- Traders stay scared of buying and selling BTC regardless of a potential bullish breakout.

- Altcoins dominated the market within the first week of 2023; though on-chain alerts protected a BTC market steadiness.

The antics of Bitcoin [BTC] over the previous couple of months have been swindled in unpredictability, main many traders torn between aping into “alternatives” or anticipating one other nosedive. In mild of all this, the Bitcoin concern and greed index nonetheless confirmed that there was nonetheless excessive concern available in the market.

Bitcoin Concern and Greed Index is 26. Concern

Present value: $16,836 pic.twitter.com/cQQHquwj1a— Bitcoin Concern and Greed Index (@BitcoinFear) January 6, 2023

What number of BTCs are you able to get for $1?

The hope to achieve and the have to be cautious

Off the again of dismay, CryptoQuant analyst Tomáš Hančar opined that BTC might change to bullish circumstances ahead of anticipated. Hančar, who revealed his evaluation in the marketplace knowledge platform, cited the alternate depositing transactions hitting a four-year low as certainly one of his causes.

Conditions like this often align with the concern and greed index place of lack of commerce consideration. Aside from the deposits on the 30-day Shifting Common (MA), the analyst pointed to the Bollinger Bands (BB).

Based mostly on his evaluation, the BB exhibited intense contraction, which has by no means been the case. Therefore, this place might convey a few breakout and vital uptick.

Whereas he solidly stood his bull floor, Hančar requested merchants to be cautious of the lengthy consolidation, which might have an effect on the potential of a worthwhile breakout. He wrote,

“This could be a very worthwhile get away commerce both approach, however should you play these cease purchase/cease promote “by the roof” or “by the ground” set ups after such an extended consolidation, you should definitely handle your danger correctly.”

Altcoins’ dominance inflicting unease

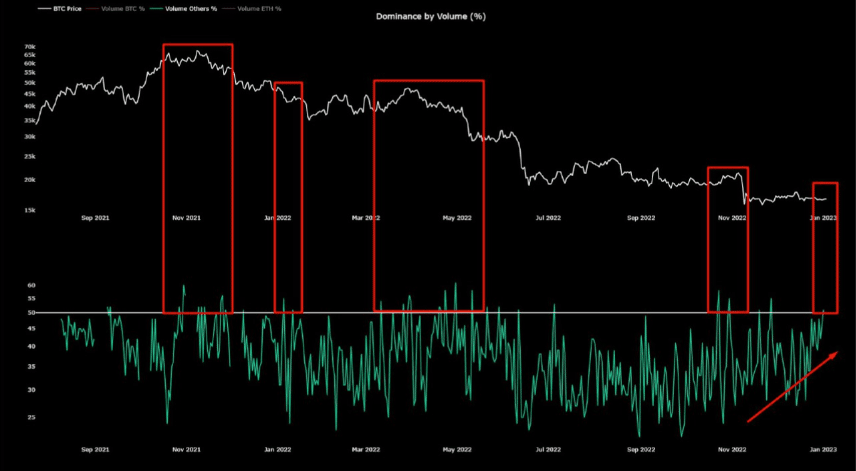

One other CryptoQuant publication was involved for BTC as many altcoins outperformed it within the first few days of the yr. In keeping with Maartunn, a 50% altcoin dominance over BTC was unhealthy.

The circumstances meant merchants had been discontented with BTC whereas attending to different choices. This positioned danger on the BTC curve. Maartunn additionally in contrast the state to the top of the bull run in 2021 and the huge altcoin supremacy over BTC through the Ethereum [ETH] Merge.

Supply: CryptoQuant

A 0.02x potential worth lower if BTC hits Polygon’s market cap?

Within the case the place the dominance abounded, BTC might drop additional beneath the $16,800 area. Nonetheless, info from CoinMarketCap, at press time, confirmed that the altcoin surge had subdued. So, there could be no want for an exorbitant fall.

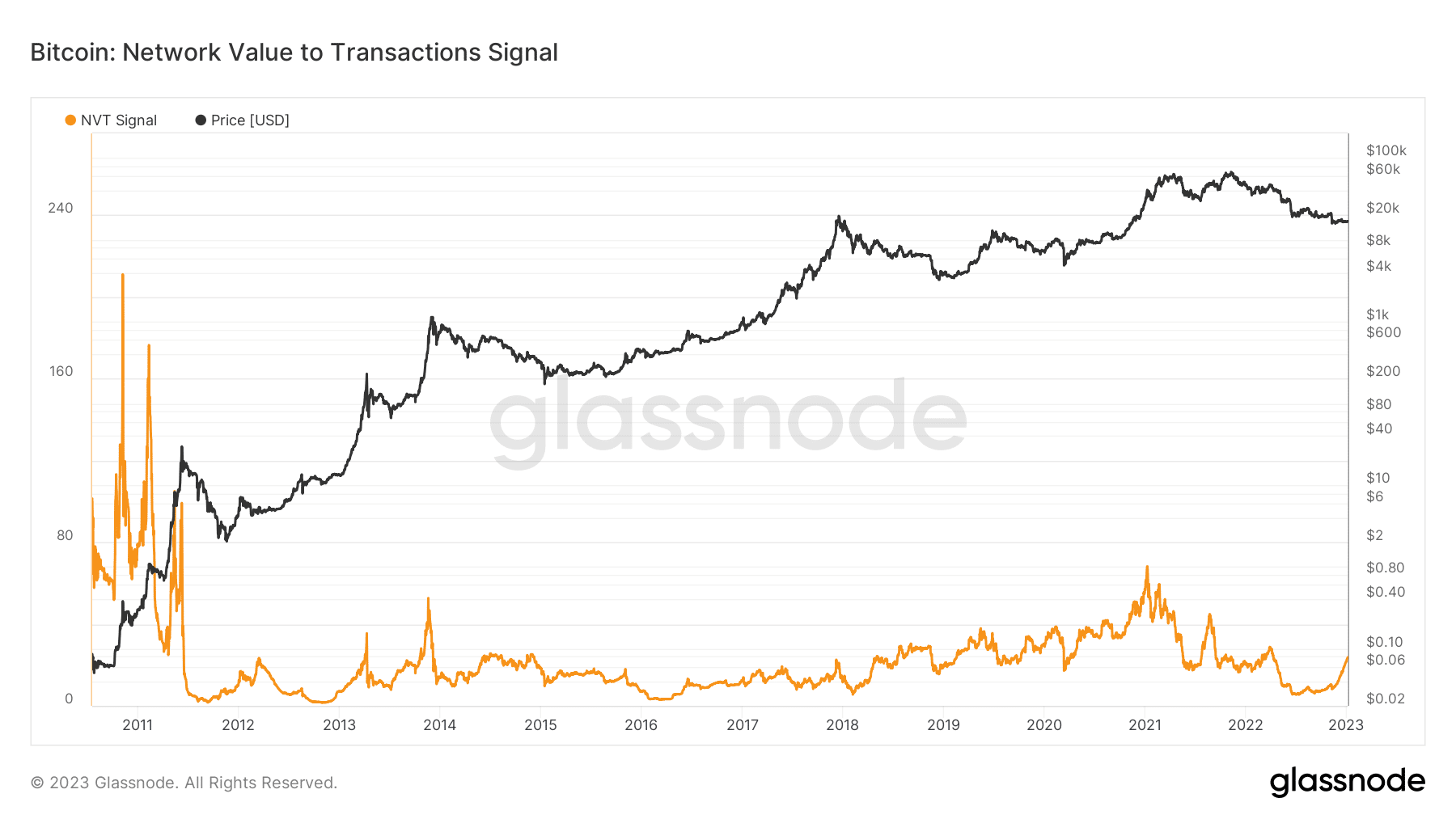

For the Community Worth to Transaction (NVT) sign, Glassnode showed that it has barely risen from its downfall in November 2022. This metric makes use of the 90-day transferring common to evaluate how the market cap outpaces transaction quantity.

At 18.96, the NVT sign was approaching equilibrium. This prompt some form of market stability and a potential mid-phase of the bear market.

Supply: Santiment