The whole cryptocurrency market capitalization stood at $938.47 billion as of 07:00 UTC on Sept. 7 — down 5.2% over the previous 24 hours.

Bitcoin’s market cap fell by round $20 billion or 6.2% to $358.94 billion over the day. In the meantime, Ethereum’s market cap stood at $185 billion, down 7.9% from round $201 billion on Sept 6.

The highest ten market cap cryptocurrencies have been all crimson over the previous 24 hours, with Cardano posting the best losses after falling 9.26%, in line with CryptoSlate information.

Tether (USDT) and USD Coin (USDC) market caps stood at $67.55 billion and 51.61 billion, respectively, whereas BinanceUSD (BUSD) market cap stood at $19.74 billion, rising barely in comparison with Sept 5. USDT’s market cap remained flat, whereas USDC’s market cap fell barely over the previous day.

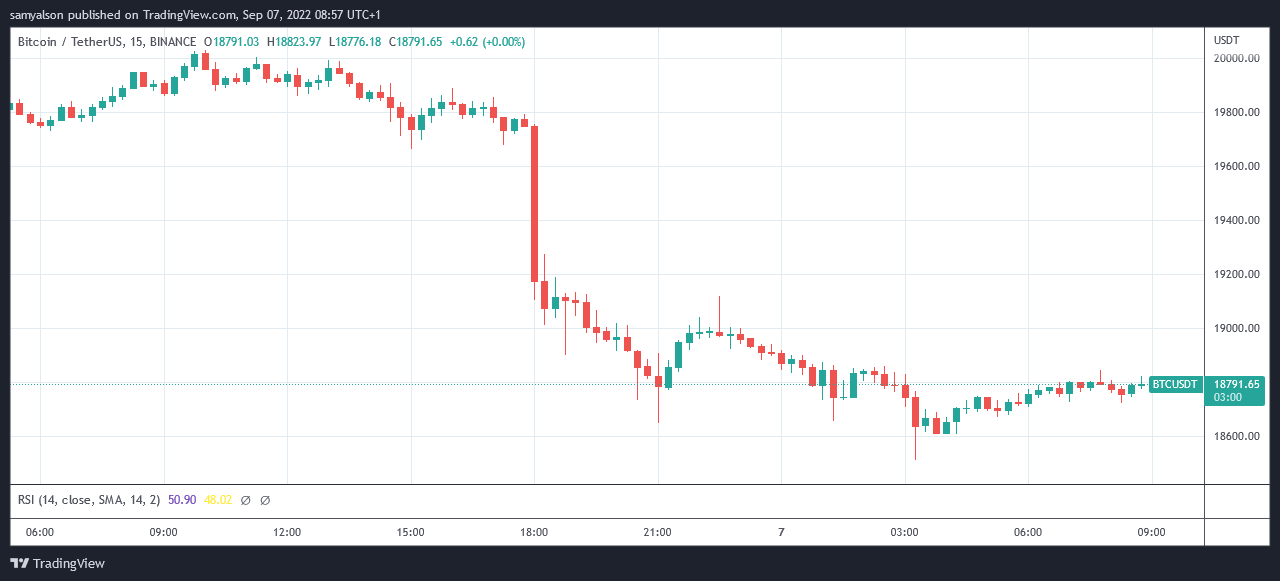

Bitcoin

Bitcoin (BTC) noticed vital losses over the previous 24 hours and was buying and selling down 5.21% at 18,700 as of 07:00 UTC — under the earlier all-time excessive set in November 2017. BTC’s market dominance dipped to 38.3% since 8 am, the bottom since February 2018.

The worth of the most important cryptocurrency continues to battle and lose market share. Market sentiment stays largely bearish, with the Bitcoin greed and concern index pointing in direction of excessive concern.

BTC was buying and selling flat on Sept 6 till round 17:00 UTC, when it began crashing considerably. The worth of BTC dropped as little as $18,715 round 20:00 UTC, put up which it recovered barely, solely to crash once more, slumping under $18,600 at round 02:15 UTC on Sept 7.

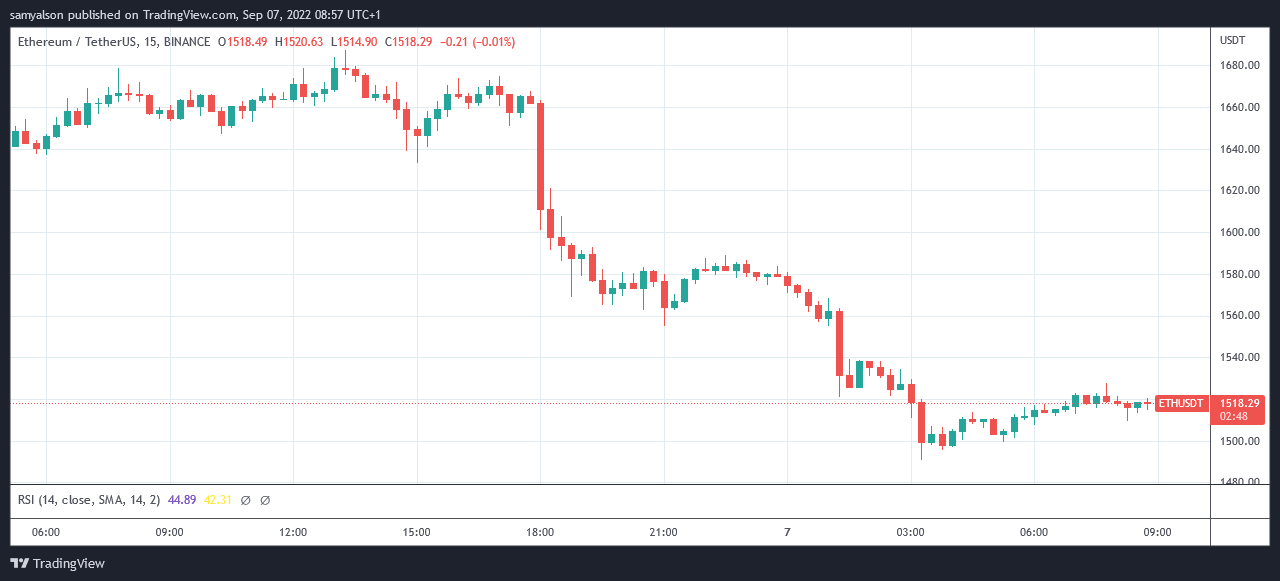

Ethereum

Ethereum (ETH) fell 8.65% and was buying and selling at $1,51 as of 07:00 UTC after dropping a lot of the positive aspects remodeled the previous week. Anticipation of the Bellatrix improve — the final vital improve earlier than the Merge — boosted the worth of ETH within the early hours of Sept 6. Nevertheless, the technical points after the improve went dwell triggered bearish stress on ETH’s value.

Regardless of the worth falling 4.11% over the previous week, ETH has been persistently performing higher than Bitcoin over the past 30 days because the Merge comes nearer. The Merge has additionally ballooned staked ETH to an all-time excessive of 14.26 million, valued at round $21.6 billion at present costs.

ETH value began falling sharply at round 17:00 UTC, dipping to round $1,560 by 20:00 UTC. The worth then recovered barely, however continued to fall quickly after till it dipped under $1,500 at round 02:30 UTC on Sept 7.

High 5 gainers

Voyager Token

VGX bagged the largest positive aspects for the day, up 20.94% over the previous 24 hours. The token was buying and selling at round $0.92 as of press time — up 67.99% over the previous 7 days.

Though Voyager was the primary lender to file for chapter after Three Arrows Capital went bust, the agency is now evaluating bids for a buyout, the deadline for which was Sept 6. Voyager had beforehand rejected FTX’s proposal for getting out its loans and belongings at market value, besides its publicity to 3AC. Supporters of the token imagine VGX may quickly check $1, regardless of the corporate’s liquidity disaster.

Binary X

BNX bagged the largest positive aspects for the day and was buying and selling at $1.36, up 5.85% over the previous 24 hours. The token’s value elevated sharply at round 12:30 UTC on Sept 6, though the token has been buying and selling downwards since. It isn’t presently identified why the token’s value shot up.

Voxels

VOXEL is up 5.2% over the previous 24 hours, buying and selling at $0.28 as of press time. The token is up 24.12% over the previous week, however its present buying and selling value is considerably decrease than in mid-August when it was buying and selling at round $0.42.

Radio Caca

Whereas the token has been buying and selling practically flat over the previous week, it posted 2.09% positive aspects over the previous 24 hours and was buying and selling at $0.00038. That is regardless of the token value falling sharply round 17:00 UTC, mirroring the autumn of BTC and ETH costs. The token is down 15.39% over the previous week.

Helium

HNT gained 2.05% over the previous 24 hours and was buying and selling at $3.88 as of publishing time. Nevertheless, the token is down 30.36% over the previous week. The group has been plagued with doubts because the builders proposed shifting the undertaking to Solana from its native blockchain late final month.

High 5 losers

DeFiChain

DFI noticed the most important losses of the day, slumping by 23.22% over the previous 24 hours to commerce at $1.03 on the time of publishing. The token had skilled a pointy uptick on Sept 3, however the day’s losses eradicated all positive aspects.

SSV Community

SSV dipped 16.98% over the previous 24 hours, buying and selling at round $14 at press time. The token, nevertheless, posted positive aspects of 5.53% over the previous week, and the present hunch may to attributed to volatility.

Synapse

SYN posted losses of 16.62% over the previous 24 hours. The token was buying and selling at $1.29 as of press time, after eliminating all its positive aspects since Sept 5. The explanation behind the volatility of the token shouldn’t be identified at current.

Lido DAO Token

Following the hunch in ETH value, LDO additionally suffered losses. It slipped by 16.55% over the previous 24 hours, buying and selling at $1.82 round press time. Over the previous month, the token value has dropped by 21.66%.

Ethereum Basic

As of press time, Ethereum Basic (ETC) had misplaced the positive aspects remodeled the week and was buying and selling at $34.32, down 16.16% each day,

Earlier this week, the worth of ETC was pumping as ETH miners moved to the community forward of the Merge, which can flip Ethereum right into a proof-of-stake community.