- CME Open Curiosity in Bitcoin grew, implying a decline in volatility.

- Miner income fell whereas promoting strain elevated.

In accordance with a 31 January tweet by Arcane Analysis, Bitcoin’s [BTC] rally was slowing down. Regardless of this, institutional curiosity in Bitcoin continued to develop.

Forward of the curve – Jan 31

Bitcoin’s momentum has come to a halt, and we see the primary tendencies of elevated threat urge for food from offshore longs whereas institutional participation stays excessive because the FOMC press convention approaches.https://t.co/E6m19OnqrZ

— Arcane Analysis (@ArcaneResearch) January 31, 2023

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

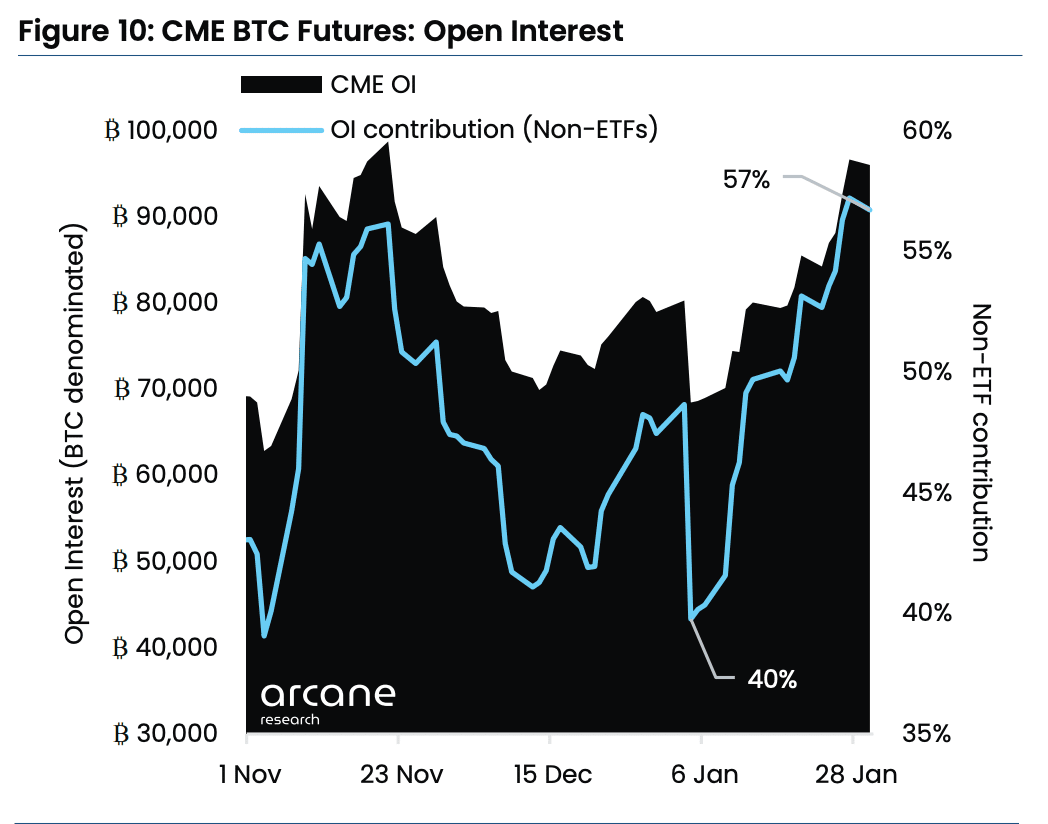

One indicator of excessive institutional curiosity in Bitcoin was the rising CME Open Curiosity in Bitcoin. In accordance with Arcane Analysis, the proportion of Open Curiosity in Bitcoin that’s not associated to exchange-traded funds (ETFs) elevated from 53% to 57%.

This surge, together with a robust presence of institutional traders in Bitcoin futures, is a optimistic signal. The CME performed a key position in figuring out the value of Bitcoin and was a driving power behind vital shifts available in the market in October 2020 and April 2021.

Supply: arcane analysis

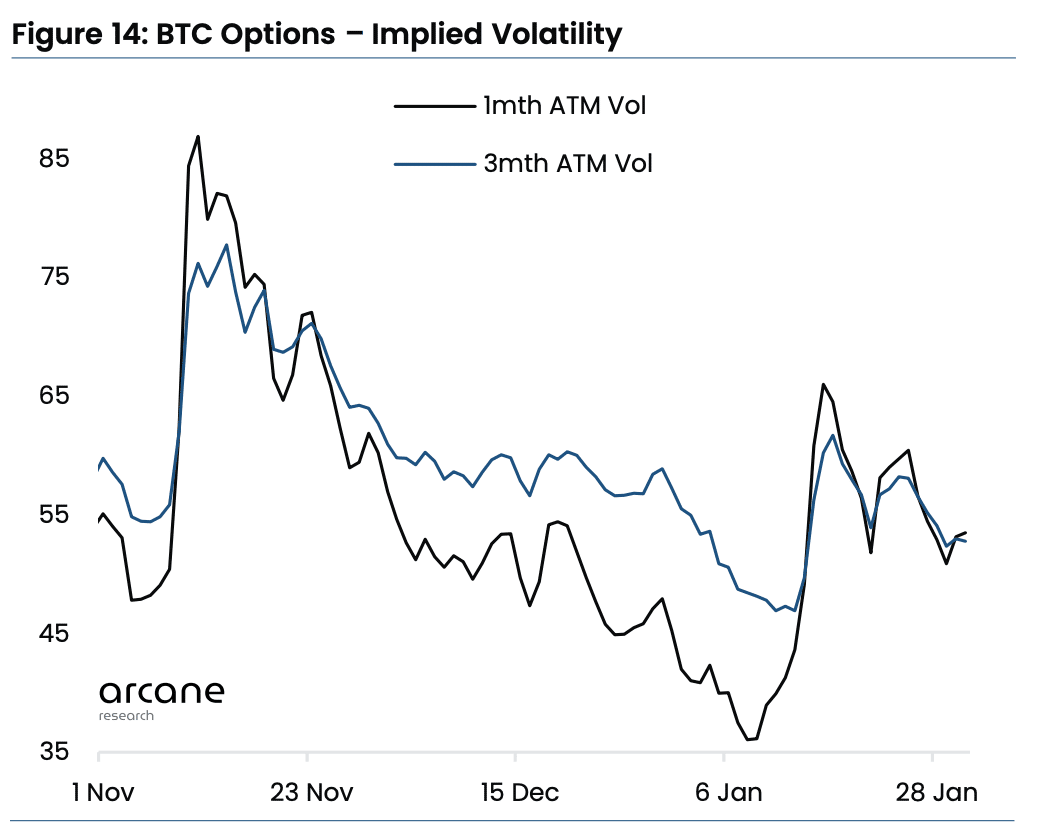

Together with the rising institutional curiosity, the implied volatility for BTC decreased. Prior to now seven days, Bitcoin remained comparatively secure, fluctuating round $23,000, inflicting implied volatility to lower.

At press time, implied volatility was within the low 50s, even for longer time frames. This was just like the degrees seen in early November, because the choices market predicted a slower tempo available in the market.

Supply: arcane analysis

Miners battle

Together with institutional curiosity growing within the Bitcoin derivatives market, retail traders gained curiosity in Bitcoin as properly. In accordance with Glassnode, the variety of addresses holding greater than 0.01 cash of their addresses elevated during the last month.

At press time, the variety of Bitcoin addresses holding multiple coin reached an all-time-high of 4.21 million.

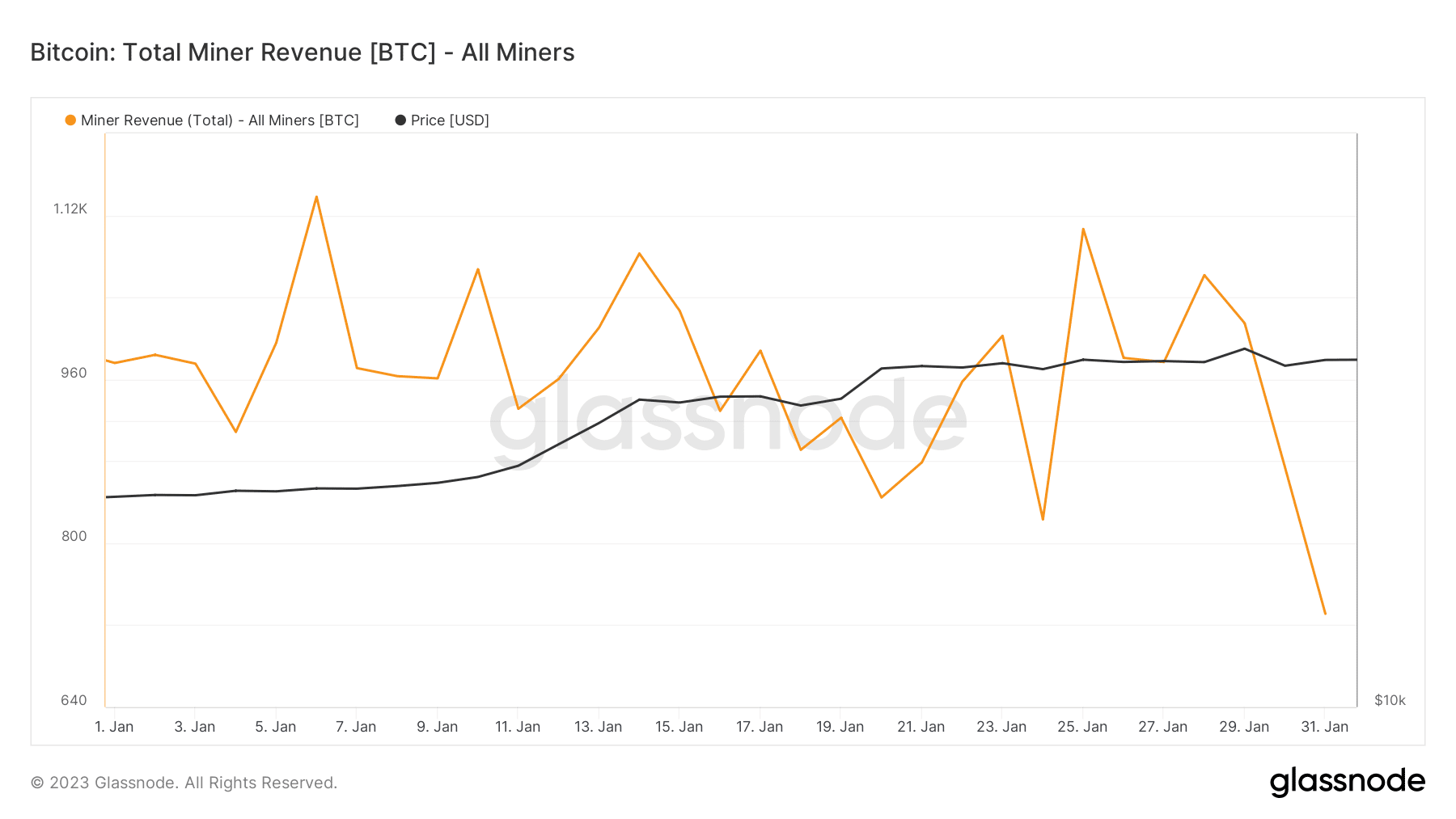

Nonetheless, despite the fact that retail traders confirmed curiosity in Bitcoin, miners weren’t having a good time. Over the past week, the income generated by Bitcoin miners lowered materially. Together with that, the rising costs of electrical energy impacted miners negatively as properly.

Hashrate Index’s evaluation of how US electrical energy costs affected the Bitcoin mining business in 2022. The twin strain of rising electrical energy costs and falling bitcoin costs has led to the chapter of some largest corporations corresponding to Core Scientific. https://t.co/k3opxZFToL pic.twitter.com/JkL0p3oLSH

— Wu Blockchain (@WuBlockchain) January 31, 2023

This might enhance the promoting strain on miners, which might incentivize them to promote their holdings and influence the value of BTC negatively.

Supply: Glassnode

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

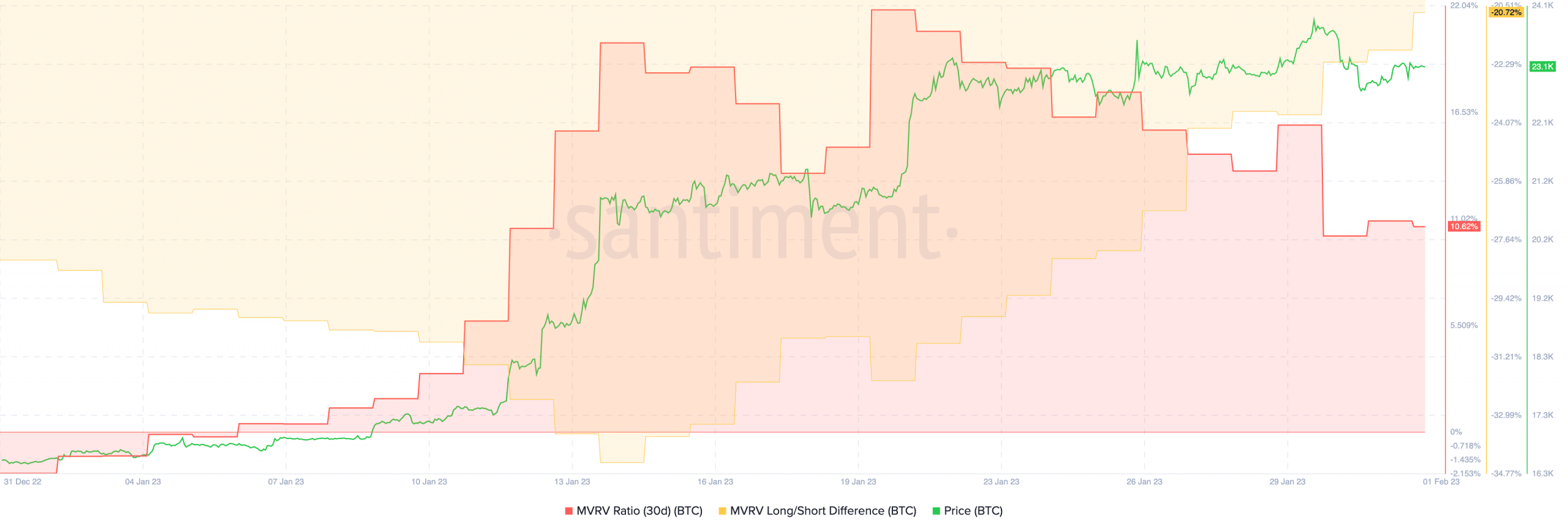

One other indicator of rising promoting strain on holders could be the growing MVRV ratio, as evidenced by Santiment. This indicated that many of the addresses holding Bitcoin might revenue in the event that they bought their positions.

The lengthy/brief indicator was adverse, which instructed that it will be short-term holders that will revenue most from promoting their positions. It stays to be seen whether or not these short-term holders resolve to promote their holdings or proceed to HODL.

Supply: Santiment