Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.

- BTC might retest the $19.00K mark.

- A break under 7-period EMA would invalidate the above bias.

The U.S. CPI knowledge confirmed that the nation’s inflation price had cooled off to six.5% at press time. Markets had been upbeat afterward, and the S&P 500 Index (SPX) climbed to $3983.16 from the $3969.60 mark on the day past.

Learn Bitcoin’s [BTC] Value Prediction 2023-24

Equally, Bitcoin [BTC] rallied, breaking above its mid-December excessive of $18.40K, however confronted a bearish order block at $19,046. A retest of this degree is probably going if U.S. inventory markets continued to rally, based mostly on barely favorable macroeconomics.

Is a retest of $19,046 doubtless?

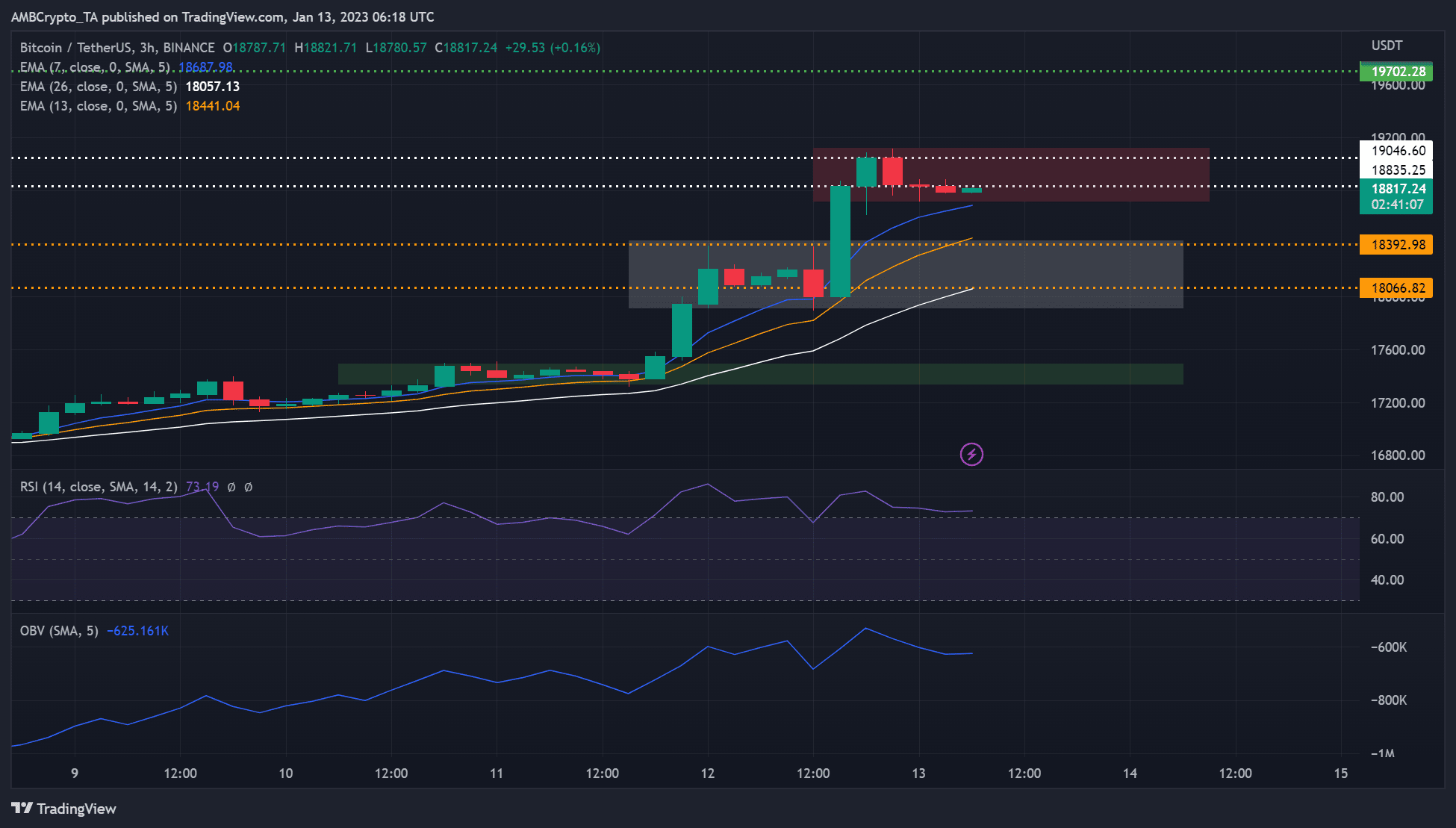

Supply: BTC/USDT on TradingView

Bitcoin’s RSI has been hovering across the overbought zone since 7 January on the three-hour chart. Equally, the OBV rose as nicely. Nonetheless, at press time, RSI was barely flat however within the overbought zone whereas OBV dipped.

This confirmed that purchasing strain was robust regardless of being comparatively stagnant at press time. Subsequently, BTC might try to interrupt above $18,835 and retest the bearish order block at $19,046.

BTC might commerce inside the purple zone ($18.72K – $19.14K) within the subsequent few hours or days. In an excessive situation, BTC might break above the vary and goal $19.70K if SPX (S&P 500 Index) broke above $4000.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

Nonetheless, if bears power BTC right into a downtrend, the seven-period (blue line) or 13-period EMA (orange line) might maintain them in verify. However such a transfer would invalidate the above bullish bias.

BTC’s open curiosity rose because the Trade Stream Steadiness remained constructive

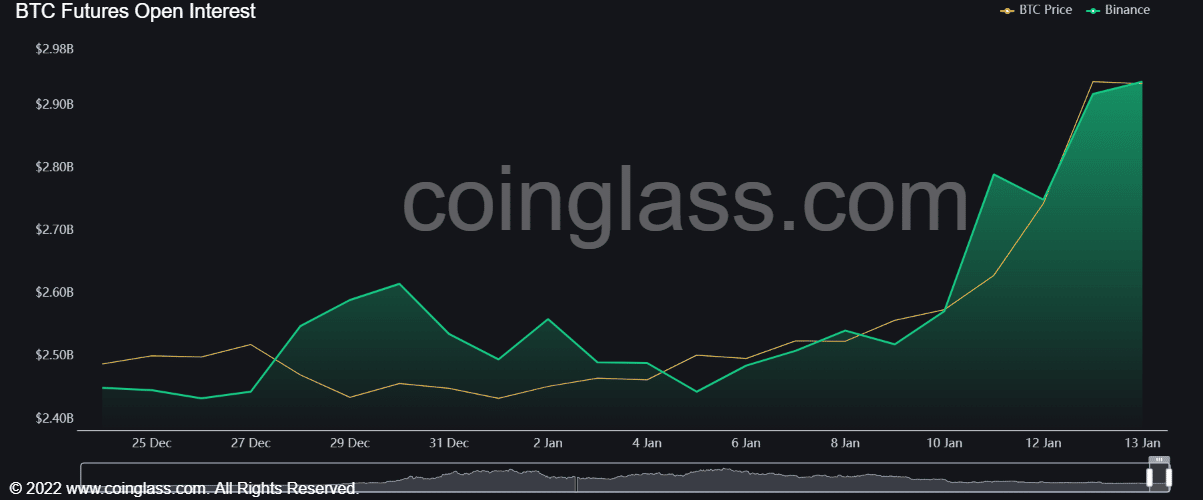

Supply: Coinglass

BTC’s open rate of interest has been growing since 5 January. Subsequently, extra money flowed into the BTC futures market, which might additional enhance BTC costs.

As such, buyers might count on a attainable uptrend momentum that might enhance BTC bulls to focus on $19.05K within the close to time period.

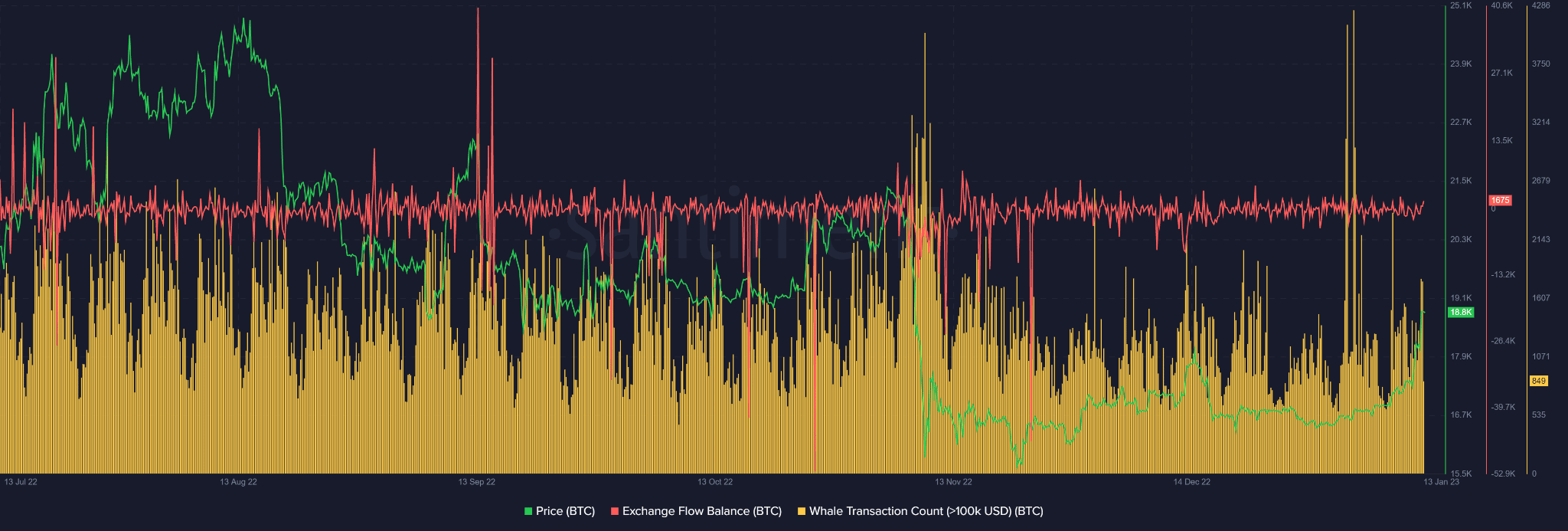

As well as, BTC noticed an uptick in Whale Transaction Depend with greater than $100K and $1M between 7 January on the time of writing, which might have influenced the latest worth surge.

Supply: Santiment

Furthermore, the Trade Stream Steadiness remained constructive at press time, displaying extra BTC flowed into exchanges than out. It might level to BTC demand because of its present bullish momentum.

Subsequently, BTC might stay bullish and goal at $19.70K or $20K within the subsequent few hours or days. However such an upswing might rely upon SPX transferring above $4000. So, buyers ought to monitor S&P 500 Index (SPX) efficiency earlier than making strikes.