With 622 each day common GitHub commits, Cardano [ADA] is now main different blockchains with probably the most improvement exercise within the final 30 days, new data has revealed.

Right here’s AMBCrypto’s Value Prediction for Cardano [ADA] for 2023-24

High Tasks by common each day improvement exercise on #GitHub within the final 30 days$ADA $KSM $DOT $ATOM $MANA $SNT $ICP $VEGA $ETH $FIL $HBAR $EGLD $FLOW $LINK $APT $AUDIO $NEAR $MIOTA

Knowledge from: https://t.co/cnh4gfkYzq pic.twitter.com/jTNTXdVKrT

— 🇺🇦 CryptoDiffer – StandWithUkraine 🇺🇦 (@CryptoDiffer) November 3, 2022

Main layer 1 community Ethereum [ETH] was ranked ninth with 271 each day common GitHub commits after Polkadot [DOT] (494) and Cosmos [ATOM] (338).

How have the final 30 days been?

On the time of writing, ADA was buying and selling at $0.4106. In October, ADA was exchanging arms for as little as $0.33. Nonetheless, a value reversal on 21 October pushed the altcoin to shut the buying and selling month with an index value of $0.40.

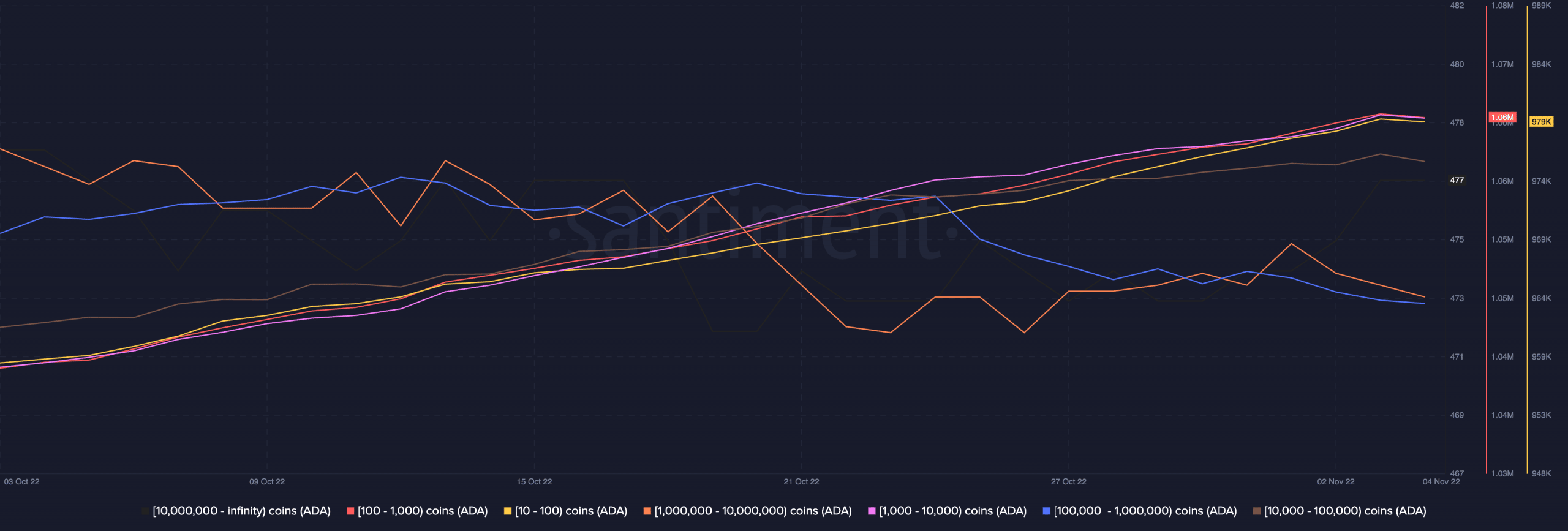

Whereas ADA’s value noticed little to no progress over the previous month, on-chain information from Santiment confirmed that the depend of whales that held between 10 to 100,000 ADA cash climbed constantly. Conversely, greater stakeholders that held between 100,000 to 10,000,000 ADA cash progressively let go of their holdings over the identical time interval.

For context, the depend of ADA whales that held between 100,000 to 1,000,000 ADA cash fell by 0.1%, whereas the depend of people who held 10,000 to 100,000 ADA cash rose by 1%.

Supply: Santiment

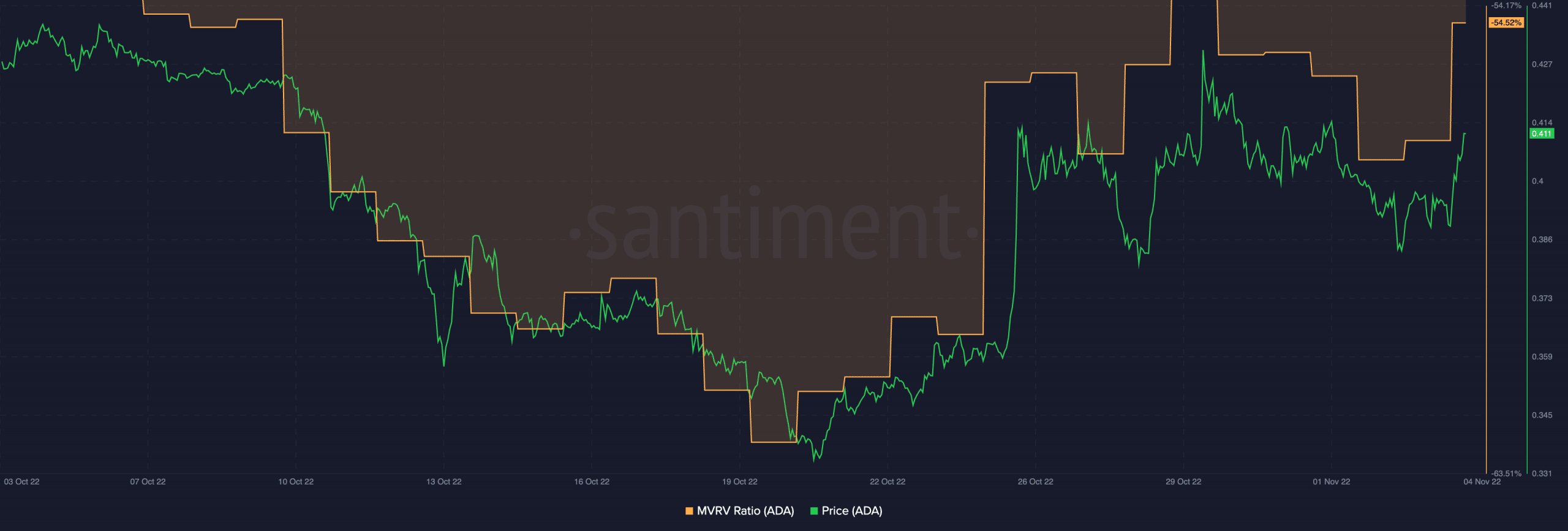

Because of extreme current volatility in ADA’s value, lots of its holders have seen losses on their investments. Actually, ADA’s MVRV ratio, during the last 30 days, gave the impression to be flashing a damaging worth. It was as little as -62.88% on 20 October when the altcoin traded round its $0.30-price stage. As the worth retraced, the MVRV ratio additionally tried to right itself.

At press time, ADA’s MVRV ratio was -54.52%. This advised that the prevailing ADA market was “undervalued” on common. Subsequently, holders would understand losses in the event that they tried to promote their ADA cash.

Supply: Santiment

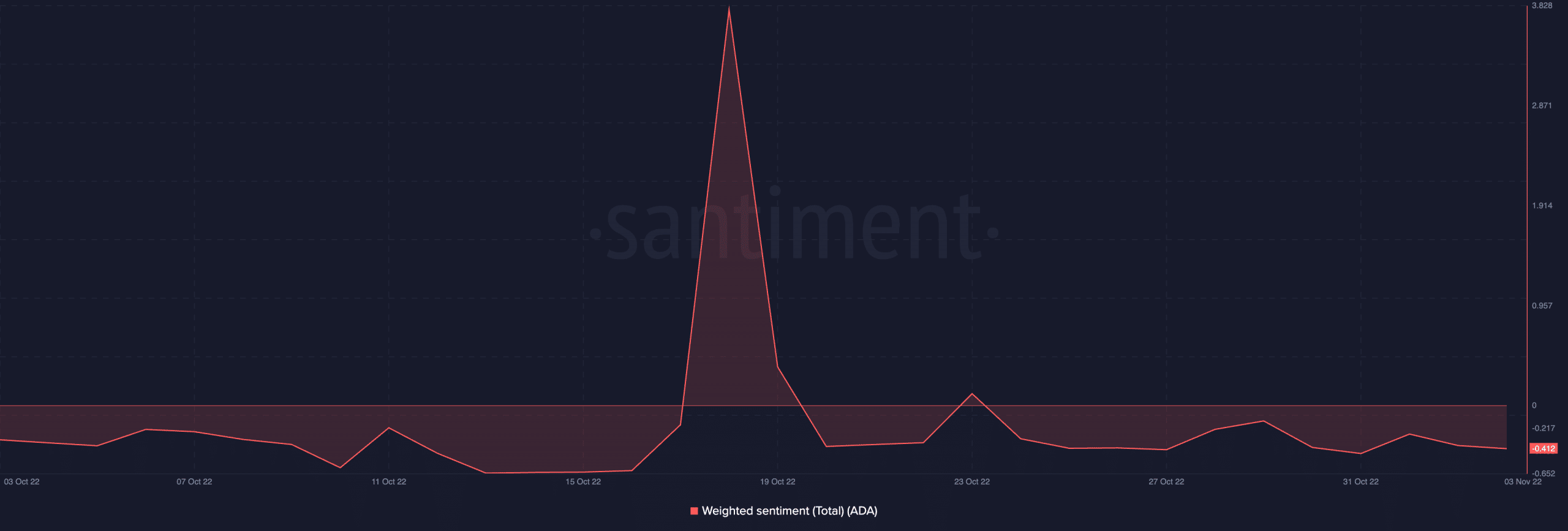

Unsurprisingly, as ADA’s value remained with none important appreciation, damaging sentiment has trailed the main altcoin since 20 October. On the time of writing, its weighted sentiment had a studying of -0.142% on the charts.

Supply: Santiment

The place is it heading?

Whereas ADA’s value hiked by 3% within the final 24 hours, its buying and selling quantity noticed a 15% decline. This indicated that ADA holders harboured low convictions within the upward motion of the asset’s value. A value reversal or consolidation often follows this until conviction will increase.

Moreover, as noticed on the each day chart, the momentum of coin distribution surged as sellers overran the market. A have a look at the Exponential Shifting Common (EMA) place revealed that the 20 EMA (blue) was under the 50 EMA (yellow) line, depicting the severity of the continued bear motion.

Lastly, the dynamic line (inexperienced) of ADA’s Chaikin Cash Circulation (CMF) rested under the central spot at -0.03. This underlined an uptick within the asset’s promoting strain.

Supply: ADA/USD, TradingView

![Cardano [ADA] may be leading on this front, but on others…](https://ambcrypto.com/wp-content/uploads/2022/11/michael-fortsch-6CiqXsgGaM-unsplash-1-1000x600.jpg)