- BLUR’s value has dropped by 98% because it launched on 14 February.

- Blur continues to see elevated person exercise.

Blur’s governance token BLUR has suffered a large 98% drop in its worth inside simply 20 days of its launch, in line with CoinMarketCap information.

Following a number of months of anticipation, the zero-fee non-fungible token (NFT) market launched its governance token on Valentine’s day.

As group members started claiming their airdropped tokens and buying and selling the identical, BLUR’s value shot as much as nearly $50 on the identical day.

Nevertheless, nearly instantaneously, it quickly started its descent. At press time, the alt traded at $0.6915.

Is your portfolio inexperienced? Try the Blur Revenue Calculator

Revenue strains are blurred

A have a look at the alt’s efficiency on a every day chart revealed that many BLUR holders have since begun distributing their holdings.

Evaluation of key momentum indicators has proven no indicators of accumulation exercise since 14 February, indicating that most of the airdropped customers have been solely keen on cashing in on the tokens and promoting them off.

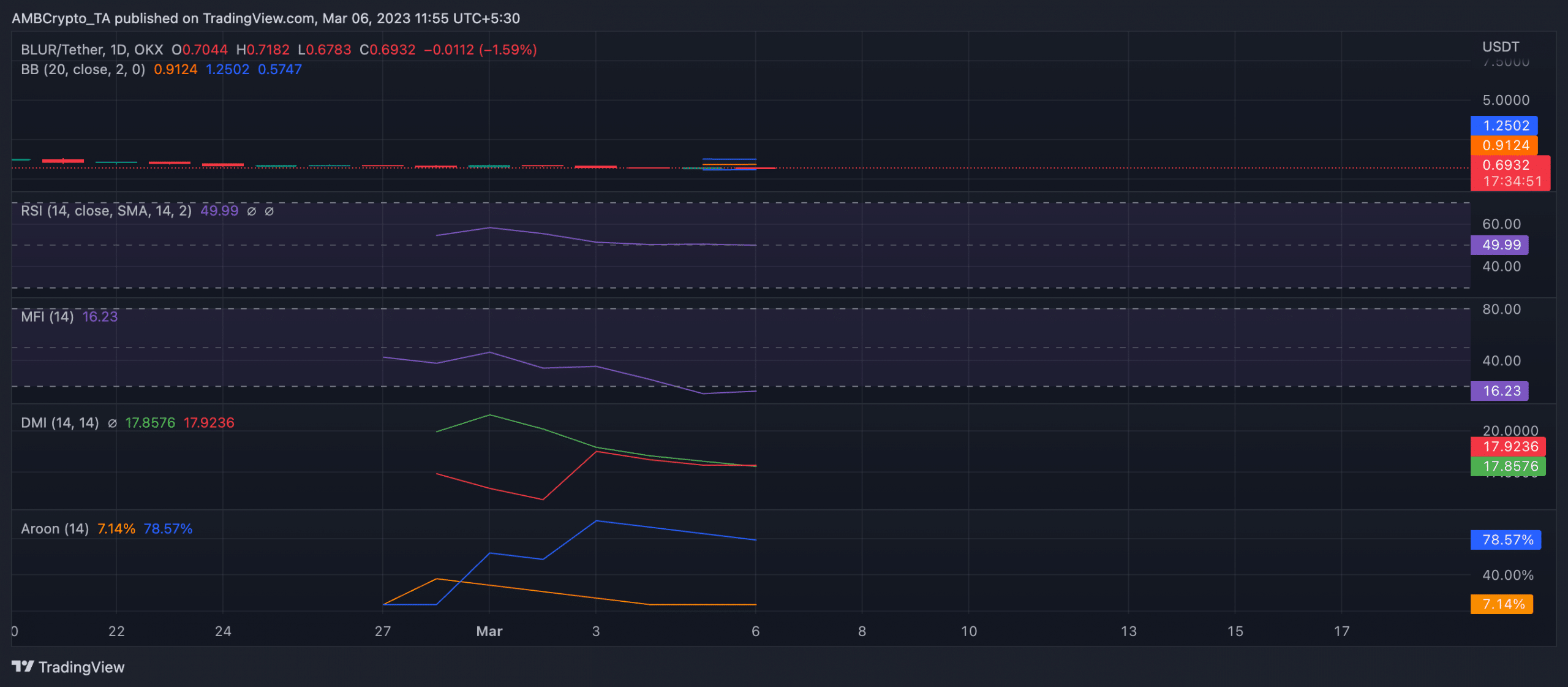

With vital distribution nonetheless ongoing at press time, Blur’s Cash Movement Index (MFI) rested deeply within the oversold area. It was 16.23.

Additionally, in a downtrend, the Relative Energy Index (RSI) lay under the 50-neutral place at 49.99

Additional, the Directional Motion Indicator (DMI) confirmed that promoting strain exceeded shopping for strain because the BLUR sellers had management of the market as of this writing.

The constructive directional indicator (inexperienced), at 17.85, was positioned under the unfavorable directional indicator (crimson) at 17.92. An additional decline in shopping for momentum is predicted to push the unfavorable directional indicator upward, solidifying the sellers’ maintain available on the market.

As talked about above, BLUR clinched its highest value stage of $45 on the day it launched. The Aroon Up Line (orange) at 7.14% confirmed this and hinted at an additional value drawdown.

It’s trite that when the Aroon Up line is near zero, the uptrend is weak, and the latest excessive was reached a very long time in the past.

Supply: TradingView BLUR/USD

Life like or not, right here’s BLURs market cap in BTC’s phrases

Blur’s grip available on the market stays unmatched, whereas OpenSea falters

Regardless of the regular fall within the worth of its governance token, Blur continues to report elevated person exercise.

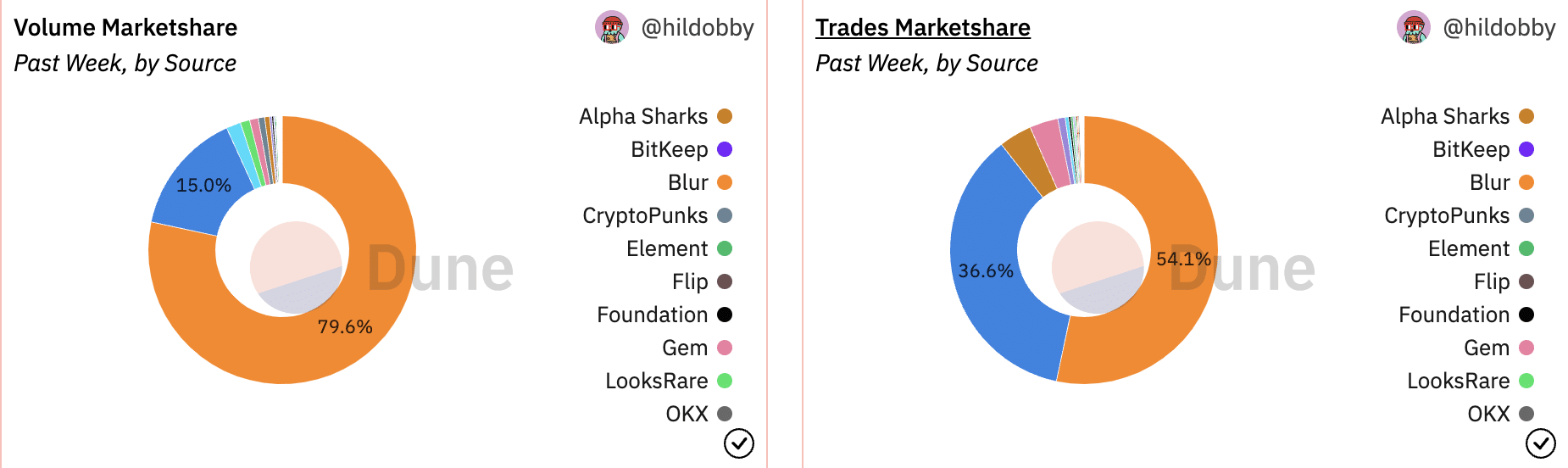

In reality, the NFT market was answerable for 79.6% of the complete market gross sales quantity within the final week.

OpenSea, then again, contributed solely 15% throughout the identical interval. Additionally, extra NFT trades have been accomplished on Blur than have been accomplished on OpenSea within the final week, per information from Dune Analytics.

Supply: Dune Analytics

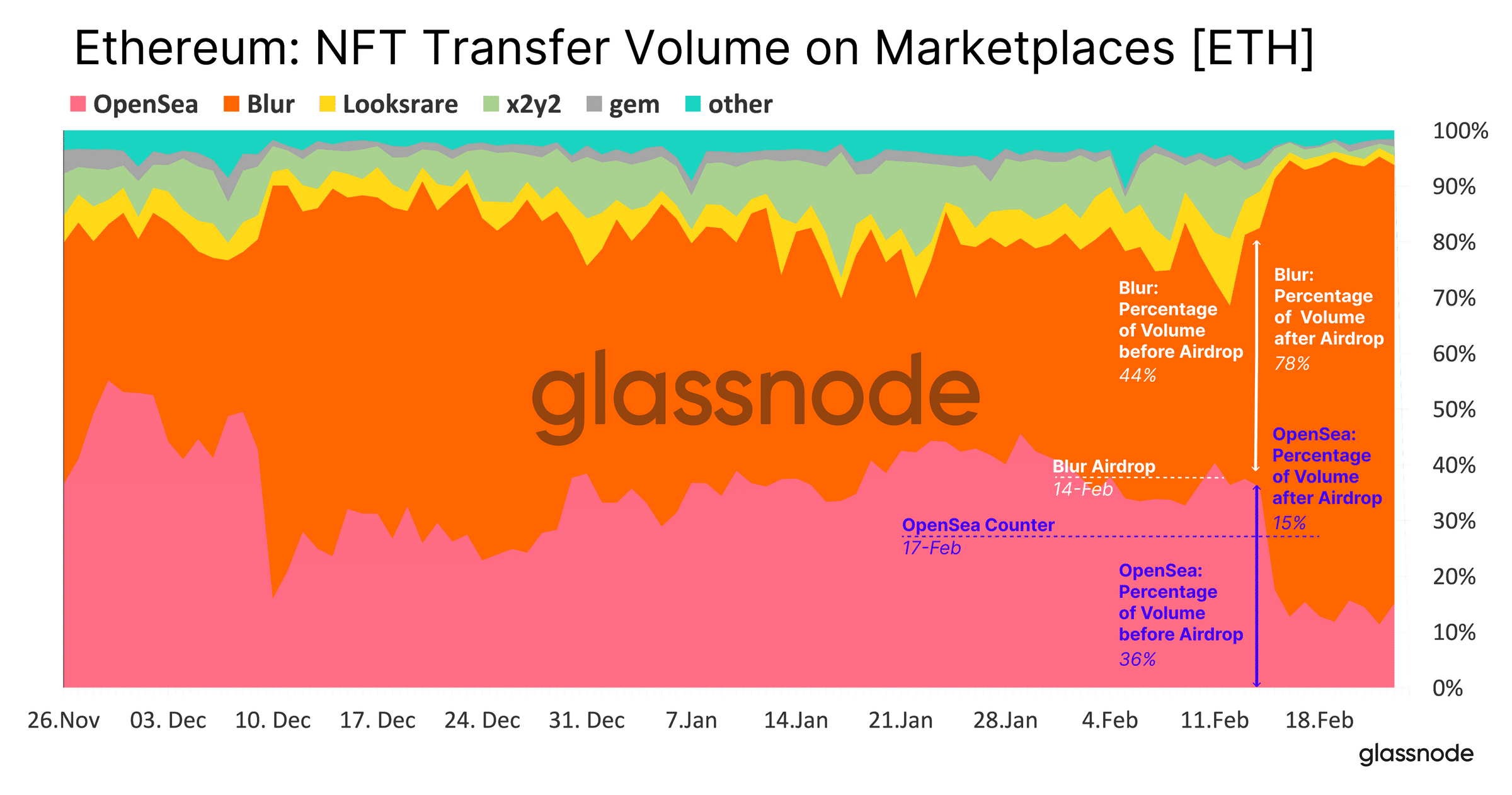

Glassnode, in a current report, famous that the surge in Blur’s market share got here after its token AirDrop on 14 February.

Previous to the AirDrop, the NFT market, and aggregator held 48% of the entire NFT switch quantity out there.

Nevertheless, after the AirDrop, its NFT switch quantity soared to 78%, vastly impacting OpenSea. Consequently, OpenSea’s NFT switch quantity fell by 21% within the aftermath of the BLUR AirDrop.

Supply: Glassnode

In accordance with information from Dune Analytics, 360 million BLUR tokens have been airdropped on 14 February. With a 60-day window interval to say these tokens, 342.92 million BLUR tokens have been claimed up to now by eligible customers of the NFT market.

As soon as the 60-day window to say the airdropped tokens elapses, it stays to be seen whether or not it will culminate in a decline in NFT’s market utilization, which might probably restore OpenSea to its earlier stage of prominence.