Crypto analyst Jamie Coutts highlights that blockchain know-how sees adoption no matter the cryptocurrency market’s positivity or negativity.

“5 million day by day crypto customers at present, is more likely to be 100m in lower than 5 years,” he famous.

Blockchain Forges Its Distinctive Path

Coutts asserts that blockchain adoption charges stay constantly excessive, whatever the prevailing market cycle within the crypto house, be it a bull or bear market.

“Bear market/Bull market adoption of blockchain know-how continues unabated. Not having publicity to one of many largest structural traits of the following decade might be pricey.”

In the meantime, a latest PwC report emphasised the rising significance of blockchain know-how in addressing the increasing concern of monetary inclusion.

The report underlines the urgency of adopting blockchain on a broader scale to fight this concern.

Be taught extra: What Is Market Capitalization? Why Is It Vital in Crypto?

Main Monetary Establishments’ Blockchain Challenges

PwC’s statistics reveal the growing problem of restricted entry to conventional banks and the flexibility to economize for a good portion of the worldwide inhabitants, making it extra crucial than ever to embrace blockchain know-how at a bigger scale.

Just lately, Sergey Nazarov, Chainlink co-founder, highlighted the obstacles presently dealing with banks of their efforts to undertake blockchain know-how.

Nazarov identified that the substantial monetary and temporal investments made by banks worldwide within the conventional SWIFT fee system will make it difficult for them to transition away from it.

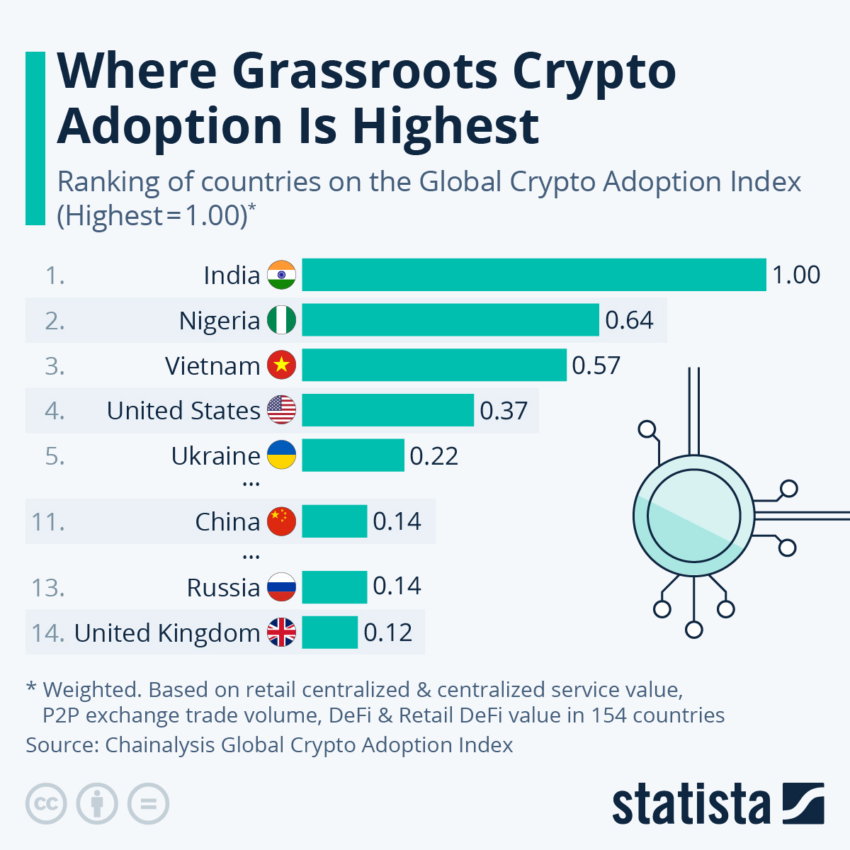

Conversely, the main hotspots for world crypto adoption aren’t essentially the obvious selections.

Grassroots world crypto adoption by nation. Supply: Statista

India holds the primary place on the worldwide crypto adoption index, with Vietnam, the Philippines, Ukraine, and Kenya carefully following swimsuit.

Be taught extra: Deploying Blockchain Infrastructure: Challenges and Solutions