- Miners would possibly revert to a income enhance because the Puell A number of left the capitulation space.

- Market statistics confirmed that the present situation was not overheated.

Bitcoin [BTC] holders weren’t the one recipients of welcome developments not too long ago. Just like the holders, miners who’ve struggled with inhospitable situations may additionally have trigger to rejoice within the close to time period. That is after they’d spent months in losses.

What number of are 1,10,100 BTCs price right this moment?

Solace within the face of hope

The explanation for this projection is because of the Puell A number of’s exit from the pink zone. The Puell A number of is a vital metric that gauges mining profitability. The metric underpins the correlation between the each day coin issuance and the 365-day Shifting Common (MA) of the identical issuance.

In accordance with Philip Swift, founding father of LookIntoBitcoin, the Puell A number of was out of the capitulation area after 191 days of languishing within the zone.

The Puell A number of reveals current reduction for #bitcoin miners.

After 191 days in capitulation zone, the Puell A number of has rallied. Displaying reduction for miners by way of elevated income and certain diminished promote strain.

Free dwell chart: https://t.co/G9HDcNLL9T pic.twitter.com/MBRef5fZIE

— Philip Swift (@PositiveCrypto) February 2, 2023

Moreover, Glassnode knowledge confirmed that the metric was near overthrowing the erstwhile defeat. At press time, the Puell A number of was 0.996. This was thought of a powerful rally contemplating {that a} decrease worth signifies a income shred.

Alternatively, the present state of roughly one suggests a rise in miner income. Therefore, this might be very important to lowering the promoting strain from miners, which they’d used to cowl up for the hawkish market situation.

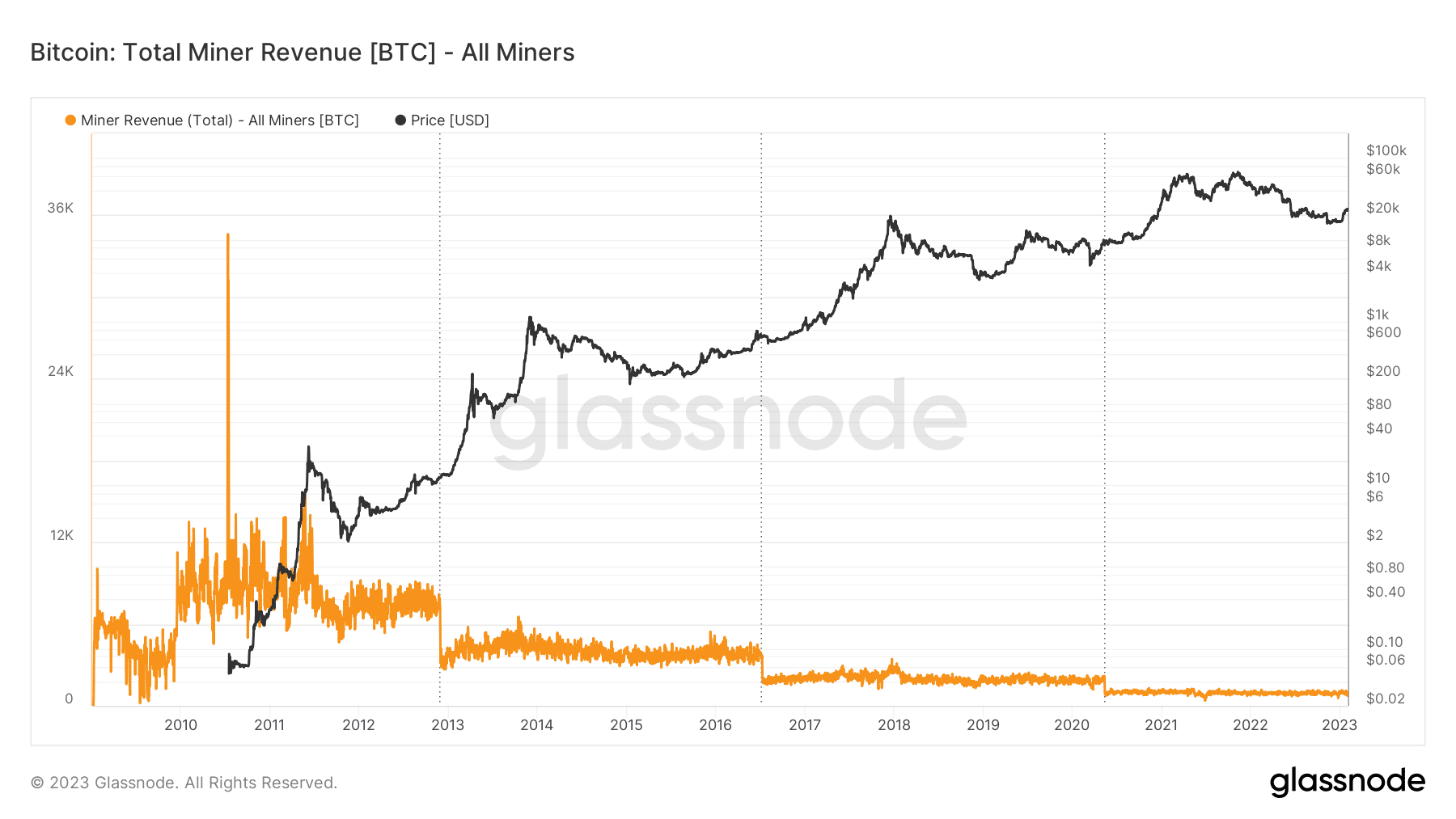

On the time of assessing the knowledge from Glassnode, the miner revenue was edging towards the uptrend. This metric reveals how a lot validators of the community have made. And this consists of newly minted cash. On the time of writing, the income was 976.80 BTC.

Supply: Glassnode

Certainly, the optimistic market response to the FOMC announcement additionally expanded to the mining operational sector.

Ease on the warmth

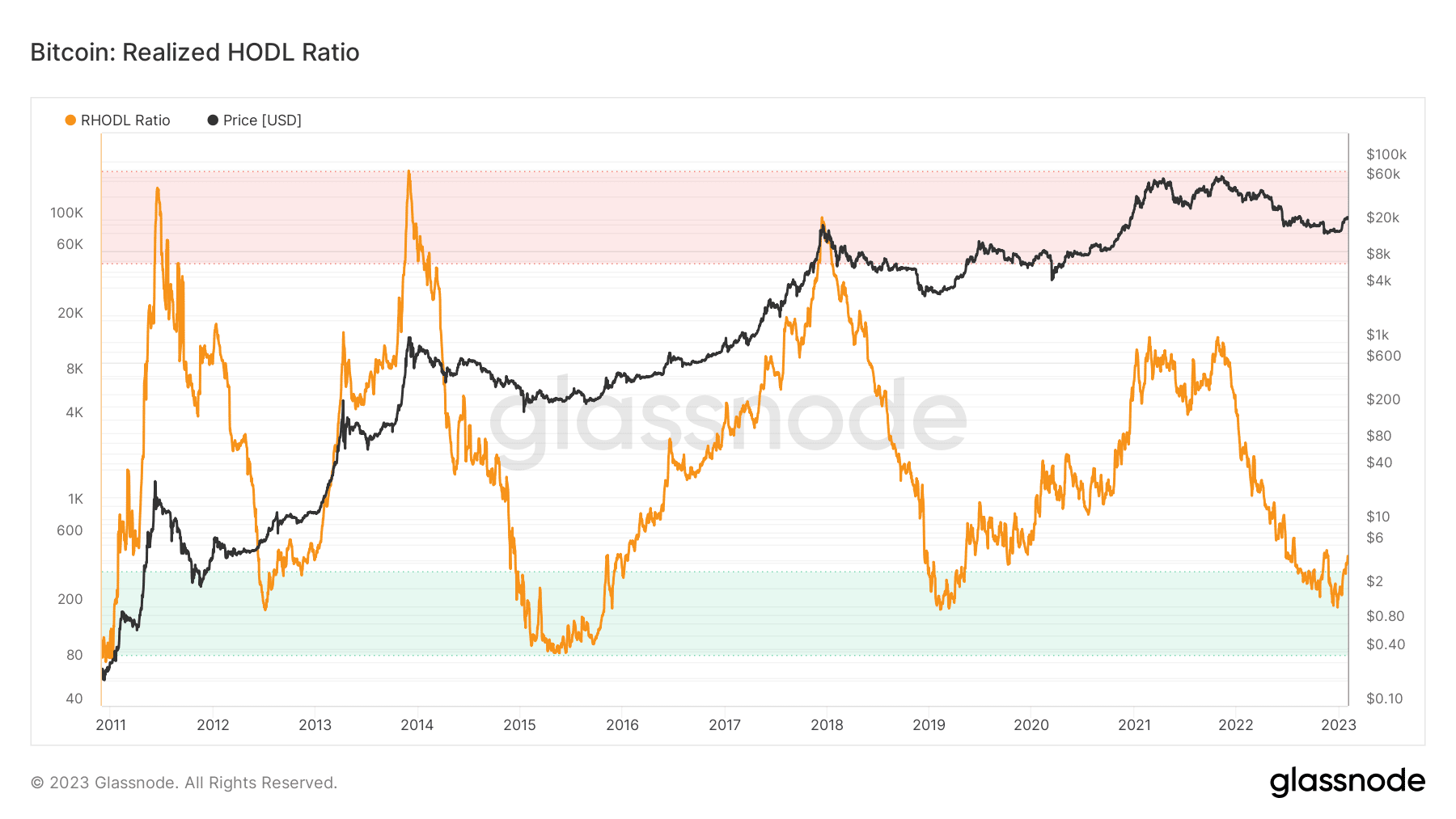

As well as, Glassnode knowledge revealed that all the Bitcoin market was stabilizing. In accordance with the on-chain data supplier, the Realized HODL (RHODL) ratio had risen to 387.22 on 28 January.

The RHODL ratio weighs the connection between the one-week and one to 2 years Realized Cap HODL waves. However because the ratio was not extraordinarily excessive, it indicated that the market was not overheated and that this cycle prime would nonetheless be a far attain. This might provide a shopping for alternative for the long run.

Supply: Glassnode

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

In the meantime, the BTC worth motion was in a position to get the higher of the projected draw back following the FOMC pronouncement. Nonetheless, the value discovered it difficult to re-hit $24,000, in accordance with CoinMarketCap. Some analysts maintained the established order that the coin was solely getting stronger.

In a current tweet, stock-to-flow creator PlanB stuck to his previous opinion of a $25,000 200-week MA whereas noting that the halving would play an important position.

#bitcoin is getting stronger .. halving is coming🔥 pic.twitter.com/h4TD3JPuWC

— PlanB (@100trillionUSD) February 2, 2023