- Curve has alluded to plans to combine with zkSync 2.0 mainnet.

- The combination might assist Curve and CRV scale as CRV value has been in a decline.

Curve to launch on zkSync

As extra customers turned to Defi and DEXs because of the FTX collapse, Curve Finance and its native CRV token grew to become one of many winners.

Curve, is an Ethereum-based multichain expertise. Its most up-to-date assertion said that it will combine with the zkSync 2.0 mainnet to additional enhance its choices.

It was revealed on 14 December that Curve Finance could be one of many protocols to deploy on the zkSync 2.0 mainnet. This deployment could be the primary of its type on the ZK-rollup, a revolutionary scaling and privateness mechanism for Ethereum.

Curve’s DAO has incentivized Curve to grow to be a high Automated Market Maker (AMM) that has constructed tons of of liquidity swimming pools by its manufacturing facility.

The case for integration

Its transactions utilizing ERC-20 tokens are low-cost, quick, and liquid due to Curve’s proprietary algorithms. The community routinely processes greater than $100 million in day by day quantity, making it one of many high DeFi by way of quantity.

Incorporating Curve into zkSync means extra people can expertise the promise of common crypto accessibility. Because of this, the protocol will have the ability to profit from the pace, scalability, and safety of the zkSync 2.0 platform and make it out there to a wider viewers of customers within the DeFi surroundings.

Extra folks might use the ecosystem by integration, which could result in growth. The ecosystem’s native coin, CRV, may also profit from this.

A decline in value and TVL

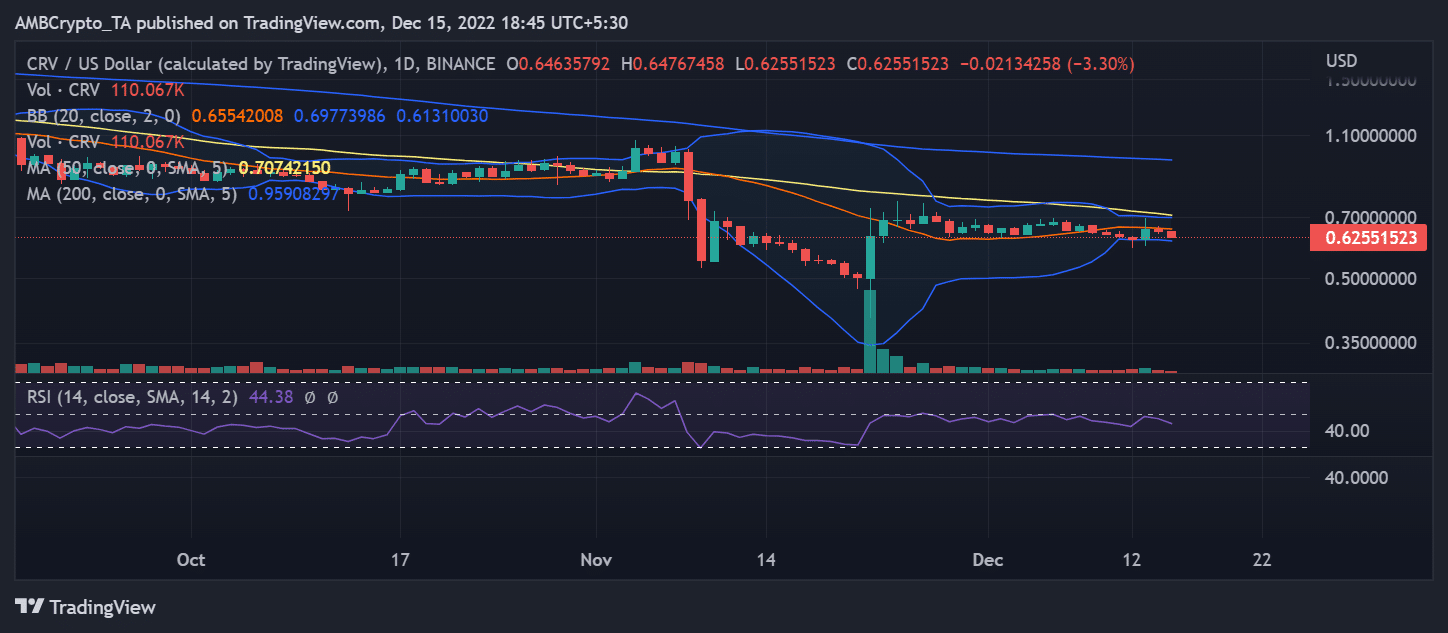

The asset had been seeing little value motion currently, in line with a test at CRV in a day by day timeframe. On 13 December, CRV’s most up-to-date string of worthwhile pricing adjustments was seen.

The asset grew about 6%, bringing the worth to about $0.60. The worth had, nonetheless, decreased by greater than 4% over the earlier 48 hours, as might be seen. The Relative Power Index fell beneath the 50-line mark, indicating a value decline. The RSI’s place indicated that the asset was bearish.

Supply: TradingView

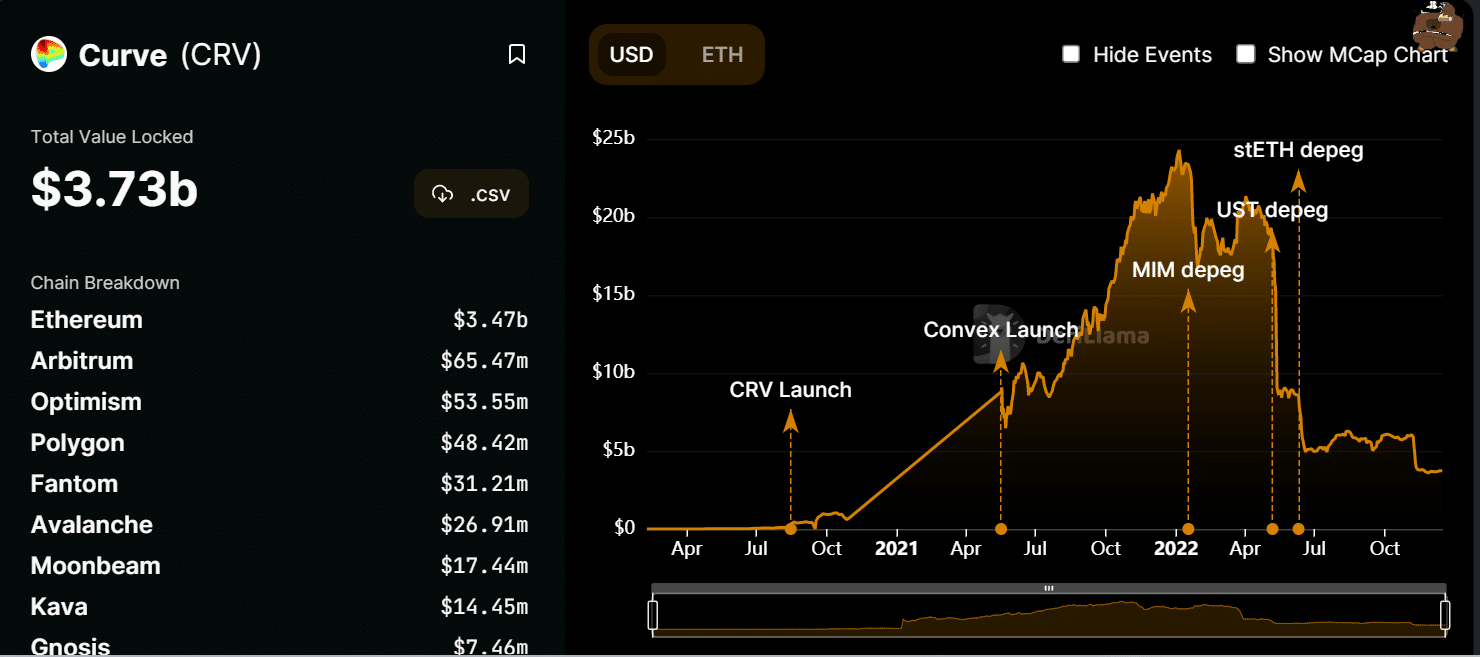

Moreover, a look at Curve’s Whole Worth Locked (TVL) revealed that it had not too long ago decreased by billions of {dollars} as a result of varied incidents.

The TVL was $3.73 billion as of the time of writing, down from virtually $18 billion earlier within the 12 months. Because the protocol could be launched on chains included into the zkSync, integrations might hasten TVL’s development.

Supply: DefiLlama