- BSV noticed a decline of 5% on 11 January.

- Robinhood’s delisting plans announcement contributed to the downward worth motion of BSV.

Bitcoin Satoshi Imaginative and prescient [BSV] has gone by what could be thought-about an surprising downward development in worth not too long ago. Buyers’ property had over 5% of their value erased inside 24 hours because of the incidence. Is the downward development anticipated to proceed, and if that’s the case, why?

What number of are 1,10,100 BSVs value as we speak?

Robinhood halt BSV commerce, delisting on the best way

Bitcoin SV’s worth has been on a downward development, as depicted by a chart with a every day timeframe. It’s attainable that the prevailing sentiment in the marketplace performed a task, however extra investigation suggests extra components at play.

Inventory and cryptocurrency buying and selling platform Robinhood said on 11 January that it might quickly cease supporting Bitcoin SV and delist the token later within the month.

In keeping with the newest Robinhood announcement, as of 25 January, clients can now not commerce, buy, or in any other case cope with Bitcoin SV. After that point, all unsold BSV in consumer accounts shall be offered and credited to their accounts robotically.

A fork of Bitcoin Money (BCH) resulted in Bitcoin SV, usually often known as “Satoshi’s Imaginative and prescient.” Its larger block measurement, which ends up in decrease transaction prices, units it other than different variants of Bitcoin [BTC], resembling Bitcoin Money [BCH].

Promoting strain spikes quantity metric

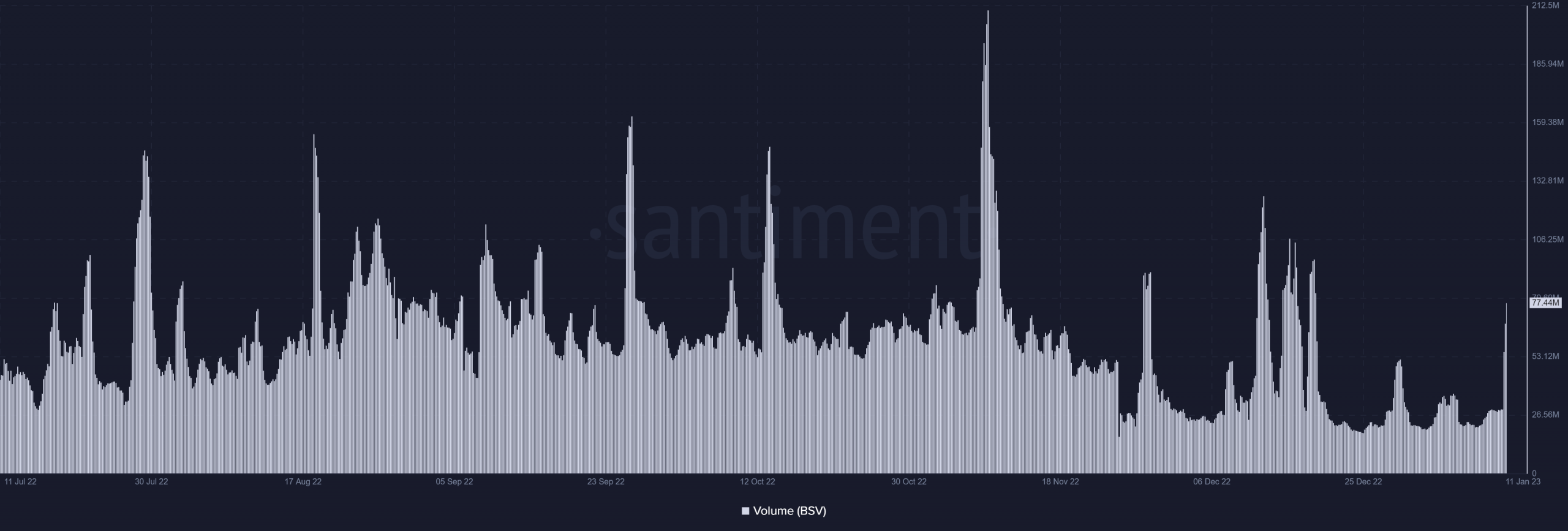

As per Santiment’s quantity metric, on 11 January, there was a big enhance within the variety of transactions. The graph under revealed that over $77 million was traded over that timeframe. This was the primary time within the 12 months that such a excessive variety of transactions could be documented, making it significantly noteworthy.

Wanting on the quantity indicator on the worth chart in additional element, promoting strain had been predominant within the quantity of transactions. BSV’s worth fell as promoting strain grew to become extra prevalent.

Supply: Santiment

Is your portfolio inexperienced? Take a look at the BSV Revenue Calculator

BSV declines in a every day timeframe

BSV’s every day timeframe chart revealed that the asset was at present in a bear development because of the downturn it was experiencing. An examination of the every day timeframe chart confirmed that the Relative Power Index line had deviated under the impartial space. The asset was buying and selling at round $41.4 on the time of writing, having misplaced about 1%.

Supply: TradingView