Blockchain

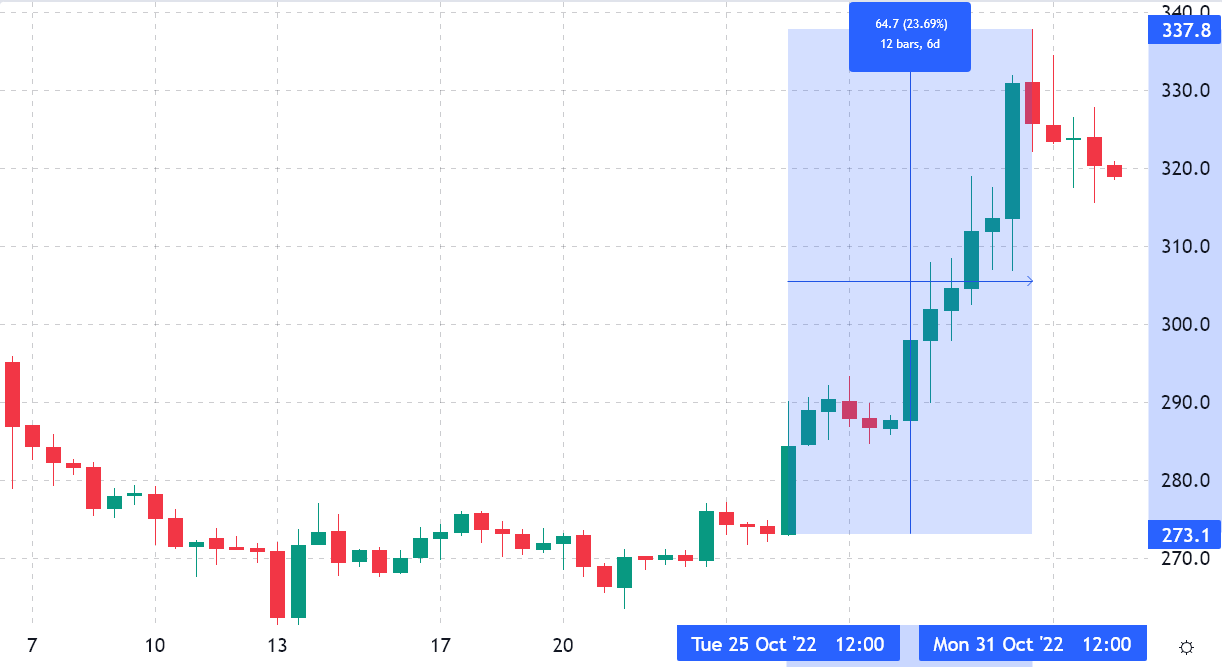

After a formidable 23.7% rally between Oct. 25 and Oct. 31, Binance Chain BNB, has confronted a robust rejection from the $330 resistance. Is it attainable that the two-day 6% sell-off from the $337.80 peak may point out that additional hassle is forward?

Let’s check out what the information exhibits.

BNB Coin (BNB) 12-hour at Binance, USD. Supply: TradingView

Analysts pinned the latest rally to the Oct. 28 information that Binance had invested $500 million in Twitter. Nevertheless, the community’s deposits and decentralized functions metrics haven’t accompanied the advance in sentiment.

The robust upward motion was largely based mostly on stories that Binance was getting ready to help Twitter in eradicating bots. The hypothesis emerged after billionaire Elon Musk raised the $44 billion required to finish his buy of the social media platform.

In absolute phrases, BNB’s year-to-date efficiency displays a 40% decline, however it ranks forward of opponents as Ether (ETH) is down by 59%, Solana (SOL) 82% and Polygon (MATIC) registers a 79% correction.

To know whether or not the latest 6% downturn is a presage of a deeper correction, merchants ought to take a look at the community’s use by way of deposits and customers.

BNB TVL dropped lower than its opponents

Usually, analysts have a tendency to provide an excessive amount of weight to the whole worth locked (TVL) metric. Though this may maintain relevance for the decentralized finance (DeFi) trade, it’s seldom required for crypto video games, nonfungible token (NFT) marketplaces, playing and social functions.

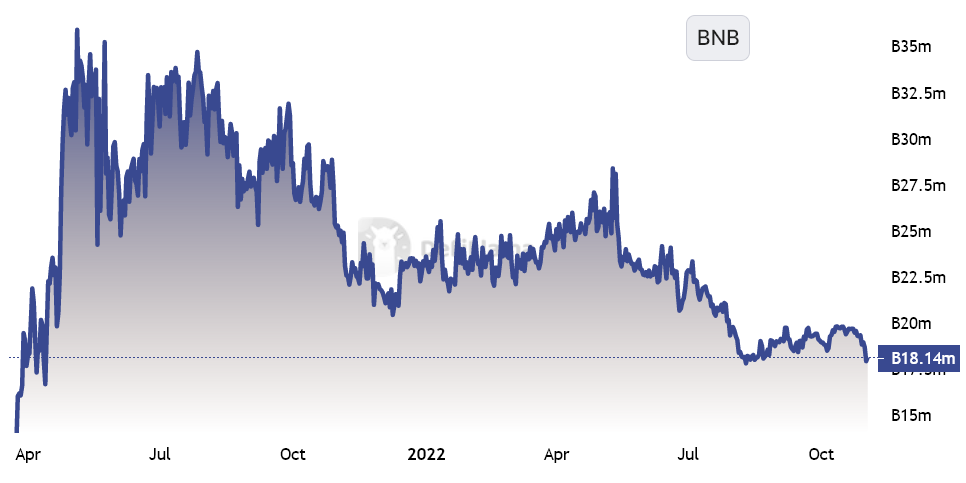

BNB Chain Whole Worth Locked, BNB. Supply: DefiLlama

BNB Chain’s major decentralized functions (DApps) metric confirmed weak spot in late July after its TVL dropped beneath 22.5 million BNB. Extra not too long ago, the TVL dropped to 18 million BNB, nearing the bottom ranges seen since April 2021.

In greenback phrases, the present $5.9 billion TVL is the bottom determine since Aug. 11. This quantity represents 10.9% of the cryptocurrency market mixture TVL, in response to knowledge from DefiLlama.

Nonetheless, the month-to-month 5% TVL contraction was decrease than its good contract community opponents. As an illustration, the Ethereum community’s TVL fell by 13% in ETH phrases in the identical interval. Solana’s community TVL went down by 22% in SOL phrases and Polygon’s community TVL declined by 19% in MATIC phrases.

DApp use has additionally underperformed in opposition to competing chains

To verify whether or not the TVL drop in BNB Chain is troublesome, one ought to analyze different DApp utilization metrics.

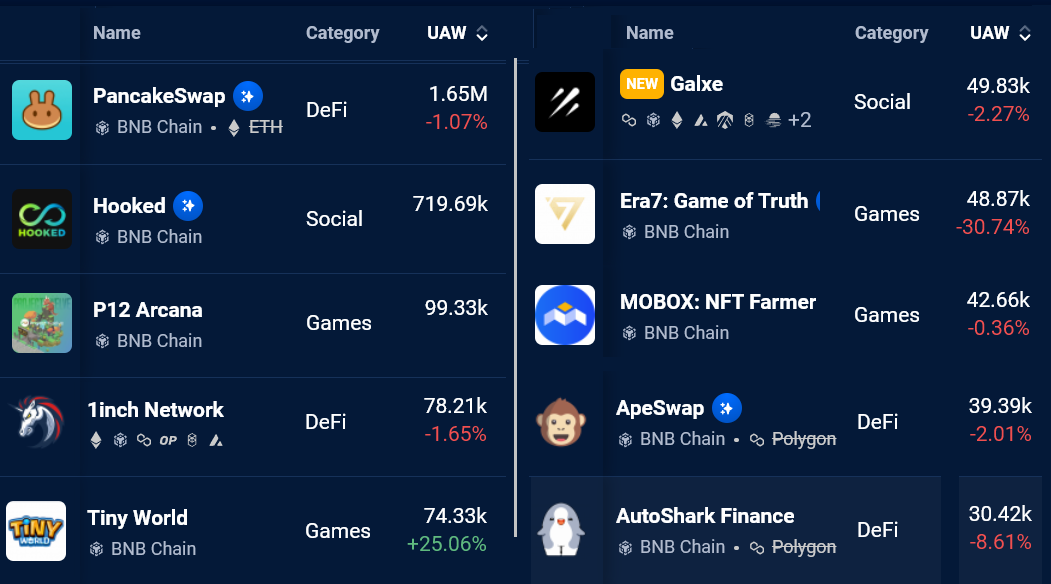

BNB Chain most lively 30-day DApps. Supply: DappRadar

Nov. 2 knowledge from DappRadar exhibits that the variety of BNB Chain community addresses interacting with decentralized functions declined by 5% in comparison with the earlier month. As compared, Ethereum posted a 5% lower, and Solana customers dropped by 13% in the identical interval.

BNB Chain’s TVL has been impacted the least in comparison with comparable good contract platforms, and the variety of lively addresses interacting with most DApps surpassed 40,000 in 8 situations. Ethereum, alternatively, racked up solely 5 decentralized functions with 40,000 or extra lively addresses in the identical interval.

The findings above counsel that the BNB Chain is holding floor versus competing chains, which helps the latest rally. Consequently, the information ought to be thought-about favorable for BNB buyers and weaken the percentages of additional value corrections.

The views and opinions expressed listed here are solely these of the writer and don’t essentially replicate the views of Cointelegraph.com. Each funding and buying and selling transfer includes danger, you need to conduct your personal analysis when making a choice.