On this episode of NewsBTC’s all-new each day technical evaluation movies, we’re wanting on the Bitcoin worth month-to-month chart and the DXY Greenback Forex Index forward of the month-to-month shut.

Check out the video beneath.

VIDEO: Bitcoin Worth Evaluation (BTCUSD): August 30, 2022

We’re coming all the way down to the wire right here within the month of August, with lower than 48 hours remaining till the month-to-month candle shut. The month is very essential for quite a few pivotal causes of which we’ll evaluate within the video and within the textual content and charts beneath.

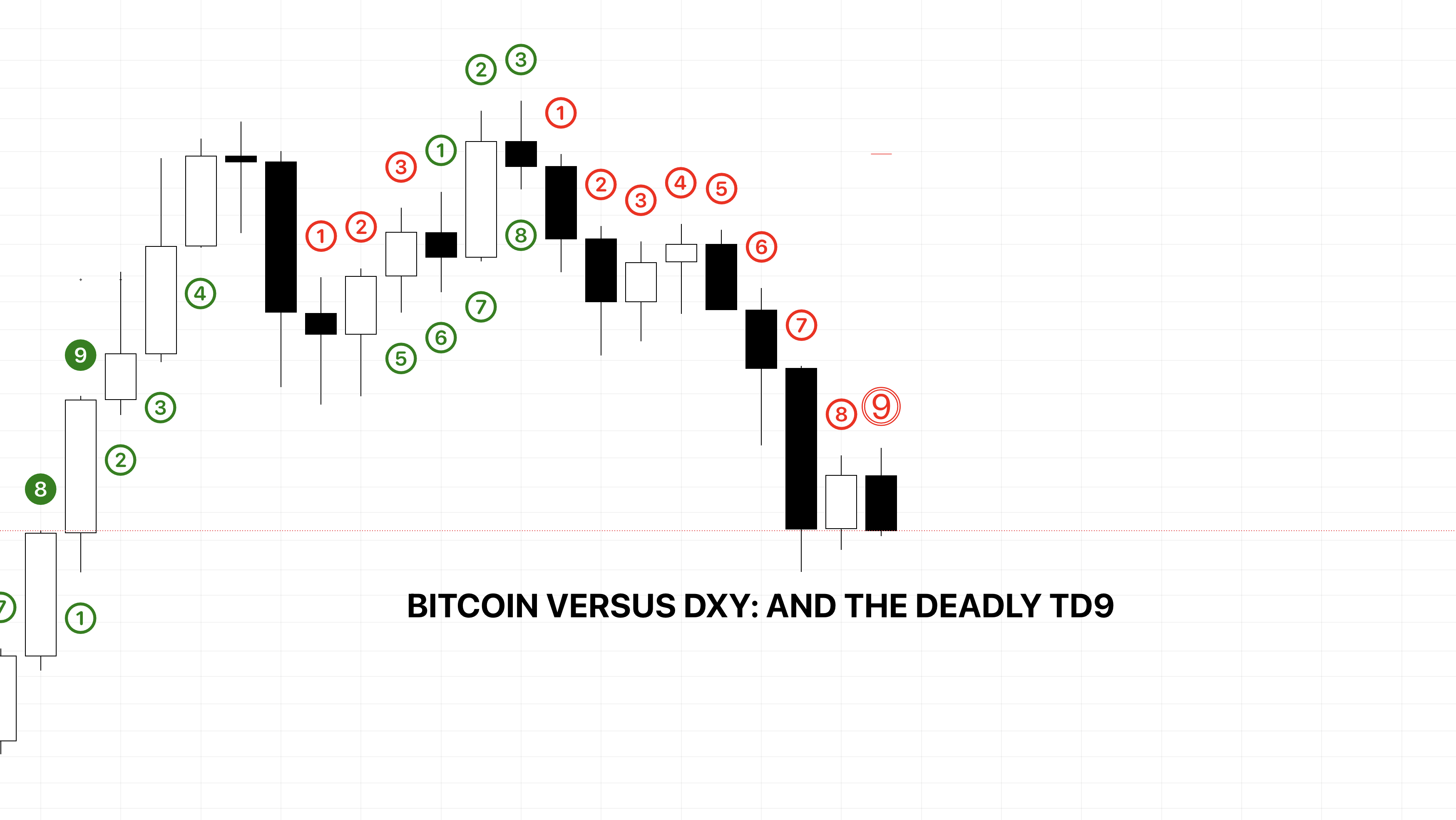

The Terrifying TD9 Purchase Setup On Month-to-month Timeframes

The primary and most vital issue weighing over the subsequent couple of days within the crypto market, is a looming TD9 purchase setup. The TD Sequential is a market timing indicator. Merely reaching a 9-count is sufficient for a purchase setup. Nevertheless, the sign is far stronger when the collection is perfected.

This may solely occur with a sweep of the present low beneath round $17,500. It will additionally require a breakdown of all-time excessive resistance turned help and a breakdown of a decade-long month-to-month pattern line.

A perfected TD9 setup would lead to dropping this pattern line | Supply: BTCUSD on TradingView.com

May A Hidden Bullish Divergence Save The Day?

Bitcoin worth continues to relaxation on the decrease Bollinger Band – a primary for the primary ever cryptocurrency on the excessive timeframe chart. What we don’t need to see is worth motion shut outdoors the decrease band, which may result in an explosive down-move.

Regardless of this threat, there are a number of indicators {that a} backside may be in. The month-to-month momentum on the LMACD histogram and Relative Power Index may very well be signaling a hidden bullish divergence. Stochastic can be nearing a turning level after reaching oversold circumstances – one other recurring backside setup, particularly when mixed with a breakout of a downtrend resistance line.

Is that this sufficient for a backside? | Supply: LTCBTC on TradingView.com

Or Will The DXY Defeat BTC Bulls But Once more?

Keep in mind, one half of the BTCUSD buying and selling pair is the greenback. Because of this when the greenback is robust, the BTC aspect of the buying and selling pair takes a beating.

One of the best ways to gauge the power of the greenback is thru the DXY – the greenback forex index – which is a weighted basket of high world currencies buying and selling towards the greenback. Very like Bitcoin worth motion is reaching oversold circumstances with a attainable hidden bullish divergence, the DXY is overbought and probably forming a bearish divergence on every of the identical indicators: RSI, LMACD, and Stoch.

Are greenback bears ready for an opportunity to strike? | Supply: LTCETH on TradingView.com

Evaluating Currencies: Bitcoin Versus The Greenback

The similarities to the 2014 and 2015 bear market versus the newest bear market in 2018, look like because of the greenback power. The final time the DXY was this overbought was throughout what’s referred to as crypto’s worst bear market ever.

Plotting BTCUSD behind the DXY we are able to take a more in-depth have a look at the attainable correlation – or anti-correlation. The final prolonged up-move within the DXY is what led to such a prolonged bear part in crypto. Apparently, the Bitcoin plot at some factors seems to be performing as dynamic help and resistance for the DXY, maybe displaying off an anti-correlated relationship via the buying and selling pair.

Bitcoin has bottomed every time the DXY pushed above the BTCUSD plot line. Bear markets arrive throughout DXY upmoves, and Bitcoin performs properly when DXY strikes sideways, and the perfect when DXY is falling. With the DXY probably at oversold circumstances on the month-to-month timeframe, a pullback may very well be close to or perhaps a full pattern change that in the end lifts Bitcoin out of its bear market.

Bitcoin has labored as dynamic help and resistance for the DXY chart | Supply: BTCUSD on TradingView.com

Be taught crypto technical evaluation your self with the NewsBTC Buying and selling Course. Click on right here to entry the free academic program.

Comply with @TonySpilotroBTC on Twitter or be part of the TonyTradesBTC Telegram for unique each day market insights and technical evaluation training. Please word: Content material is academic and shouldn’t be thought-about funding recommendation.

Featured picture from iStockPhoto, Charts from TradingView.com