Disclaimer: The findings of the next evaluation are the only real opinions of the author and shouldn’t be thought of funding recommendation.

- Can the 20/50 EMA bullish crossover help Chiliz’s bullish efforts within the coming days?

- The altcoin noticed a decline in each day energetic addresses however maintained a comparatively excessive market cap dominance.

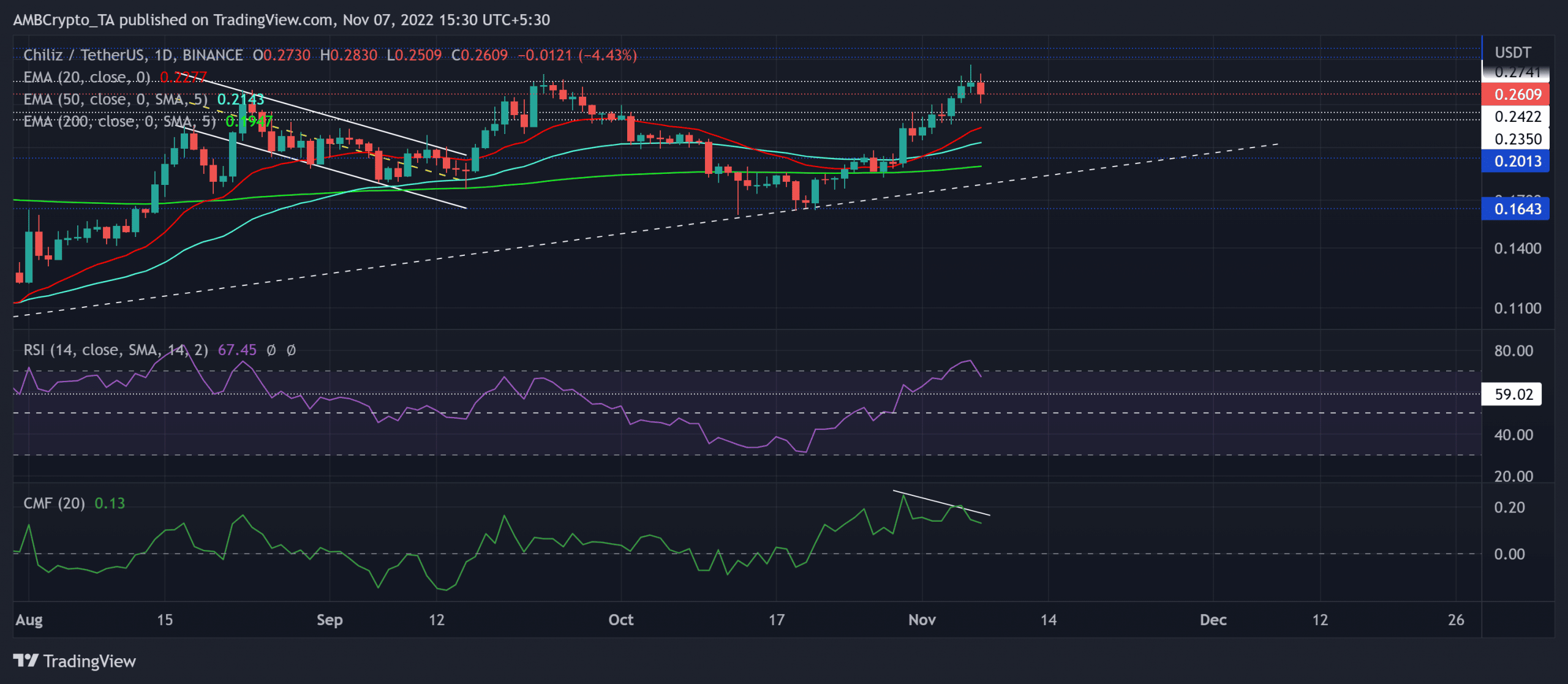

Chiliz’s [CHZ] bullish resurgence from its multi-monthly trendline help (white, dashed) firmly coordinated a bullish rebuttal rally. The resultant good points set the stage for the bulls to keep up a place above the 20/50/200 transferring averages.

Right here’s AMBCrypto’s value prediction for Chiliz [CHZ] for 2023-2024

With the north-looking 20 EMA (crimson) enterprise a bullish crossover with the 50 EMA (cyan), patrons may attempt to keep up their benefit within the coming weeks. Owing to a comparatively excessive correlation with Bitcoin [BTC], patrons ought to issue within the broader market sentiment to gauge CHZ’s capability to proceed rising.

At press time, CHZ was buying and selling at $0.2609, down by 2.04% within the final 24 hours.

Can the patrons discover dependable rebounding grounds?

Supply: TradingView, CHZ/USDT

The bulls discovered renewed stress after a morning star candlestick setup on the five-month trendline help. This restoration from the $0.16 degree entailed a whopping 63% ROI from 21 October to six November.

The restoration reversed from its long-term resistance mark within the $0.274 zone. Ought to the present candlestick shut as crimson, CHZ may witness an Night Star candlestick sample within the each day timeframe.

A convincing rebound from the $0.23-$0.24 vary can place the altcoin for an upside within the coming days. A right away or eventual bullish comeback can witness the primary main resistance barrier within the $0.27 zone. A detailed above this mark can open doorways towards the $0.3-$0.31 vary.

However a reversal under the $0.23 help degree may hamper the bullish progress. In these circumstances, the 20/50 EMA may provide a restoration potential.

The Relative Energy Index (RSI) noticed a reversal from its overbought area because the altcoin eyed to check the 59-mark help. Any rebound from this help may proceed aiding CHZ’s bullish endeavors.

Moreover, the Chaikin Cash Movement’s (CMF) decrease peaks over the previous week confirmed a bearish divergence with the worth motion. This studying depicted the potential of ease in shopping for stress.

A decline in each day energetic addresses

Supply: Santiment

An evaluation of information from Santiment revealed a pointy plunge within the variety of each day energetic addresses over the previous day. Empirically, the worth motion managed to point out a comparatively excessive sensitivity towards this metric.

Ought to the worth motion observe, CHZ may see a near-term draw back earlier than selecting itself up.

Supply: Messari

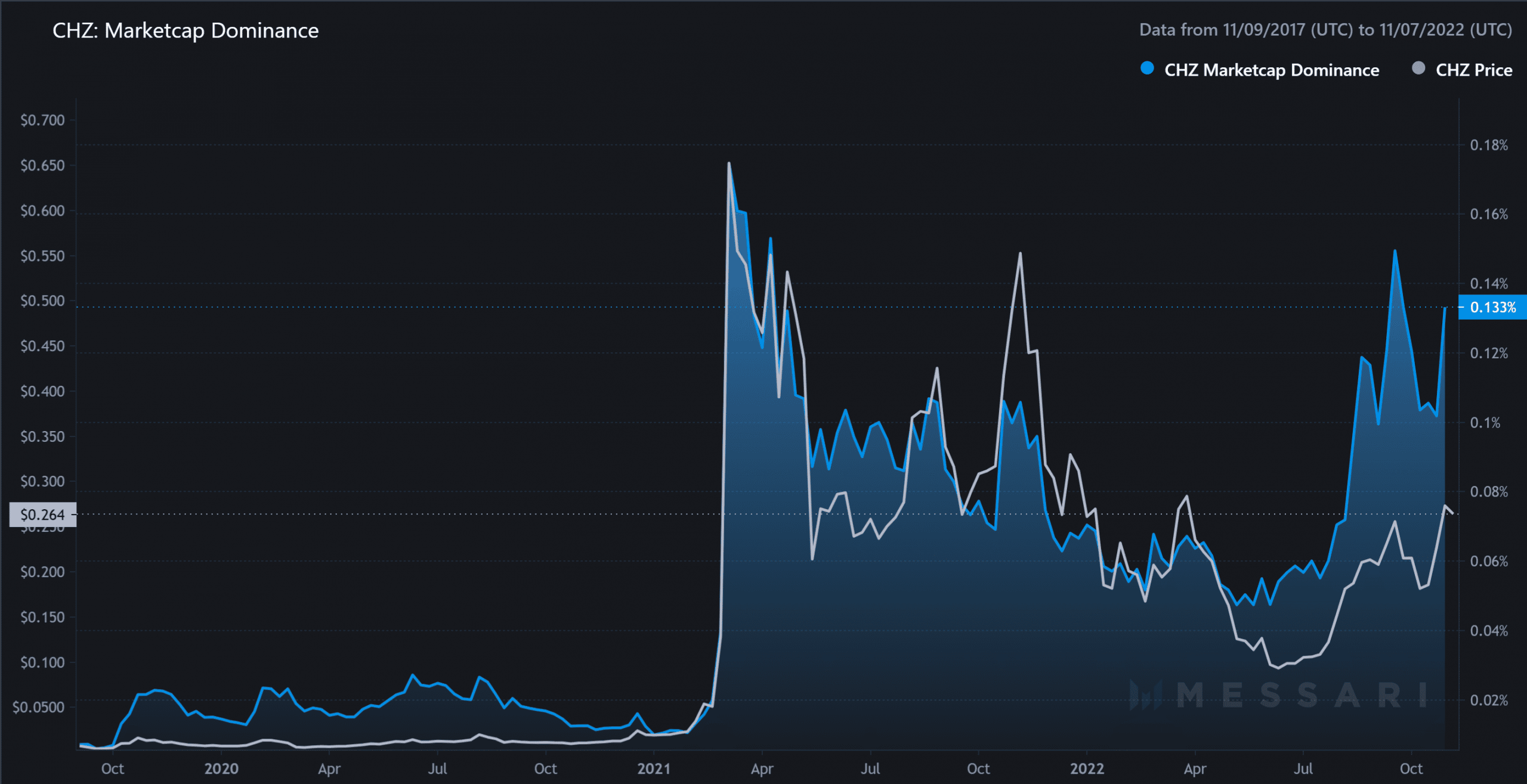

Nonetheless, CHZ’s market cap dominance noticed a stable spike up to now few months because it reached its ATH ranges in September. This studying entailed that CHZ carried out fairly effectively relative to its peer altcoins over the previous few months.

The potential targets would stay the identical as above. Lastly, merchants/traders ought to hold an in depth watch on Bitcoin’s motion and its results on the broader market to make a worthwhile transfer.