- BTC’s value motion has the potential to go towards the standard March decline.

- Cash that had moved within the final decade have been now greater than these held on exchanges.

Bitcoin [BTC] has the “behavior” of performing woefully in March through the years, making it the second worst month through the years, bar 2013. Whereas the primary two months of the yr could have been off to a wonderful starting, buyers may must be careful for the red-loving month, Miles Deutscher opined.

2023 is off to begin for #Bitcoin, with 2 consecutive inexperienced months (assuming at the moment’s month-to-month shut holds).

However wanting forward: Traditionally, March has been the 2nd worst performing month – with a mean $BTC return of -5.72% (exc. 2013).

What’s your outlook for March?👇 pic.twitter.com/jm3JB0JJ0y

— Miles Deutscher (@milesdeutscher) February 28, 2023

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

Can the king coin disregard the development?

Through the first 30 days of the yr, BTC went on a 40% uptick. Though the second month was not as spectacular, the king coin gained 6.71% within the final 14 days, as proven by CoinGecko. So, does the technical outlook assist a inexperienced continuation or would it not finish in a fallback?

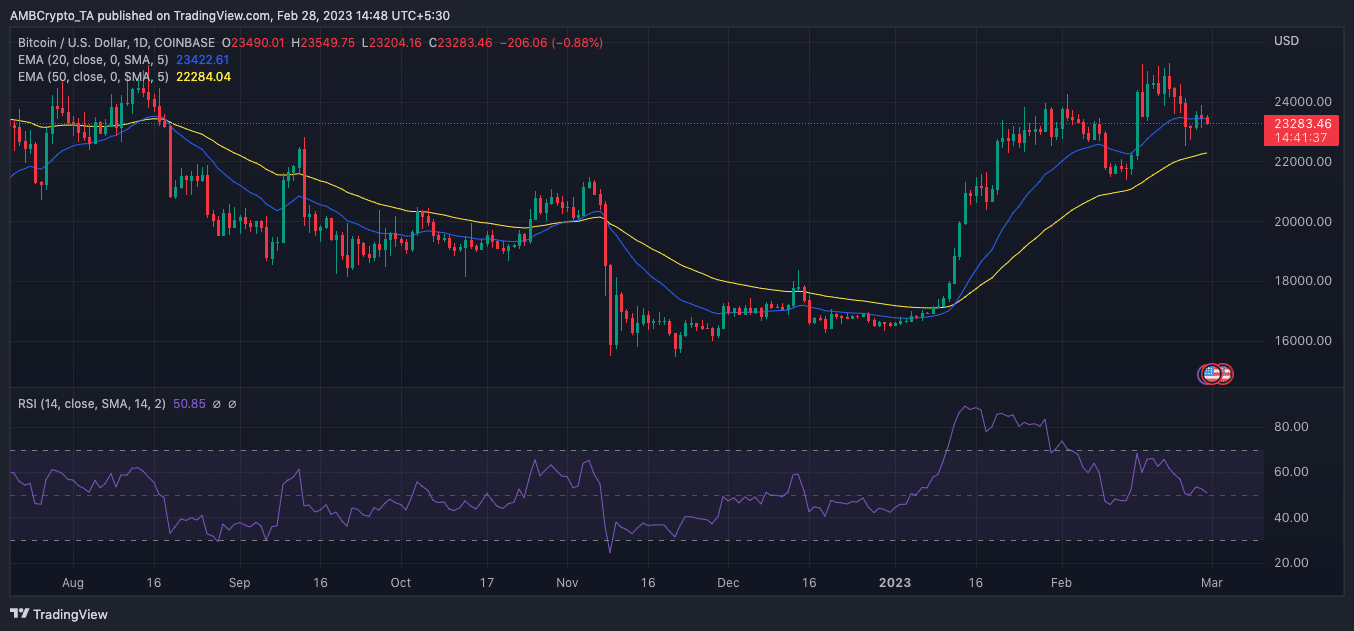

Contemplating the Exponential Shifting Common (EMA), it was attainable that BTC may development towards its efficiency ten years again. This was as a result of the 20-day EMA (blue) was above the 50-day EMA (yellow).

Whereas the brief to mid-term may provide acquire alternatives, the Relative Power Index (RSI) remained in a impartial state at 50.98. This means that the momentum at press time did have a tendency in assist of a robust bullish or bearish sentiment.

Supply: TradingView

Robust-willed holders of the last decade surpass…

In an attention-grabbing replace, on-chain analyst and Reflective Analysis co-founder Will Clemente shared that 10-year dormant addresses have been greater than BTC held on exchanges at press time.

This will likely, nevertheless, not be stunning, because it was uncommon for long-term holders to instantly exit their positions. However short-term speculators largely did not see out the bear market season.

One other on-chain analyst, Willy Woo, appeared unsurprised by the information. Noting that 2.6 million BTC has not moved throughout the interval, Woo talked about that Chainalysis projected the quantity to develop to three.7 million by 2030.

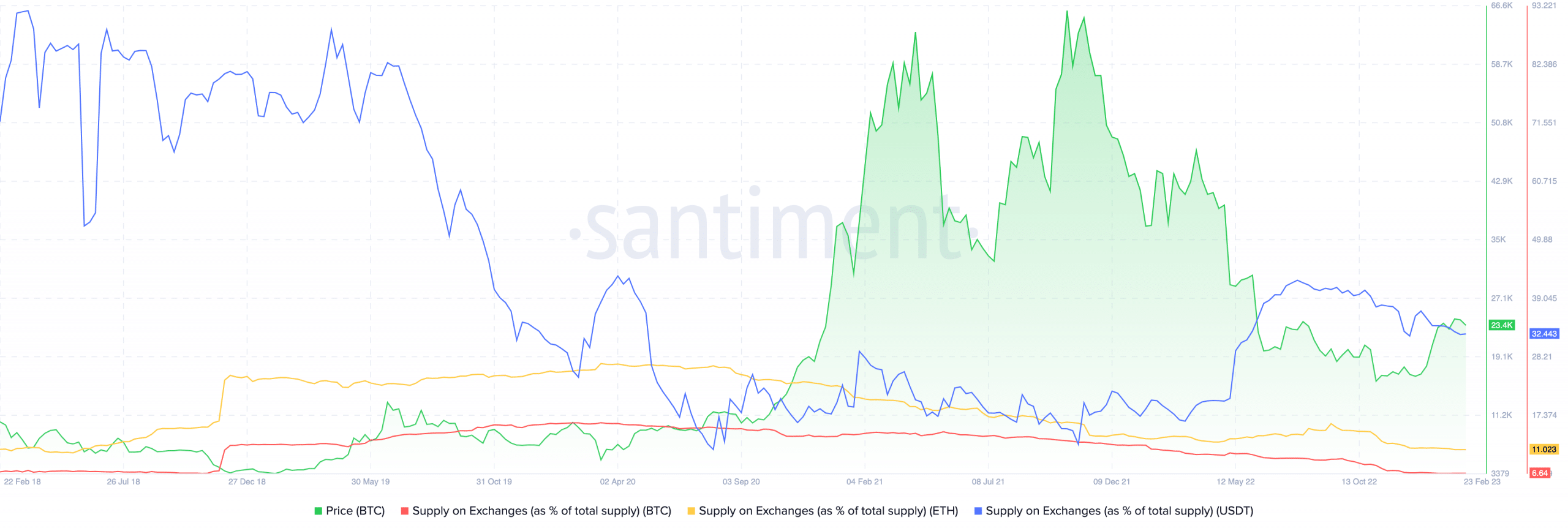

Effectively, the explanations for the unmoved addresses outpacing present trade holdings might be linked to the November 2022 FTX collapse. This was additionally reaffirmed by Santiment, as each BTC and Ethereum’s [ETH] five-year trade provides hit the bottom.

Supply: Santiment

Practical or not, right here’s BTC’s market cap in ETH’s phrases

Moreover, Bitcoin Quant Dealer Charles Edwards tweeted that the January uptick was no coincidence. He went forward to say that it was the beginning of the bull market whereas giving his causes.

January was large for Bitcoin, not simply because value went up quite a bit. I consider it was the beginning of the bull marketplace for Bitcoin for these 9 causes:

— Charles Edwards (@caprioleio) February 28, 2023

Edwards pointed to a number of components, together with macroeconomic change and miners’ unprofitability. Nonetheless, he hammered on the 2024 halving impact, noting that,

“We’re at optimum halving cycle timing the place Bitcoin sometimes bottoms (This fall 2022 and Q1 2023). Like clockwork, Bitcoin has bottomed within the window 12-18months prior to each halving previously.”

![Can Bitcoin [BTC] defy the infamous ‘March Chronicle’ in 2023?](https://ambcrypto.com/wp-content/uploads/2023/02/po-2023-02-28T113125.974-1000x600.png)