A carefully adopted quant analyst says that two main Bitcoin stakeholders are closely accumulating BTC at present ranges regardless of unsure market situations.

Ki Younger Ju, the pinnacle of analytics agency Crypto Quant, tells his 308,400 Twitter followers that deep-pocketed buyers are aggressively loading up on BTC by means of prime digital asset change Binance.

“Whales are accumulating BTC in Binance.

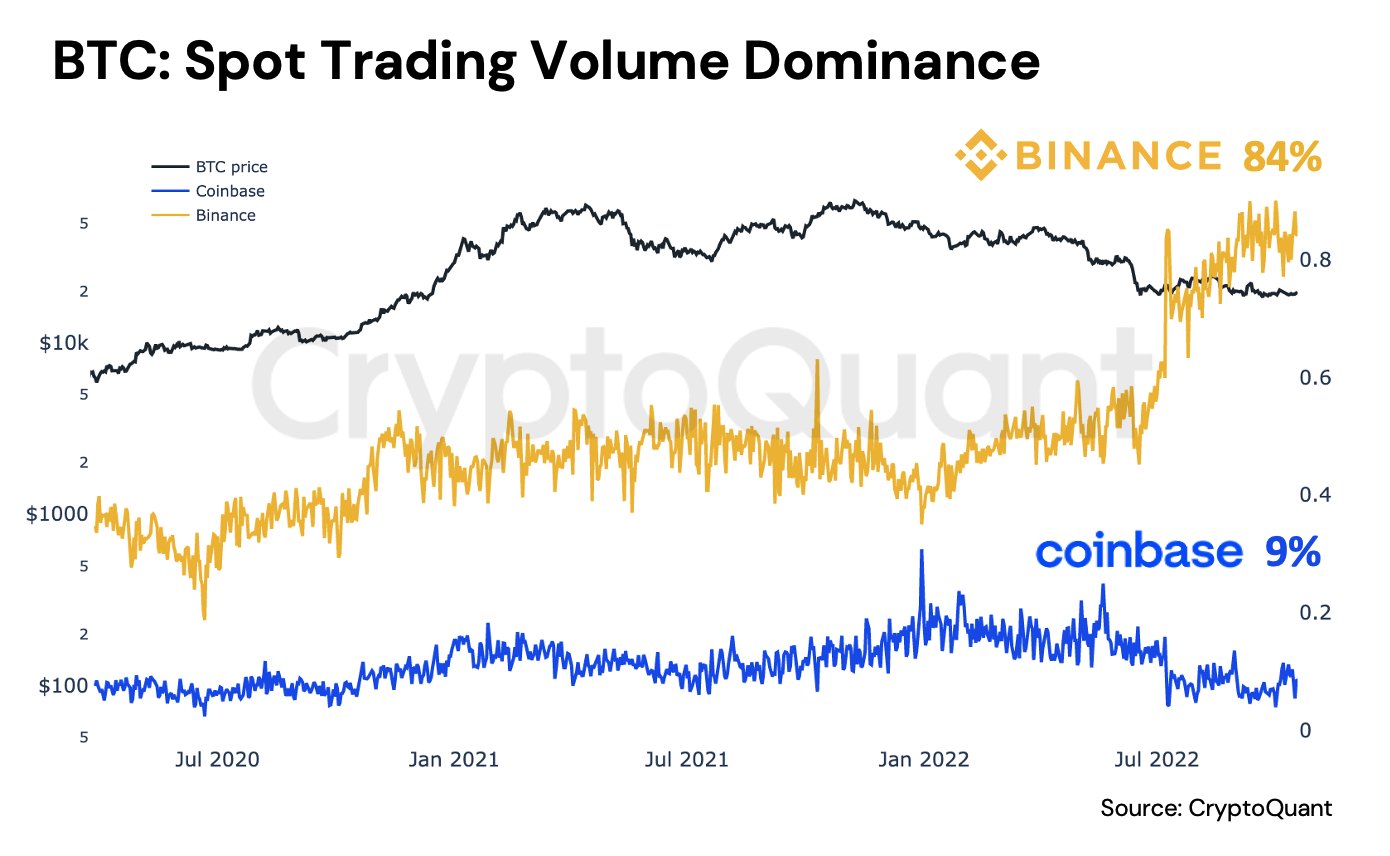

Since Bitcoin worth hit the $20,000 stage, Binance’s spot buying and selling quantity dominance skyrocketed, and it’s now 84%. The second largest is Coinbase, 9%.

Unsure whether or not these whales are establishments utilizing prime brokers or crypto OGs (unique gangsters) for now.”

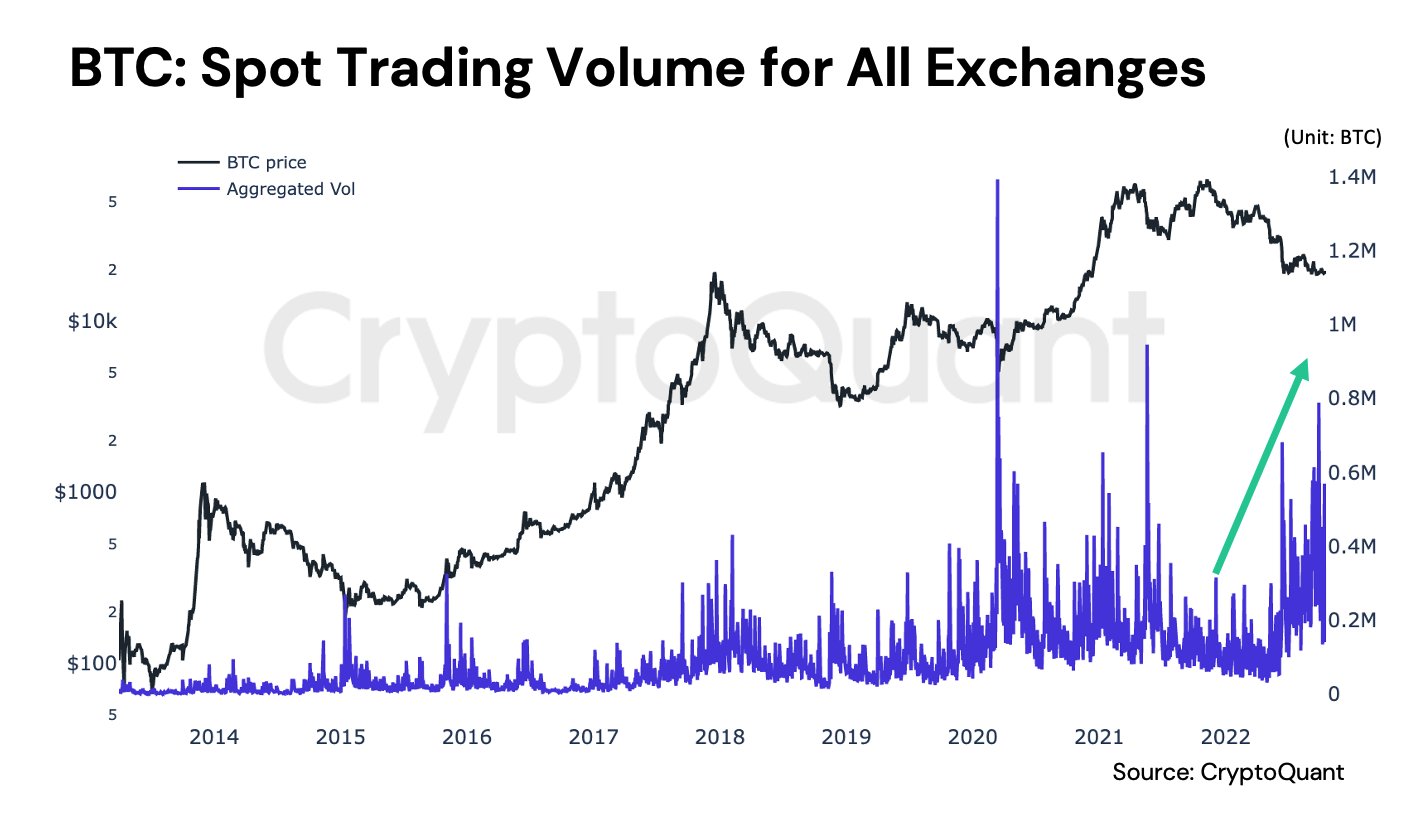

Ki Younger Ju additionally highlights that Bitcoin’s spot buying and selling quantity has surged throughout all exchanges within the final six months, indicating that there’s adequate demand to soak up the extraordinary promoting strain.

“BTC spot buying and selling quantity for all exchanges elevated 20x over the previous six months.

The amount renewed a year-high final month, however not a lot change within the day by day closed worth, indicating somebody(s) is shopping for all of the sell-side liquidity.”

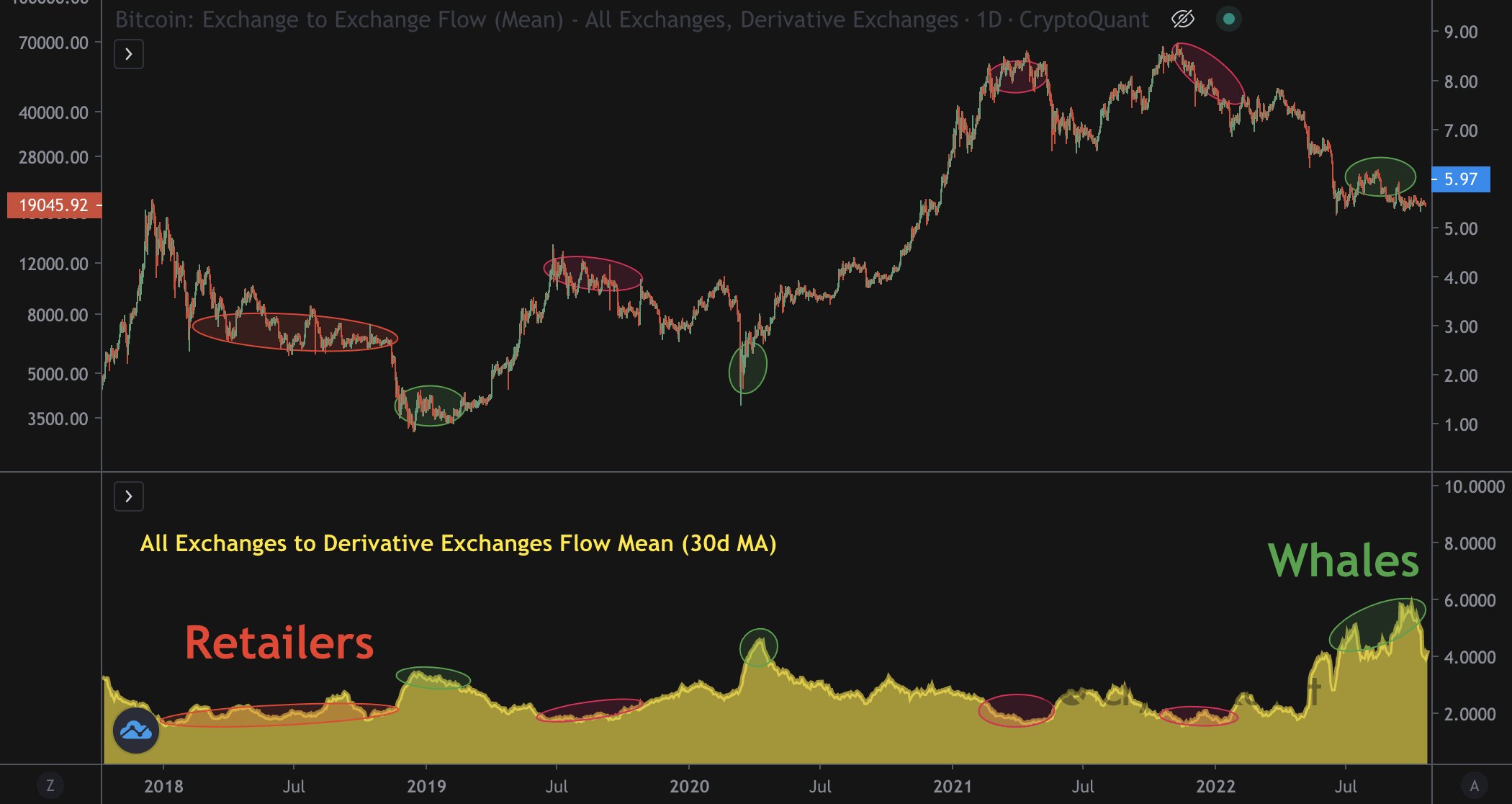

The Crypto Quant CEO additionally notes that whales have taken over the BTC futures markets.

“BTC futures merchants at the moment are largely whales.

The typical quantity of Bitcoin deposits to by-product exchanges from different exchanges is comparatively huge, a five-year excessive.”

Based mostly on the quant analyst’s chart, it seems that Bitcoin tends to backside out when whales dominate the futures markets.

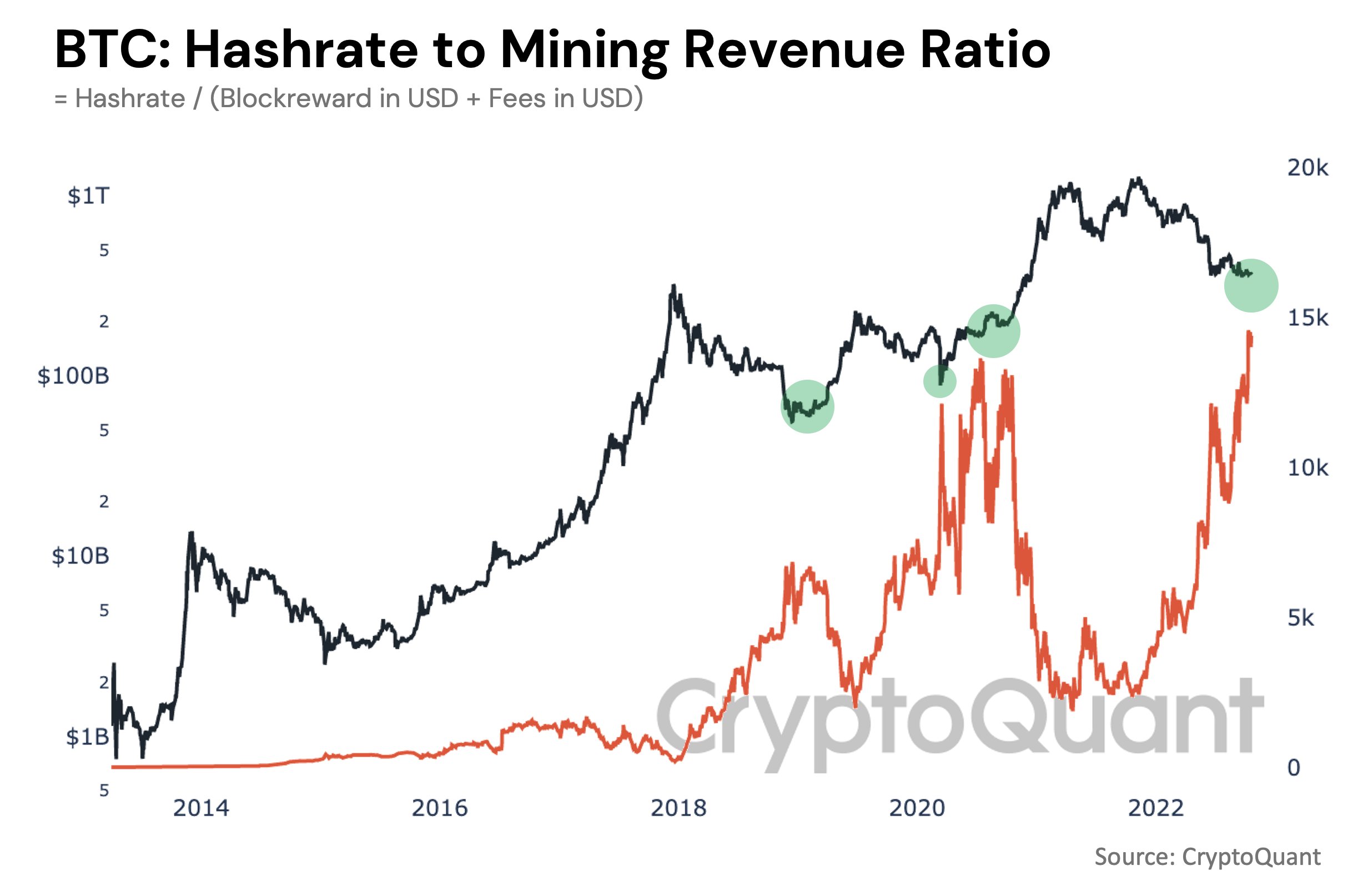

Taking a look at one other essential Bitcoin stakeholder, Ki Younger Ju says BTC miners are “extraordinarily bullish now” on the most important crypto by market cap.

“Hashrate to mining income ratio hit an all-time excessive, which means they preserve investing in infrastructure regardless of very small BTC mining income.

Traditionally, miners had been underwater within the quick time period however by no means failed in the long run.”

At time of writing, Bitcoin is swapping palms for $19,209, flat on the day.

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Examine Value Motion

Observe us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any loses you might incur are your duty. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please word that The Day by day Hodl participates in internet affiliate marketing.

Featured Picture: Shutterstock/studiostoks