- The variety of new Bitcoin addresses has hit a three-month excessive.

- Nevertheless, considerations over Silvergate contributed to a drop of almost 5% within the BTC value.

Worth fluctuations in Bitcoin [BTC] have been pushed previously by each particular person and institutional buyers. Current developments, nevertheless, point out that one social gathering has much more sway than the opposite over the route of the worth.

Learn Bitcoin (BTC) Worth Prediction 2023-24

Enter, retail buyers

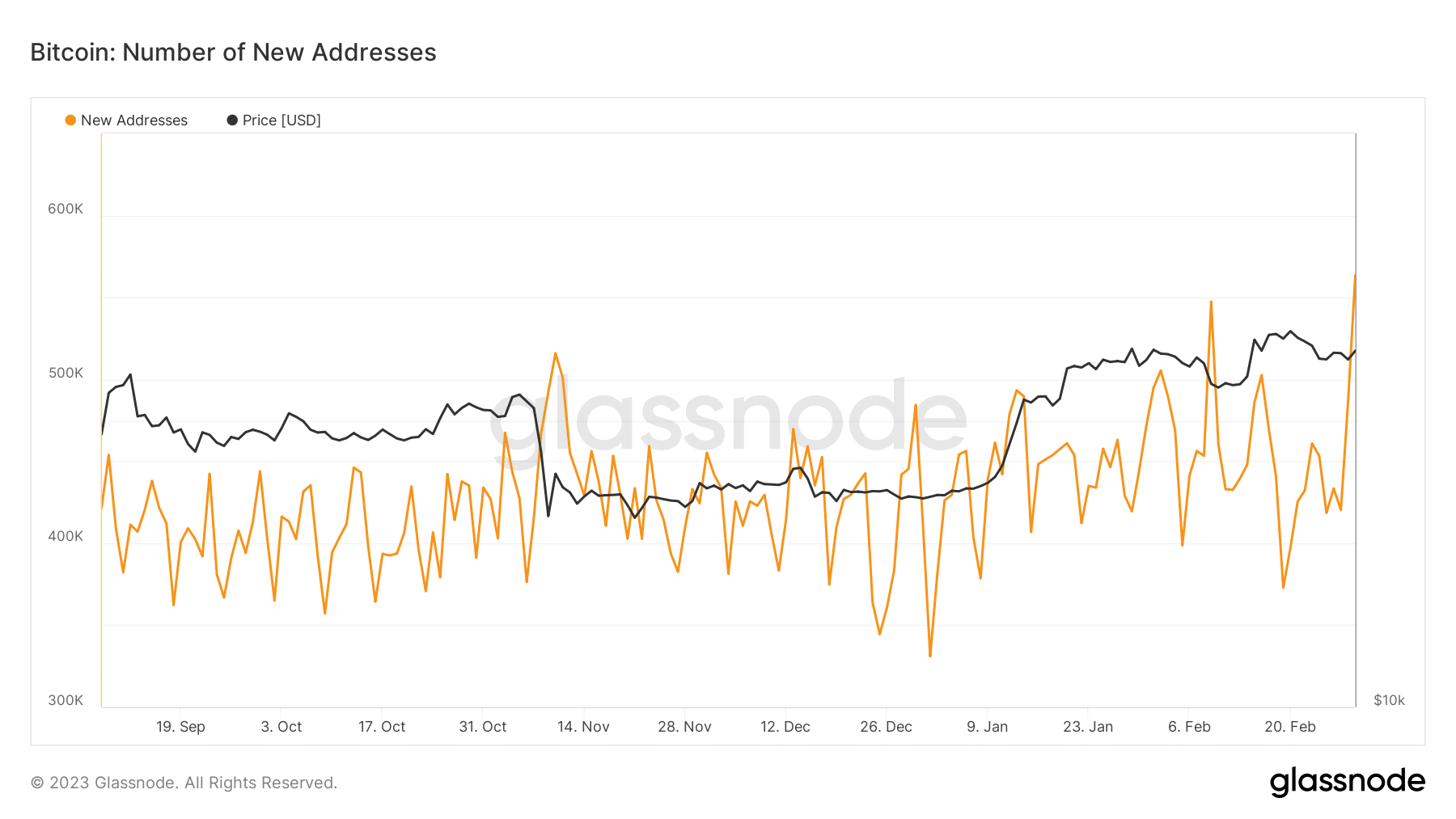

There was a rise within the variety of new addresses on the Bitcoin community, in accordance with knowledge from Glassnode. The gradual improve in Bitcoin costs occurring lately additionally coincided with the rise in new addresses.

Supply: Glassnode

On 2 February, 505,298 new addresses had been registered, as measured by the Glassnode metric. An intensive examination of the graph confirmed that it was essentially the most vital quantity the community had seen within the previous three months.

Additionally, November 2022 is the one month within the previous 5 months to have seen statistics much like, however considerably larger than, November 2022.

Based on Alicharts, the rising variety of Bitcoin addresses is trigger for optimism. Because of this, barring any unfavorable impact from institutional actors, the asset’s value could rise much more, signaling rising confidence in BTC.

The institutional gamers’ impact

Once we contemplate the function of institutional actors, we see that the worth of Bitcoin has been negatively affected by the collapses of exchanges like Mt.Gox, Terra, and FTX. Bitcoin was nonetheless making an attempt to burst past the $24,000 barrier, however current information may need dampened the rally.

In lower than an hour on March 3, the worth of Bitcoin [BTC] dropped from $23,500 to $22,240, a drop of just about 5%. There was widespread unease about the way forward for the crypto-friendly financial institution Silvergate Capital, which contributed to the decline.

Based on CoinMarketCap knowledge, the worth decline diminished Bitcoin’s complete market capitalization by $22 billion.

The curious case of Silvergate

Silvergate is a number one cryptocurrency financial institution that has established relationships with key buying and selling platforms. The crypto-friendly monetary establishment has delay submitting its yearly 10-Okay report back to the SEC (SEC).

As a result of extra vital losses in its fourth fiscal quarter final 12 months in comparison with what was initially reported in January, the financial institution notified the SEC that its monetary situation may very well be totally different than beforehand revealed.

The financial institution had additionally reportedly voiced concern over the dearth of readability in crypto guidelines. Because of this, corporations and exchanges dealing in cryptocurrencies have distanced themselves from banks. This contains the likes of Circle, Coinbase, Bitstamp, and Galaxy Digital.

BTC enters a bear pattern

The value of Bitcoin was nonetheless struggling to get well from the autumn, as of this writing. It was buying and selling at $22,000 and had misplaced greater than 4% on a every day timeframe.

The current hunch has additionally prompted the worth to maneuver under the quick Transferring Common (yellow line). The Relative Power Index (RSI) line had crossed under the impartial zone, signaling it had additionally entered a bearish pattern.

Supply: TradingView

How a lot are 1,10,100 BTCs value at present

Bitcoin optimism?

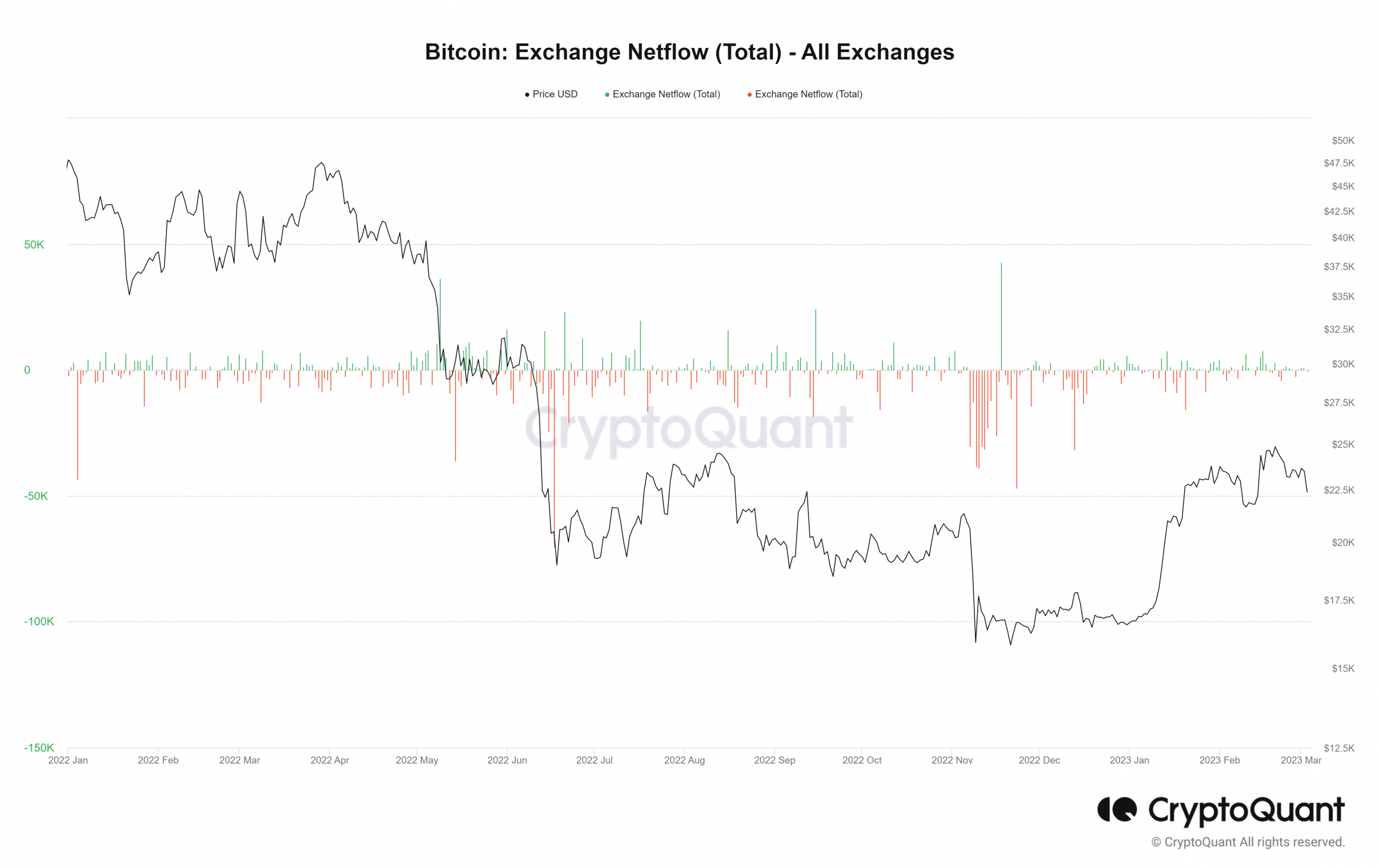

Regardless of the current lower within the value of Bitcoin (BTC), there wasn’t panic. Trade deposits didn’t appear out of the atypical, in accordance with the Trade Netflow knowledge from CryptoQuant.

On the time of writing, there have been fewer than 200 deposits on exchanges, even when there have been extra deposits than withdrawals. But, because the story unfolds, it’s important to think about how institutional and retail buyers reply and have an effect on value motion.

Supply: CryptoQuant