- Bitcoin holders’ income attain a brand new all-time excessive.

- Promoting stress stays comparatively low, nonetheless, quantity declines.

As a consequence of all of the concern, uncertainty, and doubt (FUD) that surrounded the crypto area during the last 12 months, many addresses had been compelled to promote their Bitcoin holdings.

Nevertheless, there was a bit of addresses that continued to point out religion within the king coin BTC and HODLed their method by the woods.

Apparently, these long-term holders at the moment are seeing all-time highs when it comes to their profitability.

Learn Bitcoin’s Worth Prediction 2023-2024

Unsure which #Bitcoin holder is extra spectacular as all of them proceed to make all-time highs.

1+ 12 months = Have held the whole lot of 2022

2 + years = Purchased the highest of the 2021 bull

3+ years = Anticipate this to begin trending upwards ( 1 week away from covid)

5+ years = Purchased… https://t.co/IzUbZeZRX8 pic.twitter.com/6B2g3vV1QU— James V. Straten (@jimmyvs24) March 4, 2023

Reportedly, HODLers who’ve held their BTC for anyplace between 1-5 years, have been seeing a profit-making alternative.

Nevertheless, because the profitability of those holders rises, the general incentive to promote these holdings will increase.

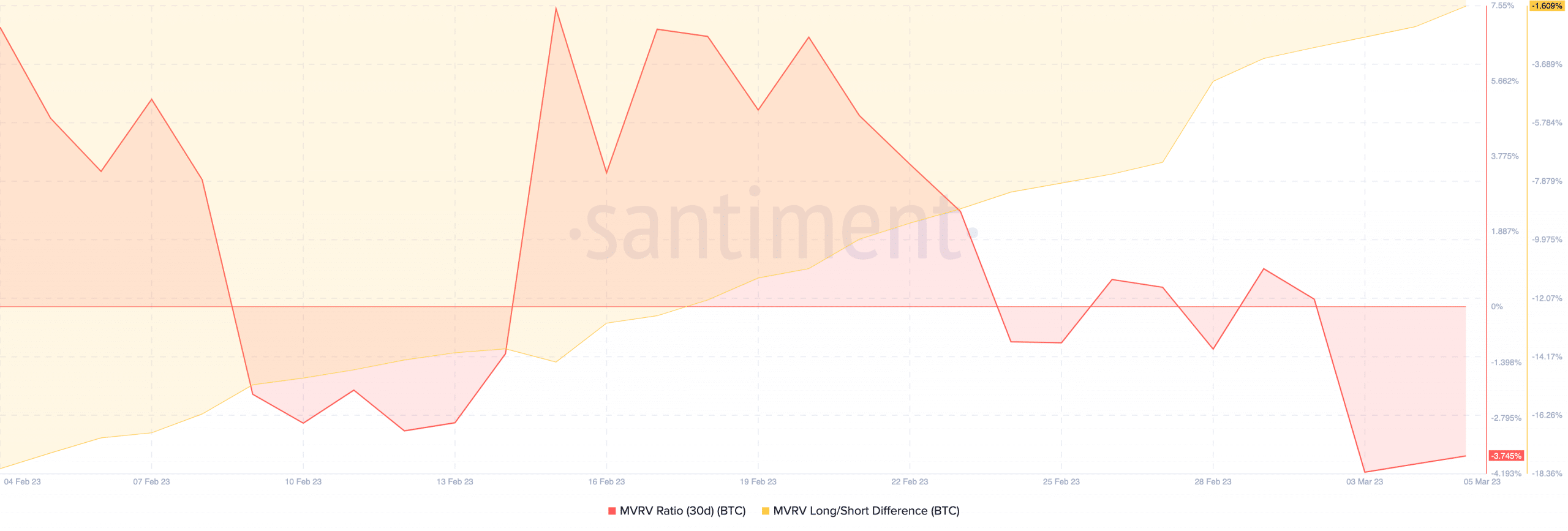

An attention-grabbing metric to take a look at at this level could be the MVRV ratio.

Properly, the MVRV ratio for the king coin was destructive, on the time of writing. This implied that almost all of BTC holders would find yourself taking a loss in the event that they bought their coin on the present value.

This additionally advised that the worthwhile holders had been a minority on the Bitcoin community. And, therefore there was no main promoting stress that might be anticipated.

Supply: Santiment

Addresses get energetic

In actual fact, whales additionally confirmed huge curiosity within the coin of late. Therefore, normal exercise on the Bitcoin community started to rise.

In response to knowledge supplied by glassnode, the variety of BTC transactions reached a 2-year excessive on 5 March.

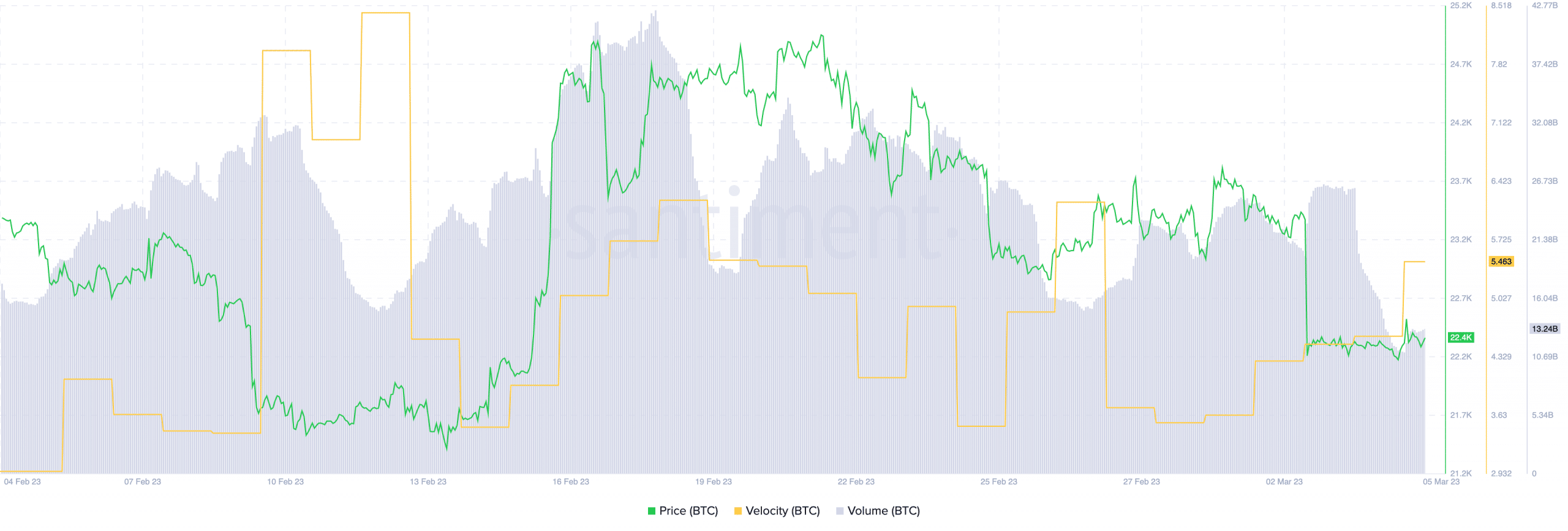

Moreover, the excessive velocity of Bitcoin implied that the variety of occasions BTC was being transferred amongst addresses, had elevated. Sadly, that wasn’t the case with the quantity metric.

Supply: Santiment

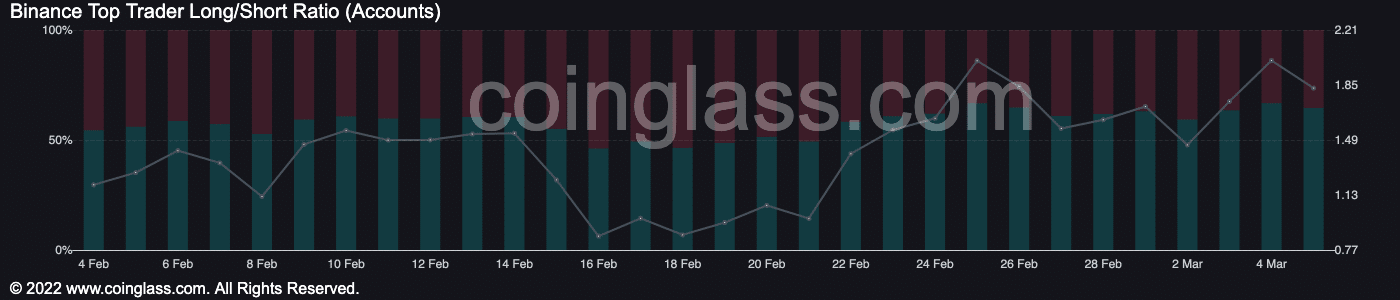

Nevertheless, the declining quantity didn’t deter merchants from going lengthy on Bitcoin. In response to coinglass’ knowledge, the share of lengthy positions taken for Bitcoin on the Binance change elevated from 50.5% to 64.66% prior to now few weeks.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

Supply: coinglass

That being stated, it stays to be seen how these lengthy positions on BTC play out for merchants in the long run.