The Federal Reserve raised rates of interest by 0.75 share level enhance for the fourth consecutive time as of final week. This allowed international equities a short interval of reduction, and main cryptocurrency Bitcoin [BTC], witnessed a small rally in its value.

______________________________________________________________________________________

Right here’s AMBCrypto’s value prediction for Bitcoin [BTC] for 2023-24

______________________________________________________________________________________

Moreover, Glassnode, in a brand new report, discovered that the newest surge within the value of the king coin could possibly be attributed to the “value insensitive HODLer cohort”. These HODLers proceed to carry their investments and “the primary glimmers of demand re-entering the system.”

Maintain on for expensive life

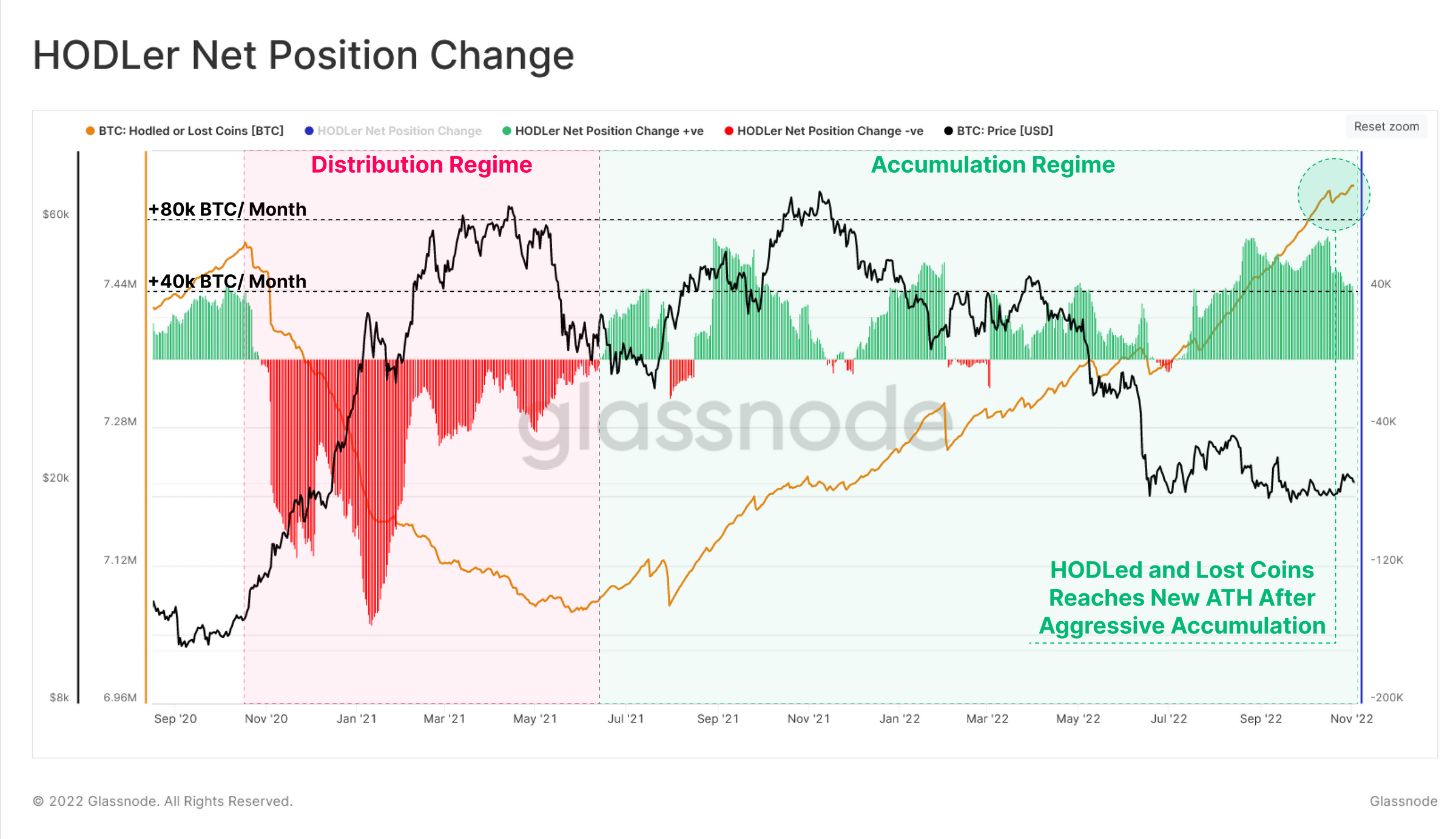

Glassnode assessed the HODLer Web Place Change metric, which tracks the 30-day change in HODLed or Misplaced coin provide (essentially the most dormant on-chain). It discovered that “aggressive accumulation” by this cohort of BTC holders pushed the rely of dormant cash on the community.

This led to new all-time highs. Previous to this, HODLers had aggressively offered their holdings to make a revenue into the cycle topping formation.

Supply: Glassnode

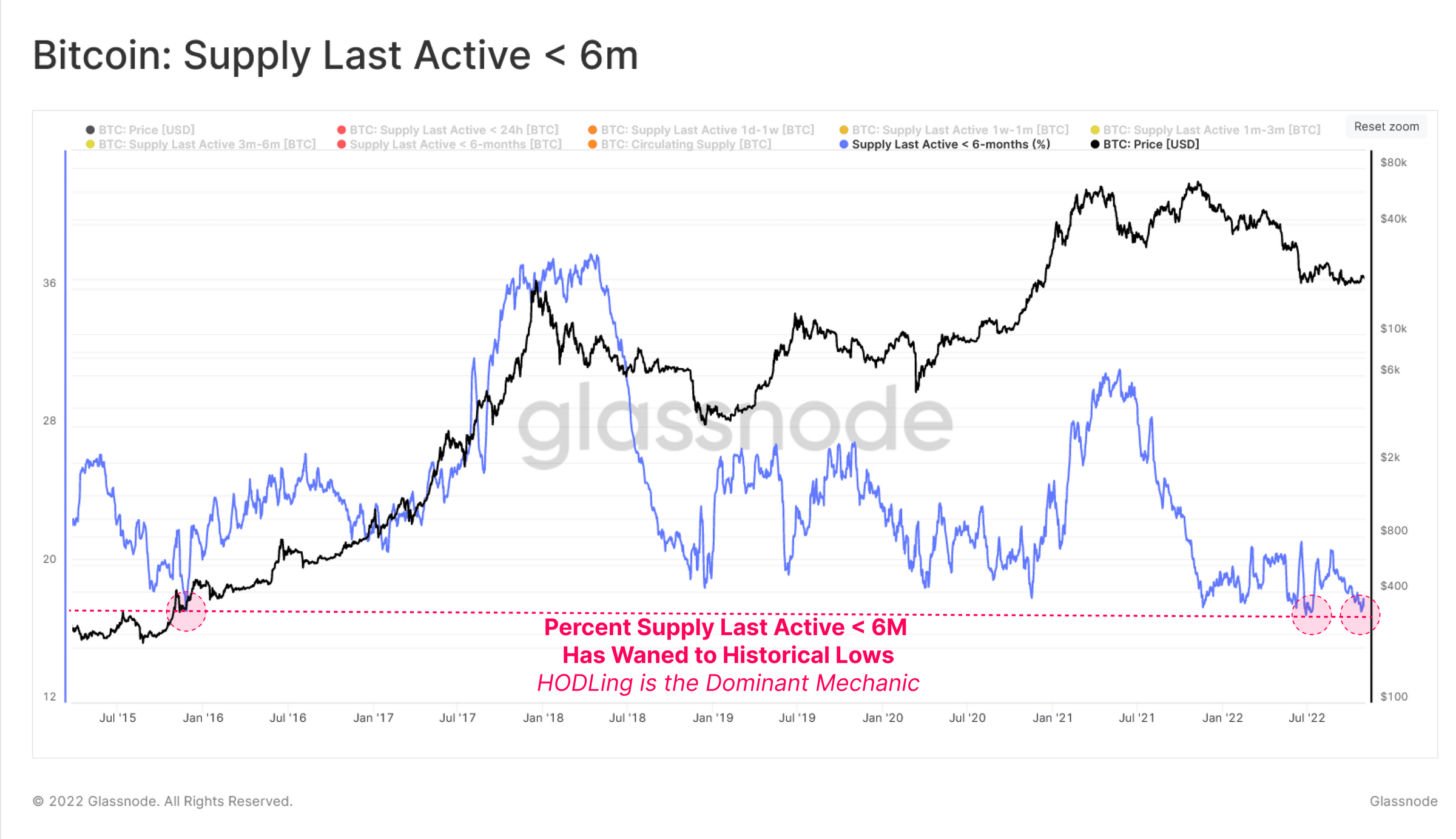

Conversely, sizzling cash, that are BTC cash deployed in day-to-day buying and selling, continued to say no, Glassnode discovered. In response to the on-chain analytics platform,

“The provision youthful than 6 months outdated which is on the market in the marketplace has remained round historic lows since Might 2022 and continues to say no, additional reiterating the intense stage of HODLing current within the present market.”

Supply: Glassnode

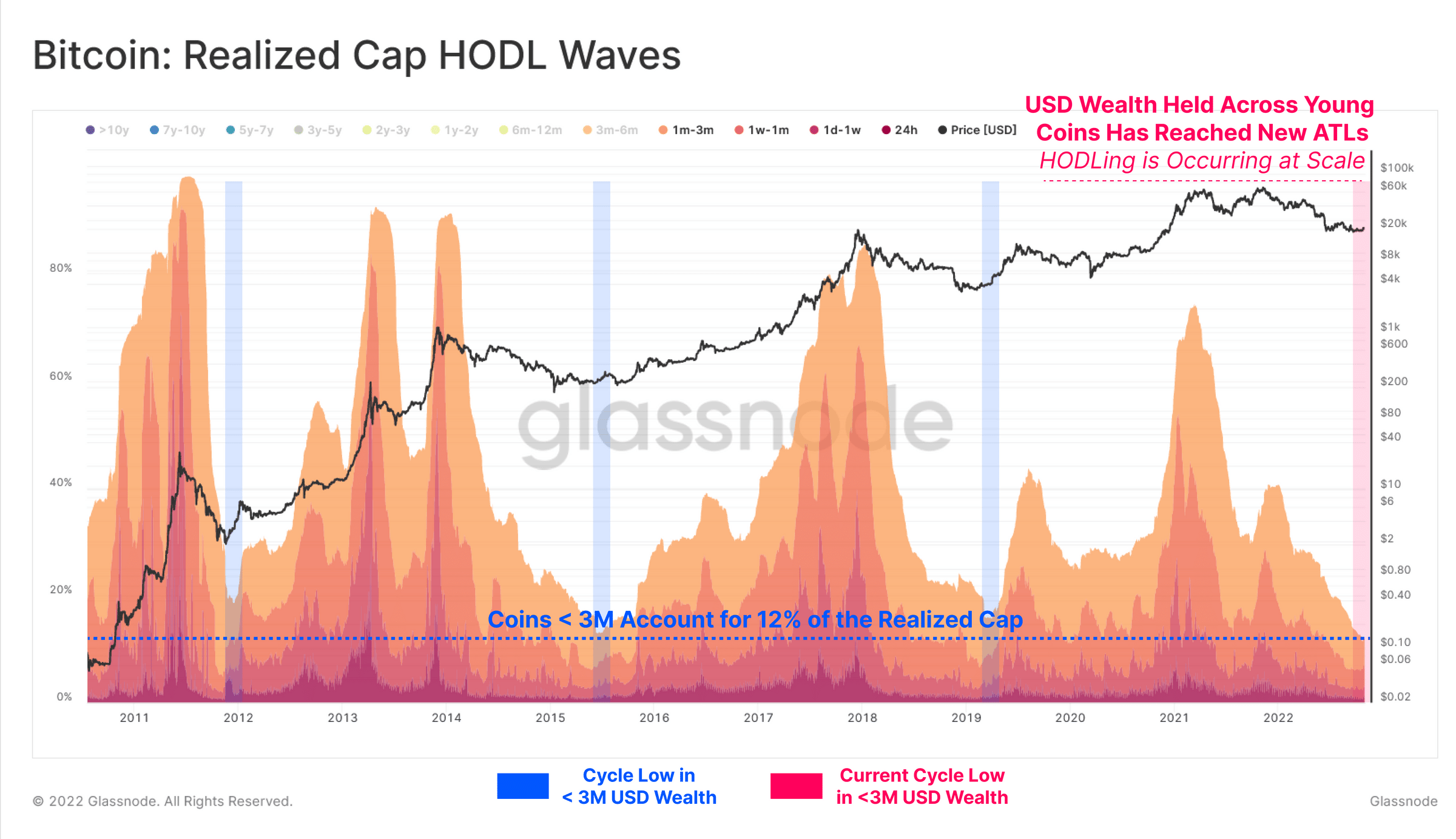

An evaluation of Realized Cap HODL Waves metric revealed that BTC HODLer cohort was “essentially the most dominant they’ve ever been.” This metric is used to examine USD-denominated wealth held by particular age cohorts. Glassnode discovered that for BTC cash youthful than three months, the USD wealth held throughout this age cohort was at an all-time low.

Alternatively, for these older than three months, the wealth held reached an ATH. This, based on Glassnode, confirmed “a convincing refusal to spend and promote, regardless of the persistent challenges in international capital markets.”

Supply: Glassnode

Extra tips up its sleeves

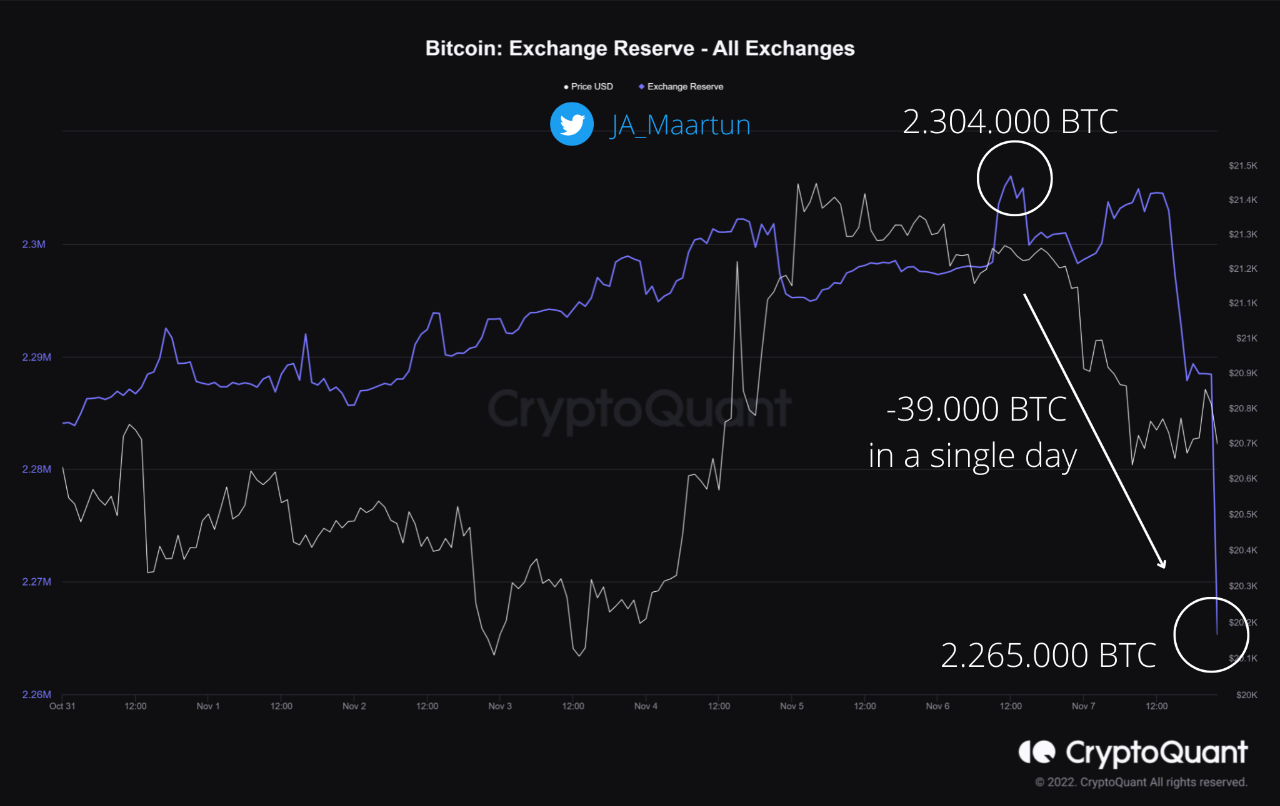

In response to CryptoQuant analyst maartunn, the previous few days have been marked by a continued decline in Bitcoin Reserves on Exchanges. Throughout intraday buying and selling on 7 November, an enormous quantity of BTC moved exterior of recognized exchanges.

Thus, resulting in a decline in Alternate Reserves from 2,304,000 BTC to 2,265,000 BTC. Maatuun opined that “that is a fully unbelievable signal of confidence within the Bitcoin community.”

Supply: CryptoQuant

A decline in BTC Alternate Reserves precipitates an upward progress in value in the long run. Moreover, it’s pertinent to notice that unfavorable macro components would possibly contribute to a fall in value within the short-term.