A prime govt at monetary providers big Constancy Investments believes that Bitcoin (BTC) is at the moment a discount.

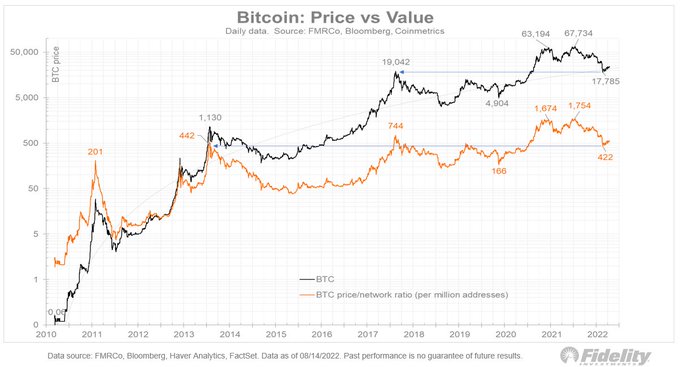

Constancy’s director of world macro Jurrien Timmer says that primarily based on the thesis that Bitcoin worth will rise as its community grows, the flagship crypto asset is wanting “low cost”.

“In case you consider in Bitcoin’s adoption-curve thesis (i.e. that the community will proceed to broaden consistent with earlier S-curves), then it’s cheap to view Bitcoin as low cost at these ranges.”

Based on the macro professional, the value of Bitcoin is below the precise and projected development of its community.

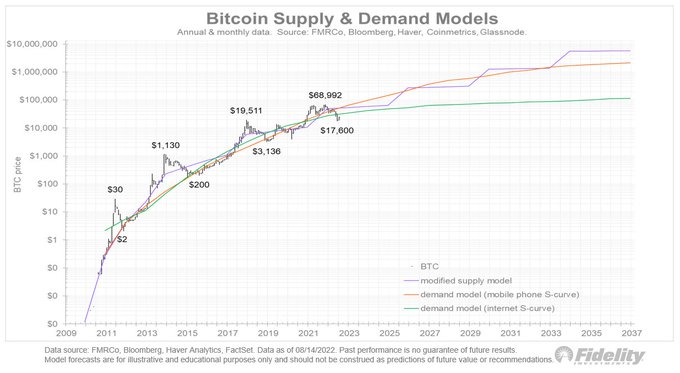

“For me, the primary nuance is the slope of the adoption curve. Whether or not we use the mobile-phone curve or web curve as proxies, Bitcoin’s worth is under its precise and projected network-growth curve. That curve offers a basic anchor for Bitcoin’s worth.”

Timmer has beforehand defined that Bitcoin’s adoption charge is more likely to mirror that of cellphones or web know-how.

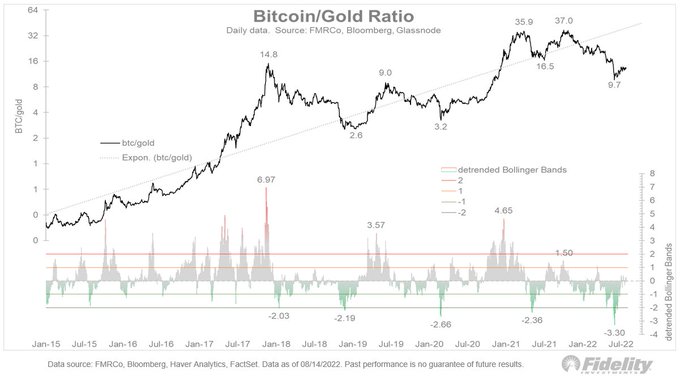

Utilizing the analogy of Bitcoin as digital gold, Timmer says that the king crypto was massively oversold in the course of the current market downturn and has deviated from the pattern when the 2 are in contrast aspect by aspect.

“If Bitcoin is gold’s precocious youthful sibling, it is smart to have a look at Bitcoin priced in gold (i.e., Bitcoin’s beta to gold). Technically, the current sell-off produced the largest oversold situation in years (measured because the variety of normal deviations from pattern).”

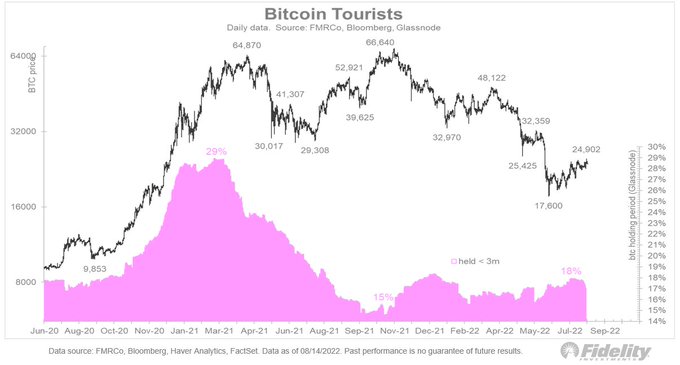

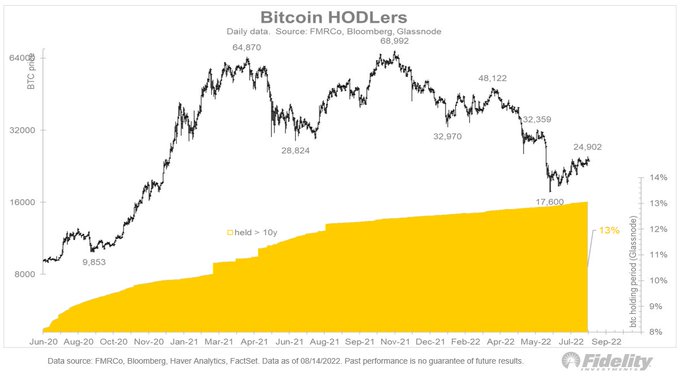

The macro professional additionally says that amid the crypto downturn, the proportion of Bitcoin held for lower than three months (short-term holders) stays comparatively unchanged whereas the proportion of Bitcoin held for over 10 years (long-term holders) is rising.

“Who’s shopping for Bitcoin lately? Apparently not the vacationers (i.e., short-term holders). The share of Bitcoins held lower than three months has barely budged recently.”

“However the variety of HODLers retains rising. The share of Bitcoin held for at the least 10 years is now 13%.”

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Examine Worth Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any loses you could incur are your accountability. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please word that The Each day Hodl participates in internet online affiliate marketing.

Featured Picture: Shutterstock/Maria Starus