- Chainlink joins the record of most traded sensible contracts among the many prime ETH whales.

- LINK bears face resistance threatening to chop brief their current dominance.

The Chainlink blockchain is regularly extending its tentacles throughout the decentralized panorama. Its long-term expectations are significantly excessive however its native token LINK stays undervalued at finest. However, there may be some hope even within the brief time period.

Learn LINK’s value prediction 2023-2024

The most recent WhaleStats alert places LINK within the crosshairs of addresses with giant balances. It’s because Chainlink made its manner into the record of most used sensible contracts among the many prime 1,000 ETH whales within the final 24 hours. This statement confirms that ChainLink remains to be experiencing wholesome ranges of utility.

JUST IN: $LINK @chainlink one of many MOST USED sensible contracts amongst prime 1000 #ETH whales within the final 24hrs🐳

Peep the highest 100 whales right here: https://t.co/jFn1zIOq03

(and hodl $BBW to see knowledge for the highest 1000!)#LINK #whalestats #babywhale #BBW pic.twitter.com/pSPFvjivwD

— WhaleStats (monitoring crypto whales) (@WhaleStats) January 19, 2023

The timing of this statement is right, particularly contemplating LINK’s value stage. The token pulled again by as a lot as 10% from its present month-to-month excessive. This places it inside the 50-day shifting common, in addition to the 50% RSI stage the place it’s more likely to bounce off.

Supply: TradingView

The worth had already began demonstrating indicators of a possible bounce again. There are some fascinating observations that show why the draw back could have been minimize brief.

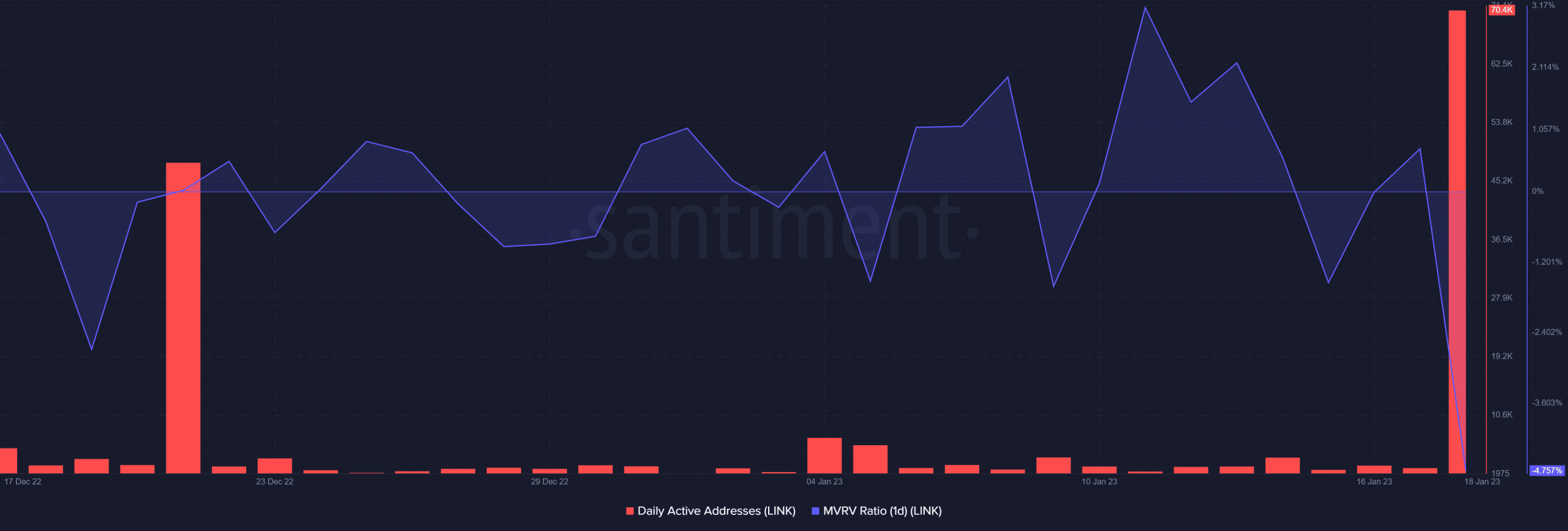

We did witness a large drop within the MVRV ratio since 11 January which confirms a large drop in profitability. The identical metric is presently at a brand new month-to-month low.

Supply: Santiment

Extra notably, LINK’s every day energetic addresses surged to a brand new month-to-month excessive within the final 24 hours, on the time of writing. These observations doubtless characterize a resurgence of bullish demand contemplating that the bears failed to take care of dominance.

Searching on skinny ice?

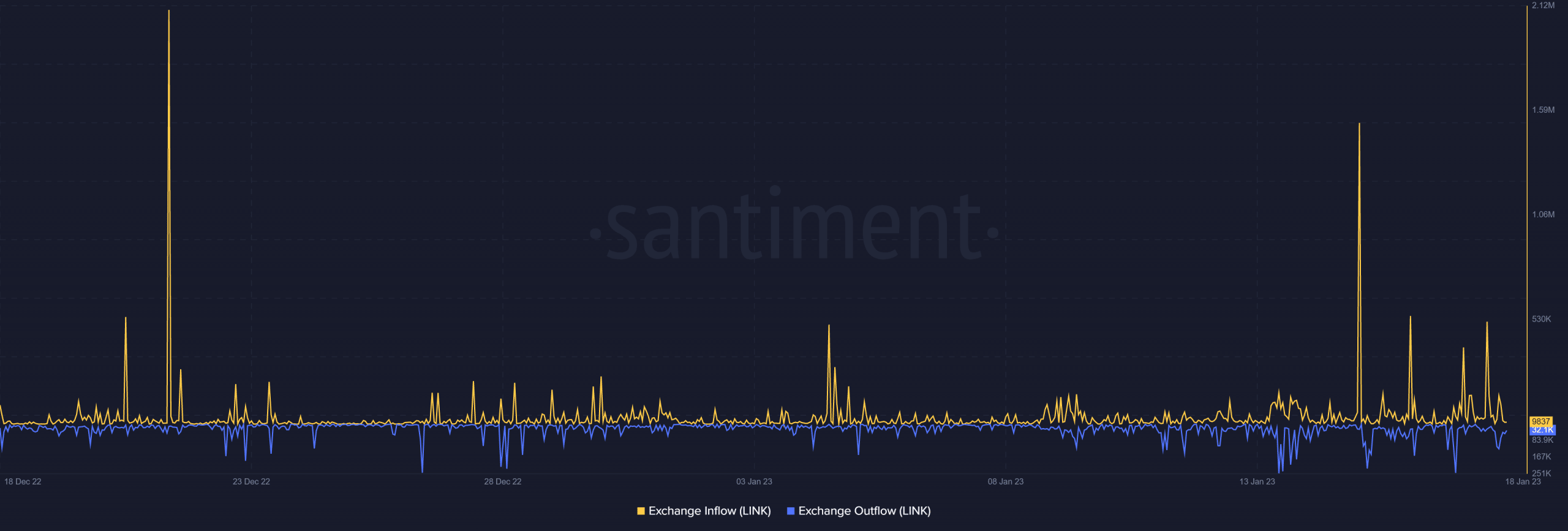

An evaluation of LINK’s trade flows confirms that bears have been beforehand in management. Nevertheless, a surge in trade outflows was additionally evident within the final 24 hours, though not sufficient to maintain a robust rally.

Supply: Santiment

These observations level in direction of a possible short-term upside. Regardless of this, LINK remains to be underperforming in some segments whatever the utility it guarantees to supply by way of cross-chain integration.

What number of are 1,10,100 LINKs price at present?

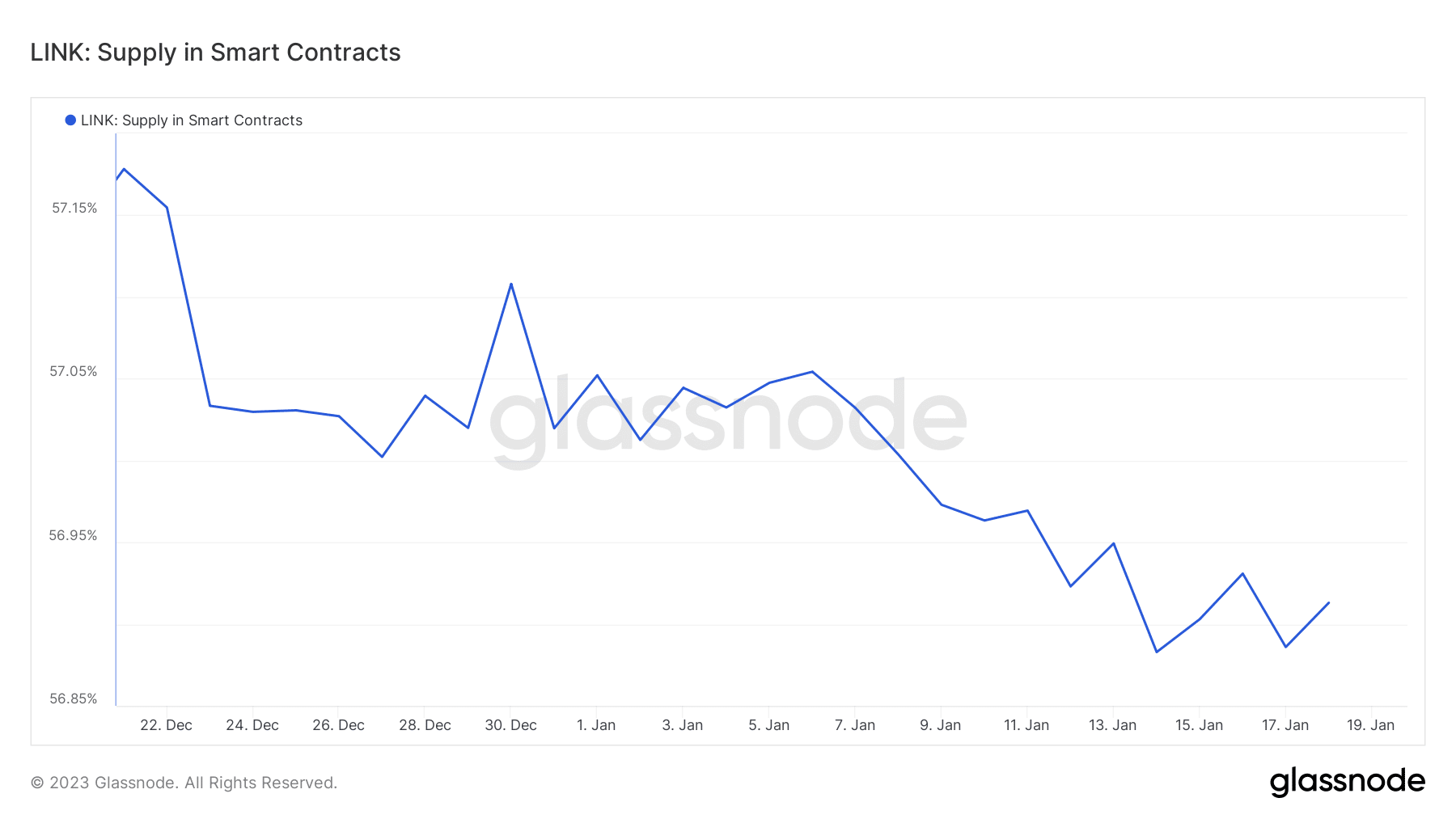

One space that reveals relative underperformance is the quantity of LINK provide locked within the sensible contracts. This quantity has been declining for the final 4 weeks, particularly throughout the first weeks of January when costs have been rallying.

Supply: Glassnode

A possible cause for this final result is that traders have opted to give attention to taking short-term features. This displays the uncertainty of the newest crypto rally within the present month. Extra so the uncertainty behind whether or not the rally represents the beginning of the subsequent bull run.