Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion

- The bearish BTC every day construction remained unbroken however the decrease timeframes confirmed sturdy bullishness

- A powerful rejection might gasoline promoting strain however consolidation beneath $22.6k would doubtless level towards additional positive aspects

The volatility returned simply earlier than the opening of the Asia markets. Bitcoin posted fast positive aspects and appeared to violently invalidate the concept the market would proceed to descend.

Nonetheless, from a technical perspective, there remained an opportunity that BTC might resume the earlier hunch after the positive aspects of the previous few hours.

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

$212 million have been liquidated prior to now 24 hours and 83.5% of them have been quick positions, in accordance with Coinglass data.

The return of BTC to a former trendline resistance provided a super alternative to quick the king of crypto as soon as more- however will this be a profitable commerce?

Bitcoin pumps proper previous a important degree of resistance

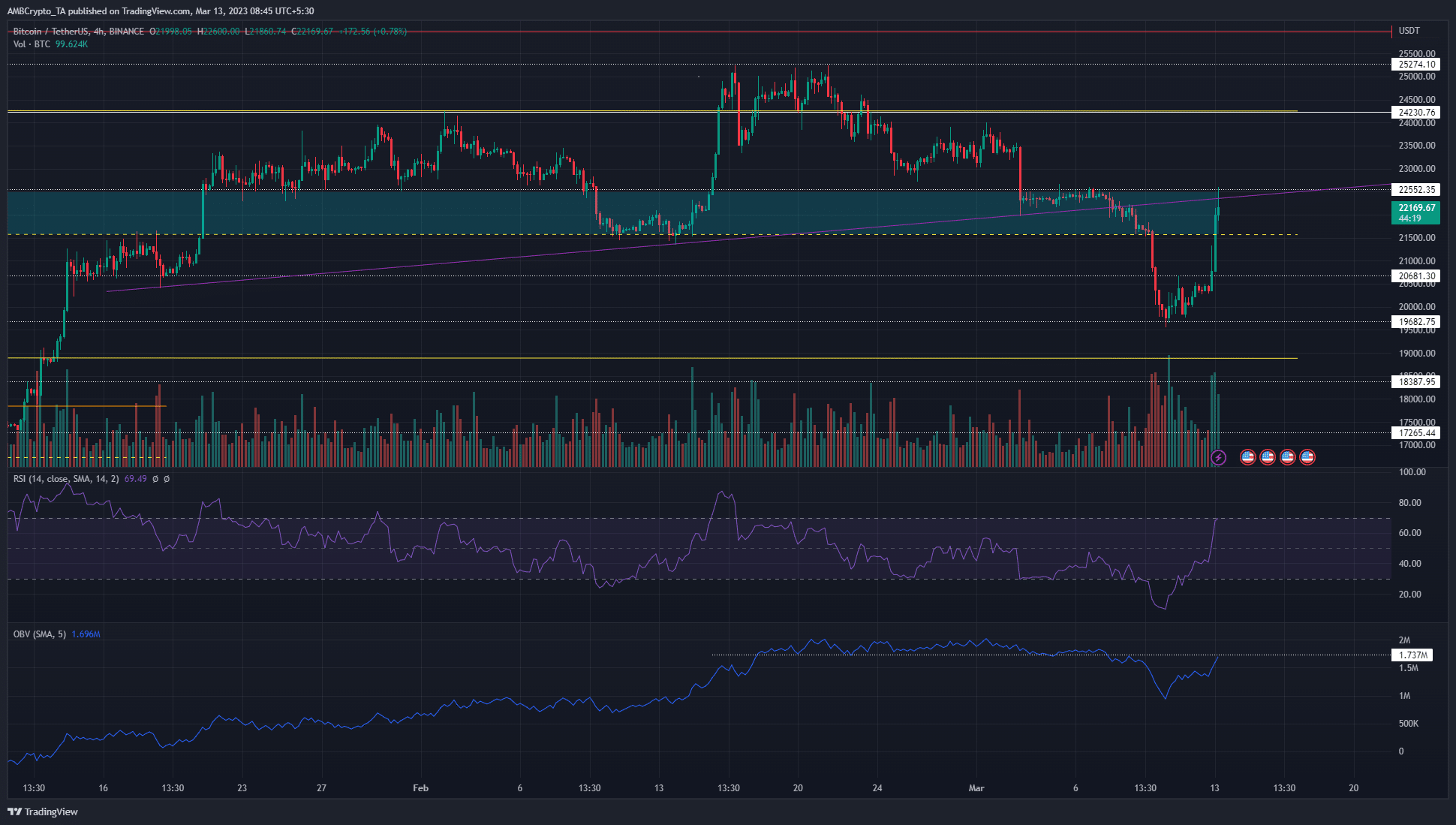

Supply: BTC/USDT on TradingView

The $21.6k mark served as an necessary degree of help on 10 February and the rally to $25.2k continued after a retest of this degree. Over the previous week, the worth fell quickly beneath the $22.2k decrease timeframe help and crashed straight previous the $21.6k help as promoting strain intensified.

The weekend noticed Bitcoin settle across the $20k mark after a 4-hour candlewick right down to $19.5k. Patrons stepped in because the markets started to open in Asia, and the costs noticed a large rally. The transfer from $20.3k to $22.5k measured 11%, however the worth was but to interrupt the bearish construction on the every day chart.

As for the H4 construction itself, it was debatable. Extra aggressive approaches would depend the transfer above $20.6k as a structural shift. Then again, a extra conservative method can be to attend for a session shut above $22.6k.

Is your portfolio inexperienced? Examine the Bitcoin Revenue Calculator

The decrease excessive at $22.6k fashioned early in March and developed over 4 days, whereas the $20.6k one occurred over a weekend. Therefore, Bitcoin patrons had grounds to stay cautious regardless of the swift positive aspects in current hours.

Late longs might get punished, and FOMO have to be averted. BTC stood at risk-to-reward space to quick the coin. This upward transfer might have been a liquidity hunt earlier than a gradual bleed over the subsequent week or two.

In the meantime, an H4 session shut above $22.6k would invalidate the bearish thought.

The futures market confirmed sentiment shifted to bullish

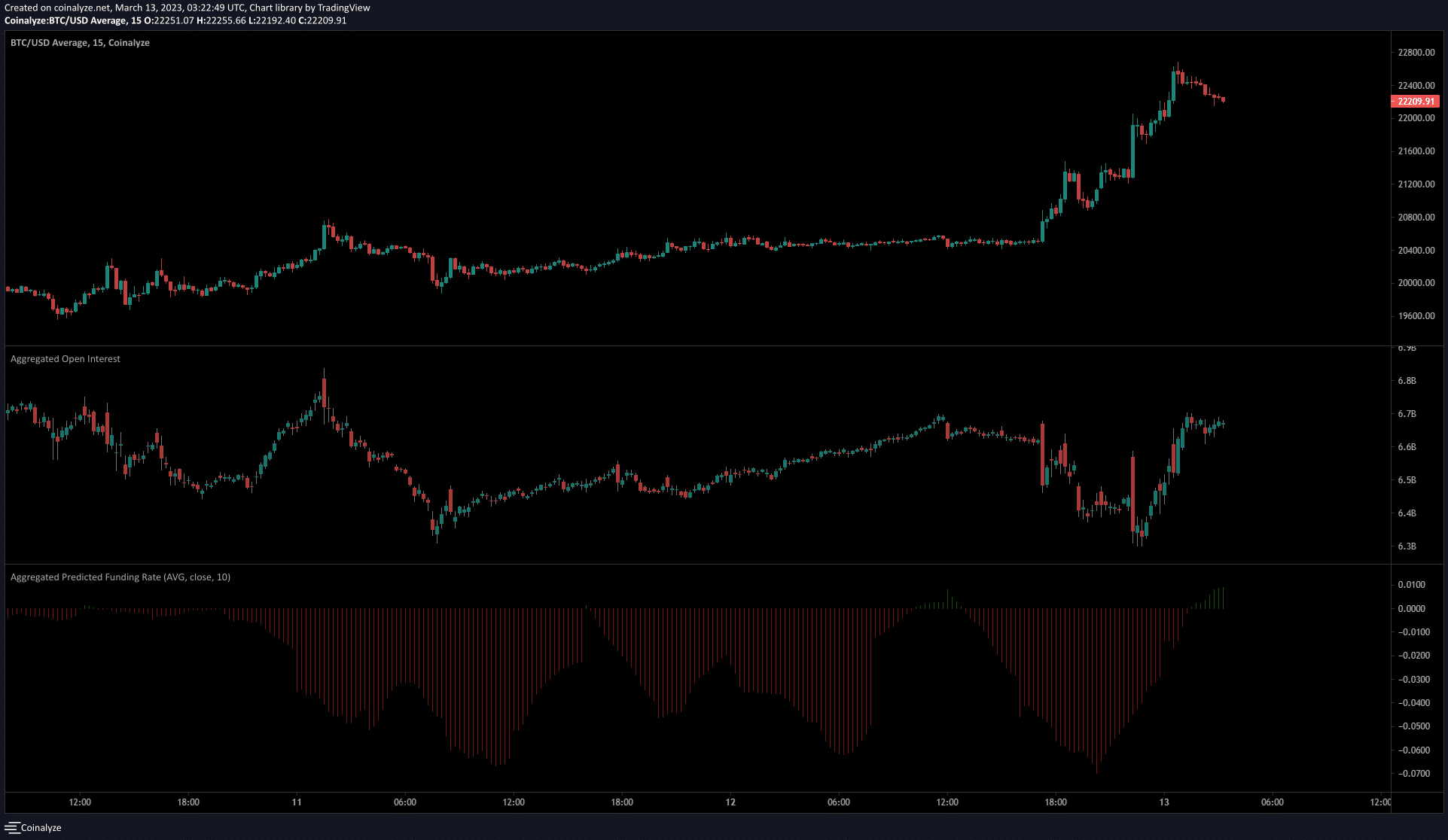

Supply: Coinalyze

The 15-minute chart confirmed that the late hours of Sunday noticed a excessive unfavourable funding charge to point out quick positions crowded the market.

When the worth shot previous resistance ranges and compelled these positions to shut, it induced sturdy shopping for strain. Therefore, initially, we see a fall within the Open Curiosity to point out bearish sentiment. This shifted after the BTC transfer above $21.2k.

Thereafter, each the OI and the costs started to advance quickly. The funding charge additionally started to shift and at press time was constructive as soon as extra. Collectively, they confirmed bullishness on the decrease timeframes.