- Binance lately skilled a large internet outflow on the again of a potential prosecution from the DOJ

- BNB token has additionally been on a downtrend in current days

Hypothesis that Binance could possibly be prosecuted has led to a flurry of consideration on the alternate up to now day. There was a reported improve in withdrawals, which might point out that this prompted some customers to panic.

Due to this, the worth of its native cryptocurrency, BNB, could have dropped. Do Binance and BNB have extra to their narrative than meets the attention, or is that this simply Concern Uncertainty, and Doubt (FUD)?

Learn Binance Coin’s [BNB] value prediction 2023-2024

On 12 December, Reuters released a report that set off the chain of occasions. Key Binance executives had been allegedly on the sting of US prosecution, in response to the information company’s report.

The report claimed that the Division of Justice (DOJ) had been concentrating on Binance, the most important centralized bitcoin alternate, for years. Differing opinions amongst DOJ investigators had been, nonetheless, holding up a full-scale arrest and prosecution.

A key level of rivalry, in response to the report, was the burden of the collected proof.

Panic withdrawal or regular exercise?

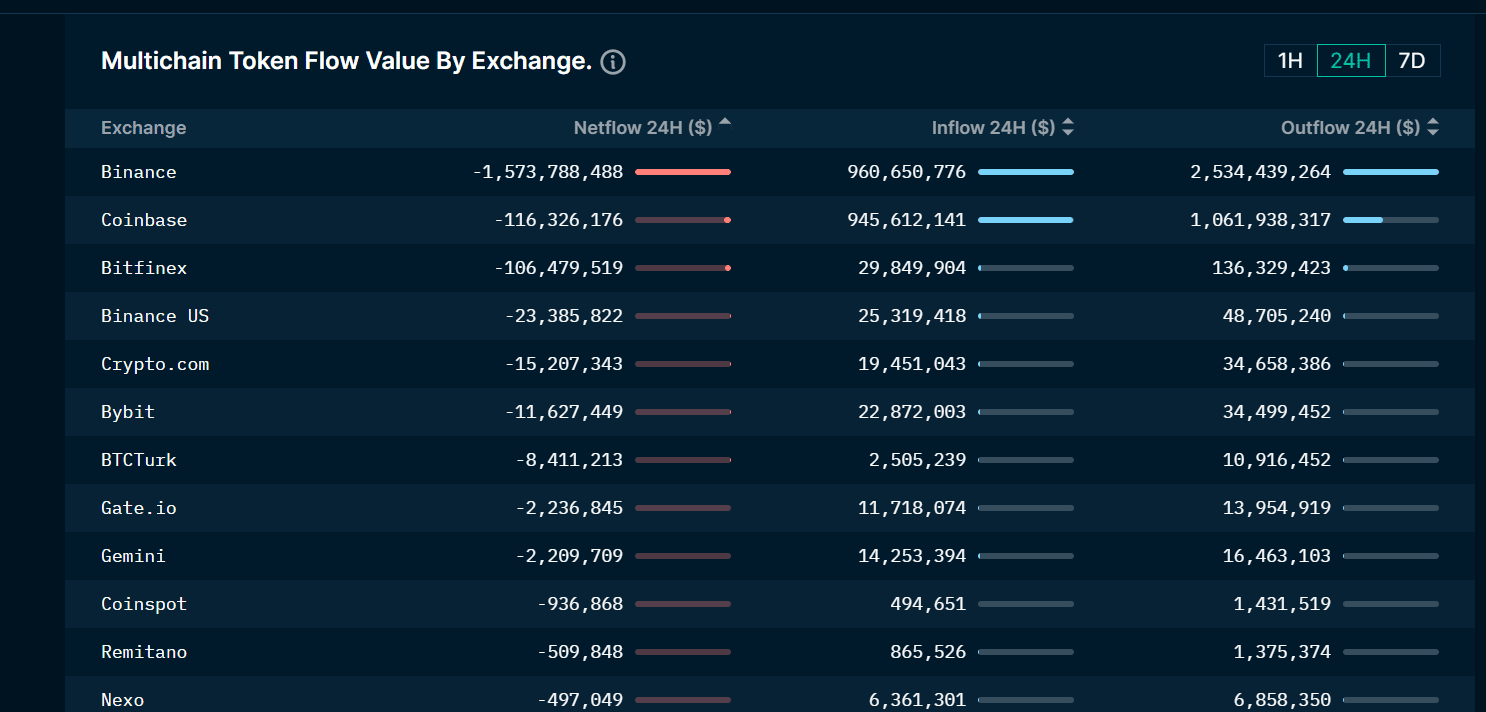

Customers of Binance apparently received right into a state of concern as soon as the knowledge was launched, as a large withdrawal was noticed as soon as the report was launched. Knowledge from Nansen showed that over the course of 24 hours, Binance noticed a destructive internet circulation of billions of {dollars}.

Even when this modification wasn’t straight associated to the information, the timing of the large outflow contributed to the FUD that prompted the withdrawals. The continuous criticism the alternate acquired as a result of audit and Proof-of-Reserve additionally didn’t assist this narrative.

Supply: Nansen

Andrew Thurman, an analyst, tweeted that couple of market makers had made substantial withdrawals through the earlier days. Blockchain information revealed that vital quantities have been transferred away from Binance by various customers over the previous week, together with main cryptocurrency market makers similar to Leap Buying and selling and Wintermute.

By way of withdrawals from Binance, Leap Buying and selling appears to face out as a transparent frontrunner. Fixed exercise off-exchange could point out a dearth of liquidity.

Leap has internet outflows from Binance in extra of $146 million on the week, and no inflows

If Binance books appear like they’re utterly drained of all liquidity, the exit of presumably the most important MM might be purpose why

Supply: https://t.co/aasol67vsX https://t.co/GbeXfXqwce pic.twitter.com/yLYXgBEsSW

— Andrew T (@Blockanalia) December 12, 2022

BNB Drops in Day by day Timeframe

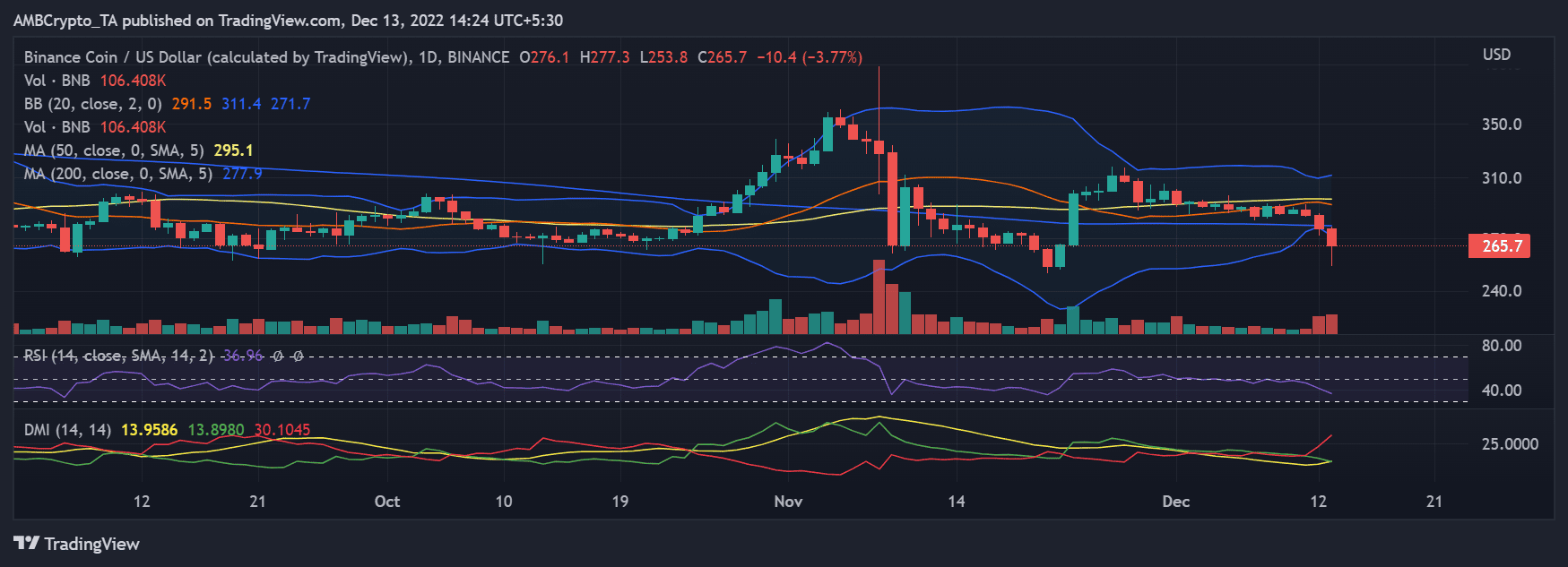

The native token of the alternate, BNB took discover of the happenings and reacted similarly. The asset’s value motion was horizontal up till 11 December, as could possibly be seen within the each day timeframe chart, when it began to say no.

It had misplaced greater than 4% of its worth, and through the buying and selling time that was being noticed when this was being written, it had misplaced one other 3%.

Supply: TradingView

It’s potential for an extra downturn to happen due to the Relative Power Index’s (RSI) stance, which was under the impartial line. Moreover, the quantity indicator’s indication confirmed that sellers had been in management. Being an alternate token, holders could also be recalling the demise of FTT when FTX went bankrupt.

FUD or Extra? Coming Days will Inform…

Twitter account lookonchain reported that Wintermute had deposited practically $150 million and that Justin Solar had put $100 million into Binance inside the previous 24 hours. This motion might quell the lingering FUD or be interpreted extra broadly by critics.

Binance additionally posted a rebuttal to the Reuters information report in an try to make clear its place.