Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion.

- The day by day timeframe construction was strongly bullish.

- A dip beneath $22.2k will break the decrease timeframe bias.

Bitcoin rallied laborious all through January and has posted positive factors of 44.3% from the swing low to the swing excessive of January. Whereas that is a powerful feat by itself, it should even be remembered that Bitcoin knew nothing however promoting stress for almost all of 2022.

Learn Bitcoin’s Worth Prediction 2023-24

In January and February 2019, BTC launched into a 300% rally that lasted almost 5 months. Has BTC launched into an analogous path as soon as once more? Within the face of all of the bearish information in latest months, a revival in costs and demand was a nice surprise- and BTC bulls might have extra in retailer.

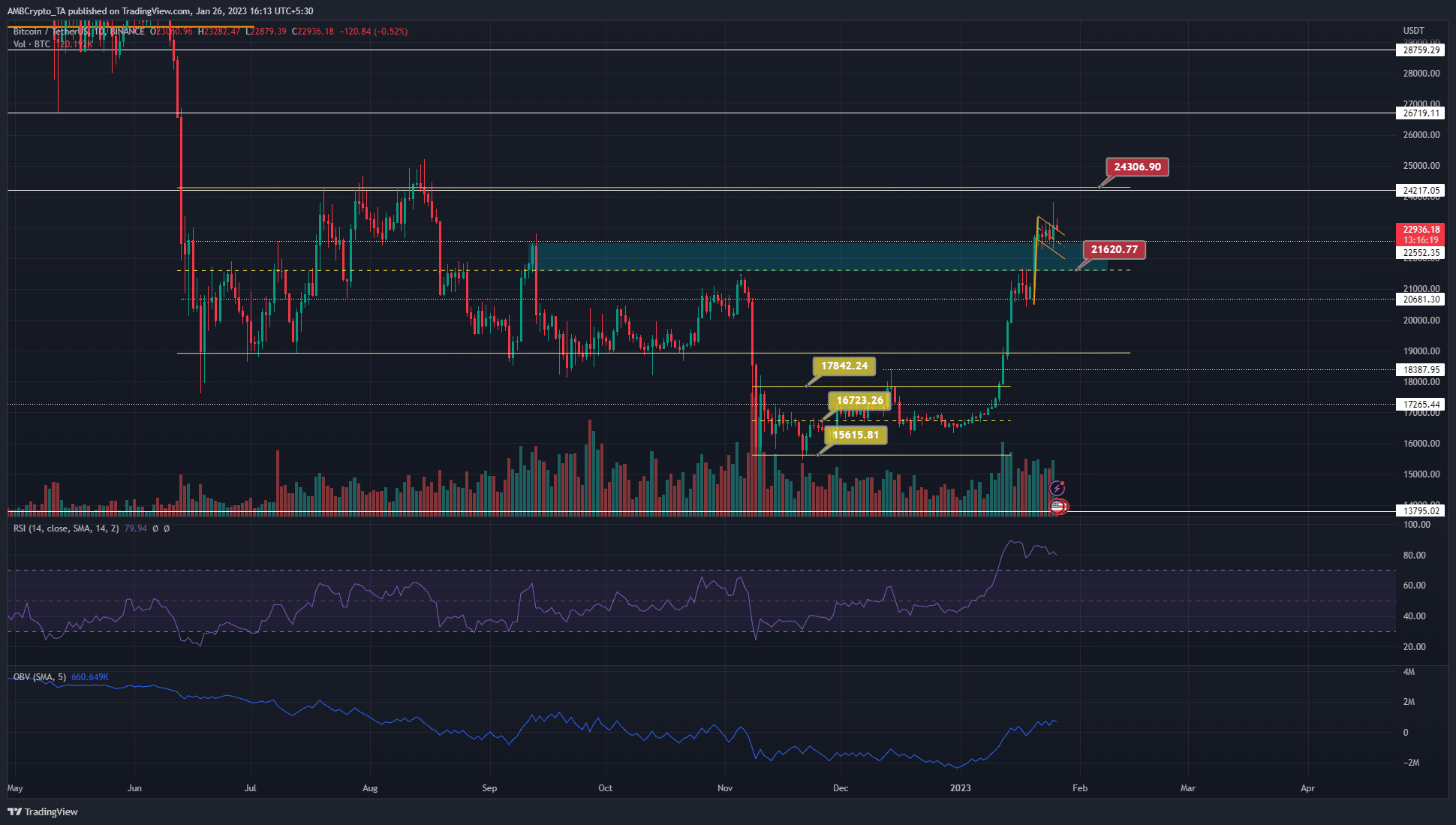

The bullish breaker from September has been defended to date

Supply: BTC/USDT on TradingView

Bitcoin fashioned a bull flag and climbed above it. The following stage of resistance lies on the vary highs of $24.3k. This space was final examined in mid-August. The size of the flag workers meant a bullish breakout will goal the $25k mark.

Above the $24.3k stage, the following vital ranges of resistance lie at $26k, $26.7k, and the $28k area. As a result of lack of value motion from Bitcoin on its descent in June, it was unsure the place BTC will run into important resistance between $24k and $28k.

Is your portfolio inexperienced? Examine the Bitcoin Revenue Calculator

Invalidation of the bullish concept could be a day by day session shut beneath $21.6k. This might make the worth motion of the previous few days a deviation, and a reversal towards $19k might begin.

Nonetheless, as issues stand, this course was unlikely. The RSI confirmed sturdy bullish momentum and the OBV was in an uptrend as nicely to indicate real demand.

The Open Curiosity has flattened alongside the worth in latest days

Over the previous 4 days, each the worth and the OI have been flat. The spot CVD has retreated to indicate promoting stress. Therefore, regardless of the breakout from the bull flag, the veracity of the transfer above $23k may very well be in query if OI and CVD don’t decide up. The expected funding price was optimistic to point bullish sentiment.

The upper timeframe market construction was bullish, and a session shut again beneath $20.6k would break this construction. A revisit to the $21k-$21.6k space might happen because of the inefficiency left behind on the swift transfer upward.