- ETH may herald earnings in 2023, in keeping with the founding father of Union Ventures Fund.

- Merchants remained optimistic, and validators on the community grew.

Fred Wilson, the co-founder of Union Ventures Fund, confirmed religion within the potential for Ethereum [ETH] to develop over this 12 months. In a press release on 3 January, Fred predicted that despite the fact that plenty of web3 initiatives would fail in 2023, Ethereum would nonetheless present progress.

He additionally predicts that the big caps in web3 (BTC and ETH primarily) will begin to entice extra curiosity from buyers and may do nicely in 2023. He’s extra bullish on ETH personally as a result of it has one of the best underlying financial mannequin of any web3 asset. https://t.co/CGVsaCSJcc

— Wu Blockchain (@WuBlockchain) January 3, 2023

What number of ETHs are you able to get for $1?

12 months of the bull for ETH?

The explanation for this bullish sentiment was as a result of Fred believed that Ethereum had one of the best underlying financial mannequin of any web3 asset. There have been different explanation why buyers had been feeling bullish about ETH.

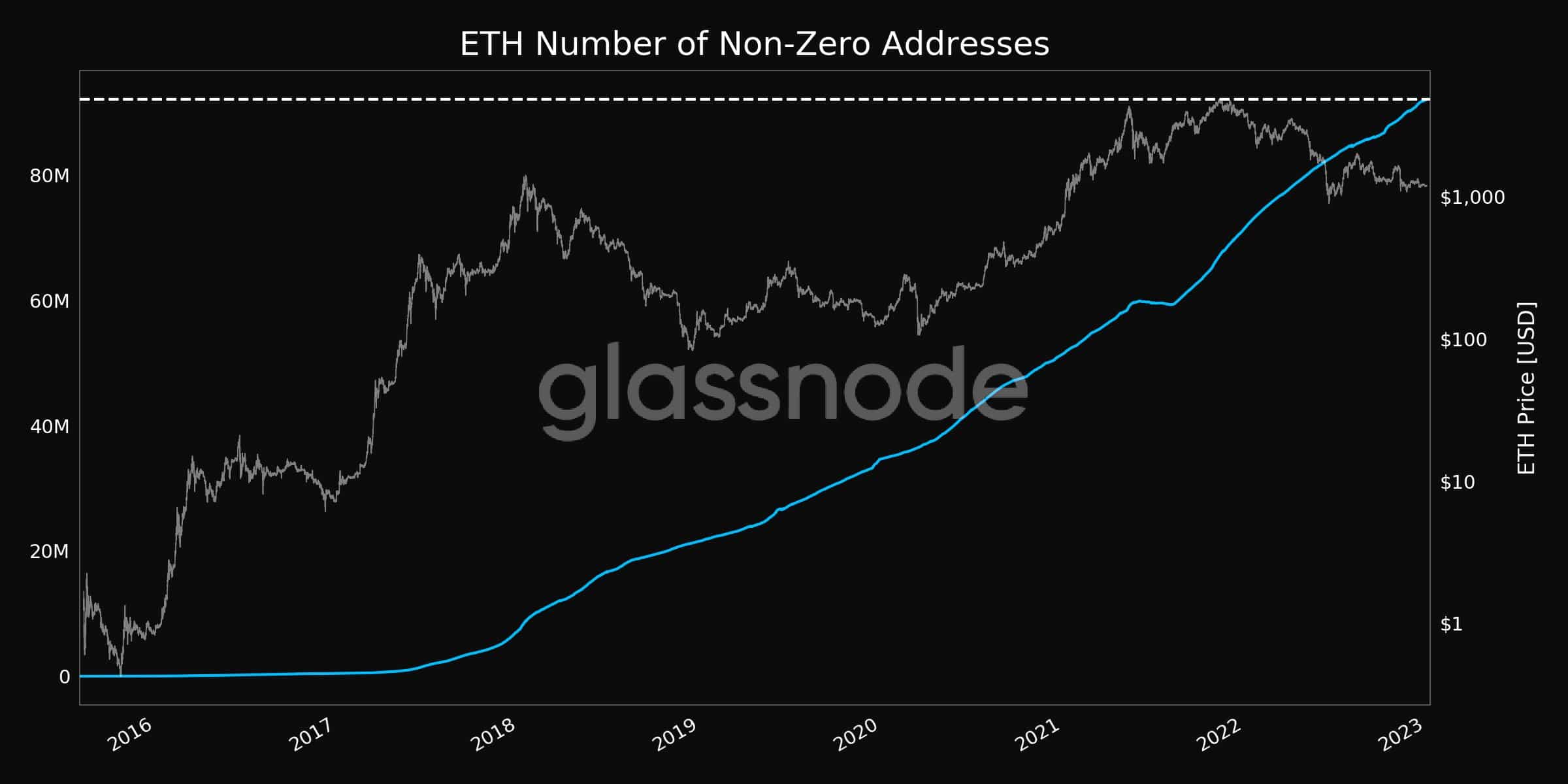

One in all them can be the rising variety of addresses on the Ethereum community. In line with knowledge supplied by Glassnode, the variety of non-zero addresses grew considerably over the previous couple of months and reached an all-time excessive of 92 million addresses.

Supply: glassnode

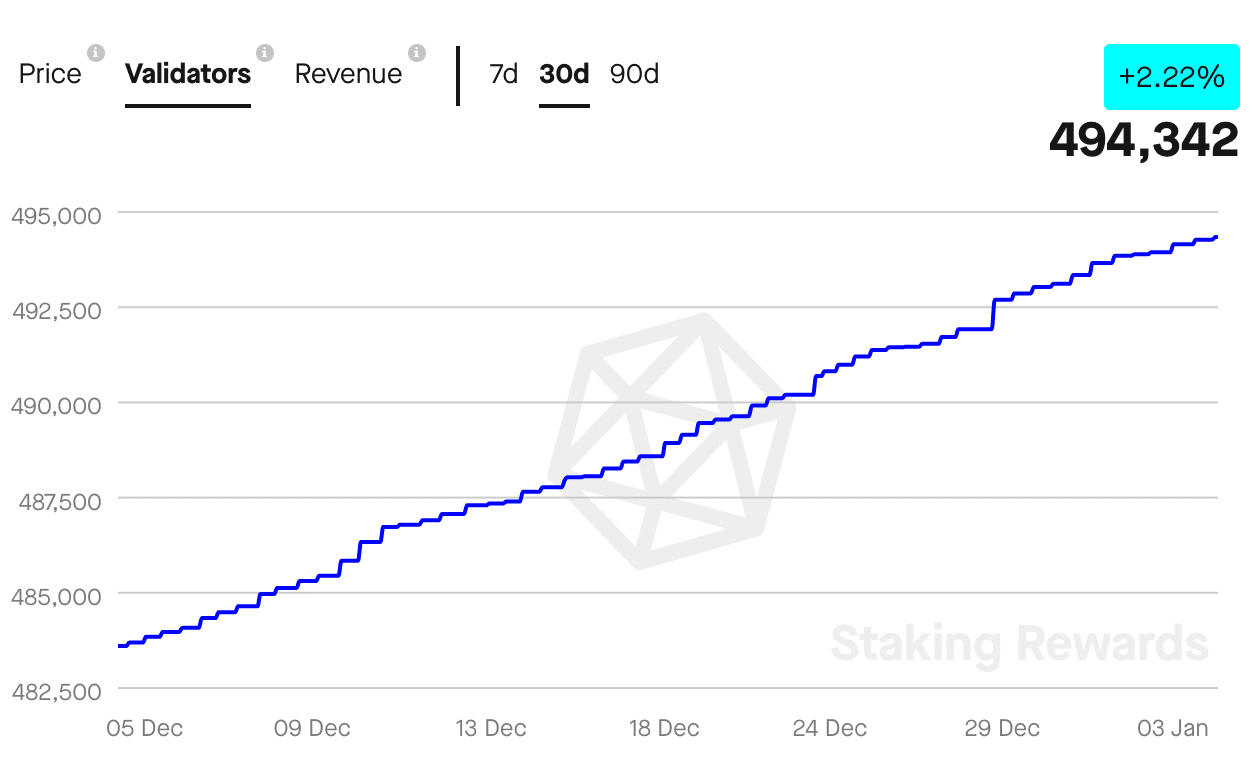

Together with the addresses, the validators on the Ethereum community grew as nicely. The variety of validators on the community elevated by 2.22% over the past month. Furthermore, the income generated by these validators elevated by 1.65% within the final seven days.

On the time of writing, the variety of validators on the Ethereum community stood at 494,342.

Supply: Staking Rewards

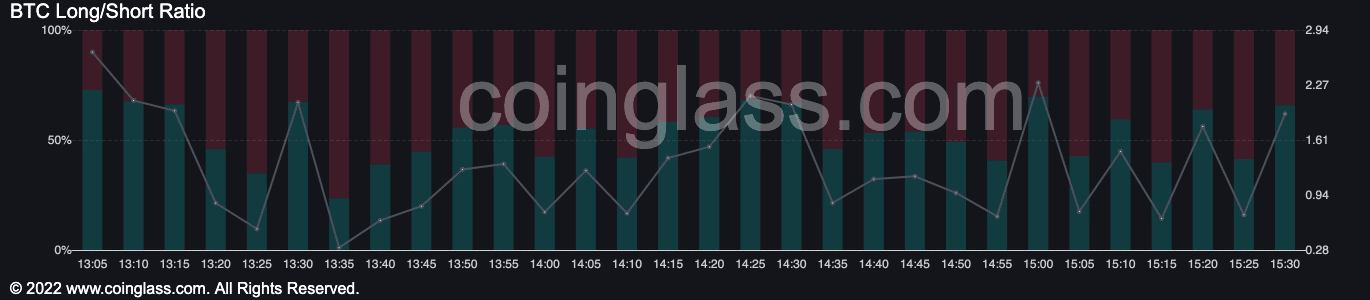

The validators weren’t the one group of people who confirmed religion in Ethereum, as merchants additionally confirmed optimism in favor of ETH.

In line with knowledge supplied by Coinglass, the variety of lengthy positions being held in favor of Ethereum surpassed the brief positions by an enormous margin. At press time, 65.82% lengthy positions had been being held by merchants.

Supply: Coinglass

ETH holders and builders

Nonetheless, despite the fact that the final sentiment for Ethereum appears bullish, there have been a couple of areas the place Ethereum may present enchancment.

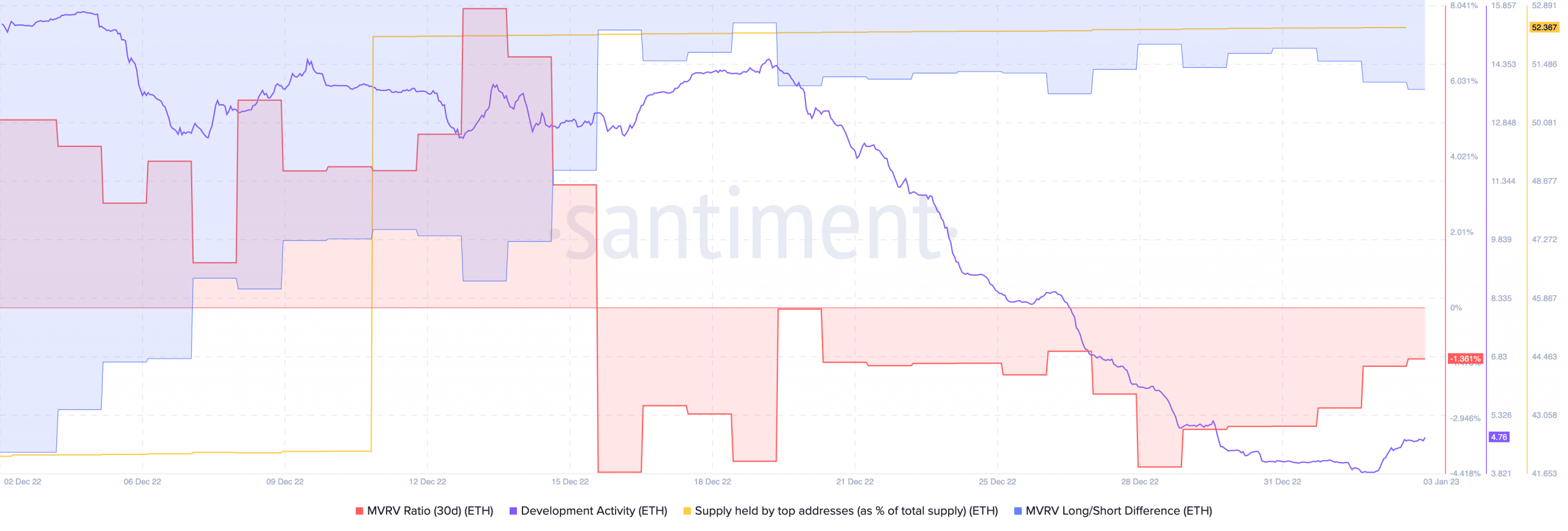

For example, the event exercise for Ethereum declined immensely over the past month. This implied that the contributions being made by Ethereum’s crew on its GitHub decreased.

Nonetheless, the declining improvement exercise didn’t deter Ethereum whales. The share share of Ethereum being held by giant addresses noticed a large surge over the past two weeks. However this curiosity from whales wasn’t sufficient to influence ETH’s worth positively.

Are your ETH holdings flashing inexperienced? Verify the revenue calculator

The decline in worth resulted in a declining Market Worth to Realized Worth (MVRV) ratio. This implied that almost all Ethereum holders would take a loss in the event that they bought their holdings. The unfavourable lengthy/brief distinction prompt that it was largely short-term buyers that may bear a loss.

Supply: Santiment

It’s but to be seen whether or not the short-term holders would promote their positions. On the time of writing, ETH was buying and selling at $1,216.88. Its worth fell by 0.66% within the final 24 hours, in keeping with CoinMarketCap.

![Bullish on Ethereum [ETH]? This venture fund founder might agree with you](https://ambcrypto.com/wp-content/uploads/2023/01/1668951909537-98a709a6-52a9-46e8-9139-11de4bf3fc69-1-1000x600.png)