- Bitcoin could also be thrust into unchartered territory as BRICS challenges the U.S. greenback.

- Assessing the potential consequence for Bitcoin if BRICS succeeds.

An fascinating factor is going on within the international enviornment and it’d simply be one of many main components that will affect Bitcoin demand later this 12 months. A battle is being waged towards the greenback and this may problem its international reserve standing.

What number of are 1,10,100 BTCs value at the moment?

Geopolitical tensions are additionally taking the battle to the financial entrance. Russia and China are in joint efforts to roll out a brand new widespread international foreign money referred to as BRICS in alliance with quite a few different nations.

Geopolitical tensions are additionally taking the battle to the financial entrance with BRICS in its place for the greenback. This growth can probably trigger a large influence globally however what does this imply for Bitcoin?

If BRICS catches on and manages to draw extra international locations, then the U.S. greenback may lose its grip as the worldwide reserve foreign money.

Such an consequence can probably put the greenback on the quick lane to lose much more worth. Bitcoin may take pleasure in larger demand as individuals embrace different technique of holding worth.

The USD can also face extra strain and fewer demand from traders as a result of present debt state of affairs and recession fears.

In the meantime, Bitcoin is about to conclude a bullish first month of 2023. And to this point these addresses which were shopping for appear to be holding on to their cash. Glassnode Alerts confirmed this about Bitcoin provide exercise;

📈 #Bitcoin $BTC Quantity of Provide Final Energetic 1d-1w (1d MA) simply reached a 1-month excessive of 490,925.339 BTC

Earlier 1-month excessive of 489,165.093 BTC was noticed on 23 January 2023

View metric:https://t.co/8VrSovS3cQ pic.twitter.com/wkSBnBxxeF

— glassnode alerts (@glassnodealerts) January 29, 2023

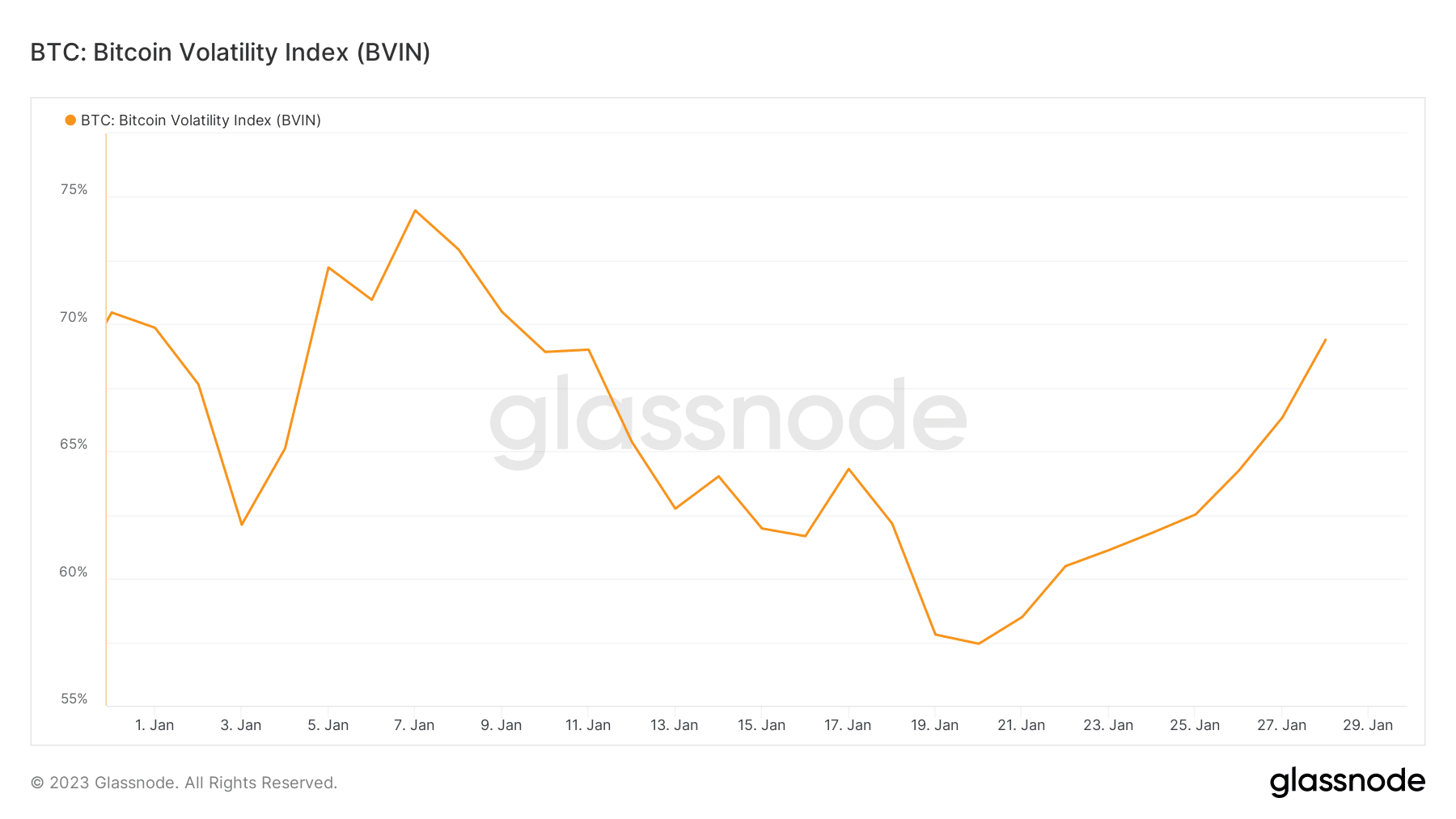

Bitcoin’s volatility index pivoted in favor of the upside since 20 January. This implies that Bitcoin is likely to be headed for extra unstable value actions firstly of February.

Supply: Glassnode

The resurgence of confidence in Bitcoin bulls is completely timed to soak up a number of the liquidity from the dollar outflows.

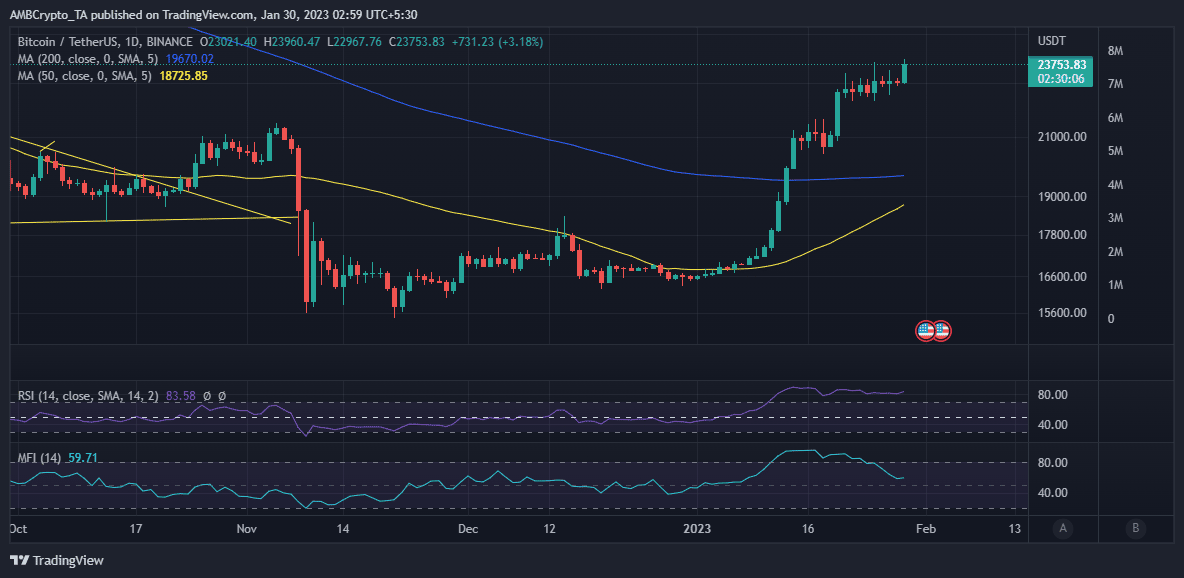

Bitcoin has to this point demonstrated resilience towards the draw back. Its newest rally confirms the sturdy demand and low promote strain as traders decide to carry on to their cash.

This allowed BTC to push nearer to the $24,000 value vary. It traded at $23750 at press time.

Supply: TradingView

Can BRICS benefit from Bitcoin from a blockchain perspective?

There have been reviews claiming that banks in BRICS member states are exploring potential blockchain implementation.

Whereas this will nonetheless be throughout the realm of hypothesis, it is likely to be a powerful transfer for BRICS member international locations.

That is excellent news for Bitcoin as a result of it would underscore sturdy effectivity and velocity. It could not solely supply BRICS a aggressive benefit but in addition make it simpler to make use of as a reserve.

Not going the blockchain route will possible put BRICS at a drawback now that extra international locations are exploring this expertise.

BTC could get to work together with BRICS on its dwelling turf. The potential implications could prove fairly fascinating, particularly for Bitcoin’s long-term outlook.