On September 5, Liz Truss was formally declared Britain’s new Prime Minister (PM) after nearly three months of campaigning. The figuring out spherical was determined by a celebration member vote, through which Truss beat rival Rishi Sunak 57.4% to 42.6%.

The following day’s entrance pages have been plagued by photographs of Truss beaming with victory. Nevertheless, removed from being a joyful event, the previous Overseas Secretary takes cost throughout a cost-of-living disaster, double-digit inflation, and the chance of a recession subsequent 12 months.

Furthermore, the newly appointed PM has but to state her digital asset insurance policies, stoking fears that the federal government will shelve the nation’s crypto hub ambitions beneath her management. Particularly as Sunak, who was instrumental in driving crypto-friendly insurance policies throughout his tenure as Chancellor, won’t be supplied a task in Truss’s new cupboard.

Analyst Michael Suppo assumed the worst by tweeting, “Goodbye to a U.Okay. Crypto Hub,” whereas implying that the brand new PM has extra urgent issues to take care of, particularly tackling inflation and steering the financial system via this difficult interval.

Liz Truss is the brand new UK Prime Minister

Goodbye to a UK Crypto Hub…

Hi there increased inflation figures…

— Suppoman (@MichaelSuppo) September 5, 2022

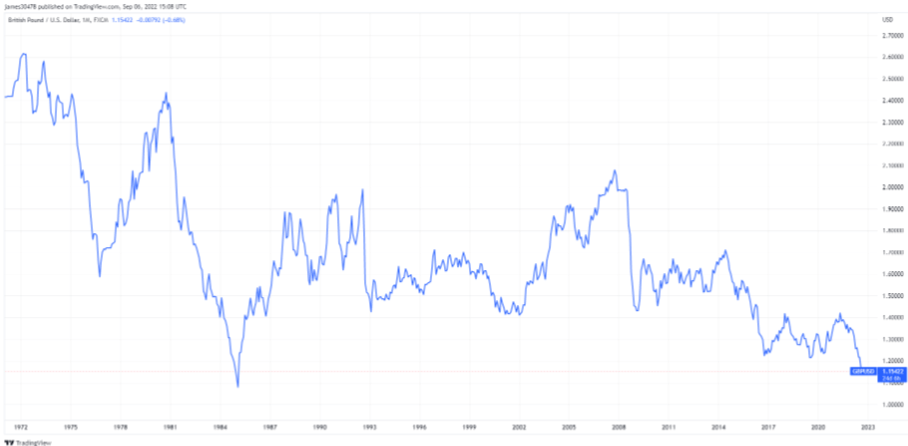

The pound continues to sink towards the greenback

The pound slid to a 37-year low towards the greenback, mirroring the dire financial state of affairs going through Truss and the U.Okay. financial system.

Furthermore, contemplating the power of the greenback’s momentum, with the DXY on monitor to retest all-time highs, analysts anticipate additional GBP weak spot.

Regardless of Truss vowing “to cope with the vitality disaster,” the pound has continued its hunch towards the greenback within the days previous her appointment.

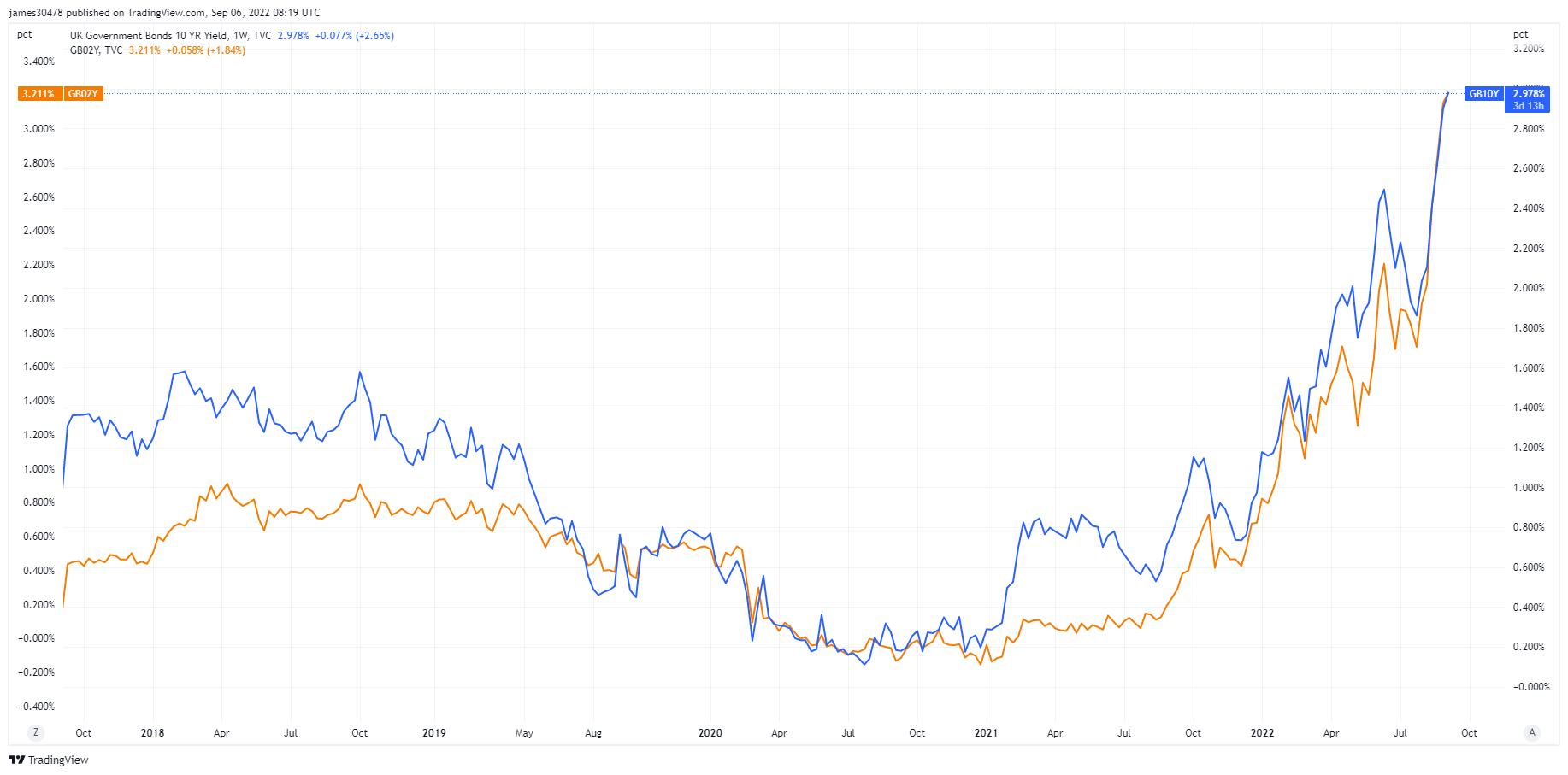

Bond markets sell-off

In response to Reuters, bond markets responded to Truss’s appointment with the sharpest sell-off of long-dated bonds because the covid19 disaster hit in March 2020.

Bond markets are involved on the scale of debt issuance on the playing cards if Truss goes forward with plans to freeze U.Okay. vitality payments. The scheme is ready to value £150 billion ($171 billion) and would see a cap on hovering fuel and electrical energy prices for households and companies.

Deutsche Financial institution Economist Sanjay Raja stated as these measures could be funded by extra borrowing, the medium-term danger of larger inflationary stress looms.

“Elevated fiscal help ought to add to mixture demand within the medium time period, rising inflation and in the end rising the quantity of tightening wanted for the Financial institution of England to get inflation sustainably again to focus on.”

In response, yields on two-year and ten-year U.Okay. authorities bonds have spiked to multi-year highs, at 2.9% and three.0%, respectively.

Nevertheless, with inflation operating at 10.1%, the chance of additional charge hikes by the Financial institution of England (BoE) gives added impetus for yields to spike even increased. The knock-on impact would see extra ache for risk-on property, together with cryptocurrencies.

Analysts anticipate the BoE to implement a 50 foundation level hike following its subsequent coverage assembly on September 15.