- Bitcoin witnesses curiosity from merchants who need to go lengthy

- Its hashrate decreases, however charges collected by miners proceed to develop

Bitcoin is on the receiving finish of huge curiosity from merchants as funding charges present lengthy bias, in line with Santiment’s report.

😖 Merchants are viewing #Bitcoin‘s 2-year low value ranges as a #buythedip alternative. Funding charges present an excessive #long bias, notably on @FTX_Official, the place many consider their funds could also be inconceivable to withdraw. Emotions of hopelessness usually correlate with greater threat. pic.twitter.com/OW2buYx2gb

— Santiment (@santimentfeed) November 9, 2022

Learn Bitcoin’s Worth Prediction 2022-2023

BTC rolling within the “dip?”

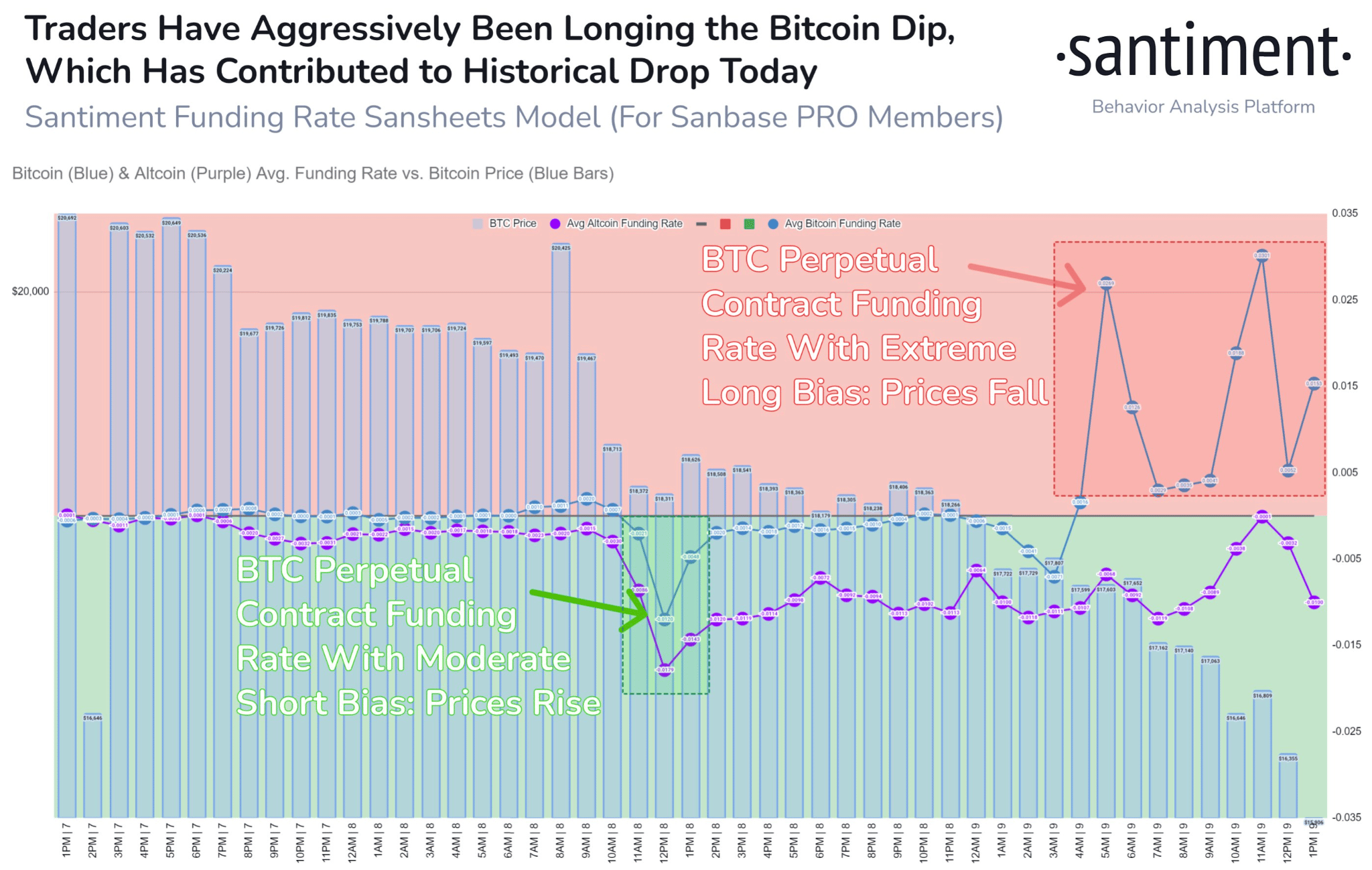

Santiment, a number one crypto analytics agency, tweeted on 10 November that merchants had been aggressively longing the Bitcoin dip. As could be seen from the picture beneath, BTC’s perpetual contract funding charge noticed a particularly lengthy bias whereas BTC’s value fell. Together with that, the perpetual contract charges with brief bias declined.

Supply: Santiment

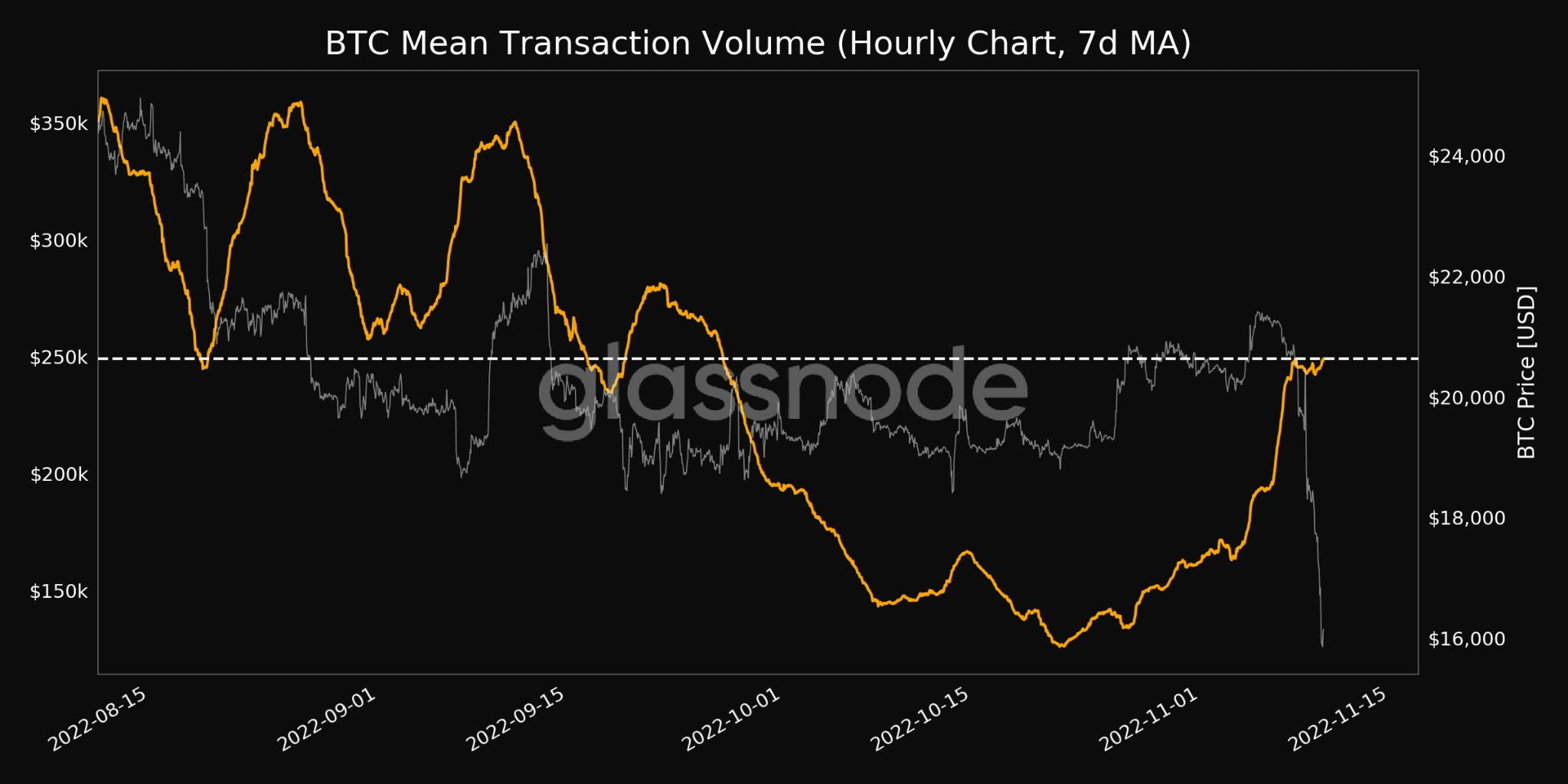

Coupled with this improvement, the general imply transaction quantity for Bitcoin witnessed an uptick as effectively. From the picture beneath, it may be seen that the imply transaction quantity grew considerably over the previous week. On the time of writing, the imply transaction quantity for Bitcoin had reached a one-month high of $249k.

Nevertheless, regardless of these optimistic developments, massive traders’ curiosity continued to say no. In line with glassnode, the variety of addresses holding over one thousand cash reached a 2-year low of two,101.

Supply: glassnode

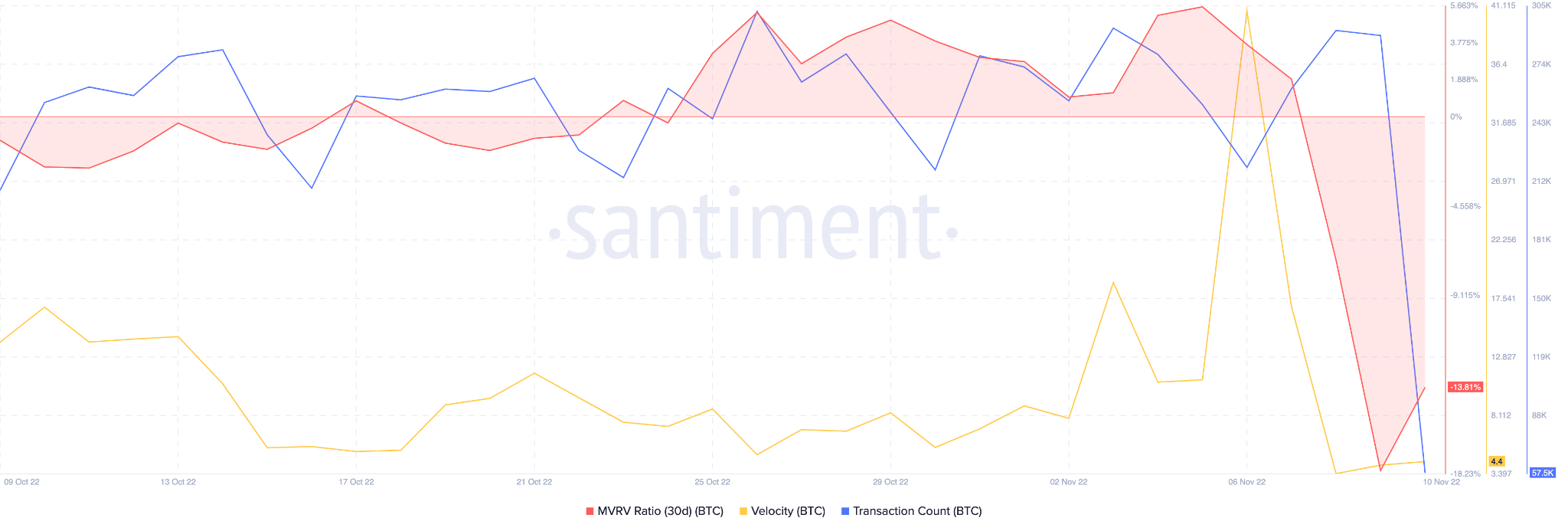

Furthermore, Bitcoin’s velocity declined over the previous few days, indicating that the frequency with which Bitcoin was being exchanged amongst addresses had sunk.

Even the transaction depend took a success. In addition to, the MVRV ratio fell throughout the identical interval. Thereby, indicating that most individuals will notice losses if all of them promote their Bitcoin holdings on the present value.

Supply: Santiment

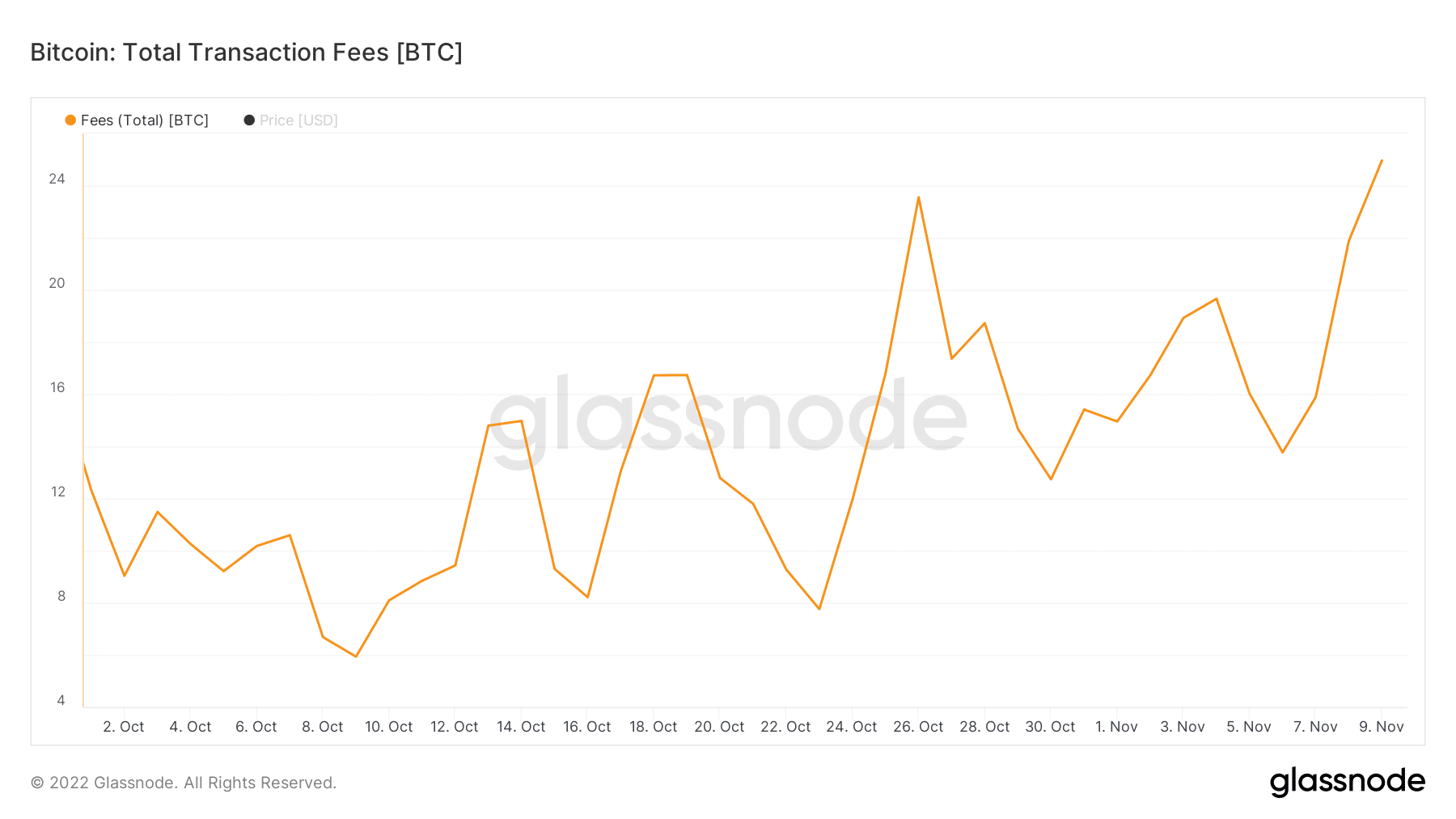

By way of mining, Bitcoin’s hashrate fell by 9.33% during the last seven days, in line with information supplied by Messari. Nevertheless, throughout the identical interval, the quantity of charges collected by Bitcoin miners continued to develop.

Regardless of the expansion when it comes to charges collected, the miner income fluctuated. Uncertainty when it comes to how a lot income could be collected by mining Bitcoin might induce promoting stress on Bitcoin holders.

Supply: glassnode

That mentioned, on the time of press, Bitcoin was buying and selling at $16,674. Its value depreciated by 6.96% within the final 24 hours in line with CoinMarketCap.

Its quantity additionally decreased by 5.38%. Nevertheless, its market cap elevated over the previous week, and on the time of writing, Bitcoin captured 37.62% of the overall crypto market.