- Some Bitcoin whales have decreased the variety of cash they maintain.

- A CryptoQuant analyst says the BTC value might pattern decrease within the quick time period.

The variety of addresses holding 1000 Bitcoin [BTC] has continued to lower in line with a current replace from Santiment. The on-chain analytics platform tweeted on the primary day of March that these whales who have been instrumental to the BTC value bounce in January and February have been now solely 2,011 in quantity.

As revealed by Santiment, this quantity represents the bottom in about three years. Often, huge whale accumulation leads to value will increase.

Nevertheless, dumps by this identical group put cryptocurrencies like BTC prone to decline. So, will BTC ultimately succumb to the stress from these whales?

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

Traders remained skeptical

For the reason that final week of February, BTC had not made a big transfer within the upward route. In line with CoinMarketCap, the seven-day efficiency of the king coin was a 4.73% decline, bringing the 30-day pattern to a impartial halt.

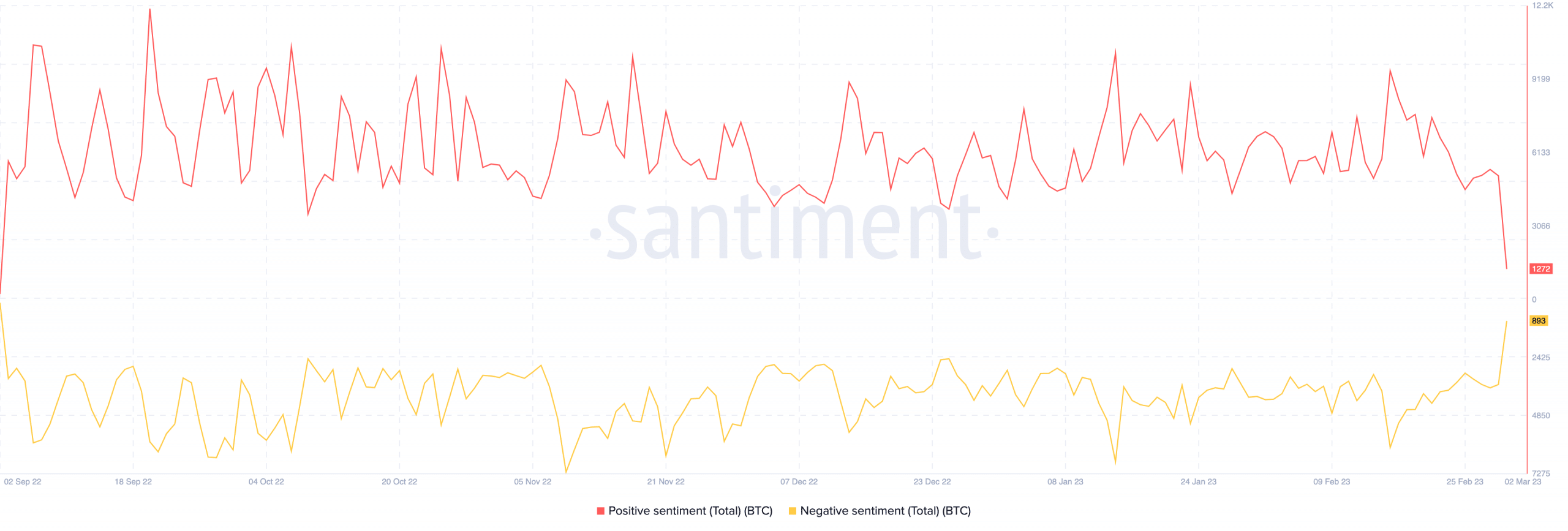

This decline signifies that BTC was already yielding to the affect of the highest addresses’ exit. Whereas the coin value nonetheless remained above $23,000, the viewpoint towards BTC was very completely horrible. This was as a result of the optimistic sentiment that hit a crest mid-last month, had decreased considerably. At press time, Santiment confirmed that the metric was 1245.

Nevertheless, the unfavorable sentiment painted a special state of affairs. On the time of writing, the metric had elevated to 877. Apparently, this has been the case since its reverse quantity was at this yr’s highest.

Contemplating the pattern, it implied that the broader market notion of a rally was massively truncated.

Supply: Santiment

Whatever the notion, CryptoQuant analyst Achraf Elghemri opined that BTC might commerce round $22,000 sooner than anticipated. Highlighting suspicious actions on the charts, Elghemri talked about:

“Technically forming portfolios on an combination scale regardless of a low value, however there’s nonetheless a goal of twenty-two,241, however generally to keep up a backside above the underside and high of the highest”

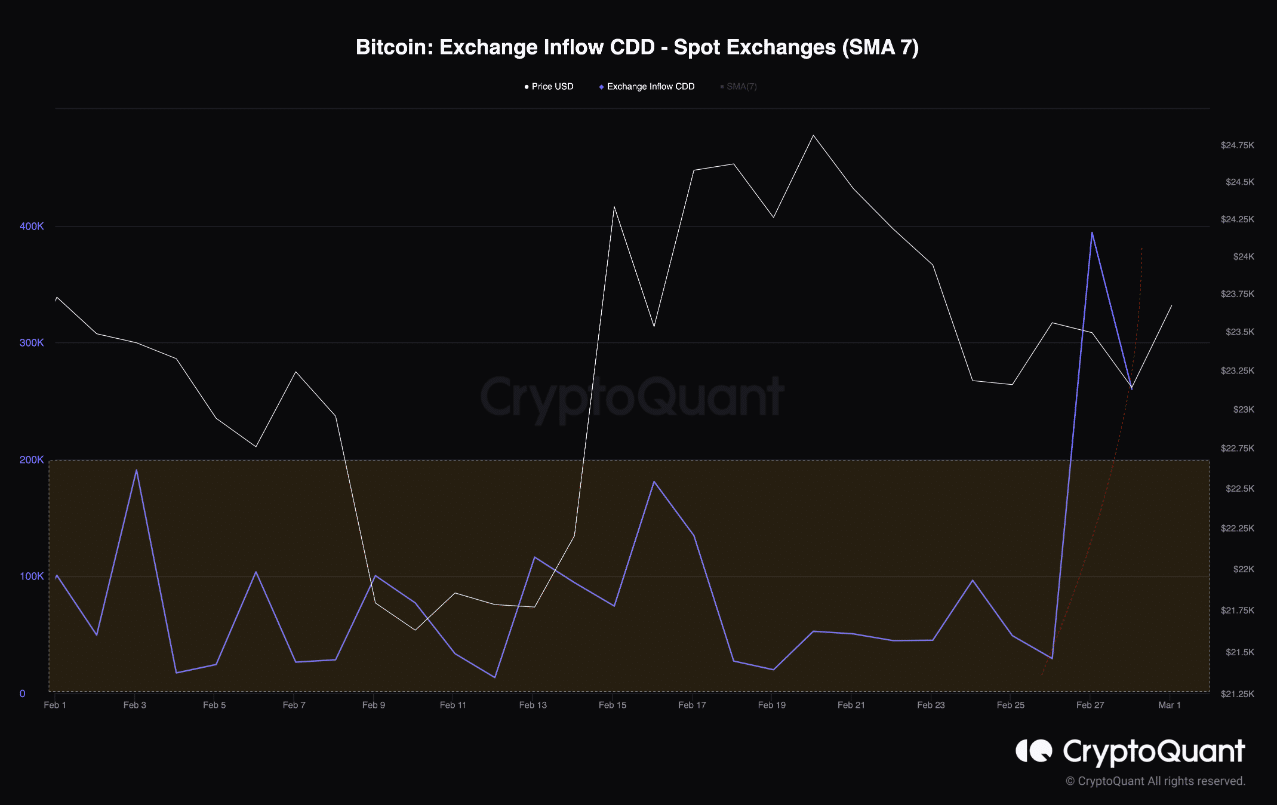

The analyst additionally referred to the Bitcoin deposits proportion and the change influx Coin Days Destroyed (CDD). The CDD evaluated the variety of cash that aren’t being spent. So, the rise within the picture proven beneath meant that there was excessive volatility, a reversal danger, and doable promoting stress.

Supply: CryptoQuant

Sensible or not, right here’s BTC’s market cap in ETH’s phrases

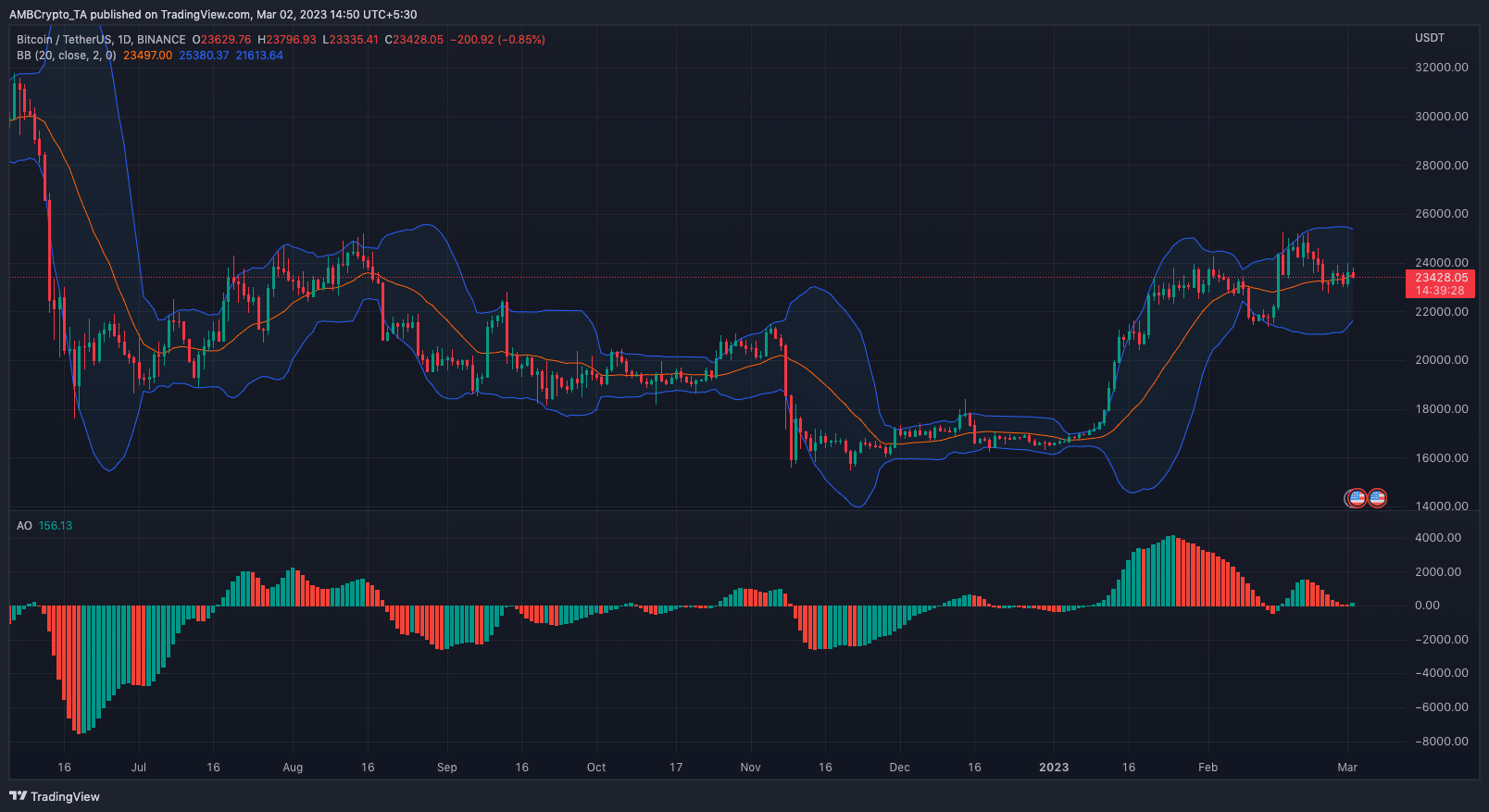

Moreover, the technical outlook confirmed the evaluation’ place as a result of the Bollinger Bands (BB) indicated excessive volatility. Nevertheless, BTC was in a extra unbiased state for the reason that value averted touching any of the bands.

Relating to its momentum, the Superior Oscillator (AO) indicated minute bullish traits. However a number of the crimson bars above the midpoint convey a case to negate the bulls.

Supply: TradingView