- Bitcoin’s hashrate reached a brand new all-time excessive on 26 February.

- Day by day energetic customers have elevated over the previous weeks and different metrics have been bullish.

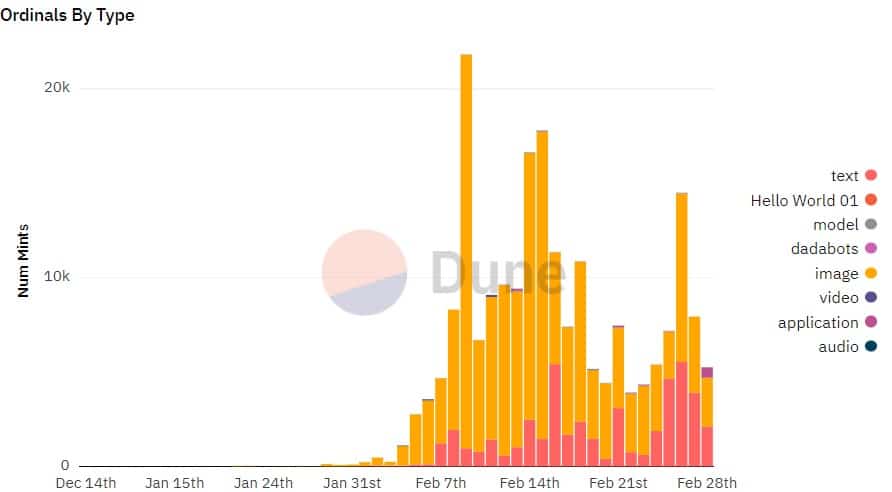

Bitcoin [BTC] Ordinals crossed the benchmark of efficiently inscribing over 200,000 NFTs. This milestone was reached swiftly, because it has solely been a few months since Ordinals’ launch. The full Ordinals inscribed on the time of writing was 207,269, with image-type ordinals accounting for the lion’s share, adopted by textual content.

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

Nevertheless, it was attention-grabbing to notice that the amount registered a decline after inscribing the best variety of Ordinals on 9 February.

Supply: Dune

Ordinals inviting new miners into the community

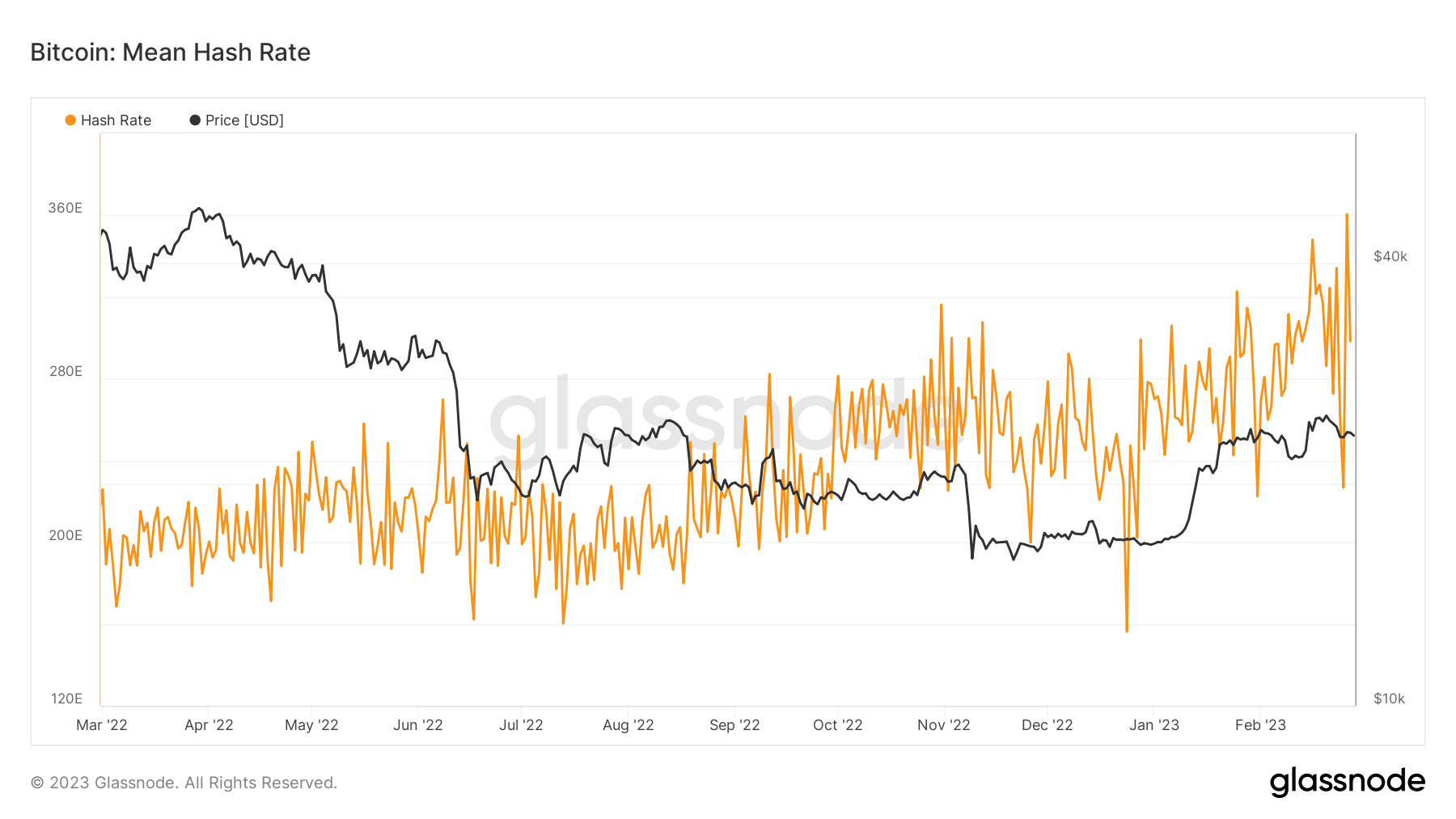

Whereas extra NFTs have been being minted in the previous couple of weeks, BTC’s mining trade witnessed progress as its hashrate reached a brand new all-time excessive on 26 February 2023. The surge in hashrate mirrored an inflow of latest miners within the community, and Ordinals might have performed a significant position in fueling this hike.

Supply: Glassnode

A doable cause for miners’ curiosity in Ordinals may be the impression it had on BTC’s value. As BTC’s value elevated, income generated by mining grew to become extra profitable, leading to a rise within the variety of miners. When the hashrate reached a brand new ATH, it was clear that miners have been bullish on BTC and, by extension, Ordinals.

BTC equipped on the metrics entrance

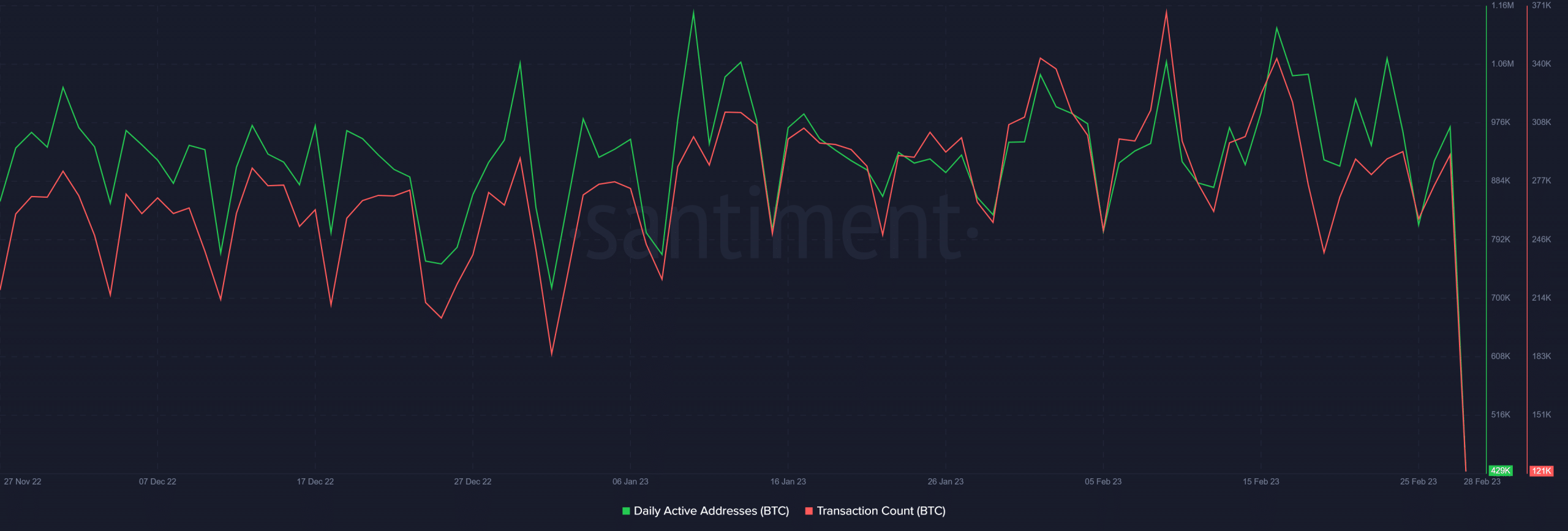

Based on Glassnode, BTC’s Taproot utilization reached an all-time excessive just a few days in the past, because of Ordinals, which used the protocol for inscription. As Ordinals’ reputation skyrocketed, so did BTC Taproot utilization and adoption. Not solely this, however Bitcoin NFTs additionally had an impact on the community’s utilization, which was evident from Santiment’s information.

For instance, BTC’s transaction rely elevated over the previous couple of weeks. Moreover, BTC’s each day energetic addresses adopted an analogous sample and elevated. Each of those uptrends may be attributed to the rising reputation of Ordinals.

Supply: Santiment

Is your portfolio inexperienced? Examine the Bitcoin Revenue Calculator

Will Ordinals’ achievements be mirrored on BTC’s chart?

As Ordinals’ reputation and inscription proceed to extend, the probabilities of this growth mirrored in BTC’s chart can’t be understated. CryotoQuant’s data revealed fairly just a few key metrics that recommended that BTC may break its resistance close to the $25,000 zone within the days to comply with.

The derivatives market remained assured on BTC, as its taker purchase promote ratio indicated that purchasing sentiment was dominant. BTC’s funding price additionally regarded optimistic, which will increase the probabilities of a value uptrend. Furthermore, BTC’s change reserve was declining, which is a optimistic sign because it signifies much less promoting stress. At press time, BTC was buying and selling at $23,371.22 with a market capitalization of greater than $451 billion.

Supply: CryptoQuant