Over the previous few months, many miners have confronted huge challenges to maintain up income and proceed to mine Bitcoin [BTC]. With the rising hashrate and hovering power costs, miners proceed to face one issue after one other. And one such miner occurs to be Core Scientific.

_____________________________________________________________________________________

Right here’s AMBCrypto’s Worth Prediction for Bitcoin [BTC] for 2022-2023

_____________________________________________________________________________________

The place is my mine?

One of many largest blockchain miners, Core Scientific, issued an announcement that implied that it could should explore bankruptcy. The mining group anticipated that its present money sources shall be depleted by the tip of the yr, probably sooner. This could possibly be an indicator of the truth that prime public Bitcoin miners could also be struggling the consequences of the bear market.

As will be seen from the picture beneath, the highest 10 public bitcoin miners symbolize 18% of the whole hashrate of your complete Bitcoin community. With growing energy prices and growing hashrates, miners can be compelled to promote their BTC to earn income. This improve in promoting strain for Bitcoin might influence BTC negatively.

Supply: Messari

Nevertheless, regardless of the continual promote strain being confronted by miners, miner income generated by charges witnessed some development over the previous few days. In line with knowledge from on-chain knowledge intelligence platform Glassnode’s knowledge, miner income generated by charges collected reached a one month-high on 29 October. If the income generated continues to develop, the promoting strain on miners might cut back.

Supply: Glassnode

A have a look at the mining flipside

Bitcoin miner’s income was additionally contingent on Bitcoin’s development. In line with knowledge from Messari, Bitcoin’s realized volatility went down immensely over the previous. Moreover, this determine decreased by 67% since July, making BTC much less riskier for buyers in the course of the mentioned interval.

3/ Did somebody say decoupling? 👀#Bitcoin‘s and #Ethereum’s 30-day realized volatility continues to fall as equities volatility continues to rise.

Since peaking in early July, Bitcoin’s and Ethereum’s realized volatility has declined 67% and 63%, respectively. pic.twitter.com/jmCiR7bT4c

— Messari (@MessariCrypto) October 28, 2022

One other optimistic indicator of Bitcoin’s potential development could possibly be that the general Bitcoin provide in revenue witnessed some development. Moreover, it additionally reached a one-month excessive on the 29 October.

📈 #Bitcoin $BTC Provide in Revenue (7d MA) simply reached a 1-month excessive of 10,555,234.130 BTC

View metric:https://t.co/iA2PiXhX8N pic.twitter.com/oFE1OgF8jV

— glassnode alerts (@glassnodealerts) October 29, 2022

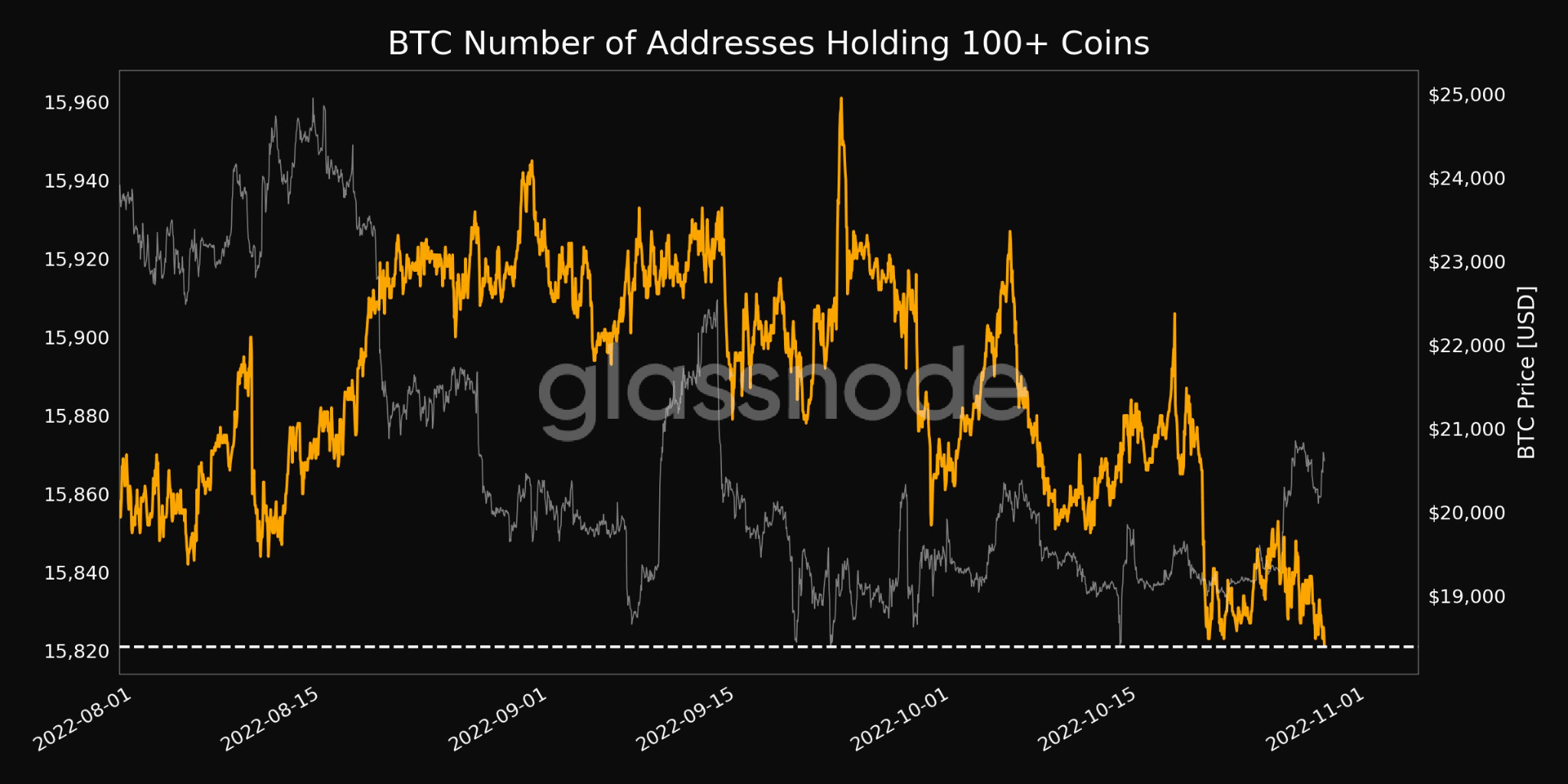

Regardless of these optimistic indicators whales confirmed their disinterest in Bitcoin. As proven within the picture beneath, it may be seen that the variety of addresses holding greater than 100 Bitcoins decreased. If giant addresses proceed to let go of their Bitcoin, BTC’s costs shall be affected negatively.

Supply: Glassnode

On the time of writing, Bitcoin had been buying and selling at $20,770 and had appreciated by 0.2% within the final 24 hours in response to CoinGecko.