- BTC miners have been experiencing an uptrend in hashrate and issue with the income not corresponding

- BTC value won’t be impacted by miners sell-off, ought to it ever happen.

Over the previous few days, Bitcoin [BTC] holders have been nervous in regards to the coin’s value declining additional as a consequence of miners promoting their holdings. How a lot of the BTC provide do miners personal, and is it sufficient to influence the market within the occasion of a sell-off?

Hashrateindex: It’s estimated that Bitcoin miners at present maintain a most of 820,000 Bitcoins, a minimal of 120,000 Bitcoins, only one% to 4% of the Bitcoin circulation, even when listed mining firms promote manufacturing in June this yr 350%, the influence has additionally weakened. pic.twitter.com/lCbEpaD88E

— Wu Blockchain (@WuBlockchain) December 18, 2022

Learn Bitcoin’s [BTC] Worth Prediction for 2023-24

Bitcoin declines

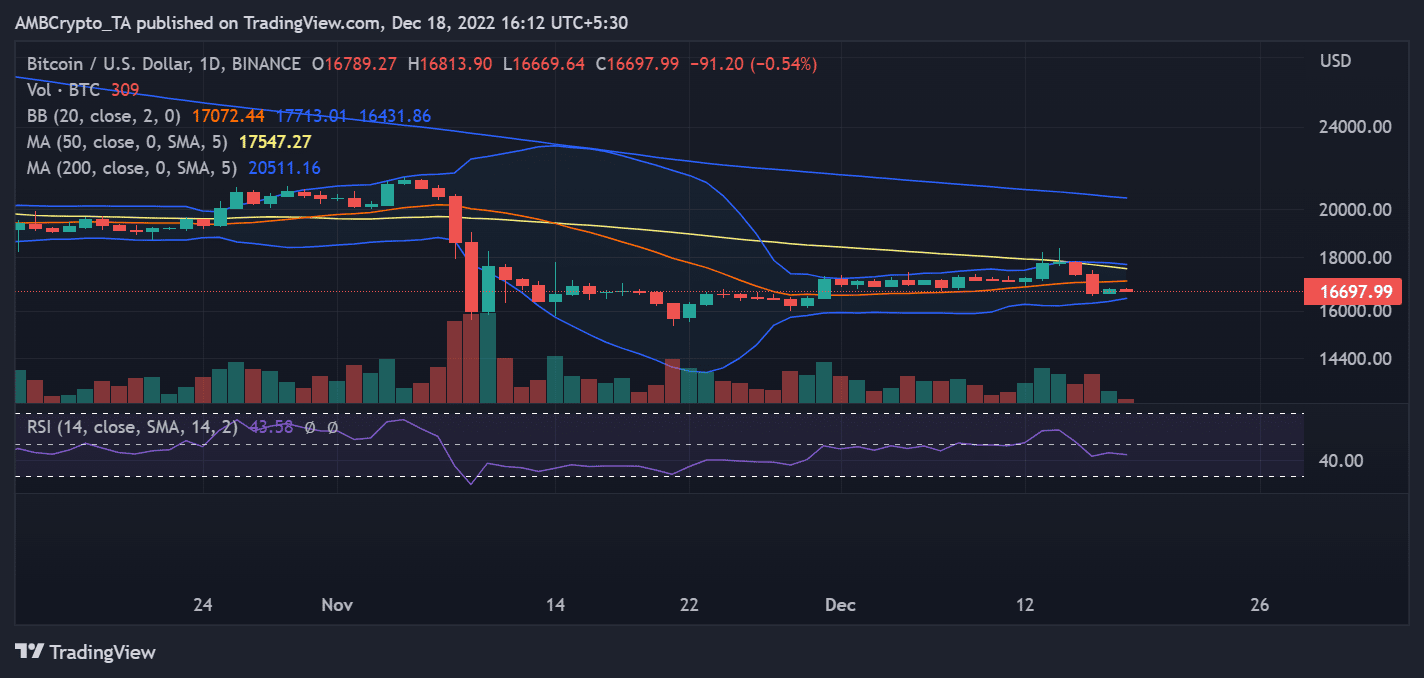

Bitcoin rose to round $18,000 on 13 December, elevating hopes for the place the value could go by the tip of 2022. Nevertheless, following the discharge of the FOMC report, the value fell, and on the time of writing, BTC was buying and selling at about $16,000.

In response to the situation of the Relative Power Index (RSI) metric on the TradingView each day timeframe chart, BTC was in a adverse pattern. As of the time of this writing, the RSI was under the 50 line. What does this signify when it comes to mining income?

Supply: TradingView

Community issue and hashrate up, income down

The Community Problem indicator revealed a pointy rise within the quantity of community issue required to course of blocks and mine BTC. The community issue reached an all-time excessive of over 36 Terahash from late November to early December, setting a report for the yr.

The indicator was excessive regardless that it decreased on the time of writing, sitting round 34k. Moreover, an evaluation of the full hashrate statistic revealed that it had skilled an upward pattern.

The profitability of mining had been trending within the different path over the months, regardless of will increase in hashrate and community difficulties. The statistic revealed that miners’ income has been dropping in latest months. The earnings was about $44,000 as of January.

Nevertheless, as of the latest information, the income had dropped to about $16, making it much less viable to resolve blocks and generate BTCs. The income decreased additional as a consequence of Bitcoin’s ongoing decline, which has led to miners’ fears of a sell-off. However what influence may their sell-off have in the marketplace?

Supply: Blockchain.com

Miners reserve vs circulating provide

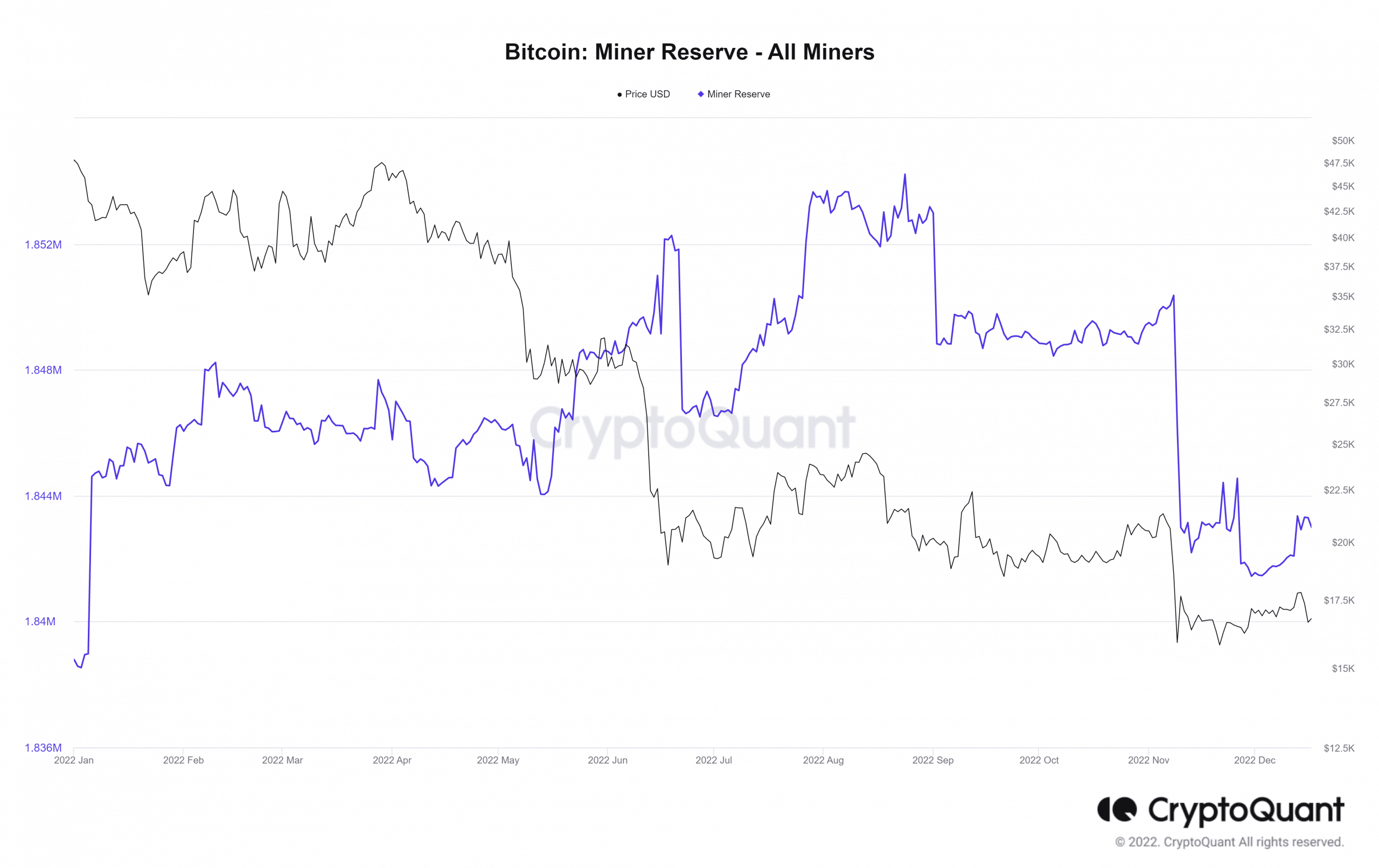

Wanting on the quantity could assist decide the impact {that a} selloff could have on BTC. On the time of writing, miners held over 16,000 BTC, price about $1.8 million, in response to information from CryptoQuant.

A chart remark additionally revealed that the reserve had decreased over time, which is comprehensible contemplating the discount within the value of BTC.

Supply: CryptoQuant

Knowledge from CoinMarketcap additionally indicated that there have been at present roughly 19.2 million Bitcoins in circulation, which, on the present value, can be price nearly $300 billion. Due to this fact, if there’s a sell-off of miners, the influence shall be negligible, if any.

An extra discount within the value of BTC may very well be a chance as a result of, traditionally, equities and cryptocurrencies normally decline throughout this market interval. This fall gained’t be attributable to a sell-off amongst miners, although.

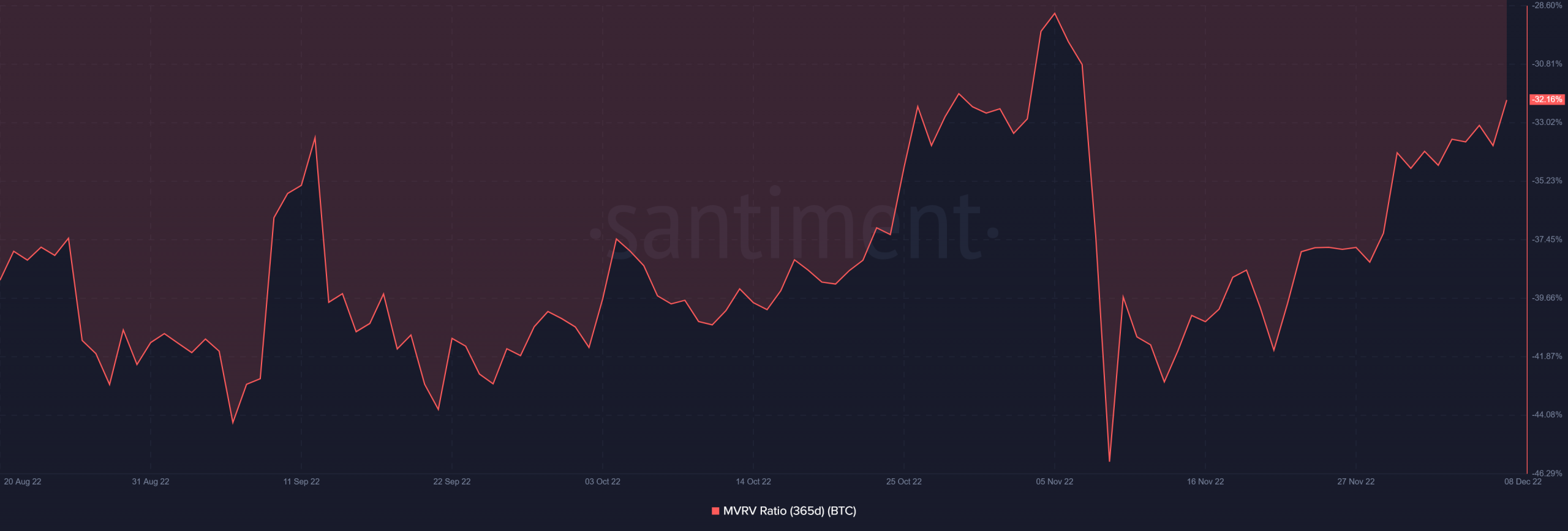

365-days traders at a loss

An evaluation of BTC’s profitability for traders who held it over the earlier twelve months revealed that they have been holding at a loss. The Market Worth to Realized Worth Ratio (MVRV) revealed that holders have been holding at a lack of over 32% over the earlier twelve months.

Supply: Santiment