- Paxos, the BUSD issuer, acquired a letter from the SEC on allegations of being unregistered safety.

- The investigation could possibly be a detriment on Binance’s half as NYDFS orders a cease to BUSD minting.

Binance USD [BUSD] holders could be confronted with a heavy cross to bear after the U.S. SEC notified its issuer of a possible probe. Wall Avenue Journal (WSJ), who appeared very familiar with the matter, reported that Paxos Belief Co. had acquired a letter pertaining to the problem from the regulator.

Learn Binance Coin [BNB] Price Prediction 2023-2024

A BUSD investigation holds Binance to account

However why is the SEC placing BUSD in danger and its holders in concern? In accordance with the 12 February report, the regulator plans to sue the agency for issuing unregistered safety and violating its buyers’ safety legal guidelines.

This new probe serves because the third clampdown on cryptocurrencies within the final two weeks. A couple of days in the past, crypto trade Kraken needed to droop its staking actions after a $30 million settlement with the SEC. Days later, Coinbase CEO alerted the crypto neighborhood a couple of potential witch hunt on Ethereum [ETH] staking too.

With the WSJ revelation in play, it may imply woe for the seventh-placed cryptocurrency in market worth and third-largest stablecoin. Nevertheless, retail holders won’t be probably the most affected if a judgment favors the SEC.

Binance, who additionally doubles as Paxos’ companion, could possibly be the most important sufferer. In accordance with Nansen, 90% of BUSD is held on the trade. This means that each institutional and retail want to retailer the stablecoin on its issuer-partner trade.

BUSD accounts for $21.7% of present Binance token holdings*, here is the dashboard hyperlink: https://t.co/x1ITMCFNRE

*The worth of the token holdings within the pockets addresses supplied by the exchanges pic.twitter.com/DT39t8QQZ6

— Nansen 🧭 (@nansen_ai) February 13, 2023

Other than that, the on-chain analytics database holds about 21.7% BUSD in its treasury. This information above makes Binance one of many largest holders of the 1:1 USD-backed stablecoin.

Exits on the way in which?

Following the report, BUSD misplaced its peg to the greenback. In accordance with CoinMarketCap, the stablecoin value was $0.09993 at press time. However on one other word, there appears to be exits from holding the coin.

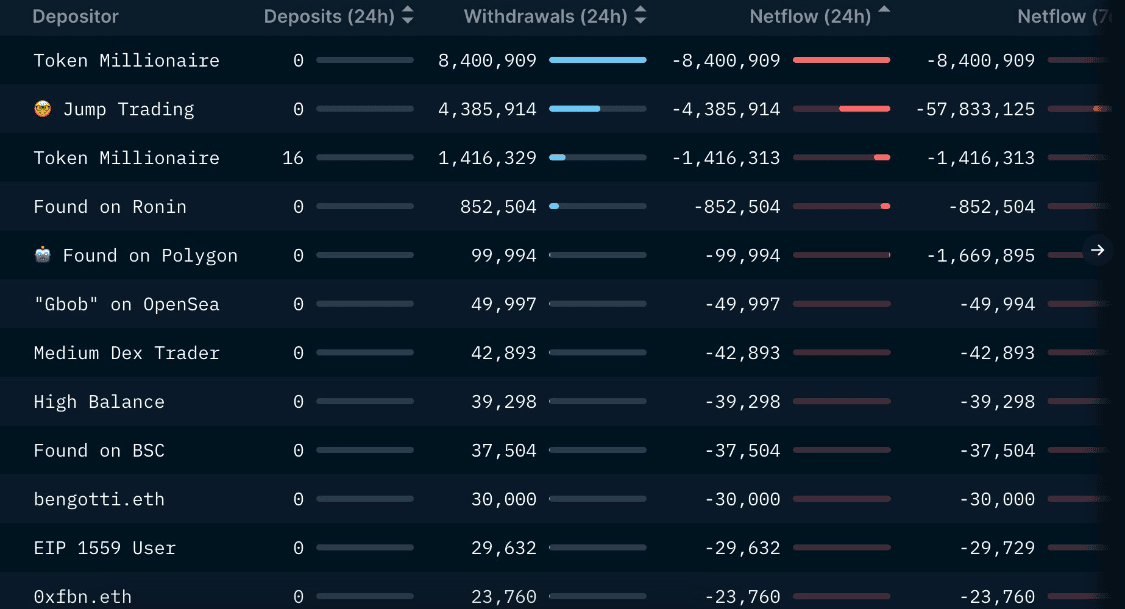

As of the early hours of 13 February, Nansen information revealed that about $57 million value of BUSD had left exchanges within the final seven days. And, this was the work of a single bounce dealer who nonetheless held $18.8 million within the pockets.

Supply: Nansen

Real looking or not, right here’s BUSD’s market cap in BNB’s phrases

In the meantime, particulars from the knowledge assessed above confirmed that BUSD has been starved of deposits within the final 24 hours. This situation would possibly infer warning taken by buyers following the disclosure.

Nevertheless, the SEC was not the one one within the BUSD case. The New York Division of Monetary Companies (NYDFS), which regulates stablecoins within the U.S., additionally regarded into the matter earlier.

In latest occasions, SEC chair Gary Gensler has repeated in a number of interviews that the regulator can be going after a number of unregistered provides within the coming weeks.

In the meantime, recently emerged reports from WSJ confirmed that the NYDFS had directed Paxos to cease minting BUSD. Binance CEO CZ, additionally confirmed it, noting that the stablecoin’s market cap would lower over time.

2/ We had been knowledgeable by Paxos they’ve been directed to stop minting new BUSD by the New York Division of Monetary Companies (NYDFS).

Paxos is regulated by NYDFS.

BUSD is a stablecoin wholly owned and managed by Paxos.

— CZ 🔶 Binance (@cz_binance) February 13, 2023

![Could Binance USD [BUSD] be the next SEC casualty as regulator digs deep into…](https://ambcrypto.com/wp-content/uploads/2023/02/po-2023-02-13T082350.201-1000x600.png)