Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion

- The market construction of Bitcoin was bearish on larger timeframes

- December’s lows at $16,256 could possibly be tagged earlier than a transfer larger, however must you purchase the dip?

The sentiment behind Bitcoin has been fearful in latest months. The autumn of FTX and the FUD round Binance aided the sellers, and the bulls had their backs to the partitions and no manner out but.

The information of inflation from the US Federal Reserve and their makes an attempt to fight it meant we may see a couple of extra months of the bear market, a minimum of.

Learn Bitcoin’s Worth Prediction 2023-24

Volatility lowered in latest weeks, and this might see a violent transfer within the coming weeks. A transfer downward may power massive liquidations, and assist type a long-term backside. On the time of writing, the market was bearishly biased.

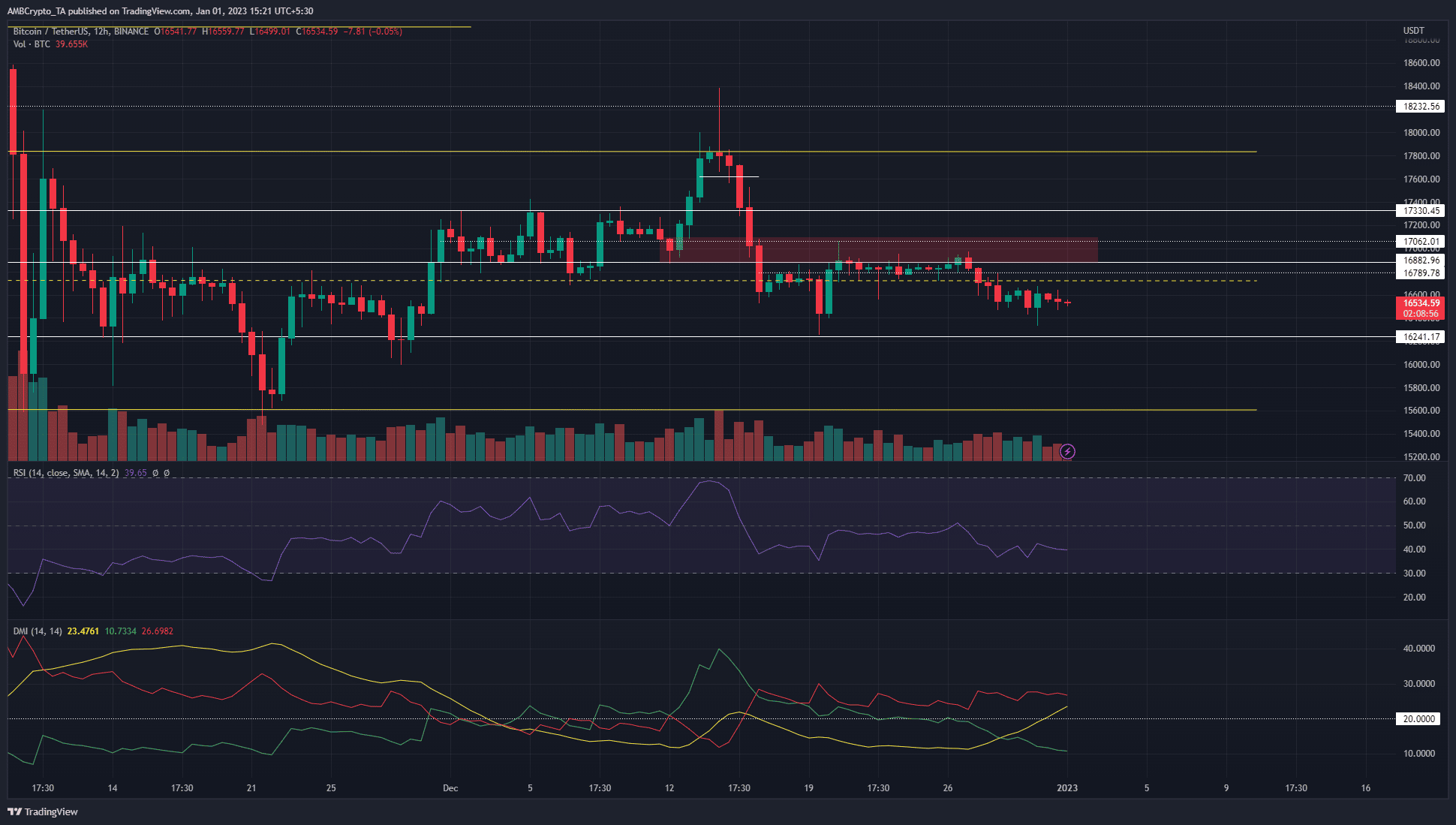

The 12-hour bearish breaker stays unbeaten, BTC has bounced from $16,450 a number of occasions as effectively

Supply: BTC/USDT on TradingView

The Directional Motion Index (DMI) indicator confirmed a bearish development was selecting up power. The Common Directional Motion (ADX) line (yellow) crossed over the 20 mark, whereas the -DI was additionally above 20 to indicate a big downward development in progress. The worth motion additionally agreed with the findings of this indicator.

BTC bounced between the $17k mark and the $16.4k space a number of occasions prior to now two weeks. Since mid-December, after the drop from $17.8k, the market construction took a bearish bias as the upper low at $17k from 12 December was damaged.

In doing so, the value additionally broke beneath the bullish order block and flipped it to a bearish breaker, highlighted by the pink field. Moreover, a transfer again above the $17k stage would give some bullish impetus to BTC.

The Relative Energy Index (RSI) continued to maneuver beneath the impartial 50 mark to indicate bearish momentum behind the king of crypto.

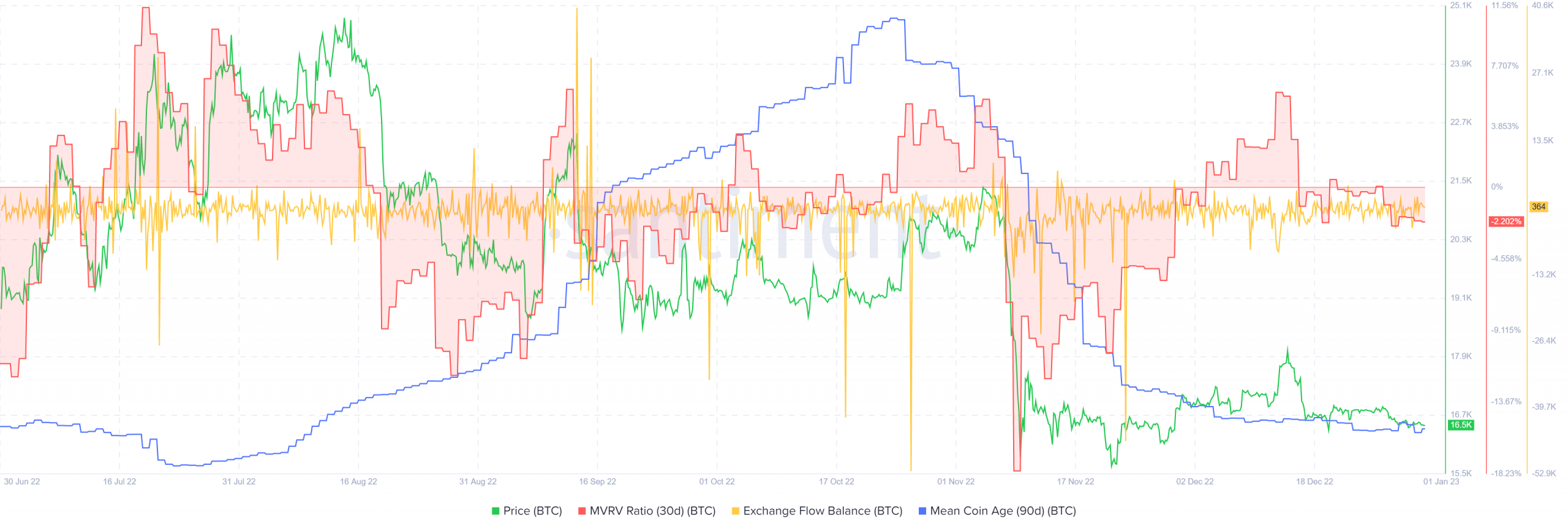

The imply coin age dwindles because the MVRV ratio dips into unfavourable territory

The 30-day Market Worth to Realized Worth (MVRV) ratio slipped into unfavourable territory after the sharp rejection BTC confronted at $18.4k. This rejection noticed the asset stoop again under $17k and indicated it was barely undervalued in line with the metric.

The 90-day imply coin age has additionally been falling since November to indicate the elevated motion of the coin between addresses, and alongside the value motion, it probably stemmed from promoting strain.

Are your BTC holdings flashing inexperienced? Test the Revenue Calculator

The alternate movement didn’t present vital quantities of BTC flowing into or out of exchanges in December. Moreover, a large influx may presage a big drop in costs and be value watching out for.