Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion.

- The construction was bullish on the every day timeframe.

- Losses of 12% in beneath two weeks highlighted bearish energy.

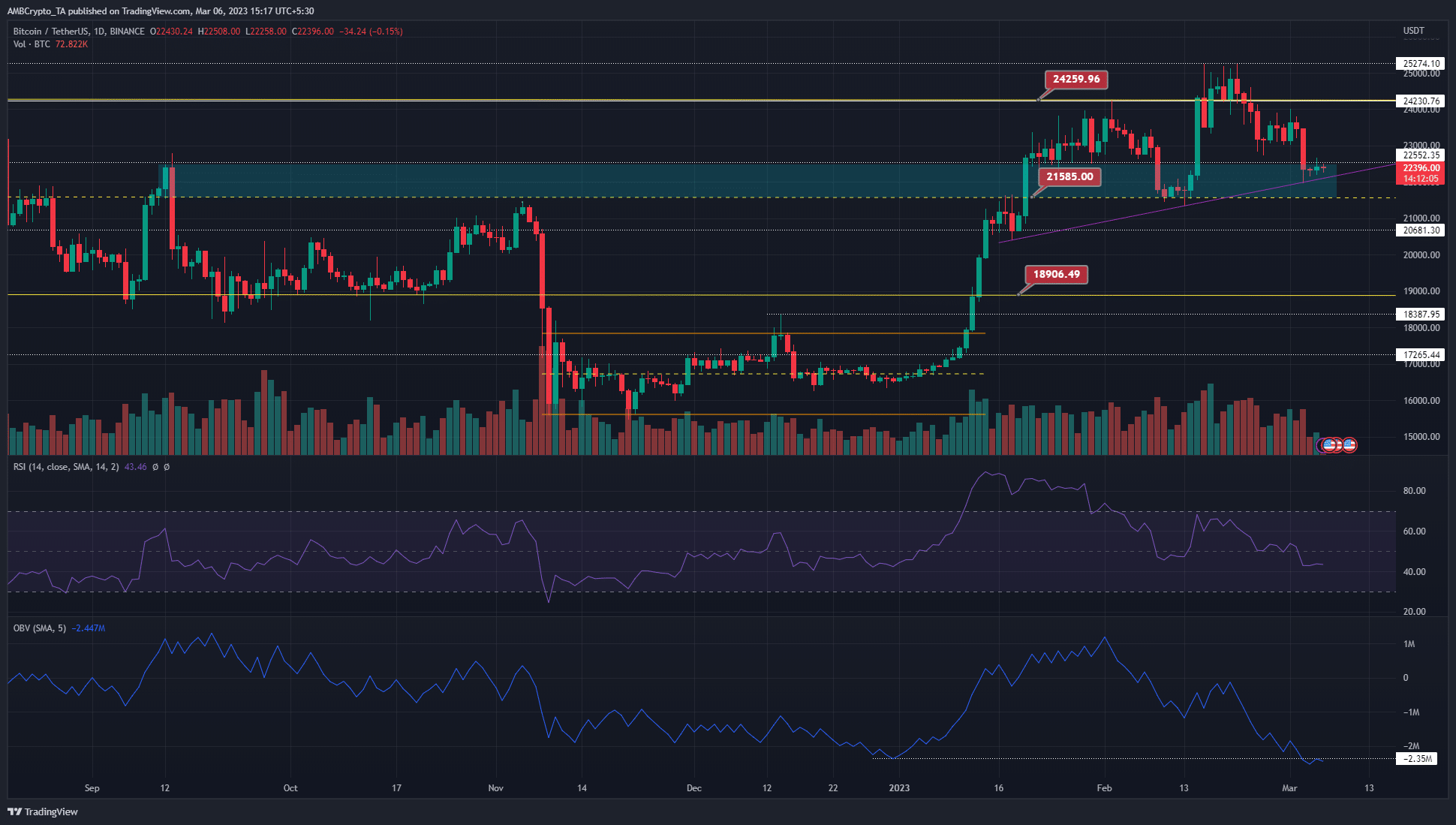

Analysts who in contrast the on-chain metrics of Bitcoin in 2023 to that within the 2018-2019 cycle discovered that Bitcoin may have fashioned its long-term backside again in January. Buyers with excessive time horizons may very well be rewarded later this yr.

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

Evaluation of the value motion confirmed that, though there was important promote stress lately, bulls nonetheless have energy available in the market. The confluence of assist within the $21.6k-$22k space underlined the potential for a bounce in costs throughout the market.

The bullish breaker from September was retested

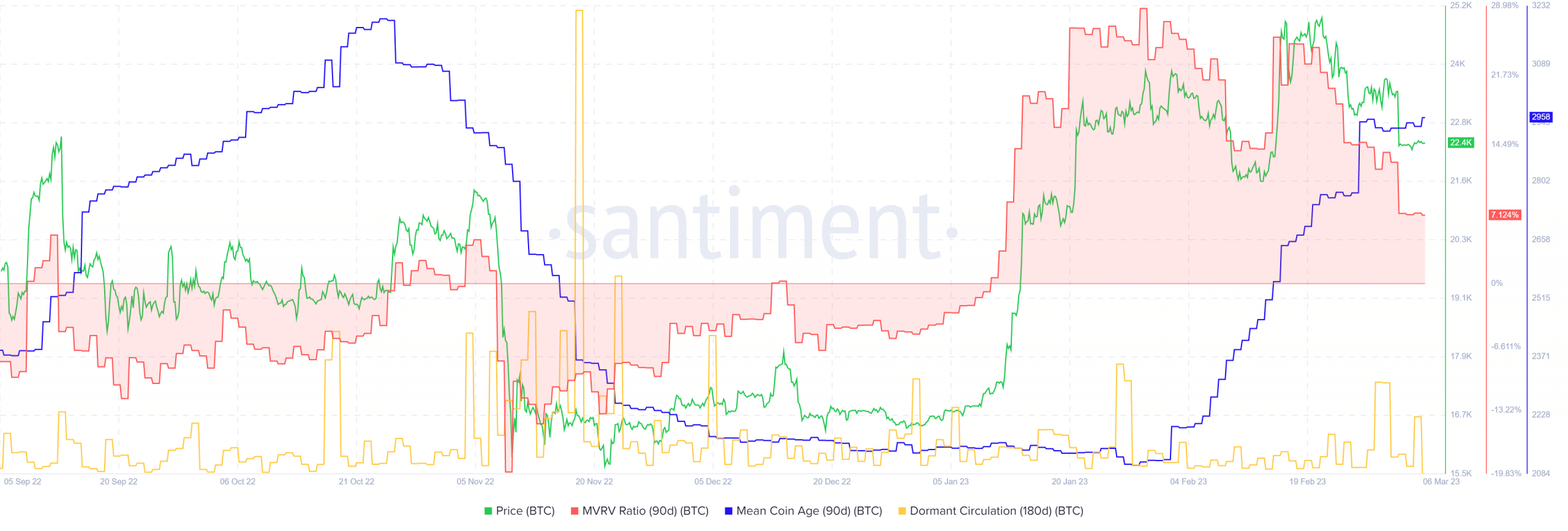

Supply: BTC/USDT on TradingView

From June to November, Bitcoin traded inside a variety that prolonged from $18.9k to $24.2k. The mid-point of this vary lay at $21.6k and was beforehand examined as assist in mid-February. The worth has sunk to this area as soon as once more after a rejection at $25.2k.

Though the king of crypto was in a position to breach the vary highs, the bulls have been unable to defend their positive aspects. This confirmed sturdy profit-taking tendencies throughout the market, and likewise highlighted the significance of $24.8k-$25.2k as resistance.

The construction on the every day chart confirmed a sequence of upper lows, marked by the purple trendline assist. Whereas decrease timeframe momentum was strongly bearish (decrease lows since 23 February) the retest of the bullish breaker from September may very well be essential.

Is your portfolio inexperienced? Examine the Bitcoin Revenue Calculator

Invalidation of the bullish concept could be a descent again under the $21.6k mark. A every day session shut would break the construction and flip the bias to bearish.

The OBV sank to a brand new low in 2023, regardless that the costs are a lot larger. This supported the concept promoting stress was dominant and the rally was close to an finish. The RSI confirmed weak bullish momentum in late February and lately fell under the impartial 50 mark at hand the reins to the bears.

There have been indicators of accumulation however holders continued to take earnings

The 90-day imply coin age was on the rise and confirmed BTC accumulation throughout the community. The final time this occurred was in October. The metric started to fall earlier than the costs did, and the same motion within the coming weeks may very well be an early signal to promote Bitcoin.

The dormant circulation confirmed noticeable spikes since early December, which highlighted how worry dominated the market.

The 90-day MVRV ratio was sliding southward however remained constructive, which indicated the profit-taking won’t be over but.