- LINK’s discounted worth has lots of room for progress earlier than it retests the breakeven level for many buyers.

- LINK’s present worth level and combined indicators from whales.

Chainlink’s native token LINK has achieved some aid from the draw back because the begin of 2023. However simply how a lot potential upside ought to LINK holders count on so far as a large restoration is anxious?

What number of are 1,10,100 LINKs value at this time?

In accordance with a current evaluation by blockchain analysis agency IntoTheBlock, roughly 70% of LINK’s present holders are at the moment at a loss.

Whereas this is applicable to most cryptocurrencies, the estimated breakeven level for many of the holders means that the LINK continues to be closely oversold.

The report additional acknowledged that the breakeven level for many merchants was above the $30 worth stage.

1/4 Let’s discuss @chainlink . Regardless of its secure worth motion over the previous 6 months, on-chain analytics point out that 70% of $LINK holders are at a loss. This is not unusual for a lot of altcoins, nevertheless it’s nonetheless one thing to bear in mind. #LinkMarines pic.twitter.com/Sg9dqPwisD

— IntoTheBlock (@intotheblock) March 8, 2023

Chasing the low cost?

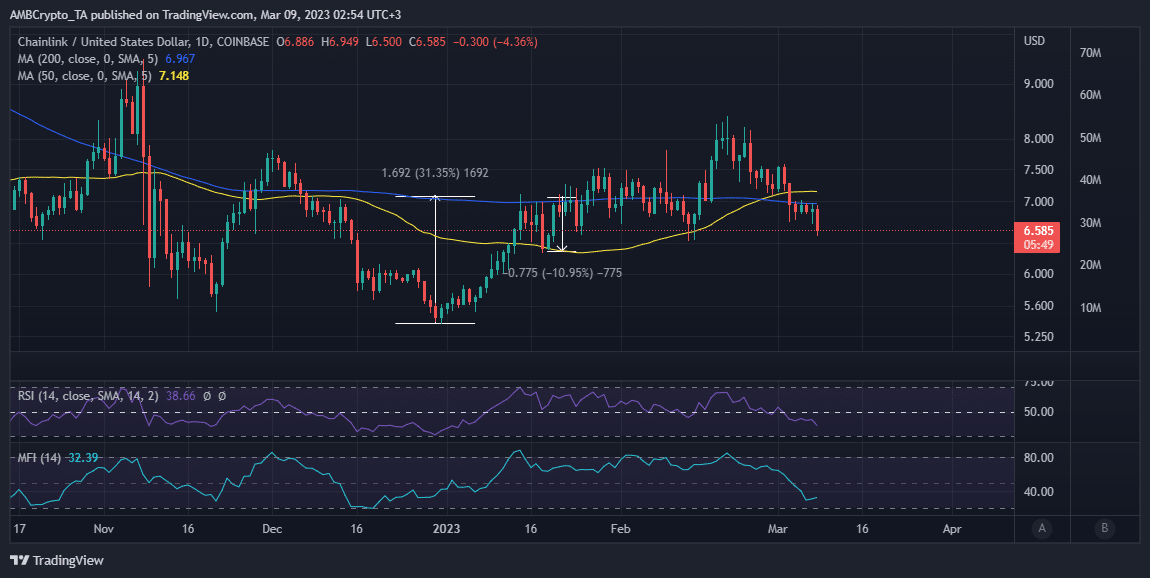

The $30 worth goal is at the moment a good distance off from its $6.58 press time worth stage. LINK should pull off a $357% rally to reclaim the breakeven worth stage. In different phrases, the token continues to be oversold and buying and selling at a wholesome low cost.

Supply: TradingView

The IntoTheBlock evaluation additionally highlighted the $6.34 worth vary as one of many nearer assist ranges to look at for. To date the value has tanked by 21% from the present 2023 excessive.

Nonetheless, the present vary continues to be inside a wholesome low cost vary. However is a powerful pivot within the works, or will the value proceed crashing?

Is your portfolio inexperienced? Take a look at the Chainlink Revenue Calculator

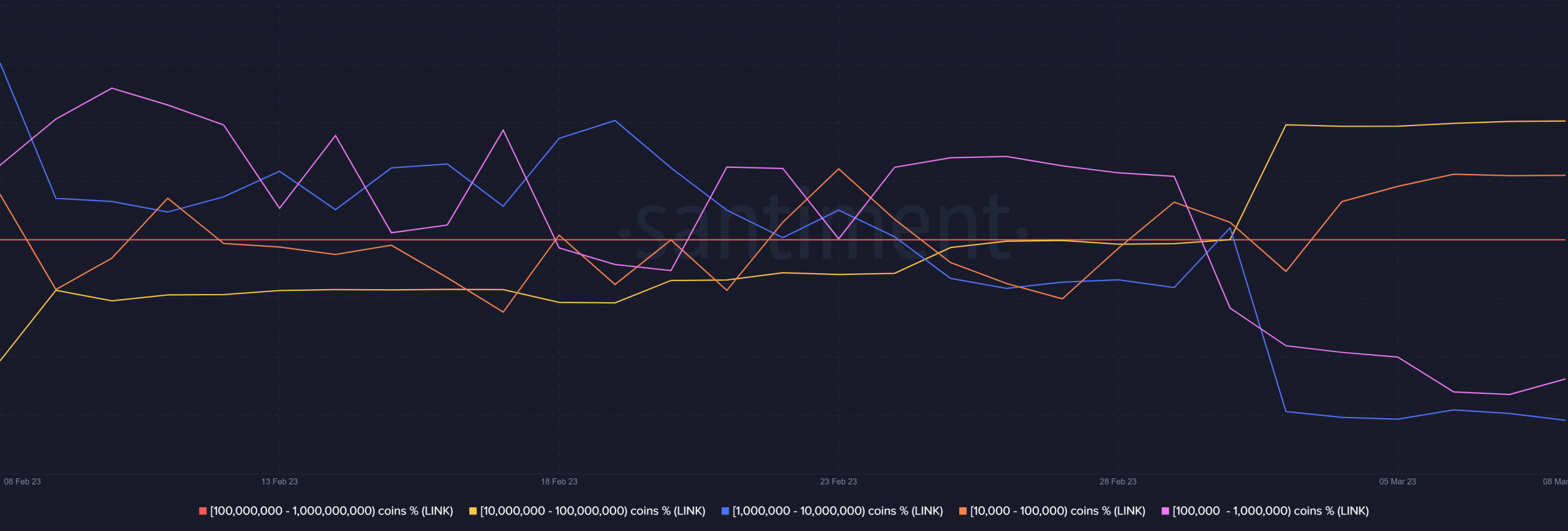

An evaluation of LINK’s provide distribution reveals that whale exercise has slowed down this week. Regardless of this, we did see a little bit of accumulation by addresses within the 100,000 to 1 million LINK class.

The latter managed 10.76% of LINK’s circulating provide. Moreover, addresses holding between 1 million and 10 million have skilled some outflows within the final three days.

The identical class controls roughly 15% of the circulating provide, therefore the upper influence on worth.

Supply: Santiment

To date many of the different high whale classes have been comparatively inactive which aligns with the market uncertainty.

Then again, the availability held by high addresses achieved optimistic progress within the final 4 weeks. The newest addition noticed on this metric was throughout the first three days of March.

Supply: Santiment

Ought to LINK buyers anticipate a strong pivot?

Market outlook is a crucial facet of LINK’s efficiency. The IntoTheBlock report confirms that LINK is closely correlated with Bitcoin, Ethereum, and MATIC.

This implies we’d see some bullish aid if Bitcoin manages to bounce off its assist zone. If that fails then LINK can also prolong its draw back.

![Chainlink [LINK] is still heavily undervalued, according to this report](https://ambcrypto.com/wp-content/uploads/2023/03/heart-padlock-g6c976b376_1280-1000x600.jpg)