- The energetic addresses and transactions rely of BNB elevated within the final quarter.

- TVL and NFT ecosystems witnessed a decline.

Messari just lately printed Binance Coin’s [BNB] 2022 This autumn report, which highlighted the blockchain’s efficiency over the past three months of the earlier yr.

As per the report, BNB Chain registered progress in fairly a couple of areas. This helped BNB start the brand new yr on a great notice.

State of @BNBCHAIN This autumn 2022 is LIVE.

Hyperlink to the FREE BNB Chain quarterly report from @JamesTrautman_ within the tweet under ⬇️ pic.twitter.com/FDETmjR7TR

— Messari (@MessariCrypto) February 5, 2023

Learn Binance Coin’s [BNB] Worth Prediction 2023-24

How has BNB been?

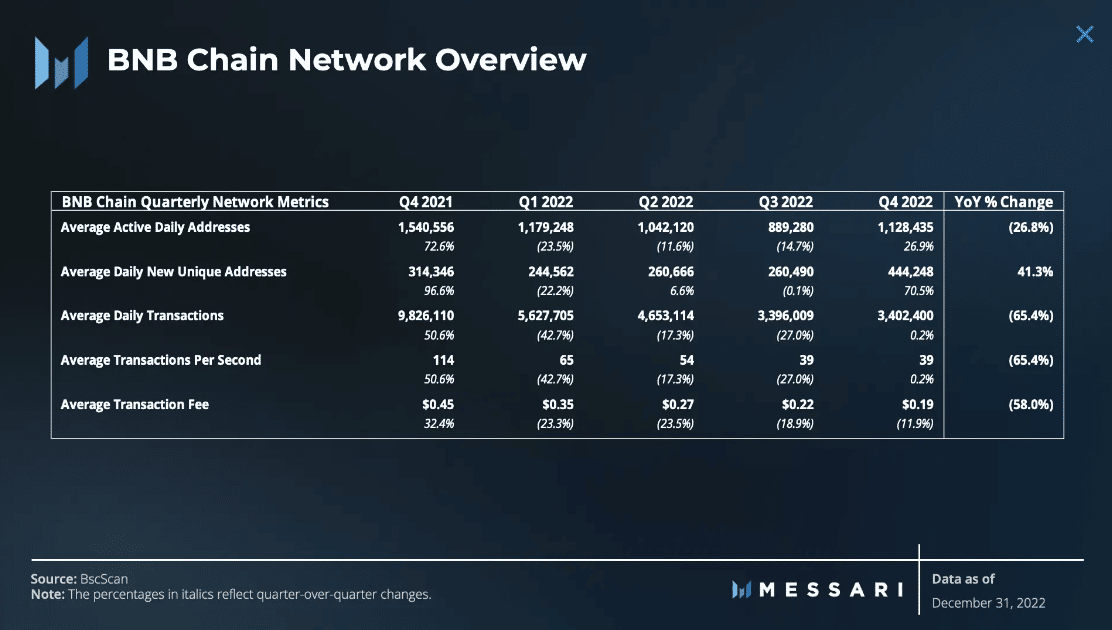

Messari’s report talked about that BNB’s common every day energetic addresses elevated significantly within the final quarter. The determine registered a rise of 30%, which mirrored its recognition within the crypto house.

Moreover, the typical every day new distinctive addresses elevated dramatically from 889k to over 1 million, indicating an inflow of latest community customers.

Common transactions additionally witnessed a slight uptick regardless of the bearish market situation of that quarter. BNB Chain’s common every day transactions undermined the downward development, ending the quarter barely up by 0.2%.

Supply: Messari

Nonetheless, not the whole lot was optimistic for BNB, as a number of of the opposite areas registered a decline. Essentially the most notable was a decline in BNB Chain’s income. In response to the report, quarterly income decreased from $66.8 million to $59.98 million in This autumn 2022.

Moreover, BNB’s community worth adopted the quarterly income and registered a decline of -13.4%.

The identical development was true for the community’s Whole Worth Locked (TVL) as the worth denominated in BNB and USD declined by 12% and 24%, respectively. Speaking about TVL dominance, PancakeSwap managed to guide, adopted by Venus and Alpaca Finance.

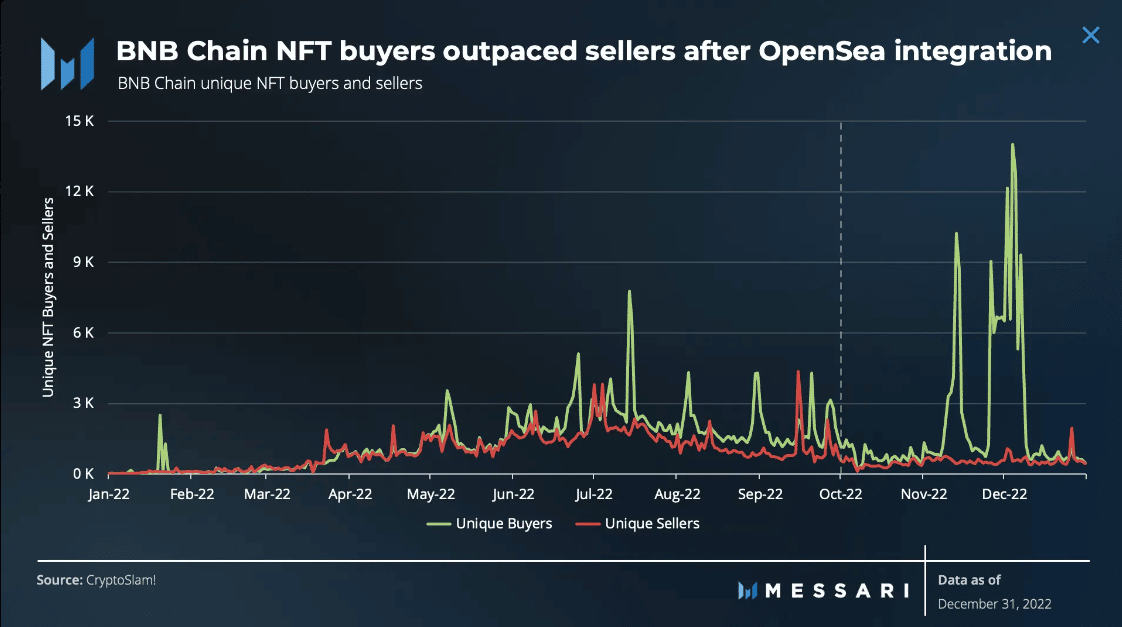

BNB’s NFT house was additionally affected by the bearish market circumstances of the final quarter.

It needs to be famous right here that BNB Chain’s secondary NFT gross sales dropped by greater than 67%, which appeared regarding for the community.

Nonetheless, the chain’s integration with OpenSea helped change the scenario. After BNB Chain’s NFTs have been listed on OpenSea, the variety of distinctive patrons skyrocketed.

Supply: Messari

Is your portfolio inexperienced? Verify the BNB Revenue Calculator

2023 introduced higher information

The brand new yr started with a change available in the market’s general sentiment as many of the cryptos gained bullish momentum. Due to this fact, a couple of of the metrics turned in favor of BNB.

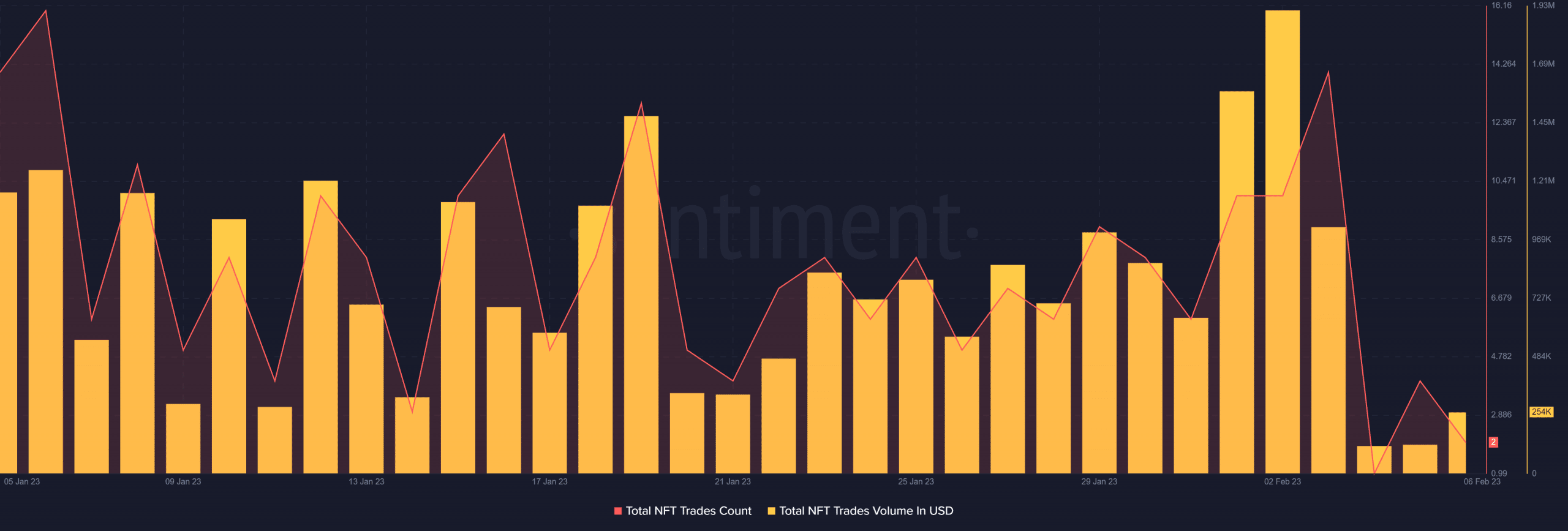

As an illustration, whereas BNB’s NFT ecosystem witnessed a decline in This autumn 2022, the brand new yr modified the situation. As per Santiment, the whole variety of NFT commerce counts and complete NFT commerce quantity in USD registered a rise within the final 30 days.

Supply: Santiment

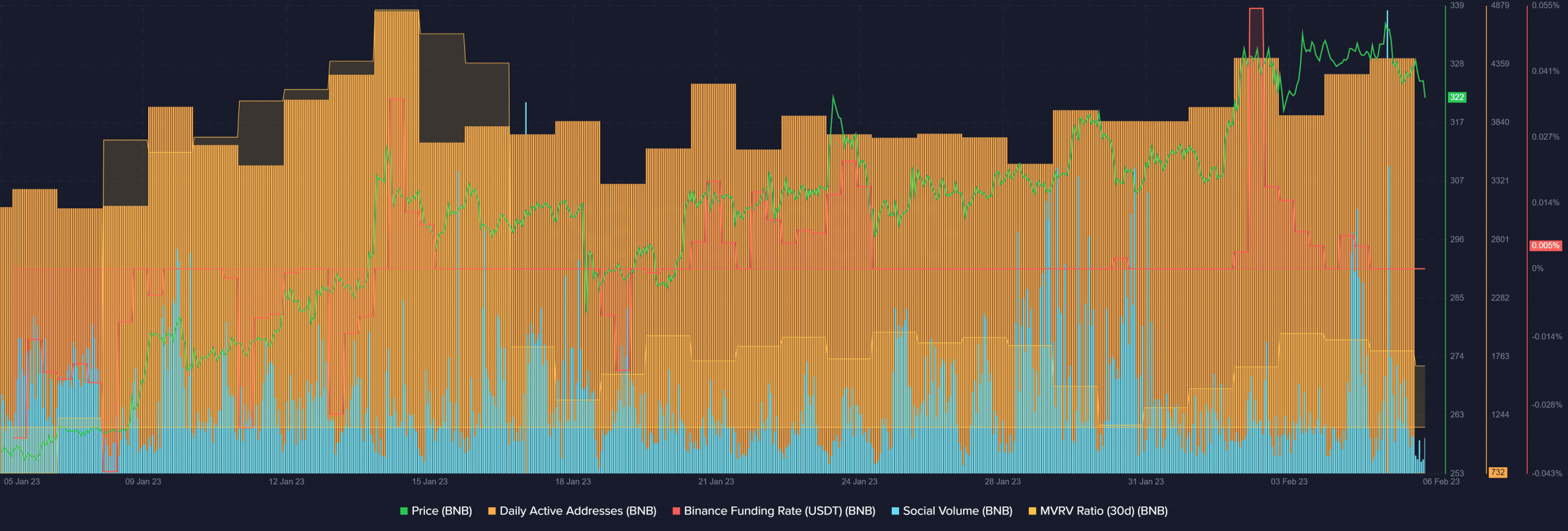

Not solely this, however BNB’s every day energetic addresses additionally elevated final month, which complemented BNB This autumn 2022’s efficiency.

The blockchain’s recognition rose as its social quantity went up. Furthermore, BNB’s demand within the futures market elevated, as instructed by its Binance funding fee.

Nonetheless, regardless of a substantial worth pump, BNB’s MVRV Ratio took a success, which was somewhat shocking.

Supply: Santiment