- Cardano token continues to fail in its fight in opposition to a downswing.

- Lengthy-term ADA holders are starting to lose curiosity because the broader market turns into hostile.

Cardano [ADA] discovered itself in acquainted territory as unusual occurrences stuffed the crypto market within the final six to 12 hours. Barely capable of produce beneficial properties for traders for fairly a while, ADA joined the all-inclusive market crash because it shed 4.18% within the final 24 hours.

Learn Cardano’s [ADA] Worth Prediction 2023-2024

Nevertheless, languishing within the purple area isn’t obscure to ADA regardless of being ranked greater by way of market capitalization. Particulars from CoinMarketCap confirmed that it has been one of many worst-performing belongings out of the highest ten. Because of this, it left traders to battle with a 23.12% 30-day decline.

Exits from the hideout

Certainly, the token dump can not exempt itself from the latest Bitcoin [BTC] lack of the $20,000 stronghold. However a few issues taking place on the Cardano chain have additionally contributed to the month-long fall.

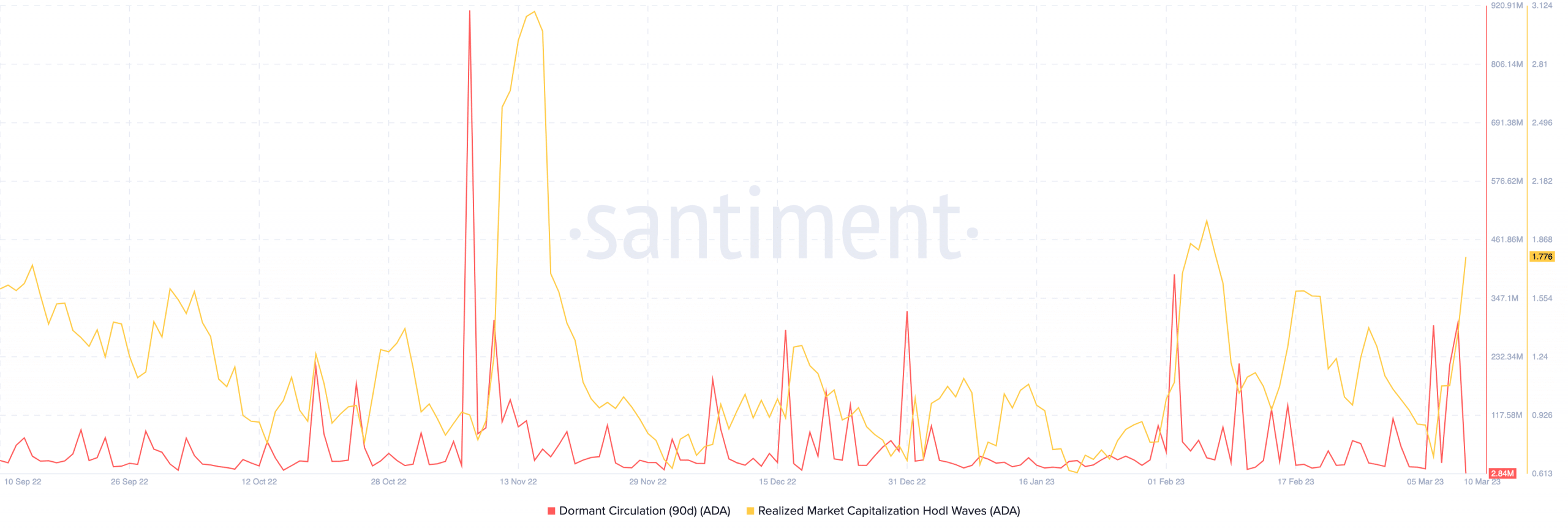

An irrefutable commentary is the development constantly displayed by its long-term holders. In accordance with Santiment, the ADA 90-day dormant circulation has hit a sequence of highs since 1 February.

This metric exhibits the variety of distinctive transactions on a given day made by traders who’ve refused to maneuver their belongings over an extended time frame.

At press time, the dormant circulation was 2.84 million. However earlier than the drop, the metric hit 295.8 million on 9 March. So, this implied that ADA traders have been choosing mid-term sell-offs as a doable means to outlive the present unfavorable circumstances.

Supply: Santiment

However, the realized market capitalization HODL wave reached a one-month excessive as proven by the chart above. At 1.776, it implies that traders weren’t able to pay greater costs for ADA, and the token was changing into much less interesting.

ADA: Swaying the trip for the bears

Though Cardano’s buying and selling quantity surpassed the common within the final 24 hours, the technical outlook was not one thing to excite quick to mid-term holders.

Is your portfolio inexperienced? Verify the Cardano Revenue Calculator

First, the Superior Oscillator (AO) which compares latest market actions to historic value actions was right down to -0.047. Not solely did the indicator stay beneath equilibrium, nevertheless it additionally shaped a bearish twin peak. Which means that sellers have been strictly accountable for the market.

As well as, the Chaikin Cash Stream (CMF), a 21-day volume-weighted distribution common closed at -0.08. This was virtually inevitable because the ADA value motion decreased on rising quantity. Therefore, ADA’s present standing exhibits weak point available in the market.

![Cardano [ADA] price action](https://ambcrypto.com/wp-content/uploads/2023/03/ADAUSD_2023-03-10_08-46-43.png)

Supply: TradingView

On the time of writing, ADA was down 89.93% from its All-Time Excessive (ATH) and has decreased 63.75% within the final 12 months. However as issues stand, there’s a likelihood that the token value trades decrease.