Following the backwards and forwards of allegations and denials, Binance Coin [BNB] might be on the verge of an additional lower. This was as a result of sudden transfers from dormant addresses abruptly occurred within the wake of an open feud between Changpneng Zhao (CZ) and Sam Bankman-Fried (SBF).

Curiously, there was hardly a see-through of the impression on BNB till a tweet by Lookonchain emerged.

Somebody is promoting $BNB! @cz_binance

3 dormant addresses awakened and transferred a complete of 263,247 $BNB($89.5M) to #Binance simply now.

Are you promoting $BNB? @SBF_FTX @carolinecapital #alamedahttps://t.co/Hd1RJodyzkhttps://t.co/kHOiK7m38ghttps://t.co/a8OPGNGjFg pic.twitter.com/fkVA6UUa4K

— Lookonchain (@lookonchain) November 8, 2022

_____________________________________________________________________________________

Right here’s AMBCrypto’s worth prediction for Binance Coin [BNB] for 2023-2024

_____________________________________________________________________________________

In line with the on-chain analyst, three dormant addresses transferred BNB price $89.5 million into the Binance alternate. Often, transactions from dormant addresses don’t happen out of the blue.

Nonetheless, the incidence of this occasion amidst a heated allegation in regards to the FTX Token [FTT] may sign holder readiness to sell-off long-term holdings. Therefore, BNB might be on the verge of dropping extra of than the three.38% 24-hour lower. However are there indicators that the alternate token may resist the promoting risk or not?

Hardly any want to worry

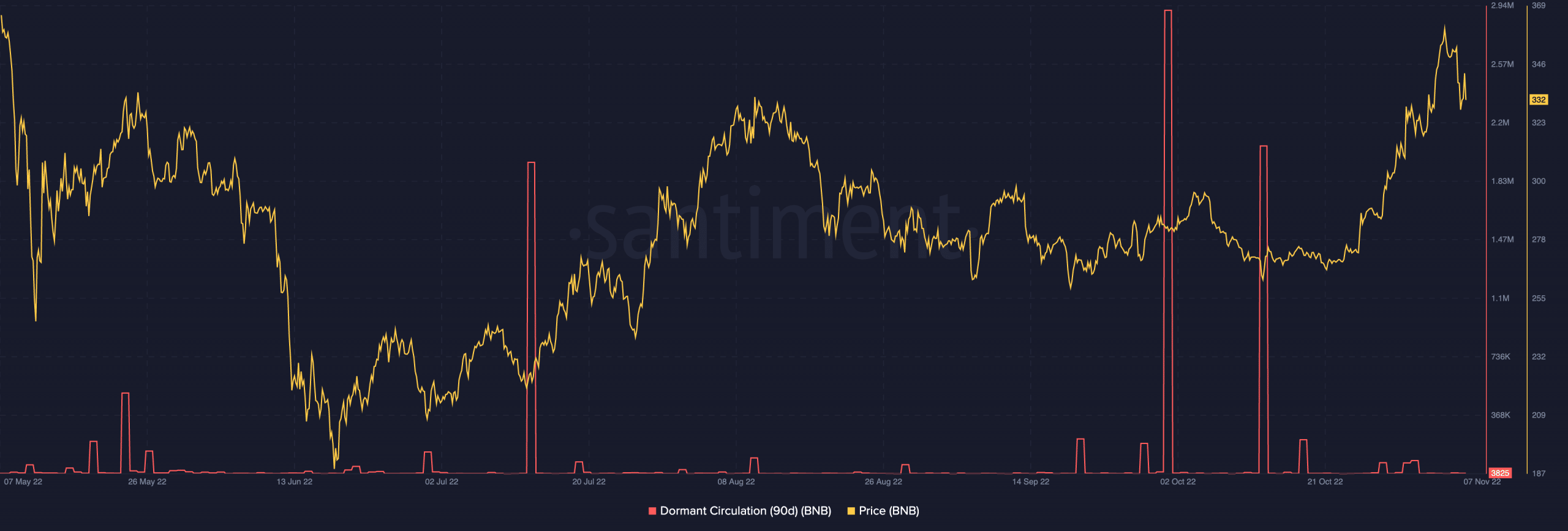

Upon assessing the BNB on-chain information, it appeared that transactions could have some impression on the ecosystem. This was as a result of the 90-day dormant circulation didn’t present obtrusive spikes. In line with Santiment, the circulation inside the interval was 3,825.

As in comparison with the circulation of 86,700 on 1 November, this was an apparent decline. Because of the lower, BNB’s risk of an additional downtrend is probably not an aftereffect of those transactions.

Supply: Santiment

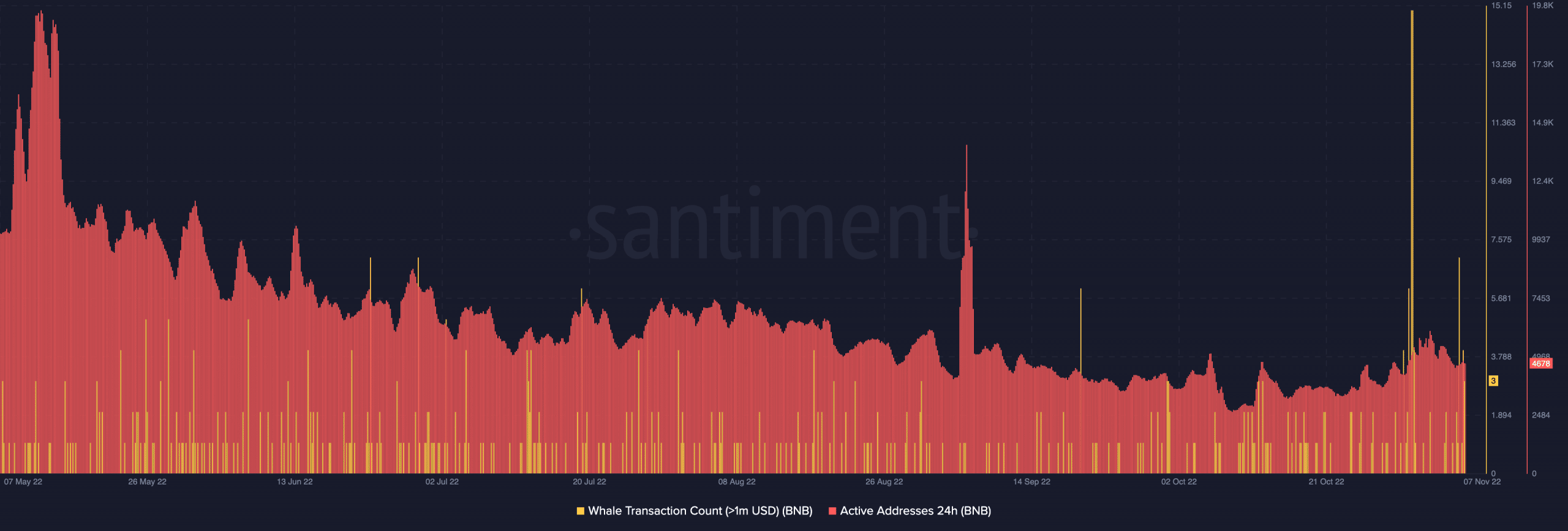

As well as, there was no important response from buyers with massive BNB holdings. In line with Santiment, there have been solely three $1 million transactions on the BNB chain at press time. This indicated that BNB whales most well-liked holding on to their holdings regardless of the feud occurring between the 2 CEOs.

As for energetic addresses, it was a lower from the quantity on 6 November. With the 24-hour energetic addresses diminishing to 4,678, it was apparent that there had been fewer profitable transactions on the chain. Equally, this implied that newly-created BNB addresses had held out in opposition to any shopping for and promoting interplay.

Supply: Santiment

The place are thou headed?

On the charts, BNB gave the impression to be struggling in between heading downwards and sustaining neutrality. Based mostly on indications from the Directional Motion Index (DMI), sellers had been in charge of the market. This was because of the detrimental DMI (pink) at 29.34 sticking its place over the consumers (inexperienced).

Nonetheless, the Common Course Index (ADX) gave the impression to be providing some respite for consumers. This was as a result of the ADX (yellow), regardless of displaying robust directional motion, gave the impression to be contemplating the draw back.

Curiously, it may appear that BNB had sufficient energy to withstand the reds. On evaluating the Exponential Shifting Common (EMA), the four-chart maintained an opportunity for restoration. At press the 20 EMA (blue) positioned above the 50 EMA (orange).

Therefore, buyers who feared a collapse may have an opportunity to take pleasure in an upturn from the earlier lower.

Supply: TradingView