- Bitcoin’s MVRV ratio and NUPL haven’t but hit a robust accumulation zone

- The coin’s UTXO may have to interrupt out of its resistance to maintain January’s momentum whereas U.S rates of interest might additionally have an effect on BTC’s demand

Bitcoin’s [BTC] 43% hike in January certainly introduced rays of hope to traders dampened by 2022’s market show. The truth is, it was among the finest first month performances of the coin in about ten years. Nonetheless, on-chain information revealed that lovers trying to accumulate extra of the king coin may not discover it difficult to select a assured shopping for alternative in February.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

Taking part in second fiddle within the second month?

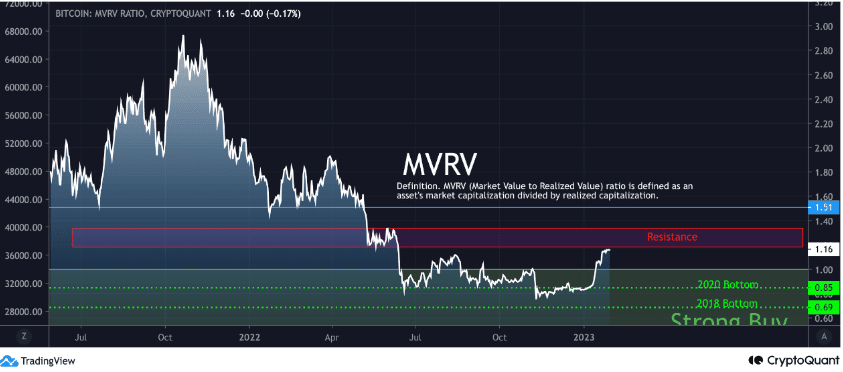

In line with On-chain Edge, a pseudonymous CryptoQuant analyst, anticipating a duplicate of BTC’s efficiency in February could possibly be a stretch. The analyst’s viewpoint was based mostly on the Market Worth to Realized Worth (MVRV) ratio.

The MVRV ratio shows attainable shopping for prospects as a result of market capitalization and realized capitalization pattern. Nonetheless, On-chain Edge identified that the MVRV ratio was 1.16, on the time he revealed. Because it was not beneath a price of 1, the prevailing BTC place may be thought-about shaky as one to doubtlessly make important features.

Supply: CryptoQuant

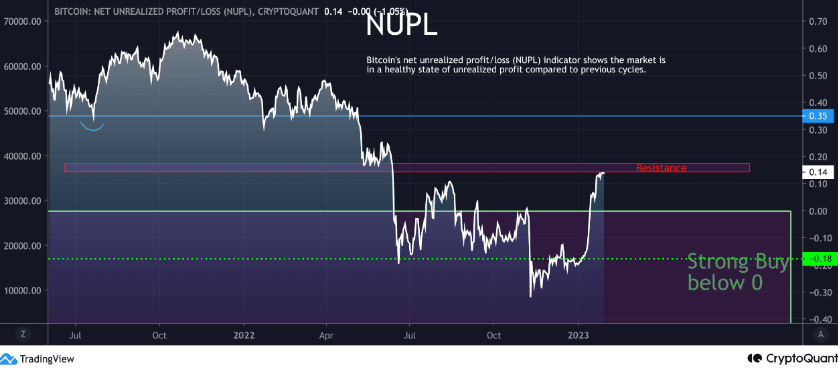

Moreover the MVRV ratio situation, the analyst additionally centered on the state of the Internet Unrealized Revenue/Loss (NUPL). This metric is laser-focused in the marketplace cap and realized cap distinction. Therefore, additionally revealing whether or not the Bitcoin community is in revenue or loss. The analyst famous,

“The rise in unrealized income over the previous couple of weeks has led to a dramatic rise within the NUPL worth, which is presently at 0.14, larger than earlier than the FTX crash.”

Whereas this could possibly be thought-about a transfer within the constructive route, there may be additionally a resistance that would draw again the NUPL’s enchancment.

At press time, the NUPL’s 0.14 worth meant shopping for on the present BTC value stays dangerous. In the meantime, a constant improve would imply issue in re-entering a wonderful shopping for zone. The analyst then concluded that traders might both wait on the following shopping for likelihood or hope for a major breakout.

Supply: CryptoQuant

January’s momentum might keep alive if…

Whereas the information talked about above signifies that a value reversal could possibly be on the playing cards, bullish prospects are additionally not down and out. Yonsei_dent, who dropped his two cents on the matter, was on the forefront of this opinion.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

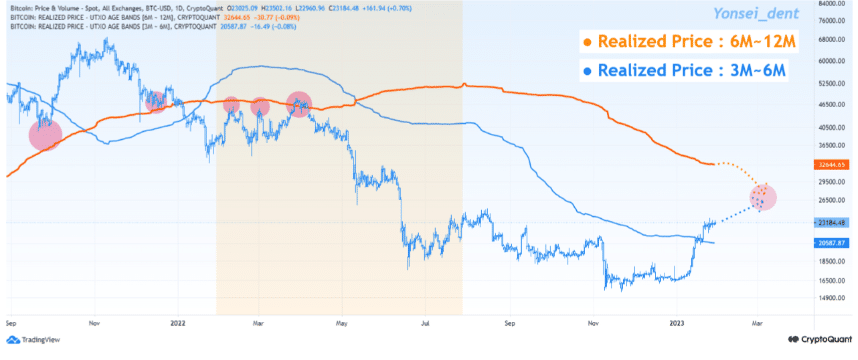

In line with him, the six to 12 months Unspent Transaction Output (UTXO) Age bands might have a say within the coin’s pattern.

Supply: CryptoQuant

Yonsei_dent used the 2021 bull market and early 2022 bear situation as an illustration. The analyst talked about that it’s vital to contemplate the UTXO attributable to its affect on BTC’s assist and resistance. He wrote,

“If the market value reaches the Realized Worth (6m~12m), that degree can act as a resistance zone. If it breaks out clearly at that degree, it can construct momentum into the bull market.”

Furthermore, the discharge of the rates of interest by the U.S Federal reserves might additionally influence BTC’s February trajectory. The truth is, in line with CME Group, there’s a excessive likelihood of the Fed elevating rates of interest. This, in flip, might minimize down traders’ palate regarding Bitcoin demand.

![Can February see Bitcoin [BTC] do a January? The odds are…](https://ambcrypto.com/wp-content/uploads/2023/01/po-2023-01-30T073845.940-1000x600.png)