- BNB’s main indicator RSI was in an overbought place.

- A lot of the metrics gave a bearish studying.

Binance Coin’s [BNB] efficiency of late has been within the patrons’ favor, like a lot of the different cryptos. Nonetheless, Santiment’s knowledge revealed that BNB was overvalued as per its MVRV Z-Rating. The metric identifies overvalued and undervalued property based mostly on quick and long-term returns.

📊 In line with MVRV Z-Rating, which identifies overvalued and undervalued property based mostly on quick & long run returns, high caps are within the following classes:

🤔 Overvalued: $BNB

😏 Undervalued: $BTC, $ETH, $XRP, $ADA, $DOGE, $MATIC, $SHIB, $UNI, $LINKhttps://t.co/52bMDRyqqn pic.twitter.com/hBURjNZOLV— Santiment (@santimentfeed) January 20, 2023

Apart from, in line with CryptoQuant, BNB’s Relative Energy Index (RSI) was in an overbought place. The RSI, when coupled with BNB’s MVRV Z-Rating, prompt that it was possible that we might witness a rise in promoting strain, resulting in a worth plummet.

On the time of writing, BNB registered over 2% weekly features and was trading at $290.88 with a market capitalization of greater than $45.9 billion.

Learn Binance Coin’s [BNB] Worth Prediction 2023-24

Right here is the state of affairs

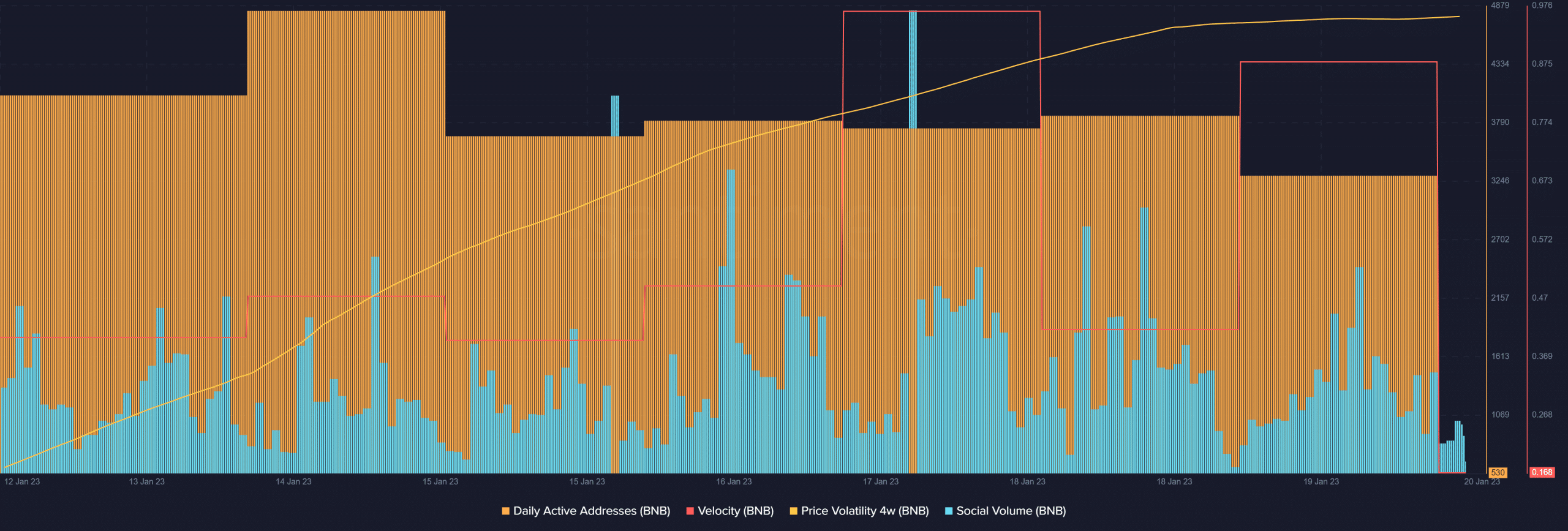

Aside from the aforementioned metrics, a couple of of the others additionally didn’t look fairly optimistic for BNB. As an illustration, BNB’s day by day energetic addresses registered a decline during the last week, which was a damaging sign.

Furthermore, BNB’s velocity additionally went down sharply. And, the token’s worth volatility went up significantly. This additional elevated the probabilities of a worth decline. Regardless of the potential of a downtrend, BNB managed to stay widespread out there as its social quantity was constantly up throughout the previous few days.

Supply: Santiment

Real looking or not, right here’s BNB’s market cap in BTC’s phrases

Can BNB beat the chances?

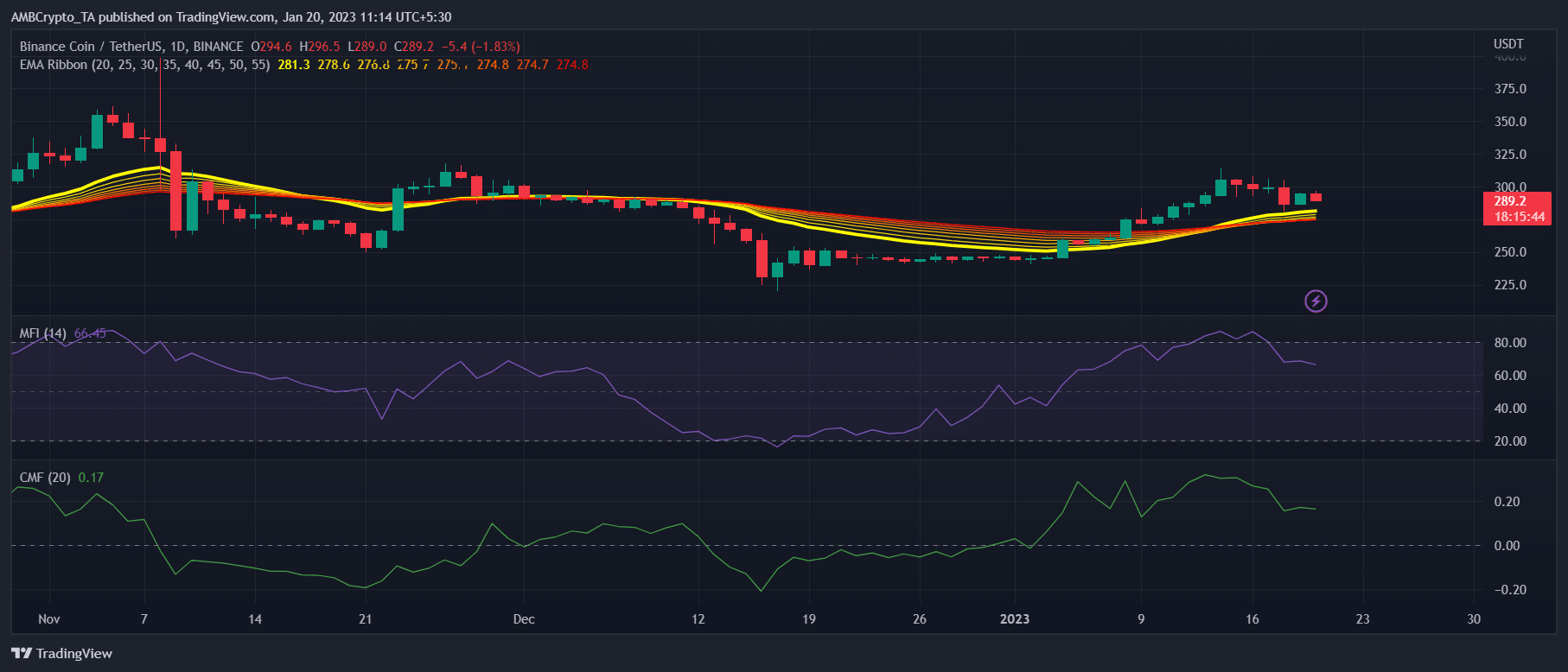

BNB’s day by day chart additionally gave a bearish notion, as a lot of the market indicators had been supporting the sellers. The Cash Movement Index (MFI) registered a downtick and was heading towards the impartial mark, which might trigger worth declines.

Although the Chaikin Cash Movement (CMF) was above the impartial place, it additionally went down barely, additional growing the probabilities of a downtrend within the coming days.

Nonetheless, the Exponential Shifting Common (EMA) Ribbon prompt that the bulls had been main the market because the 20-day EMA was above the 55-day EMA.

Supply: TradingView