Bitcoin could be returning to the underside of its present vary; trapped for months, BTC could be unable to push larger. Pushed by macroeconomic forces and uncertainty, the sideways value motion has decreased volatility throughout international monetary property.

On the time of writing, Bitcoin (BTC) trades at $19,400 with sideways motion throughout all timeframes. Earlier at this time, the cryptocurrency hinted at extra good points, however bulls have been unable to maintain momentum, surrendering BTC’s income from final week.

Bitcoin Goes Quiet, Macro Forces Take The Wheel

In keeping with Arcane Analysis, Bitcoin has seen no clear route in October. The cryptocurrency has been the best-performing asset by way of property shifting sideways over this era.

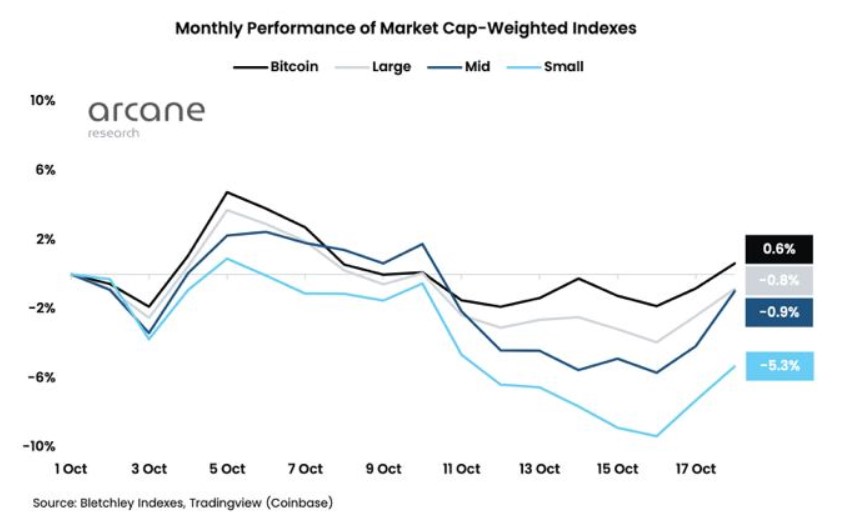

The chart beneath reveals that the benchmark cryptocurrency recorded a 0.6% revenue over the previous 30 days, whereas different crypto property trended barely to the draw back. Smaller tokens had been the worst performers, with a 5% loss in October.

Smaller cryptocurrencies usually endure probably the most in a uneven and unsure market; traders normally take shelter in Bitcoin and stablecoins, measured by the BTC Dominance and the USDT Dominance. These metrics have been trending upward after seeing a large decline in mid-October.

The spike in stablecoin and BTC dominance trace at extra sideways value motion because the crypto market enters one other stage of uncertainty till the next macroeconomic occasion triggers an explosion in volatility. Arcane Analysis famous the next on BTC’s present value motion:

Nonetheless no clear pattern in October, because the crypto market stays flat. Bitcoin and ether are gaining market shares relative to the opposite giant caps this week, whereas small caps are struggling (…). The crypto market remains to be extremely aligned with the inventory market this month. Each Bitcoin and Nasdaq are up 1% in October, with the correlation staying at report highs.

What Occurs When BTC Goes Quiet?

Extra knowledge from analysis agency Santiment signifies that Bitcoin whales could be accumulating BTC at its present ranges. The cryptocurrency is shifting close to its 2017 all-time excessive. Traditionally, these ranges have supplied long-term traders one of the best alternative to extend their holdings.

As BTC’s value tendencies sideways, Bitcoin addresses holding between 10,000 to 100,000 BTC reached their highest degree since February 2021. At the moment, the cryptocurrency was getting ready to re-enter value discovery mode following a significant bull run that took it from beneath $20,000 into the low $30,000.

The analysis agency noted:

(…) addresses holding 10 to 100 $BTC have reached their highest quantity of respective addresses since Feb, 2021. Because the variety of addresses on a community rise, utility ought to comply with go well with.

Regardless of this knowledge, the present macroeconomic circumstances could be unfavorable for a Bitcoin rally main the cryptocurrency into lengthy durations of accumulation and consolidation across the 2017 ATH and its yearly low of $17,600.