Disclaimer: The findings of the next evaluation are the only real opinions of the author and shouldn’t be thought-about funding recommendation.

- Bitcoin discovered a stable shut above its near-term EMAs to disclose a bullish inclination.

- Bitcoin’s Trade Inflows continued to depict a downtrend.

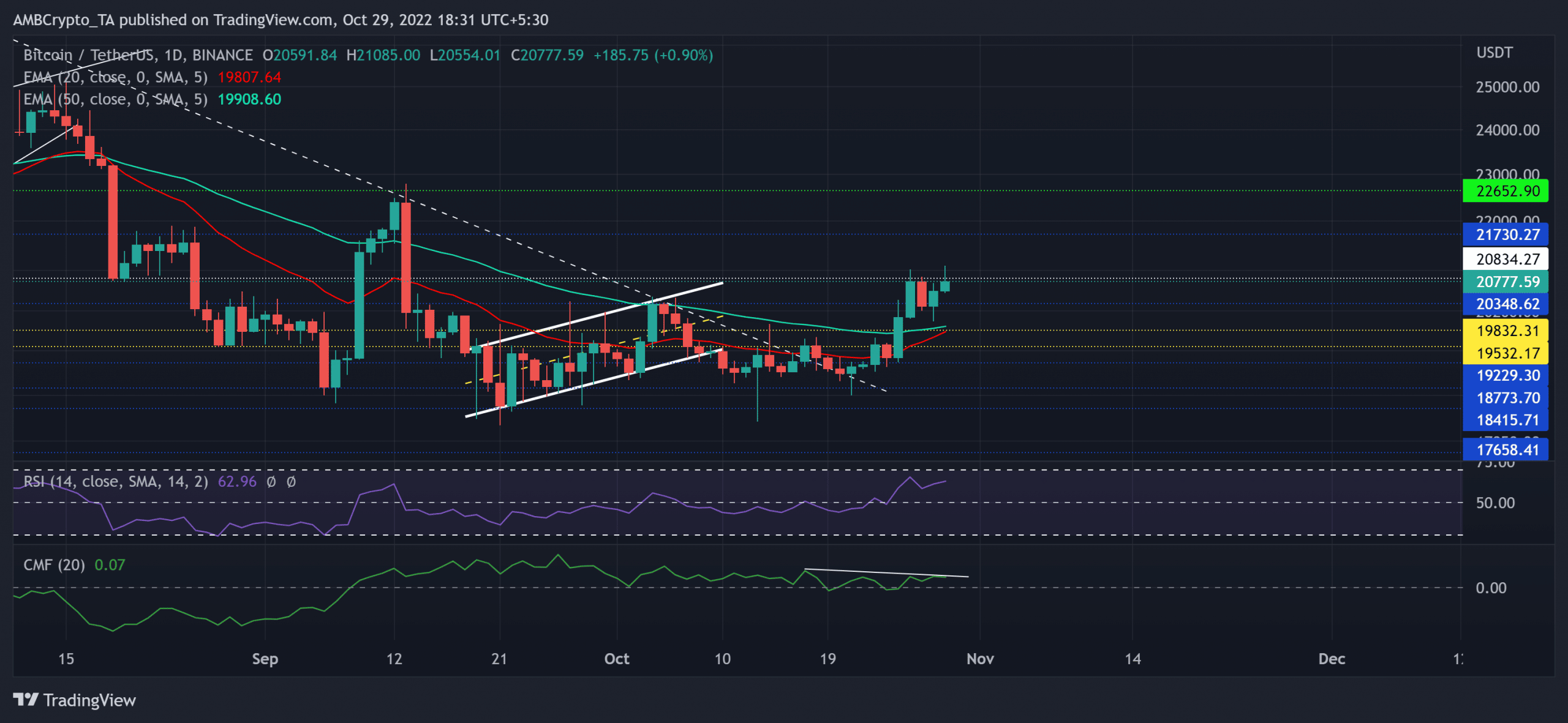

Bitcoin’s [BTC] current rally positioned the crypto above its 20 EMA (pink) and the 50 EMA (cyan) whereas unveiling a near-term shopping for edge. Since flipping its long-term trendline resistance to assist (white, dashed), BTC has marked constant positive aspects.

Right here’s AMBCrypto’s value prediction for Bitcoin [BTC] for 2023-24

The just lately discovered shopping for stress witnessed a bearish counter on the $20.8K resistance. With the 20/50 EMA persevering with to look north, the consumers would intention to take care of their benefit within the coming classes.

At press time, BTC was buying and selling at $20,777.59, up by 2.77% within the final 24 hours.

Can BTC’s rebound snap its speedy resistance barrier?

Supply: TradingView, BTC/USDT

On the time of writing, the king coin discovered a convincing shut above the 20/50 EMA. In doing so, the bulls strived to problem the restrictions of the $20.8K barrier. Ought to the consumers breach this hurdle, the coin may see continued development within the coming classes.

On this case, the primary main resistance degree for BTC would lie within the $21.7k area. The coin lastly entered a excessive volatility section after weeks of compression. Any reversals from the $20.8K mark may delay the restoration prospects for a couple of days.

Any speedy pulls may doubtless discover dependable rebounding grounds from the $19.8K-$20.3K vary. A bullish cross on the 20/50 EMA would enhance the probabilities of a continued bull run within the coming occasions.

The Relative Power Index (RSI) witnessed development because it eyed the overbought area at press time. However the Chaikin Cash Circulation’s (CMF) decrease peaks hinted at a bearish divergence with the worth. Any decline beneath the zero mark may invalidate the bullish inclinations.

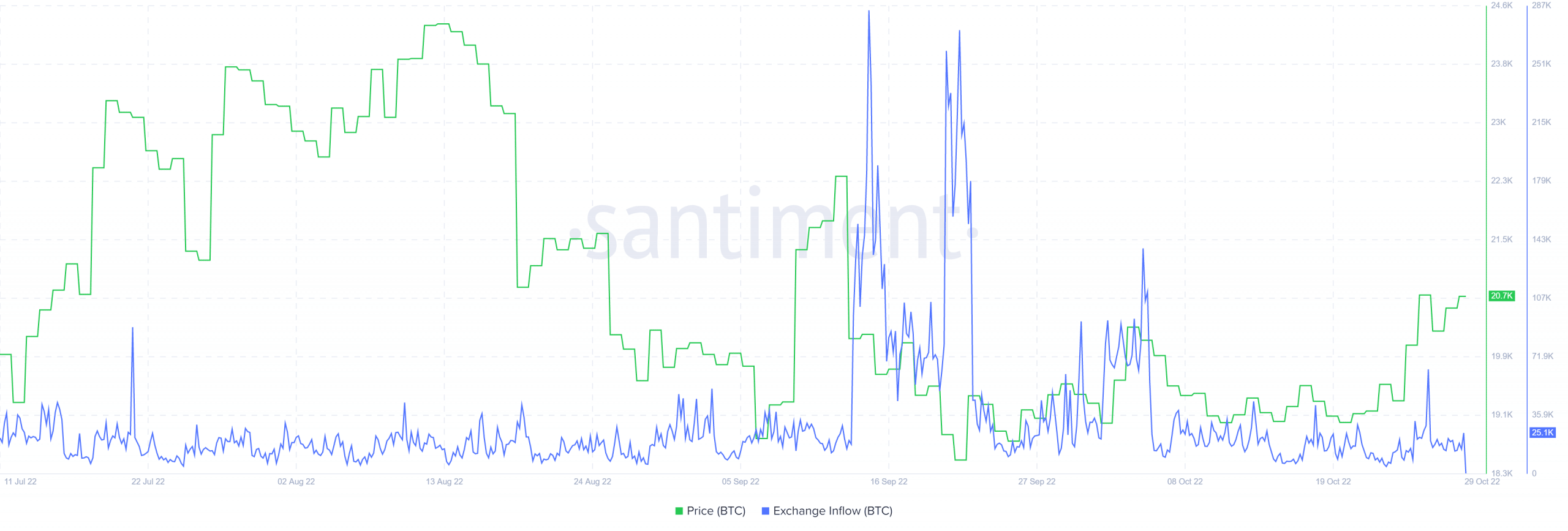

A decline in Trade Inflows

Supply: Santiment

Publish its record-high trade inflows in September, this metric noticed a constantly declining pattern over the previous six weeks. This studying entailed an improved investor sentiment whereas hinting at an accumulation signal.

Nonetheless, the targets would stay the identical as mentioned. Additionally, traders/merchants ought to consider macro-economical elements affecting the broader sentiment. This evaluation will assist them enhance the probabilities of a worthwhile guess.