Bitcoin has surged above the $29,000 mark following the Fed charge hike of 25 bps, an indication that the asset could also be decoupling from the shares.

Bitcoin Has Jumped Regardless of Fed Curiosity Fee Hike Announcement

Based on the on-chain analytics agency Santiment, the cryptocurrency market has proven some promising rise potential because the charge hike announcement has gone dwell.

Up to now 12 months, the US Federal Reserve System (“Fed”) rate of interest hikes have usually been met with panic out there, as cash like Bitcoin and Ethereum have suffered important hits to their costs following them.

This has been as a result of the sector has skilled a excessive correlation with the US shares throughout this era, which means that the costs of the belongings within the two sectors have been transferring in a similar way.

Just lately, nonetheless, issues have been altering for the higher, because the cryptocurrency and inventory markets have turn into more and more separated. The preliminary response within the costs of belongings like Bitcoin and Ethereum to the most recent announcement has additionally been a optimistic indication of this.

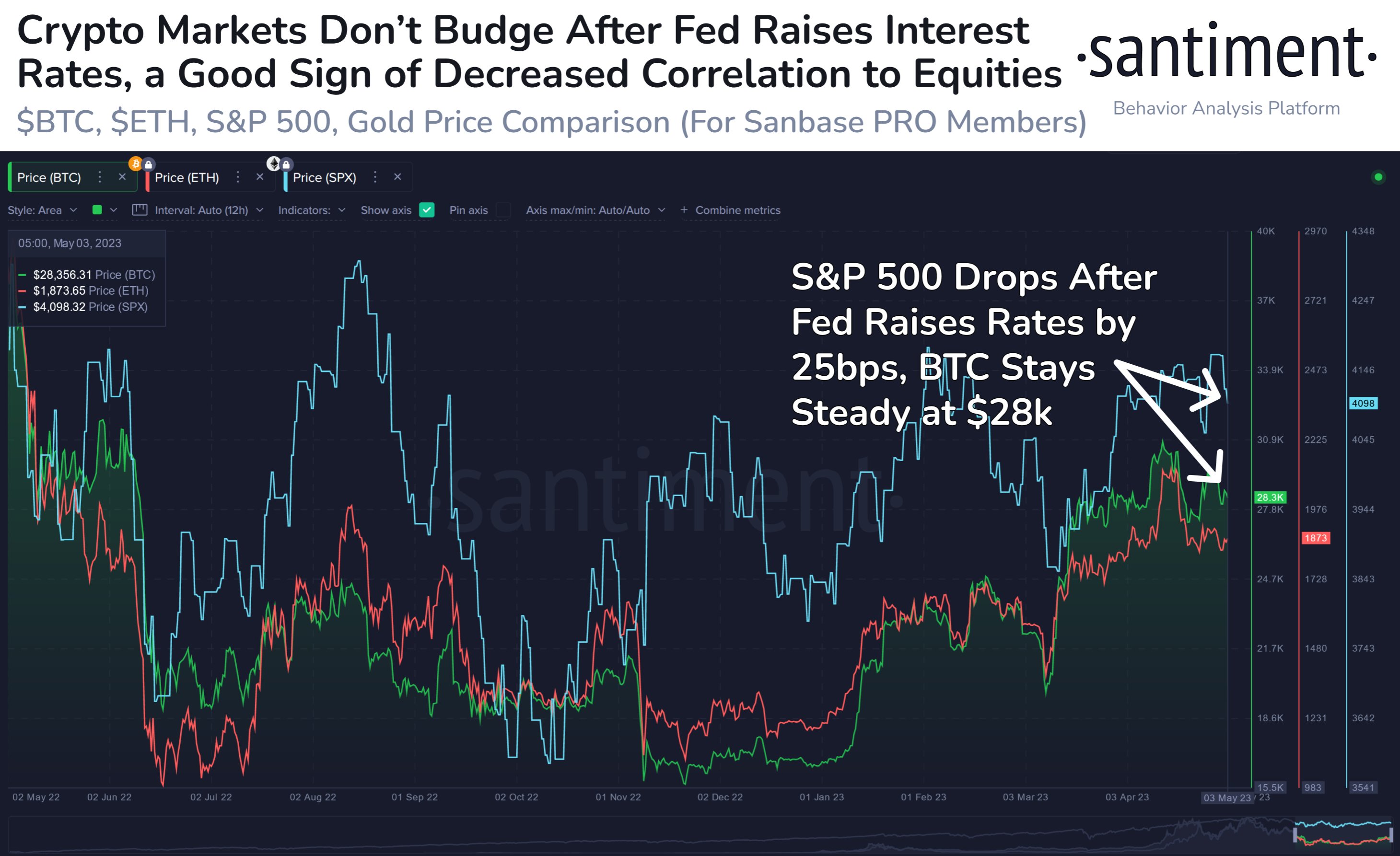

Right here is the comparability between BTC, ETH, and S&P 500 that Santiment posted one hour after the FOMC assembly:

Appears to be like like BTC did not transfer a lot following the occasion | Supply: Santiment on Twitter

As displayed within the above graph, S&P 500 fell shortly after the speed hike, whereas BTC and ETH remained regular, exhibiting the disconnection between the 2 sectors.

Each Bitcoin and Ethereum have risen within the hours since then, breaking the $29,000 and $1,900 ranges, respectively. This might be an indication that traders are comfy now that the assembly is behind them.

“No less than for now, plainly the preliminary response to this rate of interest hike was: “No less than it’s over with now. Crypto now not wants to fret about fiscal coverage till June,” notes Santiment.

On-chain information additionally reveals that the buying and selling volumes of the highest cryptocurrencies by market cap have trended up because the assembly, a sign that exercise has been rising within the sector.

BTC's value has trended up because the announcement | Supply: Santiment

One other indicator, the “energetic addresses,” which measures the every day complete variety of distinctive addresses which might be participating in some transaction exercise on the Bitcoin blockchain, has additionally noticed a surge following this Federal Open Market Committee (FOMC) assembly day, because the under chart highlights.

The indicator's worth has been going up through the previous day | Supply: Santiment

This metric offers an estimation of the overall variety of distinctive customers which might be utilizing the community proper now, so its worth going up suggests a excessive quantity of visitors has visited the chain through the previous day.

The newest spike within the Bitcoin energetic addresses is the best seen within the final two weeks, with the one from two weeks in the past being largely on account of a pointy plunge within the value.

“This rally gave the impression to be far more associated to the speed hike lastly being official, and you’ll see how energetic addresses pushed even increased instantly after the announcement,” explains the on-chain analytics agency.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $29,200, up 1% within the final week.

BTC has surged previously day | Supply: BTCUSD on TradingView

Featured picture from André François McKenzie on Unsplash.com, charts from TradingView.com, Santiment.internet