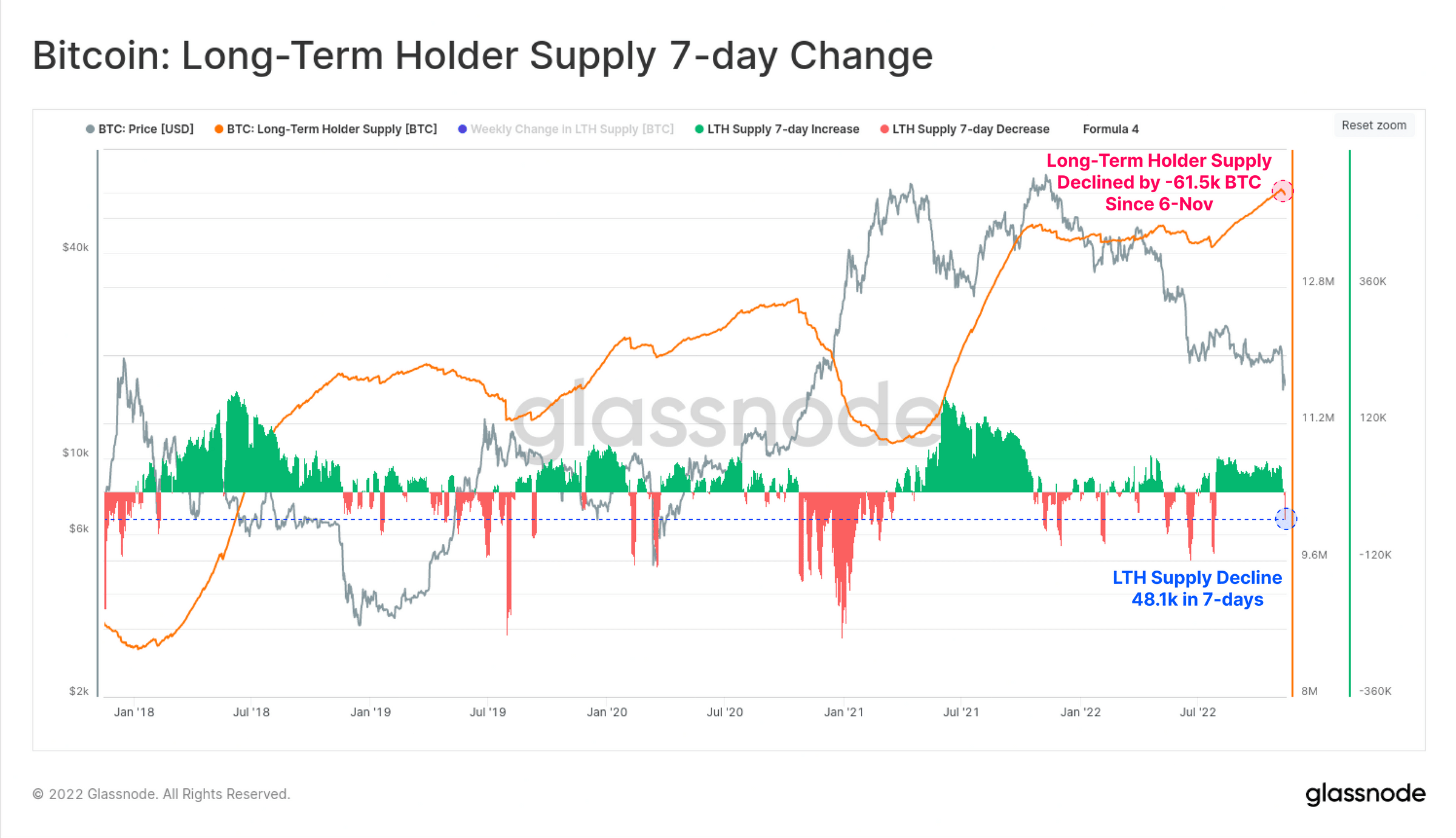

Glassnode thought of BTC’s Lengthy-Time period Holder provide metric and located that the class of BTC that was least prone to be spent declined since 6 November. Glassnode discovered that within the final seven days, about 48,100 BTC was spent. Whereas this was a notable decline, Glassnode opined that it was not sufficient “to deduce widespread lack of conviction.” It, nonetheless, added a caveat {that a} continued decline within the metric “might counsel in any other case.”

Supply: Glassnode

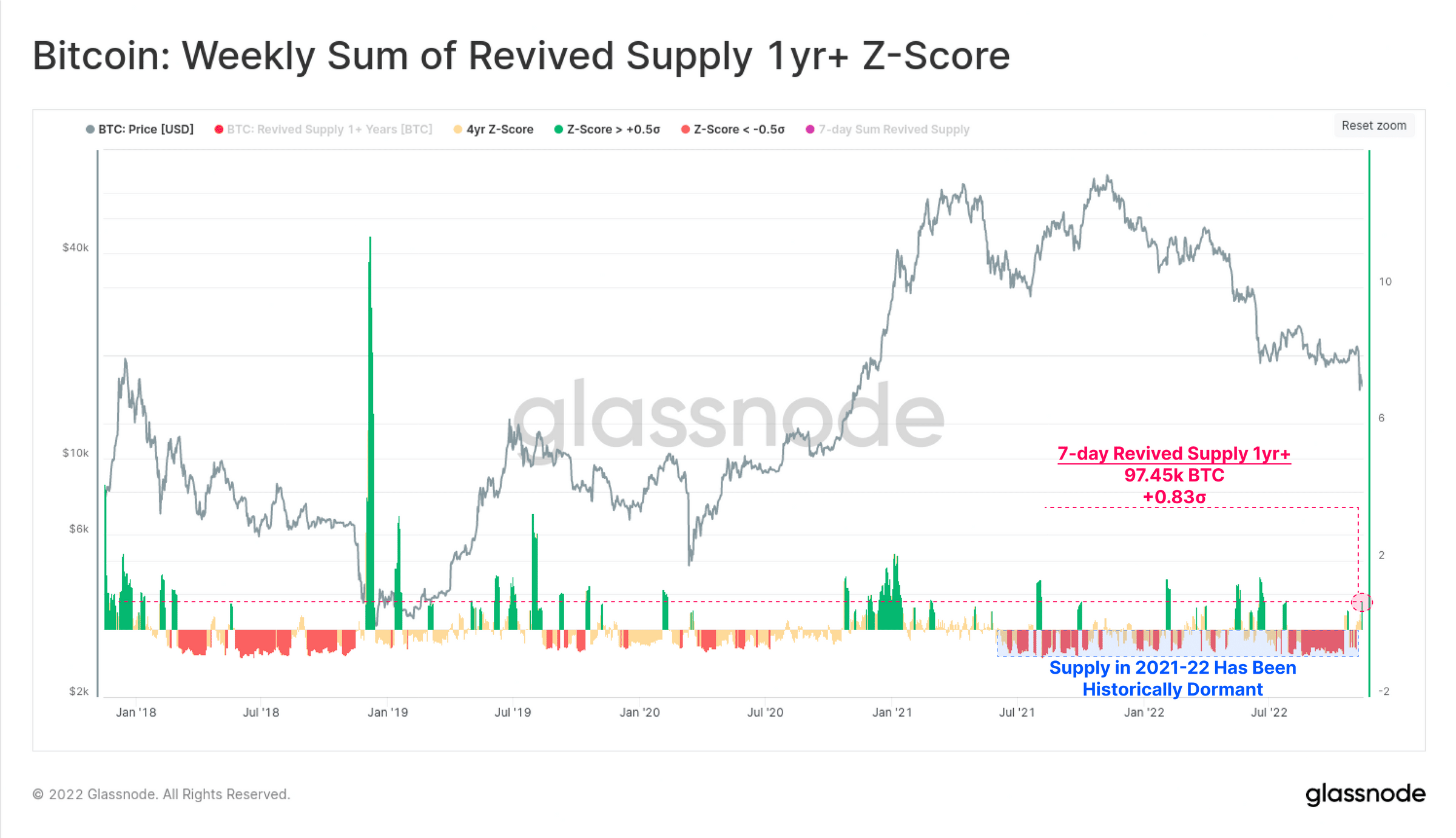

One other metric that posted a decline within the final week was BTC’s Revived Provide. Per Glassnode, 97,450 BTC which have been older than one yr have been spent “and doubtlessly returned to liquid circulation” over the past week.

Whereas this was an uncommon transfer because it represented a +0.83 sigma transfer on a four-year foundation, Glassnode famous that it was not “but of historic magnitude.” It was, nonetheless, to be stored a watch on for as a constant increment. This was as a result of an increase within the variety of BTC holders spending BTC older than one yr would imply a lack of holder conviction.

Supply: Glassnode

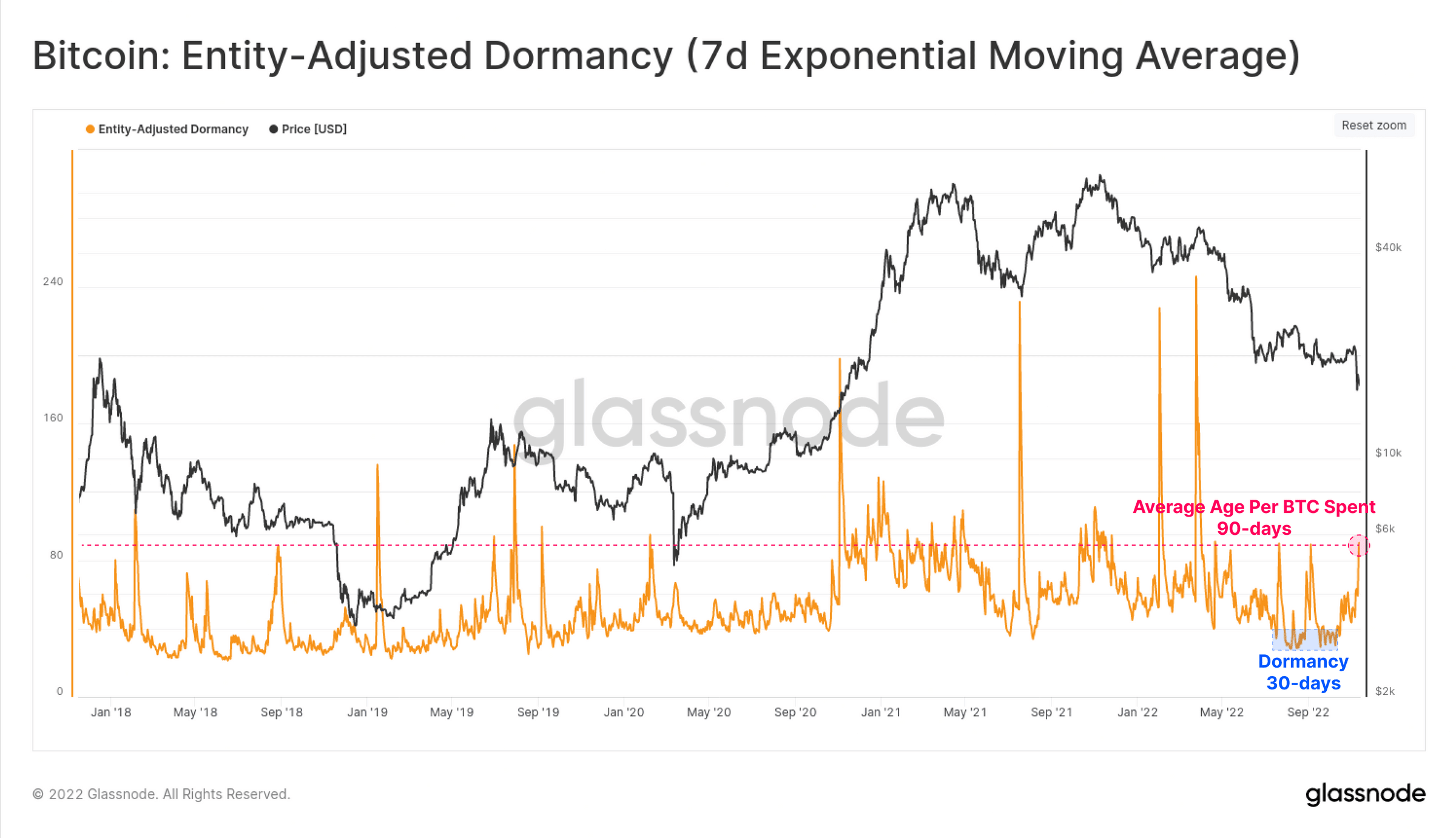

Moreover, Glassnode discovered that the typical age per BTC spent additionally climbed to over 90-days within the final week. Per the report, this index was triple than which was spent throughout September and October.

Based on Glassnode,

“The uptick in older cash being spent is noteworthy and is according to peaks seen throughout earlier capitulation sell-off occasions and even the 2021 bull market profit-taking. A sustained uptrend or elevated degree of Dormancy might point out a extra widespread panic has taken root amongst the HODLer cohort.”

Supply: Glassnode

On a ultimate word, Glassnode acknowledged,

“Total, there has definitely been a level of speedy panic inside the HODLer cohort. Nonetheless, given the magnitude of the circumstances, that is arguably an anticipated outcome. What is probably going of extra curiosity is whether or not these spikes soften in coming weeks, which might counsel that this shake-out is extra of an ‘occasion’, somewhat than a ‘pattern’.”