Bitcoin has been capable of make a resurgence in current weeks. The 25,000 USD barrier was recaptured by Bitcoin costs simply two days in the past, marking the primary time since June thirteenth.

Bitcoin Poised For New Rally

In June, Bitcoin had its largest month-to-month decline since 2011, falling over 37.3% to a ultimate worth of $19,925. Since then, it has partially recovered its worth and at this time noticed its first check of $25,000.

Bitcoin continues to rule the charts regardless of being down 46.5% from its earlier excessive, however its dominance has decreased to slightly below 40% versus greater than 50% just a few months in the past.

BTC/USD trades barely under $24k. Supply: TradingView

Nonetheless, Bitcoin has been comparatively peacefully fluctuating horizontally over the previous two weeks between $22,500 and $24,500. On the similar time, current weeks have seen a big restoration in each commodities costs and inventory markets. In consequence, the general monetary markets are experiencing the anticipated summer time rally.

Since angle had reached a extreme panic state in the midst of June on account of the monetary markets’ steep, month-long decline, notion amongst members has vastly improved through the course of the latest rebound. This in and of itself is a widely known bear market sample. Nonetheless, it received’t be recognized whether or not and the way the bears will return till round mid-September.

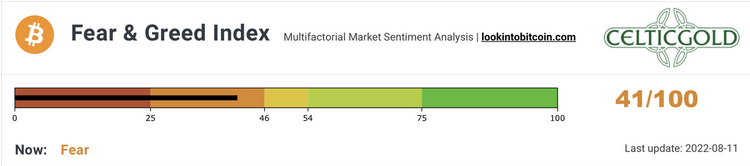

Over the earlier 4 weeks, the Crypto Concern & Greed Index has made outstanding progress. The sentiment continues to be largely scared, although. Concern nonetheless permeates the cryptocurrency trade seven months after the devastating sell-off.

Crypto Concern & Greed Index, as of August eleventh, 2022. Supply: Lookintobitcoin

The sensation of being defeated permeates the broader image as nicely. There are a number of glorious contrarian alternatives on this setting.

Total, there may be nonetheless a contrarian purchase sign because of the scared mindset.

Sharp declines within the monetary markets can be extraordinarily detrimental to retain the present administration in workplace given the midterm elections on November eighth within the US. In consequence, solely a slight decline within the monetary markets in September can be extra possible. The markets might then rise from these lows till the American election.

Since November 2021, the fairness and cryptocurrency markets have been underneath intense stress for months, however a broad rebound has now been occurring for little over 4 weeks. The Nasdaq Composite, which is closely weighted towards expertise, has elevated by over 20% from its low on June sixteenth on account of this process, including over $420 billion to its market worth. This might suggest that the bear market is formally over.

Associated Studying: Bitcoin Value Trades A Little Over $24,000, Can It Goal $27,000?

Featured picture from Getty Photos, chart from TradingView, and Lookintobitcoin